AD - WTO ECampus - World Trade Organization

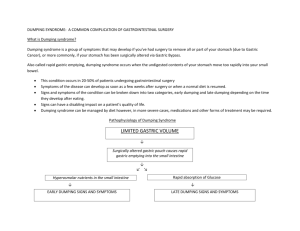

advertisement