India Speech – Europe, the Lost Continent

Europe, the Lost Continent (Slide 1)

It is possible to tell two very different stories about the European Union in the last twenty years. The first, positive account we might call the “glass half full” narrative. The second, which we have heard rather more frequently of late, focuses on the empty half of the glass.

How might we characterize, briefly, these competing descriptions ?

The positive story is one which is most often heard in Europe, and perhaps particularly in parts of continental Europe. It is the story which enthusiastic Europeans like to tell each other over civilized meals in sophisticated Brussels restaurants. It runs roughly like this.

The European Union is a noble venture which has brought peace to a warring continent. In spite of all the difficulties of integration it has succeeded in attracting 27 members, from Estonia in the North East to

Portugal in the South West, from Cyprus in the South East to the Hebrides in the North West. (Slide 2) It has been a pole of attraction for almost the whole continent. The existence of the European Union, and its promise of a prosperous democratic future, facilitated the smooth break-up of the west of the Soviet Empire and created the conditions for political stability in former communist countries in Eastern Europe. The single currency has brought low inflation and financial reform across much of the continent and all EU members, apart from the UK, are committed to joining it when they meet the criteria. (Slide 3) Furthermore, there is an additional list of countries which wish to gain access to the benefits EU membership can bring, from Iceland through Croatia and Macedonia to Turkey. An outer ring of countries is keen to negotiate association agreements of various kinds.

Europe may not be a conventional political union with the apparatus of a superstate. It may not be a superpower in global terms, at least not in the sense that it can project military force around the globe. But it could be a model of cooperation for other regional groupings keen to lower tensions and remove the possibility of conflicts between them. While others talk in the language of hard power, Europe shows what soft power can achieve.

And the European way of life, somewhat more relaxed, more socially equitable and more environmentally-friendly, may be an example for the rest of the planet in coming decades.

The benefits of aggressively free-market Wall Street capitalism seem a little less self-evident since the crisis. And Europe is still prosperous, in terms of GDP per head (Slide 4). With 500 million people, 150 million more than us, the EU economy is still bigger than that of the US (Slide 5).

So the Eurocrats comfort themselves in Brussels. Another glass of that excellent cognac, anyone ? Or should we retire to bed under our goose down duvets ? After all, we have an early meeting of the political cooperation sub-group in the morning. 11.30, didn’t we agree ?

But there is another story which paints a rather different picture. One hears it much more in North America and, increasingly, in Asia. It is also a song which British Eurosceptics like to sing.

It begins by noting that on almost any measure Europe has been losing ground to its competitors, and even to the United States. Europe’s share of global economic output has stagnated and is beginning to fall. At the same time, its influence in key decision-making bodies has been reduced.

The world’s centre of economic gravity is moving eastwards.

In political terms, Europe has shown that it lacks the unity and conviction to grapple even with problems on its borders. Only when the Americans were finally persuaded to intervene was some form of peace restored to

the Balkans. The EU has no obviously effective policies towards Russia. Its efforts in the Middle East have been largely fruitless. The continent lacks leadership. There has been no answer to the famous Kissinger question – one which he says he never asked – “when I want to know the European view, whom do I call !”

Charles Grant, one of the most notable Europhiles in the UK, recently published a paper called “Is Europe doomed to fail as a power ?” 1 , in which he said that “On many of the world’s big security problems, such as

Pakistan, the EU is close to irrelevant. Talk to Russian, Chinese, or Indian policy –makers about the EU, and they are often withering. They view it as a trade block that had pretensions to become a power but has failed to become one because it is divided, slow-moving and badly organized.”

With friends like that, as they say, who needs enemies ?

Now of course Europe’s political leaders are not ignorant of this second story. They hear it often enough themselves, and have done for a decade or more. The exercise to draft a new European constitution, initially led by former French president Valéry Giscard D’Estaing, was designed to fill the leadership vacuum and provide some continuity at the top, replacing rotating presidents with individuals with a longer time horizon, and tidying up the Byzantine decision-making processes. Unfortunately, the outcome of that exercise, as we shall see, has not been quite as Giscard hoped. The process of trying to agree the reforms was complicated by negative results in referenda in the Netherlands, France and Ireland, all of which suggested that Europe’s political elites have lost touch with their voters.

