Seafood - Department of Agriculture

advertisement

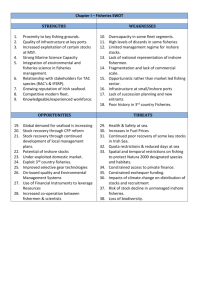

1|Page Background Paper Seafood Note: The views expressed in this background paper do not purport to reflect the views of the Minister or the Department of Agriculture, Food and the Marine 2|Page 1. Background context 2. Sectoral goals 3. Current Sectoral Analysis a) Economic b) Socioeconomic c) Technological d) Environmental e) Legal / regulatory 4. Future market prospects 5. Specific actions planned 6. Sustainability considerations 7. Challenges up to 2025 3|Page BACKGROUND CONTEXT Irish seafood exports recorded a decline in 2013 to reach a sales value of €496 million, following very strong growth of almost 65% in the value of exports over the 2009 – 2012 period. The performance in 2013 which represents a drop in value of around 7% is a result primarily in the reduction of raw material available for supply (volumes dropped by 13% during this period). The on-going strength of demand within the sector is evident by the continued rise in unit prices (around 7% higher), particular for certain species such as salmon and oysters during 2013. Strong export performances to emerging markets were recorded during 2013, notably to markets such as Cameroon, Russia, Korea, China and Hong Kong, which all showed high double digit growth. The core European markets were most difficult due to a mixture of limited supply for traditional species such as salmon and whitefish but also sluggish markets due to a poor economic climate and weak consumption. The core European markets of France, Spain, Germany, Italy and the UK remain the main outlet for Irish seafood exports with the top five markets accounting for more than 55% of total exports. However, this compares to a 60% share in 2012 and demonstrates the on-going focus of the leading Irish seafood exporters in the development of new business in emerging markets to offset some price resistance in core European markets. Seafood exports to International markets continued to grow strongly in 2013 reaching an estimated €175 million, representing a value increase of around 7%. The strongest emerging markets with high double digit growth have been Cameroon, Russia, Korea, China and Hong Kong. Good performance for pelagic species in these countries partly explains strong growth, but also a wider range of species into Korea, China and Hong Kong where crab, razors and oysters are beginning to make significant market entry at foodservice and retail level. The poor availability of Irish salmon was a key factor impacting on seafood volumes available for export in 2013, with output down by around 22% in volumes terms, which had a major impact on salmon exports in all its formats, including smoked. Despite demand for organic salmon continuing to rise significantly, Irish producers were not able to meet current demand levels due to limited production during this period. Oyster exports performed well with strong demand both in traditional markets and emerging markets such as Hong Kong. Japan, Malaysia and the UAE all recorded very strong double digit growth in the value of exports albeit from a low base. The French market continues to dominate oyster exports, with a value growth of 74% in 2013. The Italian market also performed well. Growers are holding onto oysters longer until they reach market size, with a decrease in trading of half-grown oysters, which explains volume as well as value increase of 18% and 53% respectively. 4|Page Crab exports performed strongly in 2013 with an increase in value of around 14% against a background of stable volumes. A strong performance to China was recorded with an increase of 168% in value terms. The French, Italian and UK markets also performed well for this species. The total value of pelagic exports fell slightly in 2013, mainly as a result of the reduction in blue whiting available for processing and export. Total blue whiting export volumes reduced from 63,000 tonnes in 2013 to 45,000 tonnes in 2013, resulting in a drop in export values during this period. The focus for 2015 will continue to be on building exports, reflecting the Food Harvest 2020 export target of €12 billion for the Food & Drinks sector. This increase in exports will be achieved through greater penetration of sales into premium niche markets in Asia, the US and the Middle East along with a higher value positioning for key species in the traditional markets of France, Spain, Italy, Germany and the UK. Opportunities within this sector can only be maximised through improvements in raw material availability and output. CATCHING SECTOR The seas around Ireland (ICES Sub Areas VII and VI) are among the most productive and biologically sensitive areas in EU waters. Most of the fisheries resource within the area comes under the remit of the Common Fisheries Policy (CFP). The 2013 fishing opportunities (i.e. Total Allowable Catches, TAC’s species) for the international fleets that operate in the waters around Ireland were 1,040,117 tonnes of fish, with an estimated landed value of €1.161 billion. These economic values are based on 2012 average prices and represent a conservative estimate. Ireland’s share of these fishing opportunities represents 23% by tonnage and 17% by value. These values do not include the valuable inshore fisheries (e.g. lobster, whelk) which are not managed using internationally agreed TACs but do come within the remit of the CFP. The Irish fishing fleet is largely a coastal fleet made up of 2,217 vessels, varying in size from in excess of 24 metres to under 12 metres. The fleet operates over five segments: pelagic, polyvalent, beamtrawl, specific and aquaculture. Catching of wild fish is regulated at national and EU levels under the Common Fisheries Policy (CFP). Annual quotas are also set for most fish species under the CFP. Primary responsibility for the allocation and management of these quotas rests with the Minister of Agriculture, Food and the Marine. Following the agreement of the Total Allowable Catch (TAC) and Quota Regulations at the December Fisheries Council each year, which set out for each Member State the total tonnage of catch for certain species in specific areas of the sea that they are allowed to catch, it is the responsibility of each Member State to manage their fisheries within these quotas. AQUACULTURE SECTOR The practice of Aquaculture is regulated at national level under the Fisheries Amendment Act 1997. In order to engage in aquaculture, a licence is required from the Minister of Agriculture, Food and the Marine. Furthermore, if the public foreshore is to be used for the aquaculture activity (marine aquaculture), a foreshore licence is also required from the Minister. Closed containment systems 5|Page (ponds or tanks) may also be used on land, and planning permission may be required from the Local Authority (in addition to the aquaculture licence). Marine aquaculture is by far the most common method in Ireland. Marine aquaculture can be divided into finfish and shellfish farming. Currently, aquaculture in Ireland is comprised of 850 licensed operations covering 2,000 sites, primarily consisting of shellfish production. The number of active enterprises engaged in marine aquaculture has remained stable with total of 292 enterprises. In recent years, there has been an increase in salmon and Gigas oyster production, while mussel production has decreased due to both seed supply and market