BAFI359: Intermediate Corporate Finance

advertisement

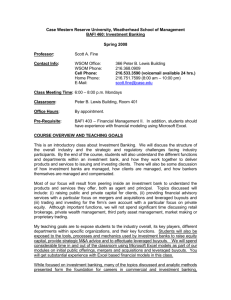

Case Western Reserve University, Weatherhead School of Management BAFI 460: Investment Banking Fall 2005 Professor: Scott A. Fine Contact Info: WSOM Office: WSOM Phone: Cell Phone: Home Phone: E-Mail: 366 Peter B. Lewis Building 216.368.0909 216.533.3590 (voicemail available 24 hrs.) 216.751.7599 (8:00 am – 10:00 pm) scott.fine@case.edu Class Meeting Time: 6:00 – 8:00 p.m. Tuesdays Classroom: Peter B. Lewis Building, Room 401 Office Hours: Monday and Wednesday or by appointment. meetings with me, as I often travel. Pre-Requisite: BAFI 403 – Financial Management II. In addition, students should have experience with financial modeling using Microsoft Excel. Please confirm COURSE OVERVIEW AND TEACHING GOALS This is an introductory class about Investment Banking. We will discuss the structure of the overall industry and the strategic and regulatory challenges facing industry participants. By the end of the course, students will also understand the different functions and departments within an investment bank, and how they work together to deliver products and services to issuing and investing clients. There will also be some discussion of how investment banks are managed, how clients are managed, and how bankers themselves are managed and compensated. Most of our focus will result from peering inside an investment bank to understand the products and services they offer, both as agent and principal. Topics discussed will include: (i) raising public and private capital for clients, (ii) providing financial advisory services with a particular focus on mergers and acquisitions and leveraged buyouts and (iii) trading and investing for the firm’s own account with a particular focus on private equity. Although important functions, we will not spend significant time discussing retail brokerage, private wealth management, third party asset management, market making or proprietary trading. My teaching goals are to expose students to the industry overall, its key players, different departments within specific organizations, and their key functions. Students will also be exposed to the tools, processes and mechanics used by investment banks to raise equity capital, provide strategic M&A advice and to effectuate leveraged buyouts. We will spend considerable time in and out of the classroom using Microsoft Excel models as part of our modules on initial public offerings, mergers and acquisitions and leveraged buyouts. You will get substantial experience with Excel based financial models in this class. While focused on investment banking, many of the topics discussed and analytic methods presented form the foundation for careers in commercial and investment banking, investment management, corporate finance and treasury management. READINGS AND CASES There is one required book, which is available at the CWRU Bookstore and at most large bookstores. This book is a humorous account of life as an investment banker, and should be read prior to the first session: Monkey Business, John Rolfe and Peter Troob, Warner Books, April 2000. The Course Packet is available in the CWRU Bookstore and contains all of the required reading materials and cases for the course. I will also hand out supplemental reading information from time-to-time. Finally, lecture notes will be made available during the course of the semester. I plan on using Blackboard to post lecture notes as well as assignments. There is a lot of reading in this class. While you are expected to read all of the materials, I will make it clear which materials must be read in detail, and which can be skimmed and used as a reference. I would also strongly encourage all students to read The Wall Street Journal on a daily basis, as well as weekly periodicals such as Business Week, Fortune and Forbes. There are also several other textbooks that cover various aspects of the industry, and may be used as a helpful reference: Investment Banking and Brokerage, by John Marshall & M.E. Ellis, Kolb Publishing Co., 1994. The Business of Investment Banking, by Thomas Liaw, John Wiley & Sons Inc., 1999. Doing Deals: Investment Banks at Work, by Robert G. Eccles and Dwight B. Crane, Harvard Business School Press, 1998. The Investment Banking Handbook, by J. Peter Williamson, Wiley-Interscience, 1998. Vault Career Guide to Investment Banking, by Tom Lott, Vault Reports Inc., 2001. In addition, there are countless good popular books that provide insight into various firms, events and issues. I would be happy to provide suggestions upon request. Some of my favorites are Liar’s Poker by Michael Lewis (the trading culture at Salomon), Den of Thieves by James B. Stewart (the insider trading scandal of the 1980s), The Predator’s Ball by Connie Bruck (the rise and fall of Drexel during the junk bond era), Barbarians at the Gate by Bryan Burrough and John Helyar (an in-depth look at one of the biggest LBOs ever), Goldman Sachs: The Culture of Success by Lisa Endlich, When Genius Failed by Roger Lowenstein (the Long Term Credit fiasco), and Tearing Down the Walls by Monica Langley (biography of Sandy Weill and his Wall Street career). 