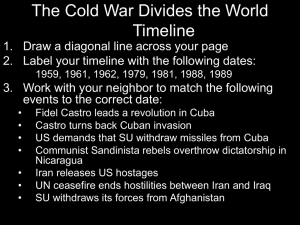

the role of the cuban-american community

advertisement