demand reduction. Over the last 10 years aquaculture output in Europe has stagnated and there has been little or no net growth. According to the Food and Agriculture Organisation (FAO) aquaculture has been the fastest growing food sector globally, however the EU has not followed this worldwide trend. The EU has recognised this unsustainable position with regard to seafood supply and has targeted resurgence in growth in output from aquaculture. Ireland’s long coastline, with numerous bays and inlets makes it well placed to increase its aquaculture output. Aquaculture takes place mainly in coastal areas but also occurs in inland freshwater areas and on land based recirculation systems. As such, it provides a vital source of employment and economic activity that contributes to the preservation of viable rural communities on a year-round basis. It is a relatively diverse sector encompassing a substantial shellfish farming element combined with a significant finfish element. There are certain areas within Ireland that have higher concentrations of aquaculture such as in, Donegal, Carlingford Lough, Wexford, Waterford, West Cork, Kerry, Galway and Mayo. The area covered by aquaculture in Ireland is 0.001% of the sea area and 0.01% of the land area. Aquaculture is a significant provider of employment in the bays where it is practiced and particularly so, along with the fishing and agriculture industries, along the west coast. The northwest, principally Donegal, provides the highest value of aquaculture production: €48 million in 2011. Finfish, shellfish and seaweed are all cultured in Ireland. The finfish production was valued by BIM in 2012 at nearly €83 million while shellfish was valued at nearly €50 million for the same year1. The principal species in Irish aquaculture are salmon, trout, rope cultured mussels, bottom grown mussels and pacific oysters (Crassostrea gigas). The industry also has other smaller productions of scallops, clams, abalone, char, perch, urchins and seaweed. SEAFOOD PROCESSIN G S ECTOR Ireland’s seafood processing industry provides an important source of economic activity and produces high value products which generate substantial export earnings to Ireland’s economy. The 1 http://www.bim.ie/media/bim/content/publications/BIM%20Strategy%202013-2017.pdf 6|Page total turnover of the Irish seafood processing industry in 2011 was €559 million which was an increase of €14m or 2.6% from 2010. The Seafood processing industry in Ireland is comprised of mostly small enterprises with less than 10 employees. Only 8% of Irish processing companies had more than 50 employees in 2011. There are currently an estimated 169 companies engaged in the handling, processing, distributing and marketing of seafood in Ireland which has remained constant since 2009. The industry is comprised of finfish, shellfish, smoked, pelagic and whitefish operators. Shellfish companies accounts for the largest number of fish processing companies in Ireland. Many companies in Ireland specialises in more than one species. In 2009, BIM opened the Seafood Development Centre (SDC). This was the first dedicated innovation facility for the Irish seafood sector. Through the support of the SDC, companies can exploit market opportunities and maximise the potential for success through integrated business development and new product development strategies. FISHERY HARBOUR CENTRES The 6 Fishery Harbour Centres were established around the coast of Ireland to promote and develop fishing activities. The Fishery Harbour Centres were and are being developed to reflect the need for this State to facilitate larger Irish and Foreign vessels fishing in deeper water to land into and operate out of Ireland. They are also developed to meet the standards expected of a modern seafood producing and processing industry. This network of 6 Fishery Harbours Centres strategically located around our coast provide state of the art facilities and infrastructure for the increasingly mobile and large scale Irish Fishing Industry. The waters around Ireland contain some of the most productive fishing grounds in the EU. On average, an estimated 1.2 million tonnes of fish are taken by the fishing fleets of EU member states from the waters around Ireland each year. The Fishery Harbour Centres have a critical role to play in implementing Government policy to firstly facilitate the Irish Seafood industry develop a modern offshore fishing fleet and a modern on shore processing industry, in addition to attracting increased numbers of landings from foreign vessels from inside and outside the European Union. To provide for the ongoing development, construction and maintenance of this important coastal infrastructure for fish and aquaculture landing sites, the Department runs an annual Fishery Harbour and Coastal Infrastructure Development Programme. A total of €17.2m has been spent on the Fishery Harbour Centres since 2011. The strategic objective of this programme is to further develop our infrastructure and facilities to best international standards, which can facilitate growing offshore fishing and onshore processing sectors, and to lead to a greater proportion of the 1.2 billion tonnes of fish caught in waters around Ireland being landed and processed in Ireland. The tonnage and value of landings in the Fishery Harbour Centres is increasing. Additionally, foreign landings in the Fishery Harbour Centres show recent significant increases. In 2013, total landings in the Fishery Harbour Centres was 237,000 tonnes, with a value of €227 million. This compares with 210,000 tonnes and a value of €137 million in 2010. Foreign landings into the 6 Fishery Harbour 7|Page Centres in 2013 were up by 30% (approx) from 1,040 tonnes in 2010 to 1,305 tonnes in 2013. This trend in combination with catering for the home fishing fleet means that adequate investment in the fishery harbour centres which are strategically placed around the Irish coast must continue to be provided. It is vital in order to ensure a fresh product that sufficient quay space and draught is available to avoid queuing and facilitate quick vessel turnaround at the ports. The increase in fuel costs and a strategy whereby more raw material is required to meet the demand for further processing of product reinforces the importance of having good port infrastructure to meet the increasing demand and to encourage landings avoiding long distance steaming. It is important also to note the fact that finfish farms are set to move further offshore resulting in the requirement to have larger, more robust and seaworthy vessels to service them. This in combination with the drive to see the inshore fishing and aquaculture industry move to higher levels of sustainability means that other ports and fishery harbours may also have to be prioritised and developed to an adequate standard so as to avoid any constraints due to a lack of fundamental safe port facilities. 