2 GRADING For some assignments, you will be encouraged and/or required to work in small groups (3-4 members). If you work in a group, only one write-up should be submitted for the group, with all members clearly listed. All members will receive the same grade for that assignment. Your grade will be based on the following: Four (4) Case Write-Ups Group Presentation Class Participation/Peer Review Take-Home Final Exam 40 20 15 25 (10 points each) (Quantity and quality) Note: All written assignments and the group presentation should be done to the same standards as a real work setting. In all cases, please proofread your work to check for grammar, spelling, etc. I also value concise, cogent work over voluminous pages of incoherent gibberish. COURSE SCHEDULE AND ASSIGNMENTS Note: Materials should be read prior to the class in which they are listed. Tues. August 30th Primary Functions, Industry Overview and Key Players Monkey Business, John Rolfe and Peter Troob, Warner Books, April 2000. “Customer and Product Focus”, by Steven Rattner, Chapter 2 in Global Investment Banking Strategy, The Economist Intelligence Unit Limited and A.T. Kearney, Inc., 1998. “Organisation and Culture”, by Sir William Purves, Chapter 4 in Global Investment Banking Strategy, The Economist Intelligence Unit Limited and A.T. Kearney, Inc., 1998. “Corporate Finance: Underwriting and Syndication”, Chapter 3 in Investment Banking and Brokerage, by John Marshall & M.E. Ellis, Kolb Publishing Co., 1994. (Pgs. 65-99) *** Discussion of Case Assignment #1 Due Next Week *** Tues. September 6th Case Discussion: Three Key Players Introduction to Initial Public Offerings *** Case Assignment #1 Due at Beginning of Class *** “The Goldman Sachs IPO (A),” Ashish Nanda, Malcolm Salter, Boris Groysburg and Sarah Matthews, Harvard Business School Publishing, 2002. “Donaldson, Lufkin and Jenrette, 1995 (Abridged),” Case 25 in Case Studies in Finance, Managing for Corporate Value Creation, Robert F. Bruner, McGraw-Hill Irwin, 2003 (pages 304-332). 3 “Hambrecht & Quist (A) & (B)”, Thomas DeLong & Nicole Tempest, Harvard Business School Publishing, 1999 and 2000. The first hour will be a case discussion of the three assigned cases. You will only be responsible for fully preparing one of them. After the break and next week, the lecture will highlight why companies go public, the process and mechanics of going public, the costs of going public to the issuer, and the profitability of IPOs to the underwriters. We will also review the IPO model. There are many readings for this week and next, all of which are listed for next week. Please pace yourself accordingly. I will hand out questions to consider for the first three readings for next week. In prior semesters, I assigned these readings as a case write-up. To lighten the workload, we will discuss these in class. Please be prepared to discuss the questions. Tues. September 13th Public Equity – Initial Public Offerings *** Discuss Case Assignment #2 Due in two Weeks *** *** Discuss Group Presentation due in five weeks *** *** Discuss Detailed Work Program for Group Presentation *** “The Making of a Millionaire” by Robert A. Mamis, Inc., May 1995. “Inside an Internet IPO”, by Robert D. Hof, Business Week, September 6, 1999. “Inside the Deal That Made Bill Gates $350,000,000”, by Bro Uttal, Fortune, July 21, 1986. “Equity Issuance,” Techniques & Solutions, The Globecon Group, December 1999. “The Issue Process for Public Securities,” Darden Publishing. “Mechanics of an Initial Public Offering,” by John J. Jenkins, Calfee, Halter & Griswold LLP, October 12, 1999. Profile of Investment Banking Contacts – Evaluation criteria for choosing RELTEC managers RELTEC IPO Summary Schedule “IPO Costs,” Skills & Applications, The Globecon Group, Aug./Sep. 1999. Spreadsheet – Sample Economics of Public Offering “What Traders Do,” by William L. Silber and Roy C. Smith, New York University, unpublished manuscript. “Chinese Walls and Research Coverage of Active Corporate Finance Clients,” by John J. Jenkins and Joseph C. Letizia, Presentation for Calfee, Halter & Griswold (unpublished), April 3, 2000. 