The Impact of Financial Repression on Interest Rate Spreads in

advertisement

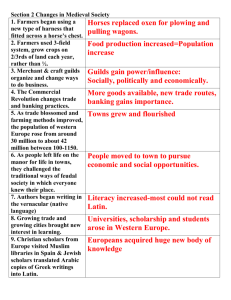

The Impact of Financial Repression on Interest Rate Spreads in Venezuela Adriana Arreaza-Coll1 Wegner Huskey Jesús Zumeta January 2009 Abstract This paper empirically examines the effect of financial repression on interest rates spreads in Venezuela. In order to have a measure of financial repression, we build an index that captures the opportunity cost of regulatory restrictions such as mandated lending programs, interest rate ceilings, reserve requirements, and the cost of financial transactions taxes. Controlling for other bank-level and macroeconomic country-level determinants, preliminary results of panel regression suggest that there is a statistically significant positive correlation between the overall index of financial repression and interest rate spreads. Keywords: Banking regulation, intermediation, efficiency JEL Classification: G21, G28, O54 Arreaza: Andean Development Corporation, Huskey and Zumeta: Universidad Católica Andrés Bello 1 Extended abstract Since the banking crisis of the mid-nineties, the banking sector in Venezuela has faced a challenging environment of volatile macroeconomic conditions and continuous changes in regulation that have affected the way they do business. Given that banks have a crucial role in mobilizing and allocating resources in the economy, their performance has always been part of the policy debate. It is the dynamics of interest rate spreads that have usually captured the spot light in this debate. In general, banking spreads in Latin America are high by international standards (Brock and Rojas-Suarez, 2000 and Gelos, 2006). Venezuela is no exception to this and, in fact, banking spreads in Venezuela are among the highest of the region, as can be appreciated in Figure 1. Moreover, interest rate margins have also been highly volatile in Venezuela over the past decade (Figure 2). Figure 1. Net Interest Rate Margins (Average 1999-2002) Note: Total interest income minus total interest expense, divided by the sum of interest bearing assets. Source: Gelos (2006) The natural question that follows is what explains banking spreads dynamics in Venezuela. A number of previous studies addressed this question, e.g. Zambrano, Vera and Faust (2001), Clemente and Puente (2001), Perez and Rodríguez (2001) and Arreaza, Fernandez and Mirabal (2001). Although these studies differ in terms of the empirical approach and of scope of the data, a common finding was that operating costs have are significant to explain banking spreads in Venezuela. Except for Rodríguez and Perez (2001), none of the other studies find strong evidence to support that market power or concentration are relevant to explain interest rate spreads. Furthermore, Arreaza, Fernandez and Mirabal (2001) find that some macroeconomic variables (inflation and interest rate volatility) are also relevant determinants. However, none of these studies examine the impact of financial repression on banking spreads. In this paper we thus assess the role of banking regulatory restrictions on interest rate spreads in Venezuela, using bank-level and country-level observations between 1997 and 2008. Figure 2. Interest Rate Margins in Venezuela (1997-2008) 60% 55% 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% Tasa activa Tasa Pasiva 2007:11 2007:01 2006:03 2005:05 2004:07 2003:09 2002:11 2002:01 2001:03 2000:05 1999:07 1998:09 1997:11 1997:01 0% Spread S2 Note: Loan rate: interest income from loans divided by total loans. Deposit rate: interest expenses on deposits divided total deposits. The spread is the difference between these rates. Source: SUDEBAN Financial repression can be defined as the set of policies, laws, controls and regulatory restrictions on banking operations that hinder the optimal allocation of resources and interest rate setting, which entail costs that banks should be willing to transfer to their margins (McKinnon, 1973 and Shaw, 1973). Therefore, an increase in financial repression should be associated with wider interest rate spreads. Entry barriers may also contribute to higher spreads by reducing competition. A number of recent studies find a statistically significant positive correlation between bank margins and banking regulation. In a cross-country study, Demirguc-Kunt, Leaven and Levine (2003) find that tighter regulation on bank entry and bank activities widens interest margins regulation and spreads. Results of panel studies focused on Latin American banking spreads also indicate that taxes and reserve requirements contribute to the prevalence of high spreads in Latin America, among other factors such as high operating costs, inflation and macroeconomic volatility (Brock and Rojas-Suarez, 2000 and Gelos, 2006). Findings of country level studies point in the same direction. Barajas, Steiner, and Salazar (1999) report that financial taxation contributes to high spreads in Colombia, in addition to imperfect competition and operating costs, the fraction of nonperforming loans. In the same vein, Fuentes and Basch (1998) study the case of Chile and Grasso and Banzas (2006) cover the Aregentinean case, finding a role for regulation on spreads. A substantial number of studies focused on Brazil suggest that taxation, administrative costs, and loan-loss provisions are the main determinants of banking spreads (Central Bank of Brazil, 1999-2003). Most of these studies focus on a single dimension of financial repression, namely, reserve requirements or taxation (of profits or of financial transactions). In turn, in this study we resort to an indicator of financial repression that encompasses the opportunity cost of regulatory restrictions such as mandated lending programs, reserve requirements, and the cost of financial transactions taxes, following Carrasquilla and Zárate (2002) and Villar, Salamanca and Murcia (2005). Figure 3 displays the evolution of the index and its different components throughout the study period. Figure 3. Financial Repression Index in Venezuela (1997-2008) Source: SUDEBAN, Central Bank of Venezuela, own