8|Page SECTORAL GOALS The outlook for the seafood industry up to 2025 is outlined under each sub sector as follows: Capture Fisheries: Pelagic: Based on the twin mega trends of global population growth and increased buying power in the Asia-pacific region, it is predicted that the current product mix coming from Ireland’s pelagic fisheries will shift from relatively low value, commodity forms towards a mix of commodity and higher value processed and convenience offerings. Inevitably as supply tightens due to the increased demand from Asia pacific, commercially viable opportunities will arise to maximize the value of Ireland’s pelagic catch for consumption, both on the home and European markets. BIM estimates that while the volume of the pelagic landings are likely to be relatively static (relative to 2012), there will be some value enhancement in this sector, with product development including that of marine proteins. Demersal (whitefish and Dublin Bay Prawns): Similar to the current situation pertaining to the pelagic landings, BIM anticipates that there will be continued growth in processing and value adding of this sector. These species enjoy a high level of consumer acceptance and recognition and lend themselves more readily to value adding and to transformation into convenience products. BIM estimates that by 2025 landing volumes will remain stable but some 30 - 40% of the catch will be utilized in further processing. Inshore Fisheries and Shellfish: The establishment in 2014 of the National Inshore Fisheries Forum, based on a network of regional forums, places a renewed focus on this important sector. With over 80% of the fishing fleet less than 12m overall length, the Forums provide a long overdue voice for the most numerous but fragmented sector of the fishing industry. Coastal communities now have the platform to participate in developing sustainable, long-term plans from the ground up through the inclusive representation on Regional Inshore Fisheries Forums (RIFFs). Harnessing the knowledge and expertise of these communities at a local and regional level and availing of guidance/advice from DAFM and its marine agencies, the Forums aim is to strike a balance between maintaining healthy marine ecosystems and providing sustained economic activity for the many single-crew boats which comprise this sector. The RIFFs bring together inshore fishermen, seafood processors, environmental interests and other marine users to get all-encompassing input from the start. There is tremendous potential to tackle limiting factors such as over-exploitation of certain stocks, over-reliance on individual species, poor visibility of existing sustainable practices and slow response to changing markets. Anticipating a more disciplined approach to local fisheries management, underpinned by appropriate research and commercial support structures could bring about a transformational 9|Page change. Once abundant fisheries, such as lobsters, scallops, crab, crayfish and possibly sea urchins could be restored to their former levels. Innovative techniques such as hatchery grown seed stock could supplement stock levels if matched with appropriate fishing effort controls and incentivised conservation initiatives. BIM estimates that landings from these fisheries could be significantly and sustainably increased and this, combined with access to best-price global markets, would result in a major increase in value. This increase in raw material supply will bring about substantial increased employment in the service and support elements such as processing, logistics, food safety management and sales and marketing which would all be deeply rooted at local level. By 2025, through a combination of increased processing of all seafood and improved output from the inshore sector, it is estimated that Ireland’s capture fisheries could yield an additional €190 million per annum. Aquaculture: By 2025, BIM envisages aquaculture as being much more integrated with inshore fisheries than is currently the case. A pilot national lobster hatchery is currently under examination by BIM and the Marine Institute to refine and assess the potential for this aquaculture technique to supplement stock levels. With interest already emerging from industry in regionally based hatcheries, the potential exists for expansion into other high-value inshore shellfish catches. In addition to this major departure from the current situation, BIM sees continued significant growth in the existing conventional aquaculture species (inter alia salmon, trout, oysters, mussels). It is also anticipated that there will be an upsurge of investor interest in producing farmed seaweed products. Assuming that the 2020 targets for expansion of aquaculture are achieved well before 2025, BIM envisage a sector yielding an additional €60 million per annum. In summary, BIM predicts that the Irish seafood sector will have substantially evolved from its current state by 2025. BIM estimates that total seafood value to the Irish economy will be €1.25 billion per annum and that it will employ an extra 1,250 full time equivalent jobs. BIM expects that there will be a smaller number of well-resourced and appropriately scaled corporate entities owning and operating the seafood sector. These may include specialised producer organisations that will bring discipline to the management of inshore fisheries and ensure stability, while providing high grade professional business, sales and marketing services to the sector generally. 10 | P a g e CURRENT SECTORAL ANA LYSIS ECONOMIC ANALYSIS CATCHING SECTOR The tables below outline the structure, activity, production and economic performance of the Irish fishing fleet in the period 2008-2011. National Fleet Small Scale Fleet 2008 2009 2010 2011 2008 2009 2010 2011 No. of vessels 1972 2044 2119 2162 835 751 769 788 Average Age of vessels (Years) 24 25 25 25 23 23 24 24 GT (thousand tonnes) 78.3 71.7 70.8 72.2 3.9 3.5 3.4 3.4 Engine power (thousand kW) 216.2 198.4 197 202.4 36.5 32.7 32.0 32.1 No. of Enterprises (N) 1833 1866 1929 1846 1357 1213 1249 1277 FTE (N) 2761 2528 2825 3166 1050 692 1000 1311 Average wage per FTE (thousand €) 16.9 15.4 21.3 21.0 2.3 n/a 8.4 2.7 Days At Sea (thousand days) 49.6 49.5 54.3 49.5 7.1 8.2 8.9 7.6 GT fishing days (thousands) 4975 4689 5143 4464 n/a n/a n/a n/a Structure Employment Fishing Effort 11 | P a g e Energy consumption (million litres) 75.7 73.9 65.0 63.8 4.1 6.0 6.5 6.8 Fuel consumption per kg landed (litre/kg) 0.38 0.28 0.21 0.32 1.17 1.47 1.24 1.45 Landings weight (thousand tonnes) 198.0 262.6 314.2 199.4 3.5 4.1 5.2 4.7 Landings value (million €) 196.5 185.9 202.1 200.3 6.0 8.6 7.7 6.8 Production Source Data: DCF 2013 Fleet Economic Member State data submissions Table 1: Fleet Data Part 1 (2008-2011) National Fleet Variable (million €) Small Scale Fleet 2008 2009 2010 2011 2008 2009 2010 2011 Landings Income 202.9 173.3 220.2 239.6 21.7 15.3 44.4 54.9 Other income 17.3 12.3 5.7 6.7 0.2 - 1.4 1.0 Labour Costs 46.5 38.8 60.3 66.3 2.4 n/a 8.4 3.6 Energy costs 43.6 32.7 38.6 49.8 2.6 2.5 3.5 5.3 Repair Costs 21.0 23.5 24.0 29.7 0.9 1.5 1.9 3.3 Other variable Costs 19.4 16.5 17.9 17.2 0.9 1.9 2.0 5.8 Non-variable costs 43.5 27.2 29.3 38.1 1.8 1.7 3.8 10.2 Capital Costs 35.7 55.7 58.4 59.5 0.7 n/a 6.9 5.1 Gross Value Added (GVA) 92.7 85.8 116.1 111.6 15.6 7.7 34.6 31.2 Gross Profit 46.2 47.0 55.8 45.2 13.1 7.7 26.2 27.7 Net Profit 10.5 -8.7 -2.6 -14.3 12.5 - - 22.5 Income Costs Economic Indicators 12 | P a g e Capital Value Fleet depreciated replacement value 426.0 410.1 511.9 367.4 6.6 n/a 93.0 56.1 In-year investments 37.7 14.5 41.5 28.7 2.5 2.7 4.7 6.2 Net profit margin (%) 4.8 -4.7 -1.2 -5.8 57 - - 40.3 RoFTA (%) 2.5 -2.1 -0.5 -3.9 191.5 - - 40.3 GVA per FTE (thousand €) 33.6 33.9 41.1 35.2 14.8 11.2 34.6 23.8 Profitability and development trends Source Data: DCF 2013 Fleet Economic Member State data submissions Table 2: Fleet Data Part 