PART L: THE GAMES OF NATIONAL

advertisement

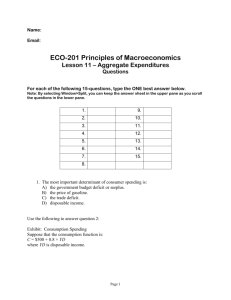

PART L: THE GAMES OF NATIONAL-INCOME DETERMINATION Topic 21: A PRESENTATION OF THE NATIONAL-INCOME ACCOUNTING SYSTEM Reading: LR: Chapter 18 [lightly] and Chapter 19 [background for Macro Economics] Chapter 20 [Important] Concept List: definitions of a progressive tax rate; a proportional tax rate and a regressive tax rate types of taxes in Canada [e.g., personal income taxes, corporate income taxes and indirect taxes on goods and services – GST, PST, import duties] macro economic goals: economic growth, full employment [95% employment] and price stability [price index no more than 5% annually – Bank of Canada’s goal is no greater than 3% inflation] potential output and output gap: gap between actual employment and full employment real and nominal national output [GDP]; implicit price deflators and a constant dollars series of GDP measurement of national output [GDP]: the final goods and services approach measurement of national output [GDP]: the factor income approach measurement of national output [GDP]: the value added approach definition of ‘final’ goods and services: goods and services sold to consumers, industry [on capital account], government, the export sector and goods which become additions to physical inventory at the end of the year GDP has two boundaries: space and time -- all economic activities within the country/region are included within the specified period which is usually a year personal expenditure on goods and services [consumption] includes durables [dining room sets], non-durables [food and clothing] and services [entertainment, rent] automobiles purchased by consumers are classified as a consumer durable imputed rent for owner-occupied home is included under consumer services and also in the factor income statement under rent gross domestic investment is the sum of new residential construction, new non-residential construction and new machinery and equipment undertaken during the period: inventory changes [increases and decreases] are also included under the investment category intermediate goods and services – raw materials, energy, services purchases – are inputs which are consumed in the production process [e.g., iron ore and coal and are transformed during the production process into steel and resin into plastic packaging] derivation of final goods and services in a simple three sector economy with no trade, no government and no inventories factor income approach includes [net domestic income at factor cost]: wages, rent, interest and profits – where profits are presented under three categories: corporate profits before taxes, net income of unincorporated farmers and net income of non-farm unincorporated businesses e.g., partnerships and sole proprietors net domestic income at factor cost [sum of all factor income gross of any taxes] plus indirect taxes less subsidies and plus capital consumption allowance [depreciation] theoretically equals the sum of all final goods and services in the final goods approach to GDP capital consumption allowance [CCA] includes depreciation taken on housing, offices and plants and machinery and equipment in the private sector plus depreciation on capital goods in the public sector [roads, buildings]: consumer durables are not depreciated value added represents an industry/sector’s own contribution towards final goods [GDP] detailed elements for the final goods statement detailed elements for the factor income statement net investment definition: gross investment less capital consumption allowance interrelationships between gross investment, net investment, replacement investment and capital consumption allowance and interpretation of negative net investment Topic 22: THE GAMES OF NATIONAL-INCOME DETERMINATION IN A SIMPLE ECONOMY Assume: Price stability in this section Reading: LR: Chapters 21 the determination of equilibrium national income in a simple economy without government, no international trade and no corporate saving the consumption function for a family, based on disposable income the average propensity to consume [APC] the marginal propensity to consume [MPC] the break-even point on the consumption curve the derived savings curve for a family: Sp = Yd - C dissaving the average propensity to save [APS] the marginal propensity to save [MPS] the sum of the two average propensities [APC + APS] equals one the sum of the two marginal propensities [MPC + MPS] equals one a country’s aggregate saving function: straight line approximation linear domestic investment equation where desired investment by entrepreneurs depends upon autonomous investment [independent of the level of Y] and induced investment [dependent on the level of Y] Keynesian investment function: autonomous investment only economy’s equilibrium condition: desired investment [DI] equals desired saving [DS] actual saving [the sum of household saving + corporate saving + government saving] always equals actual investment – the investment which is actually recorded in the national accounts, at all levels of Y: this is an identity unintended increases/decreases in investment [through unwanted and unplanned inventory adjustments] full employment level of Y autonomous investment shock to achieve full employment level of Y the simple investment multiplier; the multiplier process and the multiplier formula the multiplier is a function of leakages: principally the marginal propensity to save, the marginal propensity to tax and the marginal propensity to import the multiplier process causes the increase in Y to be greater than the positive/negative autonomous shock to the economy the multiplier is always positive and greater than one the investment-saving presentation converted to the aggregate expenditure approach [both approaches will generate the identical equilibrium level of Y] Topic 23: THE GAMES OF NATIONAL-INCOME DETERMINATION IN A FULL ECONOMY WITH GOVERNMENT AND TRADE Reading: LR: Chapter 22 [Including appendix] addition of the government sector adds: taxes, transfer payments, government expenditure and government saving addition of the international sector adds exports and imports [Note: Do not like the text presentation which combines the effects of exports and imports and converts these to a net export function. Why? The determinants of imports and exports are entirely different. the equilibrium condition is now: Y = C + Id + G + E - M disposable income is defined as: Yd = Y - taxes + transfer payments - corporate saving the spending multiplier now becomes: Ks = 1/ 1-[MPCy + MPId + MPG + MPX - MPM] when an autonomous shock occurs [i.e., when the Aggregate Expenditure Curve is shifted vertically up or down], then the change in Y becomes the product of the spending multiplier times the vertical shift in the Aggregate Expenditure Curve disposable income equals consumption plus personal saving [Yd = C + Sp] the impact of an autonomous tax shock, or a transfer payment shock, will cause the consumption function to shift vertically by the product of the MPCYd times the amount of the autonomous change in taxes [with a negative sign] or transfer payments [with a positive sign]. the behavioural equations for consumption, investment, government spending, exports, imports, taxation, transfer payments and corporate saving would always be specified in a question the consumption function will usually be defined in terms of Yd, with its slope MPCYd – however, to solve a system of equations, it will be necessary to convert the original consumption function to a function of Y, with its slope MPCy Note: if any other behavioural equations e.g., imports, were initially a function of Yd, then this behavioural equation would also require conversion to a function of Y. When the system is solved, all behavioural equations must be established as functions of Y, and not Yd the national-income determination problems will involve two exercises: a. solve the original set of behaviour equations to obtain the initial equilibrium level of Y; b. evaluate the impact on the initial level of Y, when an autonomous shock occurs the balanced budget multiplier theorem the autonomous shock necessary to bring the economy for a full employment level NOTE: The aggregate expenditure model can not satisfactorily handle inflation. Topic 24: AGGREGATE DEMAND AND SHORT RUN AGGREGATE SUPPLY ANALYSIS [Note: Long Run Aggregate Supply Curve is not included] Reading: LR: Chapter 23 Concept List: diagrams show price level on the y-axis and real national income [Y] on the x-axis three reasons for downward slope of aggregate demand curve [AD]: - inflation and trade - inflation and savings impact - inflation and interest rate impact on net investment shifts in AD curve occur through the use of monetary policy and discretionary fiscal policy short run aggregate supply curve [SRAS] and its three sections: perfectly elastic, upward sloping and vertical assumptions behind SRAS curve: - no change in the average unit cost of production in the economy - no change in the labour productivity in the economy the Keynesian/price stability part of the SRAS curve equilibrium established under AD/SRAS curve analysis an easy money policy, or an expansionary fiscal policy, could lead to an increase in real output and to an increase in the price level at the same time