Furthermore, while Europe’s decision-makers were preoccupied with the arcane details of the Nice and Lisbon treaties, a storm was brewing across the Atlantic, one whose winds blew across the European continent,

1

Centre for European Reform, 2009

creating economic destruction on a massive scale. Furthermore, the financial crisis accentuated some of the trends which underpinned the second, “glass half empty” narrative.

As we speak, Europe is continuing to clear up the wreckage after the storm and has barely began to rebuild its economic foundations. But it is nonetheless not too soon to ask how the crisis has affected the EU and, particularly, how it has altered the balance of argument between my two competing stories. Is the glass still half full, or is there only a small shot of brandy left at the bottom? Enough for just one bracing drink before

Europe closes down and sinks, Atlantis-like, beneath the waves?

That maybe enough mixed metaphors for one lecture. But I know that

Indians enjoy the colourful use of the English language, which is why your writers win the Man Booker Prize increasingly frequently.

But what has happened in the crisis which affects the position of Europe, and how can Europe respond ? Five trends, have developed over the last three years, all of which are very problematic for us Europeans.

First, our recession has been as sharp as anywhere, or sharper, and our recovery is generally slower (Slide 7). There are differences from country to country, and I am more optimistic about France and Germany than I am about Spain and the UK (not to mention Greece). Overall, the broad consensus view seems to be that Europe’s post-crisis growth rate will be sluggish. There is a huge debt overhang, both in the public sector and among households, which will need to be reduced. This deleveraging process amounts to a very strong headwind into which the European ship must sail. OECD and IMF forecasts, therefore, suggest around 2% growth for Europe at an annual rate, while China is now back at 10%, India at least at 8%, and many other developing countries are doing almost as well. The US has picked up more rapidly, in spite of all its problems.

Looking further ahead, it is hard to be optimistic. The demographics are against us. Europe’s population is likely to decline, and only immigration – not an easy political question- could turn that round, with all the tricky social consequences that come in its wake. Many European countries have been losing competitiveness, and are ill-placed to take advantage of more rapid Asian growth. Only 2% of UK exports, for instance, go to China, so we benefit little from China’s robust recovery.

The second point, which is largely a consequence of the first, is that the shift in the world’s centre of economic gravity from West to East has speeded up. Some French economists at HEC in Paris have tried to pinpoint the world’s centre of economic gravity (Slide 8). They have tried to find the place on the world’s surface which is least remote from all the major centres of activity. Thirty years ago, they think it was somewhere around Reykjavik. Now it is north of Russia, and marching on towards

Siberia, pulled by the magnetic attraction of very rapid growth in China and India.

Third, these shifts in relative economic strength have been mirrored in changes in the composition of the key governing bodies of the world economy. It is argued – indeed I argue myself – that there should have been changes earlier in the composition of the IMF Board, the G7, the

Financial Stability Forum, now Board, the Basel Committee, etc. Although these arguments were rejected for a long time, the crisis made change inevitable. So it is now clear that the most important economic decisionmaking body is now the G20 rather than the G7 or the G8. Europe has four national members of the G7, and the President of the Commission turns up as well (Slide 9). When it comes to financial matters, there is also the president of the ECB, adding to Europe’s representation. Whereas within the G20, Europe has only 5 of 20 members. This is a rather banal

calculation of influence, but it is bound to have some impact, especially when combined with declining economic weight.

And in other areas, the position is even worst. The Copenhagen climate change summit was a very unpleasant wake-up call for Europe for

European leaders. The outcome was of course generally rather less dramatic than many had hoped, but such outcome as there was came from a meeting of the Americans, the Chinese, and one or two others, from which Europe was excluded, even though it may be argued that the

EU took the lead during the build-up to the conference, and that its own ambitious carbon-reduction offer was influential.