2(2008-2011) AQUACULTURE The value and production of the aquaculture sector is set out in table 3 below. The value of the sector increased in 2011 to €128 million, while the volume of output fell slightly to 44,789 tonnes. The overall economic performance of the aquaculture sector is analysed in table 4. Table 3: Weight and value Irish Aqauculture Sector (Source: The Economic Performance of the EU Aquaculture Sector 2013) 13 | P a g e Table 4: Economic performance of the Irish aquaculture sector: 2008-2011. (Source: The Economic Performance of the EU Aquaculture Sector 2013) 14 | P a g e PROCESSING SECTOR The total turnover of the Irish seafood processing industry in 2011 was €559 million which was an increase of €14m or 2.6% from 2010. Figure 1 In 2011, the amount of income generated by the Irish fish processing industry was €565 million, consisting almost exclusively by turnover. Data reveals that, after a 6% decrease in 2009, total income increased, however, it did not reach 2008 levels even though Irish seafood exports grew between 2008 and 2011. The domestic market experienced a decline in sales between 2008 and 2011 but it has recovered and sales have increased in 2012. In terms of economic performance the Gross Value Added (GVA), Operating Cash Flow, Earnings before Interest and Tax and Net Profit for the Irish processing sector, in 2011 were €99.3 million, €27.6 million, €12 million and €8.1 million respectively. Operating Cash Flow decreased by 15% from 2010 due to increases in the costs of raw materials for production and wages and salaries. Figure 2 15 | P a g e Table 5 16 | P a g e SOCIO-ECONOMIC ANALYSIS Employment in the seafood sector is concentrated on the Western seaboard between Donegal and Cork, with significant pockets of activity in the South East and Dublin. Figure 3 Distribution of Seafood Sector Employment (Full & Part-time) Donegal Cork Galway Kerry Mayo Dublin Wexford Waterford Louth Sligo Clare Other 0% 5% 10% 15% 20% 25% Source: BIM AQUACULTURE Total aquaculture enterprises fell by -4% to 292 in 2011, of which 209 employ 5 people or less. These enterprises employed 1,748 people, showing a 2% increase on the previous year although between 2008 and 2011 employment fell by -11%. FTE for the period also fell (-26%) and at the end of the period represented 958 employees. The female FTE figure increased by 13%, but was still very low. Having said this, labour productivity for the period had risen by 160% to €55,000 but the average wage fell -10% to €26,700. 17 | P a g e Table 6: Aquaculture sector overview for Ireland: 2008-2011. (Source: The Economic Performance of the EU Aquaculture Sector 2013) Figure 4: Irish aquaculture sector employment trends: 2008-2011. (Source: The Economic Performance of the EU Aquaculture Sector 2013) 18 | P a g e SEAFOOD PROCESSING In 2011 , there were approximately 2,829 FTE’s employed in the fish processing industry which was made up of 1,990 Male FTE’s and 839 Female FTE’s. Table 7 The average wage within the seafood processing industry decreased from €32,200 in 2008 to €26,700 in 2011, a drop of 17% due to the downturn in the national economy but the figures from 2010 to 2011 remained unchanged which is positive. The number of employees and FTEs in the Irish seafood processing sector increased constantly from 2008 to 2011, reaching respectively 3,270 and 2,829 in 2011. Male employees represent around 70% of the total employees and the proportion of male/female employees has been relatively constant over time. Figure 5 19 | P a g e TECHNOLOGICAL ANALYSIS BIM sees the need for continued investment in new product development and the processing technology required to create transformational new product formats to cater for the rapidly evolving consumer preferences. BIM’s Seafood Development Centre (SDC) will act as a spearhead and a range of measures and interventions will be required to drive innovation and continued investment in the sector. In the context of capture fisheries, BIM sees the need for a range of technological developments to cater for the demands created by the obligation to land all catches (new discards policy). These will include much improved gear selectivity, techniques to reduce bycatch, improved fuel and other energy efficiencies, the adoption of ever more stringent responsible fishing standards and the introduction of aquaculture based restocking and fisheries enhancement technologies to support sustainable exploitation of certain inshore fisheries. The aquaculture industry has always been driven by technological advances and the period to 2025 will continue to reflect this trend. BIM predicts that there will be substantial progress in establishing and operating offshore marine finfish farms. It is likely that Re-circulation Aquaculture Systems (RAS) will also be advanced over the period and that these will give rise to the improved and efficient production of juveniles across a wide range of marine animal and seaweed species. In the context of shellfish aquaculture, BIM predicts that the pacific oyster sector will become largely self-sufficient in terms of spat supply and that techniques to bolster the supply of seed mussels by artificial collection will have been developed to stabilize output from the bottom grown mussel sector. All of the technologies will continue to be “greener” in their performance, maximizing the use of recycling and reusing core components and minimizing energy inputs. It is also likely that significant elements of multitrophic aquaculture development will emerge over the period serving to increase output whilst mitigating unwanted environmental impacts. 20 | P a g e ENVIRONMENTAL ANALYSIS Outlook There will be a general movement towards “greening” that all sectors of the Irish seafood industry will share in common over the period. As producers seek to leverage the value of initiatives such as Bord Bia’s Origin Green, all seafood businesses will seek to reduce energy inputs, increase levels of recycling and will adopt independent, third party verified standards, in order to be able to demonstrate their bona fides in this regard to the market place. All of the elements of the seafood chain will concentrate heavily on improving their environmental sustainability credentials. Seafood processing companies will focus on reducing energy inputs, whilst developing product formats which minimise transportation requirements and will employ environmentally friendly manufacturing techniques and eco-friendly packaging. On the capture fisheries side, vessel propulsion and catching technologies will be developed to reduce fuel inputs. Along with this, there will be a significant increase in uptake of responsible fishing standards and, where appropriate, fishing sustainability standards such as MSC, (Marine Stewardship Council) or the FAO standards. In regard to aquaculture, marine finfish production is likely to increasingly shift offshore into high water-exchange locations where environmental impact is very low and the possibility of negative interactions with migratory salmonids is significantly reduced. It is likely also that seaweed farming may develop in a multi-trophic fashion to further mitigate any negative environmental impact created by the marine finfish sector. Shellfish farming, already a net carbon fixing activity, will continue to develop production technologies focused on reuse of core components and the use of bio degradable materials. In common