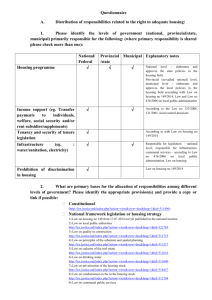

Building Sub-national Debt Markets

advertisement