calculations. Details on the index construction will be developed in the full paper. Over the last decade, there were no entry barriers for banks, the prudential regulation on capital requirements did not change and profit taxes did not vary. The aforementioned regulatory restrictions were thus the main determinants of financial repression. Although taxes on financial transactions raised costs for financial intermediaries when they were introduced during three distinct periods, it is evident that reserve requirements drove was the main driver of financial repression. In order to examine whether the overall index of financial repression is correlated with banking spreads in Venezuela, we conducted an empirical study using monthly balance sheet observations for 21 banks between 1997 and 2008. In addition to bank level variables (liquidity ratio, operating costs, non-performing loans ratio, etc.) we also control for macroeconomic variables. We conduct FGLS estimations for cross-section fixed effects and individual time trends specifications with heteroskedasticity-robust standard errors (White diagonal). The dependent variable is the interest rate spreads, calculated as interest earnings from loans divided by total loans minus deposit expenses divided by total deposits, from banks' balance-sheet data. Preliminary results of this exercise are displayed in Tables 1-3. In Table 1 we present results for the full period, whereas in Table 2 and in Table 3 the sample is split into two sub-periods. In February 2003, administrative restrictions were imposed on the foreign exchange market, which affected banking operations in this market. In addition, ceilings for loan rates and floors for deposit rates were also set at that time. Therefore, we run regressions for each sub-sample in order to account for possible structural changes. Table 1. Econometric Results Table 2 Table 3 These results indicate that our indicator of financial repression has statistically significant positive correlation with banking spreads, which becomes more apparent when we split the sample in two. Opportunity costs of high reserve requirements and of mandated loans at subsidized rates, as well as financial transactions taxes are all being transferred to spreads, even after regulating the process of interest rate setting. Amongst bank-level determinants, operating costs seem to be the most relevant and robust determinant of spreads, in line with previous findings for the Venezuelan case. Cost inefficiencies are thus transferred to spreads. Macroeconomic variables also seem to play a role on spreads. Systemic risks, as captured by interest rate volatility, contribute to boost spreads. On the other hand, the degree of monetization of the economy relative to GDP shows a positive correlation with spreads. As liquidity increased in the economy throughout the period, so did deposits, allowing banks to reduce deposit rates and thus widen spreads. Finally, the level of concentration of the banking system, measured by a Herfindahl-Hirschman index of loans, displays a negative correlation with spreads. This somewhat puzzling result may be the outcome of low levels of concentration in the Venezuelan banking system by all standard measures. Therefore, if there is market power in the system, it is not related to concentration. References Arreaza, A., Fernandez, M. and Mirabal, M. (2001). “Determinantes del spread bancario en Venezuela". Working paper, Banco Central de Venezuela. Barajas, A., Steiner, R. y Salazar, N. (2000) “Structural reform and bank spreads in the Colombian banking system”. In Brock, P. y Rojas-Suarez, L. (eds.): “Why so High? Understanding interest rate spread in Latin America”. Interamerican Development Bank, pp 153-180. Brock, P. y Rojas-Suárez, L. (2000) “Interest rate spreads in Latin America: Facts, Theories, and policy recommendations”. In Brock, P. y Rojas-Suarez, L. (eds.): “Why so High? Understanding interest rate spread in Latin America”. Interamerican Development Bank, pp 131. Carrasquilla, A. and Zárate, J. (2002). “Regulación bancaria y tensión financiera: 1998-2001” In: El Sector Financiero de Cara al Siglo XXI, Volume I, ANIF. Clemente, L and Puente, A. (2001). “Determinantes del spread de tasas de interés en Venezuela”. Instituto de urbanismo de la Universidad Central de Venezuela, mimeo. Demirguc-Kunt, A., Leaven L. and Levine R. (2003). “Regulations, Market Structure, Institutions, and the Cost of the Financial Intermediation”. National Bureau of Economic Research. Working paper 9890 Fuentes, R. and Basch, M. (1998) “Determinantes de los spreads bancarios: el case de Chile” Inter-american Development Bank, Latin American Research Network, Working Paper R-329. Grasso, F. and Banzas, A. (2006) “Determinantes del spread bancario en Argentina, un análisis de su composición y evolución (1995 – 2005)”. Centro de Economía y Finanzas para el Desarrollo de la Argentina. Documento de trabajo N°11. Gelos, R. (2006) “Banking Spreads in Latin America”. IMF. Working Paper N° 0644. McKinnon, R. (1973) “Money and capital in economic development” Washington DC: Brookings Institutions. Rodríguez, F. y Pérez, F. (2001). “¿Por qué Venezuela tiene diferenciales de tasas tan altos?”. Asesoría Económica Financiera de la Asamblea Nacional De Venezuela, report. Shaw, E. (1973). “Financial deepening in economic development” New York: Oxford University Press. Suescún, Rodrigo. (2004) “Raising Revenue with transaction Taxes en Latin America- or is it Better to Tax with the devil you know?”. World Bank. WPS3279 Superintendencia de Bancos y otras Instituciones Financieras (SUDEBAN). Montly reports. Superintendencia de Bancos y otras instituciones financieras, (SUDEBAN): “Manual de contabilidad para la banca otras instituciones financieras de ahorro y préstamo”. Villar, L., Salamanca, D. and Murcia, A. (2005).”Crédito, represión financiera y flujo de capitales en Colombia: 1974-2003”. Zambrano Sequín, L., Vera L. and Faust A. (2001). “Evolución y determinantes del spread financiero en Venezuela”. Banco Mercantil, Unidad de Investigación Económica, Serie Papeles de Trabajo, Año 1, No 2, Caracas.