with capture fisheries, aquaculture will see a continued strong uptake of certification and assurance standards such as organics, MSC where appropriate and the adoption of the new aquaculture stewardship council standards (ASC) CFP Discards Ban A key element of the new CFP is the introduction of a ban on discards, the practice of dumping unwanted fish overboard. The ban on discarding in pelagic fisheries will come into effect on 1 January 2015. A landing obligation for all other commercial fisheries will be phased in from 1 January 2016. Whilst the overall package has been agreed in the CFP Regulation, there is significant discussion taking place at many levels regarding the interpretation of some articles in advance of the Commission preparing its common understanding. The key to addressing the Discards Ban will be for Member States in a Region to collectively agree and submit for ratification in EU Law a “Discards Implementation Plan” for the Fishery concerned. This Discards Implementation Plan should be agreed through Regional Decision Making between the Member States concerned. This is particularly challenging for Ireland as we have many mixed demersal/whitefish fisheries in which current discard rates run between 40% & 80% depending on species and fishery. If all discards 21 | P a g e are simply landed with current quotas, fisheries may close early in the year for specific fisheries/species. To facilitate the phasing in of the landing obligation, a National Discards Implementation Working Group has been established consisting of representatives of all relevant stakeholders. The purpose of this group is be assist in the development of agreed practical technical proposals (e.g. storage of fish no longer being discarded on board vessels and on land, incentivising changes in fishing practices, reducing catches of juvenile fish and allowing fish stocks to grow over a set period) for submission to the relevant Regional Advisory Councils and to the Regional Member State Group. The secretariat for this group is provided from within DAFM and the Marine Institute and BIM are both centrally involved. Practical control issues surrounding the implementation of the discards ban will also require significant input from the Sea Fisheries Protection Authority. Sustainable Fisheries (Achieving) MSY A key element of the new CFP is the setting of fishing levels on the basis of the MSY Principle (Maximum Sustainable Yield). The MSY exploitation rates shall be achieved by 2015 where possible and, on a progressive, incremental basis by 2020 at the latest for all stocks. This should lead to healthy fish stocks, higher quotas for Irish fishermen and more sustainable fishing patterns. MSY for many species is not well known and proxy measures will have to be put in place. Significant input will be required from the Marine Institute and significant negotiation efforts will be needed with the Commission and in Council to ensure that there are not undue economic impacts for Ireland. Natura 2000 In December 2007, as part of a wider case against Ireland in relation to the implementation of the Birds Directive, the Court of Justice of the European Union ruled that Ireland had not complied with the Directive by not conducting appropriate assessment prior to licensing aquaculture activities. Since 2009, Ireland has been implementing a Programme of Measures to comply with the decision of the European Court, including in relation to aquaculture. That Programme of Measures also includes Ireland’s management of its fisheries in Natura 2000 areas. In relation to aquaculture and fisheries, the Programme of Measures has involved a multi-annual work programme by the Department of Agriculture Food and the Marine and its agencies, together with the National Parks and Wildlife Service. This work programme has involved a new legislative framework for fisheries, collection of benthic data on marine Natura 2000 sites, collection of data in SPAs on habitat use by waterbirds, setting of conservation objectives by the NPWS, appropriate assessment of aquaculture licence applications for sites in Natura 2000 areas and of proposals for management of fisheries in those areas, risk assessment of unmanaged fishing activities, supporting research to inform and underpin the process, and arrangements for monitoring fishing and aquaculture activities in Natura areas. While very considerable progress has been made on the Programme of Measures, and appropriate assessments are continuing to inform ongoing aquaculture licensing decisions, the scale of aquaculture activity in Natura 2000 areas has meant that many applicants for aquaculture licences have faced lengthy waiting periods. Industry representatives have asserted that this has had the 22 | P a g e effect of constraining growth in Ireland’s aquaculture sector. It is worth noting that other factors may have contributed to the lack of growth in the sector, such as access to finance during the recession years, diseases, biotoxin outbreaks and constraints on seed supply. In compliance with EU law, Ireland has not permitted aquaculture enterprises located in Natura 2000 areas to access financial supports under Ireland’s Seafood Development Programme 20072013 for the construction, extension, equipment and modernisation of aquaculture enterprises, until the site has been licensed in accordance with the conclusions of appropriate assessment. While progress on eliminating the licensing backlog arising from the European Court decision will continue to be incremental, it is expected that this environmental issue will increasingly cease to be a constraint on the licensing system in the coming years and thus on access to State supports for the development of the aquaculture sector. Sea Lice Controls Ireland’s sea lice control protocols are operated by the Marine Institute and involve regular inspections of marine fin fish sites by Marine Institute Inspectors (sites are inspected 14 times per annum). Results of inspections are provided to the farm operators within 5 working days. Results are also reported to the Department and to other interested parties such as Inland Fisheries Ireland. Overall results and trends are published annually. Notices to treat are issued to operators if lice levels are found to be above treatment trigger levels. These protocols are more advanced than those operated in other jurisdictions for the following reasons: The inspection regime is totally independent of the industry. Data obtained as a result of inspections is published and made widely available. Treatment trigger levels are set at a low level. In 2008, the State introduced a new Pest Management Strategy, supplementing the control regime already in place. This has resulted in a steady decline in average sea lice numbers on farmed salmon since its inception. The controls in operation are generally regarded as representing best practice internationally. Aquaculture licensing and environmental considerations The Department’s procedures governing the regulation of Aquaculture are rigorous and comprehensive in nature. All applications for marine based aquaculture licences are considered in accordance with the following legislation: Fisheries (Amendment) Act 1997 Foreshore Act 1933 23 | P a g e EU Habitats Directive (92/43/EEC) EU Birds Directive (79/409/EEC) Consolidated Environmental Impact Assessment Directives (2011/92/EU). The Department meets regularly with individuals