2006 865 SERB06_FIN_F

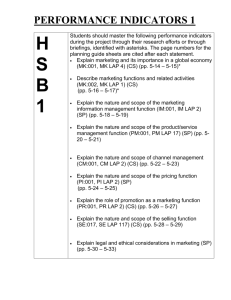

advertisement