4 Tues. September 20th Public Equity – Positioning and Valuation Depending on class size, we will meet in the computer training room down in the basement. “Note on Dilution.” “Note on Public Equity Valuation.” “Advertising Valuation” from Lauren Rich Fine. Excerpts from “Eskimo Pie Corporation,” Harvard Business School Publishing. “Valuation Analysis – Company A Initial Public Offering,” a spreadsheet model. Case study materials on “1-800 Contacts” initial public offering. Tues. September 27th Public Equity – Positioning and Valuation Continued Guest: Lauren Rich Fine, First Vice President and Managing Director, Equity Research, Merrill Lynch Tues. October 4th Case Discussion: “Eagle Finance Corp.” *** Case Assignment #2 Due at Beginning of Class *** “Eagle Finance Corp.”, Susan Chaplinsky, Darden Business Publishing, 1995. Tues. October 11th Fixed Income – Investment Grade Debt, Private Placements, Syndicated Bank Debt and High Yield Debt “Note on Bank Loans,” Susan L. Roth and Scott B. Mason, Harvard Business School Publishing, 1993. Optional Readings: “Financing Leveraged Deals,” Techniques & Solutions, The Globecon Group, June 1998. “The Credit Rating Industry”, by Richard Cantor and Frank Packer, Federal Reserve Bank of New York Quarterly Review, Summer-Fall, 1994. “Introduction” and “Part 1: An Economic Analysis of the Traditional Market for Privately Placed Debt”, in The Private Placement Market, by Mark Carey, Stephen Prowse, John Rea, and Gregory Udell, Board of Governors, Federal Reserve System, December, 1993. “Treasures in the Junkyard,” by Roy C. Smith, Chapter 7 in The Money Wars, Truman Tulley Books, 1990. 5 Tues. October 18th Group Presentations on IPOs *** Group Projects Due at Beginning of Class *** Presentations and discussion of IPO candidates Tues. October 25th Convertible Securities, Mezzanine Financing, Preferred Stock and Product Innovation Required Reading: “The Origin of LYONs: A Case Study in Financial Innovation,” by John J. McConnell and Eduardo S. Schwartz, Chapter 24 of The New Corporate Finance: Where Theory Meets Practice, Donald H. Chew, McGraw-Hill Companies, Inc., 2001. Optional Reading: “Convertibles Special Report,” by Anne Cox, Merrill Lynch, 2000. Tues. November 1st Leveraged Buyouts and Venture Capital Work in class on LBO Model. Review high-yield, mezzanine and syndicated loan materials from earlier in term. “The Economics of the Private Equity Market,” by Stephen D. Prowse, Federal Reserve Bank of Dallas Economic Review, Third Quarter, 1998. “Technical Note on LBO Valuation (A),” Carliss Baldwin, Harvard Business School Publishing, 2001. Optional Readings: “A Note on Valuation in Private Equity Settings,” Josh Lerner and John Willinge, Harvard Business School Publishing, 2002. *** Discuss Case Assignment #3 Due Next Week *** Tues. November 8th Leveraged Buyout Case *** Case Assignment #3 Due at Beginning of Class *** “Dressen,” Harvard Business School Publishing, 2005 Tues. November 15th Mergers and Acquisitions Presentation will be posted on Blackboard. We will discuss this presentation during class, including walking through the various valuation methodologies. *** Discuss Case Assignment #4 Due in Two Weeks *** 6 Tues. November 22nd Client Management and the CFO’s Perspective Guests TBA “The Union Carbide Deal (Abridged),” Thomas DeLong, Harvard Business School Publishing, 1999. Handout – Chief Financial Officer Responsibilities and Needs and Wants Review “Customer and Product Focus” and “Organisation and Culture” from first class. Tues. November 29th Mergers and Acquisitions *** Case Assignment #4 Due at Beginning of Class *** “Structuring Repsol’s Acquisition of YPF S.A. (A),” Case 44 in Case Studies in Finance, Managing for Corporate Value Creation, Robert F. Bruner, McGraw-Hill Irwin, 2003 (pages 629-657). Tues. December 6th Wrap-Up and Discussion of Final We will touch upon several topics that weren’t addressed during the term, including Real Estate, Structured Finance, Project Finance, Restructuring, Asset Management, etc. We will also revisit the syllabus to wrap-up the course. Finally, we will discuss the takehome final and provide time for Q&A and to complete the course evaluation form. Tues. December 13th Earlier!) Take Home Final Due by 5 p.m. (Can Be Submitted 7