and groups with environmental interests to discuss all aspects of aquaculture and will further enhance this interaction in the medium term. 24 | P a g e LEGAL / REGULATORY ANALYSIS 1. COMMON FISHERIES POLICY REGULATION (1380/2013) The new Common Fisheries Policy (CFP) entered into force on the 1st January 2014 and is designed to ensure the long term sustainability of fishing throughout EU waters. The CFP provides the framework for the long term sustainability of fish stocks, the continued economic viability of fishing fleets and fish processing, while supporting the communities that depend on a vibrant fishing industry. The CFP will support the rebuilding of fish stocks in European waters and will allow for setting TACs and quotas to reflect catches when a landing obligation is introduced on the basis that for the first and subsequent years, discarding of that stock will no longer be allowed. In the longer term, as fish stocks reach and are maintained at healthy levels, it will support increased fishing opportunities for fishermen. The ultimate aim of the reformed Common Fisheries policy is to end overfishing and to make fishing sustainable – environmentally, economically and socially thus resulting in a competitive and viable seafood sector for all. The new CFP involves a number of important elements. These are: Discards Ban Maximum Sustainable Yield Regionalisation Fleet balance and Advisory Councils. The discards ban and MSY have been described in the previous section. The new CFP will see an end to micro-management from Brussels and will bring the decision making process on technical and conservation measures closer to the fishing grounds, in particular to national administrations, fishermen and other interest groups. The agreed model enables Member States to work regionally, and with Advisory Councils, to develop detailed management measures, based on high level objectives set out in co-decided multi-annual plans. If agreed between the Member States, the Commission is then generally required to put these agreements into EU Law and enforce them. If Member States do not deliver decisions through the new Regional Decision Framework, the Commission is empowered to take decisions which will almost certainly be more demanding, less flexible and more damaging to Ireland’s interests. Many of the challenges to be met and changes to be made under the new CFP are in our region (North Western Waters) due to the high level of mixed fisheries, high level of discards and poor situation of many stocks. Ireland has already taken the lead in the establishment of a North Western Waters Member State Group (Ireland, UK, France, Belgium, Netherlands & Spain) and the development of its work programme. This Group will continue to require significant resources from within the Department, 25 | P a g e as well as the Marine Institute, the SFPA and BIM. The work of this group will be especially important in the context of the implementation of the discards ban (see below) All Member States are now required to put in place measures to adjust fleet capacity (number and size of vessels) to the available fishing opportunities. An annual report must be submitted to the Commission, along with an action plan where overcapacity is apparent. Failure to carry out the action plan may result in suspension or interruption of EMFF funding. The Advisory Councils (ACs) are stakeholder-led organisations that provide the Commission and EU countries with recommendations on fisheries management matters. This may include advice on conservation and socio-economic aspects of fisheries management, and on simplification of rules. The ACs are also consulted in the context of regionalisation. In addition to the seven existing ACs, the new CFP foresees the creation of four new ACs for the Black Sea, Aquaculture, Markets and the outermost regions. The North Western Waters Advisory Council and the Pelagic Advisory Council are the AC’s of significant relevance for Ireland. 2. THE EUROPEAN COMMON ORGANISATION OF THE MARKET S IN FISHERY A ND AQUACULTURE PRODUCTS (CMO) REGULATION The CMO regulation (1379/2013) was adopted on 11 December 2013 and entered into force on 1 January 2014. The CMO Regulation sets out the EU regime to manage the market and maximise value for EU seafood products. The objectives of the CMO are to ensure that the broad aims of the newly reformed CFP are translated into a production and marketing process based on sustainable fisheries and aquaculture. The CMO supports the seafood industry in facing challenges ranging from market failures, such as asymmetric information (e.g. consumer information on product sustainability), to supply shocks (e.g. natural variation). The primary aim of the CMO is to establish a stable fisheries market based on the concept of long term sustainability and a thriving fisheries industry and marketplace which is more consumer focused. The CMO uses the mechanisms of: common marketing standards (on quality, freshness, size/ weight and presentation), Production and Marketing Plans (PMPs) prepared by Producer Organisations to plan members’ production and develop joint marketing strategies, price-support schemes, and rules on trade with non-EU countries. The CMO regulation substantially changes EU funding in this field, reducing the previous 6 mechanisms to one – storage aid – which is itself due to disappear on 1 January 2019 (ref Commission implementing regulation (EU) No 1419/2013). 26 | P a g e It provides for a new mandatory tool – Production & Marketing Plans. These plans are designed to help focus recognised EU Producer Organisations with the day-to-day implementation of the Common Fisheries Policy's reform goals and allow them to manage their activities in a business-like and market-oriented manner. It improves consumer information requirements, to help consumers make informed choices. These provisions, which complement regulation (EU) 1169/2011 on food information for consumers ("FIC"), will apply from 13 December 2014. 3. EUROPEAN FISHERIES FUND REGULATION The European Fisheries Fund (EFF) Regulation (1198/2006) is the framework regulation governing EU co-funded financial supports to the seafood sector for the period 2007-2013. Ireland’s Seafood Development Programme (SDP) 2007-2013 is implemented through the EFF Regulation and will continue to disperse development funding to the seafood sector until the end of 2015. Ireland’s SDP is the principal source of development funding to the seafood sector and comprises a total fund of €66.3 million, including €42.3 million co-funding. The SDP funded Ireland’s 2008 fleet decommissioning scheme and continues to fund investments in the fishing fleet, development of aquaculture, the seafood processing sector, stock conservation measures and development of coastal areas through Fisheries Local Action Groups. 4. EUROPEAN MARITIME & FISHERIES FUND REGULATION The European Fisheries Fund (EFF) Regulation (508/2014) is the framework regulation governing EU co-funded financial supports to the seafood sector for the period 2014-2020. The Regulation was adopted on 22 May 2014. The Department of Agriculture Food and the Marine is developing a new Seafood Development Programme 2014-2020 to disperse investment funds under the Programme. The new SDP will comprise a total fund of €241 million, including €147.6 million in EU co-funding. While the new SDP is still in preparation, it is clear that it will provide significant financial supports for the development of the aquaculture and processing sectors, and for FLAGs, stock conservation and environmental management measures, measures to support the CFP reforms and to support compliance with the Habitats, Birds and MSFD Directives and for data collection and control and enforcement. 