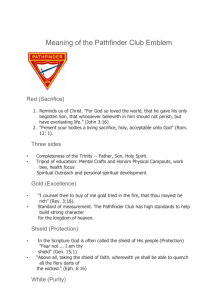

pathfinder - Institute of Chartered Accountants of Nigeria

advertisement