There is now increasingly of talk of an effective G2 running the world economy, the Americans and the Chinese. Time was when the EU was one of the most crucial actors in international trade policy. But, arguably, the

EU’s approach to trade policy has been almost entirely unsuccessful in recent years, in spite of Peter Mandelson’s efforts. As Frederic Erixon and

Razeen Sally have said in a recent paper, “In 2006 the EU launched a new trade strategy centred on bilateral trade negotiations with emerging markets in Asia. This grand strategy has not been particularly successful.

Key elements of it were ill-advised, and the lack of progress was predictable from the start. Global Europe has not has any visible effect on the Doha round” 2 .

So, everywhere you look in economic governance, the crisis seems to have accentuated Europe’s declining influence.

Meanwhile, Europe’s new constitutional settlement has turned out to be a disappointment. Many commentators would be far less polite than that.

2 Frederic Erixo and Razeen Sally, “Defensiveness and fragmentation in trade policy”, in The EU in a world in transition: Fit for that purpose ? Loukas Tsoukalis ed., Policy Network, London, 2009

There is a European president, now, but far from replacing the rotating six-month presidency, it has just added another complication which confuses foreigners no end. It confuses Europeans too, I should tell you.

Because the new jobs, the “Permanent” President and the new foreign affairs High Representative – Europe’s Foreign Minister- were so illspecified, that the candidates chosen to fill them were not perhaps those which might have been hoped (Slide 10).

Furthermore, the decision-making around the eventual choice was heavily political. So the socialist group wanted the Foreign Affairs job, and the

Christian-Democrats wanted the presidency. Furthermore, it was agreed that one of the two should be a woman. The consequences were Herman

Van Rompuy and Baroness Catherine Ashton. I do not know either of these two people personally, indeed I know almost nothing about them.

But one would have to be a very optimistic European indeed to believe that the outcome of this process will radically improve the profile of the

European Union and strengthen in its leadership. I would guess that they are not household names in Dehli or Mumbai.

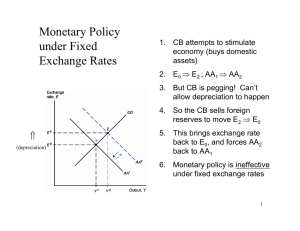

This leadership vacuum has turned out to be rather important for a fifth reason. Because Europe is in the midst of another kind of crisis, of its own making. The Greek debt crisis has demonstrated a fundamental flaw in the construction of the monetary union. This is a flaw to which some people drew attention at the time of its creation. There is a lack of a political and economic policy-making counterweight to the European

Central Bank, and particularly the lack of a body which can provide financial backing to a country which finds itself in difficulty. Of course some people argued this right from the start. In 1991 Helmut Kohl said “it cannot be repeated often enough. Political union is the indispensable counterpart to economic and monetary union. Recent history, and not just that of Germany, teaches us that the idea of sustaining an economic and monetary union over time without political union is a fallacy”.

I would not go so as far, but the Greek problem has demonstrated that without a Stability and Growth Pact, in other words without pan-

European fiscal discipline, the monetary union is vulnerable. There are some who are now recall the words of Margaret Thatcher in her 2002 book, when she said “I believe that the European single currency is bound to fail, economically, politically and indeed socially, although the timing, occasion and forced consequences are all unnecessary still unclear”.

Again, I would not go so far. Without a fiscal agreement the Monetary

Union is highly vulnerable, though that does not need to involve a large central budget, and large fiscal transfers from country to country. I agree with Otmar Issing, the former Chief Economist of the ECB, who said “the

Stability and Growth Pact contains the rules that are necessary for

Monetary Union to function. There is no need for coordination of macroeconomic policies to go any further than this” 3 . But, as he points out, the Pact was effectively abandoned, ironically because Germany and

France were unable to keep to it, a few years ago. Now we have the unfortunate situation where a Eurozone member needs financial backing

– perhaps as a result of its own profligacy and their lack of competitiveness – but the European Union is ill-equipped to provide it.

Yet, unwisely I believe, there was initial resistance to the idea that the

IMF could be brought in to handle the problem of the Eurozone countries.