27 | P a g e FUTURE MARKET PROSPE CTS There are a number of significant macro trends which are poised to have an impact on the future direction of the Irish seafood sector and which indicate that the prospects for this industry both at a global and European level are very favourable, especially in the medium to long term. Strong global population growth which is expected to reach 8 billion by 2025 will result in a huge new market for seafood. Some experts estimate that an extra 40 million tonnes of seafood will be required annually by 2030. Coupled with the forecast global population growth, the rate of income growth in the Asia Pacific is also anticipated to have far reaching implications for the consumption and trade of seafood. Asia is the world’s largest and most populous continent with a population of 4.3 billion people, it makes up 60% of the world’s population. Asia’s population growth rate has quadrupled during the last 100 years led by China which today has a population of just over 1.3 billion. It is estimated that by 2030, Asia will host 64% of the global middle class and account for 40% of the global middle class consumption. Growing incomes in this region will result in strong demand for a wider range of premium seafood as evidenced by the strong growth in seafood consumption in China which far outpaces domestic production. China is the world’s largest producer, consumer, importer and exporter of fish products-handling more than 35% of global production. Imports of seafood products to meet growing in-country consumption are projected to increase. Seafood consumption in China increased rapidly from 11.5kg per person in 1990 to 25.4kg in 2004, and is predicted to increase to 35.9 kg/year in 2020. With China’s middle class expected to increase to 650 million by 2015, coupled with a growing population of young sophisticated and affluent consumers – all the signs are pointing towards increased imports of seafood. Certain analysts are predicting that China has the potential to become a €15.5 billion seafood import market by the end of the current decade, with rising incomes and increasing domestic demand for seafood, particularly in relation to premium species. The opportunities that this trend presents for the Irish seafood industry are significant, and will continue to be harnessed and developed further throughout 2015 and further. The Middle East also offers exciting opportunities for Irish seafood companies. Irish exports to the UAE have almost doubled since 2009 and now stand at €36mn, up 17% from the previous year. This growth is driven primarily by seafood, dairy and infant formula. According to the FAO, the UAE retail sector is worth €4.7 billion and within this; only 25% of the food available is produced domestically. Due to the high level of expats and changing tastes amongst locals, many of the retailers in the region cater to western tastes. Similarly, the UAE foodservice market is increasing by 11% p.a. and is valued at €2.7bn. According to some of the leading players in this market, the foodservice sector demands a very high quality product with a growing demand in this sector for live and processed high value seafood such as oysters, crab and mussels. A large number of luxury hotels (140 five-star hotel and growing) with millions of tourists each year (Dubai's 371 hotels host a record 6.5 million guests) makes up an upper-class consumer segment where seafood consumption is growing. Recent figures show that $100m worth of seafood was imported by the UAE and food consumption is growing at a rate of 12% p.a. In order to meet this increasing demand, imports will continue to play an important role. 28 | P a g e The US is another important and growing market for Irish seafood exports, particularly for certain species such as fresh, frozen and smoked salmon and increasingly for shellfish, albeit from a small base. The US fish and seafood market grew steadily between 2008 and 2013, reaching an estimated $16.2 billion and is estimated to grow to $19.5 billion by 2018. The rise of certain ethnic groups within the US e.g. Asian, as well as a greater awareness of fish being a healthy protein replacement, are all fuelling growth. The fresh fish market accounted for $9.1 billion, frozen makes up $4.4 billion, while shelf ready/prepacked accounts for $2.6 billion. Americans consumed 4.5 billion pounds of seafood in 2012. The US is the world’s third largest consumer of seafood after China and Japan. To meet consumer demand, the United States continues to be a major importer of seafood. Over 90% of the seafood consumed in the US is imported, measured by edible weight. Fish and seafood consumption in the US is expected to increase by 9% between now and 2017 with growth anticipated across all categories as consumers become increasingly aware of the health benefits of eating seafood and supported by a range of government initiatives to drive demand. The US aquaculture industry currently meets less than 5% of US seafood demand. Given the currently sluggish domestic supply coupled with the increasing demand for seafood, imports will continue to grow in importance. Sustainability is a key driver in demand for seafood in the US and it will be increasingly important for exporters to this market to demonstrate their credentials in relation to raw material sourcing and environmentally friendly production practices. From an Irish producer perspective, opportunities are predominantly in smoked and fresh salmon. There is also an emerging US demand for Irish shellfish (crab) products. Irish fish exports to the US in 2013 were €3m (up 59% on the previous year). Despite these opportunities for Irish seafood in emerging markets, it is important to note that longer term opportunities are not restricted solely to these regions. Despite the challenging market conditions that continue to prevail in the traditional markets for Irish seafood such as Spain, Italy and to a lesser extent in France, supply constraints in these markets as a result of the shift in global supply to the East will present niche opportunities for Irish seafood exporters in the longer term and in the European market also. It is important therefore that Ireland’s strong position and reputation in these markets is maintained and promoted to encourage loyalty and to hold market share. Irish Seafood sector - Current State of Play The Irish seafood sector is well positioned to capitalise on many of the opportunities that will be presented in the growing global marketplace for seafood. The industry has many unique selling points such as its geographical position within rich fishing grounds, the diversity of species, sustainability credentials and unpolluted waters with low levels of harmful residues. Its credentials in producing premium organic seafood for example, are very strong, allowing certain Irish species such as salmon and mussels to be positioned at the top end of the market securing a price premium in key export markets. Ireland has adopted a pioneering position on organic seafood which has allowed the industry to develop a positive quality image for Irish seafood in the global marketplace. Currently, an estimated 80% of total annual salmon production in Ireland is organic and accredited to quality labels such as AB Bio, Naturland and the European organic certification label. An 29 | P a g e estimated 35% of Irish rope grown mussels are accredited to the European organic mussel standard and this figure is growing. In addition, Irish seafood has strong sustainability credentials and the industry has been able to promote and communicate across a range of internationally recognised quality labels including MSC mackerel; MSC Celtic Sea herring and the European organic standard for a number of aquaculture species. Clearly defined USP’s of Irish seafood are therefore achievable through quality standards, food safety and Ireland’s unique geographical location within Europe’s richest fishing grounds close to the Gulf Stream. This leads to the rational conclusion that Ireland is also a source of a wide variety of species in all product categories which can cater for many international markets. 