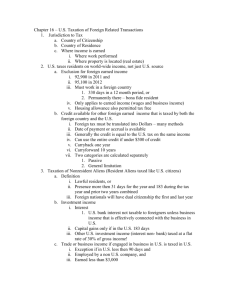

taxation - USC Gould School of Law

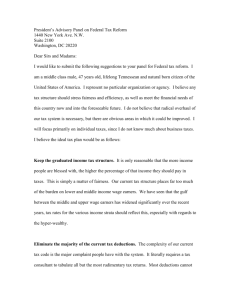

advertisement