It seems to me that the IMF is there for that purpose. While it may be attractive, as Wolfgang Schäuble has argued 4 , to think of a European

Monetary Fund in the future to provide financial assistance within the EU, that cannot be created overnight, and needs a treaty change which in turn requires a political consensus which is not currently available.

3 The Euro – A currency without a state. Centre for Financial Studies Working Paper

No. 51. December 2008

4 Why monetary union faces its biggest crisis. The Financial Times. 12 March 2010

However, I believe the European currency will survive this test, and I do not agree with those who think Greece is merely the “Canary in the coalmine”, or the first of a series of dominos which will inevitably fall.

There is much talk these days of the PIGS (Slide 11). This brutal term is used to describe Portugal, Italy, Greece and Spain, all Southern European countries with various forms of fiscal and competitiveness problems.

Their borrowing costs have raised new doubts about Euro membership in each case (Slide 12). But in fact, as the CDS spreads show, the Greek position can be distinguished from the others. Greece has lost competitiveness very seriously during its time in the single currency zone.

It engaged in creative accounting to disguise its deficit.

One thing that is very surprising about the last decade has been the divergence in unit labour costs which has opened up within the European

Union (Slide 13). Many thought that the discipline of the single currency would oblige countries to track developments in German unit labour costs. I thought so myself. But that has not been the case. It would seem that some countries have instead taken membership of the Eurozone as a licence to increase costs, and abandon fiscal discipline, creating a serious free-rider problem.

Does all of this matter? Can we now say that the EU experiment is condemned to failure, and that Europe is condemned to genteel decline, as a recent article in The Economist put it 5 . They quoted a famous line from Guiseppe di Lampedusa’s novel “The Leopard” in which the Sicilian prince, presiding over his declining small state, says “if we want things to stay as they are, things will have to change”.

5

Lessons from “The Leopard” – Is Europe becoming too accustomed to genteel decline? “Charlemagne’s Blog”. The Economist. 12 December 2009

But I think we need to be careful to identify those things which can be changed, and those which cannot. As far as the centre of the world economic gravity is concerned, and the shifting balance of GDP, I cannot see that what Europe does is unlikely fundamentally to affect that trend.

So we should not be too anxious about it (Slide 14). As the saying goes, ‘if something is inevitable, it is best to welcome it’. And, overall, we will benefit in Europe from growing prosperity in developing countries, as long as our economies are able to supply some of the things those developing countries need, whether it is heavy industrial machinery, which the

Germans are still good at providing, or higher education, where the UK has some valuable competitive strengths.

The problem is not what is happening in the rest of the world, it is that

Europe has not adapted to these changes rapidly enough, either economically or politically.

Economically, we should be careful to differentiate between countries, because the performance of different economies in Europe varies considerably, and even in the single currency zone, as we have seen, competitiveness developments have been remarkably different from place to place. What is clear is that there are countries and companies who have seen the single currency, and the protection it offers, as an excuse to sit back, rather than as a stimulus to improve. That is very unfortunate.

And the EMU problem is very serious. It needs to be solved soon. In the

Monetary Union, and we English should be careful about what we say as we are not in it, there is clearly a need for some resolution of the problem of how member states in financial stress are assisted. If no European solution is found, then Europe cannot at the same time reject IMF intervention.

More broadly, I cannot help thinking that the Lisbon Treaty, and certainly the way in which it is been operated, must be considered to be unfinished business. The current position, with competing agendas from two different presidents, cannot survive in the long run.

All of this amounts to a rather gloomy prognosis. Have we reached the end of the noble vision of European integration? Have the grand ambitions of Jean Monnet and the other founding fathers now been dissipated in a morass of competing institutions, cross-cutting agendas and wide-spread apathy ?

The answer to that question may possibly turn out to be yes, but we should not forget that there remains an idealistic streak in the European body politic, at least outside the UK. We should also not forget that the

European Union is an unusual construct, which cannot easily be judged by the analytical approaches relevant to independent countries, or even to federations like the US. Some of the criticisms of monetary union seem to me to start from the wrong perspective, for example. They assume the need for a fully common fiscal policy which, like Otmar Issing, I do not consider necessary. It is also possible that the critics of the European

Union are underestimating its soft power, and forget how attractive a society has been created in Europe – evidenced by the numbers of people who wish to emigrate there from elsewhere.