30 | P a g e SPECIFIC ACTIONS PLA NNED Seafood Development Programme 2014-2020 (EMFF) As described in earlier sections, the Department of Agriculture Food and the Marine is presently developing a new Seafood Development Programme 2014-2020. The new SDP will be the principal mechanism for dispersing public funds to support investments in the seafood sector up to at least 2020. The new SDP will comprise a total fund of €241 million, including €147.6 million in EU co-funding. While the new SDP is still in preparation, analysis to date, together with stakeholder input, suggests that there is a clear need for public support in many areas of the seafood sector to foster sustainable growth and to enable the seafood sector to achieve its enormous potential for export-led growth and increased employment in peripheral coastal communities. The European Maritime and Fisheries Fund Regulation (508/2014) provides the legal framework and significant EU co-funding to allow a broad-based programme of financial supports, subject to strategic priorities. For the aquaculture sector, it is likely that the new SDP will see the introduction of measures to build productive capacity, foster innovation and new technological development, build knowledge and skills, and promote organic aquaculture. For the seafood processing sector, it is likely that the new SDP will see the introduction of measures to promote new product development, add value to commodity products, build knowledge and skills, support the move to more efficient industry structures, improve market organisation and assist in the development of new markets for Irish seafood. For the catching sector, it is likely that the new SDP will see the introduction of measures to support the fleet in adapting to the requirements of the new CFP, including development of more selective fishing gear to reduce landings of unwanted catch, scientific supports and technological trials, the building of knowledge and skills in the industry and the maintenance of a balance between fishing capacity and fishing opportunities. For coastal communities, it is likely that the new SDP will see further development and increased emphasis on the economic development of fishing communities through Fisheries Local Action Groups. The new SDP is also likely to see significant public investment in measures to support the sustainable development of the seafood industry. These will include measures to support ongoing compliance 31 | P a g e with the Habitats, Birds, and Marine Strategy Framework Directives and measures to support the more effective enforcement of CFP rules, and collection of scientific and economic data to inform the future management and development of the industry. 32 | P a g e SUSTAINABIL ITY CONSI DERATIONS Sustainability is at the heart of the new CFP. The CFP Regulation (1380/2013) states that it “shall ensure that fishing and aquaculture activities are environmentally sustainable in the long-term and are managed in a way that is consistent with the objectives of achieving economic, social and employment benefits, and of contributing to the availability of food supplies. ….The CFP shall apply the precautionary approach to fisheries management, and shall aim to ensure that exploitation of living marine biological resources restores and maintains populations of harvested species above levels which can produce the maximum sustainable yield…...The CFP shall implement the ecosystembased approach to fisheries management so as to ensure that negative impacts of fishing activities on the marine ecosystem are minimised, and shall endeavour to ensure that aquaculture and fisheries activities avoid the degradation of the marine environment. The European Maritime and Fisheries Fund Regulation (508/2014) states that “the EMFF shall contribute to the achievement of the following objectives:.......promoting competitive, environmentally sustainable, economically viable and socially responsible fisheries and aquaculture”. Sustainability considerations will be essential elements of all measures implemented by Ireland through its proposed new EMFF co-funded Seafood Development Programme 2014-2020. More generally, the seafood sector is moving strongly to establish unimpeachable sustainability credentials. This is being achieved by the adoption of independent third party verified standards such as MSC, ASC, organic certification, green manufacturing and Responsible Fishing Standards, all of which will dovetail into the national Origin Green Initiative. 33 | P a g e CHALLENGES UP TO 20 2 5 The principal challenges facing the sector have been well analysed both in BIM’s 2013-2017 Strategy “Capturing Ireland’s Share of the Growing Seafood Opportunity” and in other strategies such as “Harvesting Our Ocean Wealth”. In the processing sector, the challenges are to secure greater raw material supply, create greater scale within the operating entities, secure further investment and develop a range of innovative, new product formats which will give the sector a competitive advantage and grow value. With regard to capture fisheries, the challenges are to come to terms with the obligation to land all catches in the new CFP, improve environmental sustainability, match the catching effort to the resource available in the demersal sector in particular and bring about a transformational rejuvenation of the once abundant inshore fisheries sector. In the context of aquaculture, because it is a livestock driven sector, there will always be new and emerging challenges for the operators in the sector to come to terms with. In recent times these have included amoebic gill disease, oyster virus and the challenges posed by climate change. The industry has shown itself to be very resilient and innovative in facing these challenges. In terms of structural issues, the main challenges for aquaculture are: the timescale for licence decisions, having regard to the requirements for appropriate assessment and other EU environmental law; to conquer the technological challenges posed by operating in the offshore environment; to lessen the dependence of the pacific oyster sector on imported spat and to also lessen the dependence of the bottom grown mussel sector on the wild seed mussel dredging; to develop the techniques and technologies for the cultivation of high value farmed seaweed species to the point where the process is commercially viable.