So failure is not certain, but nor is success.

My own view is that there are two possible ways forward, which we might call the high road and the low road (Slide 15). If Europe takes the high road, it will consolidate its gains in stability, social harmony (in relative terms), respect for human rights and high educational standards. It will spread those benefits more broadly across the continent, managing to

integrate the Balkan states, Turkey and perhaps even the Ukraine. At the same time it will succeed in turning the crisis to its advantage.

It is possible, for example, that the Greek debt crisis, which has threatened to destabilize the Eurozone in recent months, may be the catalyst for a new Stability and Growth Pact, and possibly in the longer run for a new European institution, which will in the long run make the

Monetary Union more robust and more sustainable. We can already see that new thinking has been stimulated by the need to address the Greek problem, and some previous objections to schemes of economic governance in Europe to match the single monetary policy have disappeared.

The post-crisis sluggish growth may give renewed momentum to the

Lisbon strategy, designed to enhance competitiveness, which has been stalled for some time. And perhaps the calm competence of Mr van

Rompuy will produce a steady hand on the European tiller, and gradually build credibility for the new presidency. After all, it was always unlikely that there would be a “big bang” reform in constitutional terms. The Blair project was always a dream for some, and a nightmare for others.

But we have to recognize that there is low road, too, which might be taken. Where would that lead ?

To growing irrelevance on the global stage. It may be that the US, which has clearly lost interest in Europe in recent years, will succeed in finding new firm friends in Asia. Perhaps the nightmare which was set out by the

Finnish minister Alexander Stubb 6 – in fact an LSE alumnus- will come true. He quipped that one day President Obama decides to call Europe for a view. The president forgets about the time difference and gets an

6 As reported in “Gone, Solid Gone”. Roger Cohen. The New York Times. 9 March

2010

answering machine which says: “Good Evening, you’ve reached the

European Union, Herman Van Rompuy speaking. We are closed for tonight. Please select from the following options. Press one for the French view, two for the German view, three for the British view, four for the

Polish view ...”.

This inability to produce coherence and relevance at European level may in turn encourage the independent tendencies of the French, and certainly of the British, who may well decide to go their own way in international forums to an even greater extent than before. Then we could forget indefinitely the prospect of a “single European voice”, and a process of

European disintegration, at least in political terms, would have begun.

The British Conservative party would certainly welcome that outcome, and they may soon be in a position to be able to bring it about.

In economic terms, then low road leads through stagnation to several

Japanese-style lost decades, with a rapidly declining share of global GDP, and perhaps also to the loss of social stability which has been a European trump card. On the low road some European countries became detached and the PIGS become… well, bacon (Slide 16).

I should end, however, by asking whether any of this matters to India.

Has Europe now become so irrelevant that you can stand by and watch to see which of these roads we travel, as essentially the choice will make little difference to you, even if it is important for Europeans?

I would like to suggest that it does have some relevance, and that Indians should probably wish for the high road to be taken. If Europe does not get its act together, global cooperation will be more difficult. There are many areas of global polities in which Europe can play a constructive intermediate role between the US and China. Climate change is just one of them. The oversight of global finance is another. In that area, relations between US and China are evidently somewhat strained and there is a risk of a retreat into protectionism which could damage India’s interests, and

indeed the UK’s. So a more coherent European view would almost certainly be a helpful contribution.

Also, a prosperous Europe growing more rapidly would be strongly beneficial to the Indian economy. Even though Europe has declined in relative economic importance, European consumers are collectively still almost as important to the global economy as the Americans. For all these reasons, a blocked and inward looking European Union, constantly preoccupied by constitutional debates, would not be good for the rest of the world. So those of us who cling to a belief that the European Union is a valuable construct must struggle to make it work, vain though the struggle may sometimes appear, and the present is certainly one of those times (Slide 17).