mopg: research report 2) uk opencast coal

advertisement

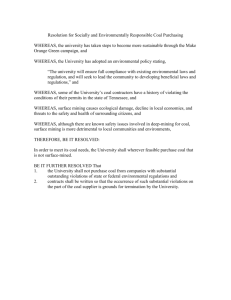

MINORCA OPENCAST PROTEST GROUP RESEARCH REPORT No 2 UK OPENCAST/ SURFACED MINED COAL: IT’S ROLE IN PROVIDING UK ENERGY SECURITY STEPHEN LEARY, CHAIRPERSON, MINORCA OPENCAST PROTEST GROUP 2008 - 2009 Summary This report reviews recent trends in the use of coal for energy generation purposes, the sourcing of that coal and changes in the production of domestically produced coal. Consideration is then given to future estimates for the demand for coal and what implications this carries for indigenous coal production, the creation of up to 180 new opencast mines between 2007 and 2025 and the possibility that, by then, the UK will only be producing opencast coal for electrical generating purposes. Before drawing a number of conclusions from the report the report indicates which parts of the country could be affected by the increased number of future opencast planning applications. OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 1 CONTENTS SECTION TITLE PAGE Nos. Section 1 Report’s Conclusions 3-5 Section 2 The Reasons for this Report 5-6 Section 3 Introduction 6 Section 4 UK Coal Demand and Supply 1988 7-10 - 2008 Section 5 Pollution Issues and Future Trends 10-13 in the Demand for Coal. Section 6 Short Term Energy Supplies and the 13-15 Demand for Coal Section 7 Energy Security and the 20m tonne 15-21 target for Indigenous Coal Production Section 8 Deep Mines and the Future Supply of 20 - 22 Coal Section 8 The Myth about ‘Clean’ Coal 22-23 Section 9 Future Areas that may face Opencast 23- 25 Mining Applications between now and 2025 References 26-31 Current and future reports in this series 31-32 Copies of this paper are available on: http://www.leicestershirevillages.com/measham/minorca-protest.html or http://mopg.co.uk/ Steve Leary can be contacted about this research paper on: OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 2 steveatmopg@googlemail.com 1) REPORT CONCLUSIONS This discussion of past and current trends argued that a sustainable domestic coal industry seems to be dependent on increasing the proportion of coal produced by opencast methods, eventually up to 100%. It seems that there are no projections currently for the use of coal if CCS technology does not prove itself to be viable either practically or commercially. Until CCS is proven to be commercially viable the Energy Markets Review team should include a projection on the demand for coal which includes this possibility. (Section 5) This discussion of past pollution issues suggests that there is likely to be a continuing decline in the demand for coal and that this level of demand is difficult to predict until the Carbon Capture and Storage systems prove themselves to be commercially viable. Even then newer technologies such as Underground Coal Gasification could have a significant impact on the future need for mined coal for generating purposes. (Section 5) A future report in this series should look further at the future demand for coal topic so that an estimate can be given for the demand for coal when the following factors, for example, can be addressed: The impact of the revised LCPD when it takes full effect in 2016 The above plus evidence that carbon capture works or does not work The impact of attempts to make more efficient use of the energy network such as the ‘intelligent grid’ idea The increasing impact of renewable and bio-fuels Consumers reducing their consumption of electricity. This is going to be an increasingly important issue for those communities facing new opencast mining applications for sites that, if OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 3 the planning application was granted, would still be coaling during and after 2016. (Section 5) As at September 2009, there is no immediate threat to the security of supply. One later indication was that stockpiles of coal were expected to increase during the winter of 2009 /10 as it looked as though gas would be a cheaper fuel to use as the ‘base load’ fuel for producing more than 50% of the UK electricity supply. (Section 6) In the future the bulk of indigenous coal production is going to be from opencast coal, which is likely to be between 50 and 60% of the production in the medium term rising to 100% in the longer term, Planning approval would have to be on average for 10 new opencast mines each year between 2007 and 2017. If extend this time horizon to 2025 as Wicks does, then the prospect is that between 2007 and 2025 180 new opencast sites will need to gain planning permission. (Section 7) In the future Energy Security issues will be used to justify granting planning permission for new opencast mines so that UK coal producers can assure generating companies that they will be able to provide indigenous coal for up to 5 years in the future. This demonstrates the interdependence between Planning Policy and Energy Policy. (Section 7) What was an aspiration target of producing 20m tonnes of indigenous coal proposed by the Coal Forum is rapidly gaining the reputation of being an official government target, locking in the need for a predominantly opencast based indigenous coal industry for the foreseeable future. (Section 7) Those opposing opencast mining applications will be in a ‘Catch 22’ situation where the new ‘Need for Coal’ argument could be wheeled out to justify every new application. Thus objectors will be ‘holed below the waterline’ before they even lodge an objection. (Section 7) Unless there is some public subsidy new deep mines are unlikely and the existing deep mines, given recent experience, have a tenuous OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 4 future. Evidence exists that the last deep mine may close as early as 2021, making the Governments Energy Security policy dependent on Opencast Coal. If any of them shut even more opencast coal production is likely. (Section 8) In the opinion of those opposed to Opencast Mining, by relying on opencast coal for its Energy Security, the Government is allowing opencast operators to ‘borrow’ large tracts of the countryside, often in remote places where to transport the coal they have to use road transport, rip the countryside apart, create holes up to 200 metres deep, on sites that can be larger than Minorca’s at over a mile long and half a mile wide, destroy natural habitats, create noise and dust in a tranquil area, blight the lives of thousands of people all to produce ‘clean’ coal. (Section 9) Numerous areas of the UK are at risk of being the victims of opencast mining in the future, 9 counties in England, 10 in Scotland, 3 in Wales and 1 in Northern Ireland. In addition 21 unitary authorities across England Scotland and Wales could also be affected. (Section 10) In light of this evidence, it may be appropriate to suggest that the Energy and Climate Change Select Committee ask for further information on the issue of whether, in the foreseeable future, the fulfilment of Britain’s Energy Security policy is going to be dependent just on the production of opencast coal which will affect one or more of the local authority areas listed above. (Section 10) 2) THE REASONS FOR THIS REPORT This report has been written for all current and future groups and organisations that are or will be formed to oppose opencast coal mining applications. Its purpose is to ensure that such groups both better understand why such an application has been made and be more capable of opposing such applications. The report reviews the demand for opencast coal especially for power generation purposes in order to enable such groups to challenge the ‘Need for Coal’ arguments that have been successfully employed at recent Public Inquiries. Why the ‘Need for Coal’ arguments were developed was explored in the first report in this series1. This report attempts a deeper analysis of trends for past, present and future OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 5 opencast coal use. It makes no claims to being authoritive; the author has limited expertise in the subject of Energy Policy. On the other hand this is, as far as is known, the first attempt to write such a report from the perspective of opposing opencast mining applications. Hopefully, future reviews will build on this initial effort and better aid in the development of ideas that not only effectively dispute the ‘Need for Coal’ arguments but enable groups in the future to effectively oppose opencast mining applications. If you have any observations on how to improve this report then let the author know. His email address is at the end of the report. 3) INTRODUCTION This report begins by analysing trends in the use and supply of coal in the UK over the last twenty years. It then demonstrates the declining trend of using coal as a primary fuel, the trend to use imported coal rather than domestically produced coal for power generation and, in the declining domestic market for coal, the increasing role being played by opencast coal production. Then consideration is given to the implication of these trends for domestic coal production in the future as, firstly increasing attempts are made to lessen the degree of pollution caused by burning coal especially for power generating purposes and secondly the Government seeks to ensure a secure energy security. The paper then argues that there is no short term threat to the security of supply for coal as stockpiles of coal are rapidly increasing. It then suggests what the future implications are of the apparent ‘official policy’ to ensure that indigenous coal production stabilises at around 20m tonnes for the foreseeable future as part of a longer term energy security policy, with between 50-60% of this coal initially being from opencast sites before, in the 2020’s, all our indigenous coal production is possibly from opencast coal. Whether such a policy is compatible with the idea of ‘Clean’ Coal is then discussed as are the reasons why deep mine coal will play such a reducing role. The 20m tonne target suggests that 10 new sites will be needed a year, which means that between 2007 and 2025, 180 communities could face the same problems as the communities around the Minorca site face – the prospect of having an industrial site for opencast coal imposed on them by a benign planning system unless they oppose it. Areas of the country where this is likely to happen are indicated at the end of the report before summarising the report’s conclusions. OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 6 4) UK COAL DEMAND AND SUPPLY 1988 – 2008 The position of Coal in Britain’s energy supply mix has changed dramatically over the last twenty years. This period spans the period during which the industry was de-nationalised on the one hand and then exposed to world energy prices and international market forces on the other. Later in this period growing concerns about the relationship between burning coal and pollution have also had an effect on the demand for coal. This has led to major adjustments for Britain’s coal industry. In the first part of this period, coal’s share of Britain’s energy mix fell from approximately 31% to 23% as natural gas took an increasing share of the market 2 Latterly, since 1993, pollution concerns have also been a contributory factor. European Community legislation aimed at reducing the level of Acid Rain meant that coal fired power stations had, over time, to reduce their emissions of Nitrous Oxide (NOx) and Sulphur Dioxide (SO2). As Beynon et al point out “ Meeting the NOX emission targets mainly involved the fitting of low NOX burners at the power stations, however meeting the SO2 targets presented the power station operators with a far greater challenge. When the electricity generating companies were privatised in 1991 only three power stations in England (Drax, Ratcliffe and Ferrybridge - totalling 8GW of capacity) were planned for flue gas desulphurisation (FGD) equipment. Later one station in Scotland (Longannet) would join the list. PowerGen refused to have FGD installed at Ferrybridge and the installation of more FGD was ruled out by the generators. Burning cheaper imported low sulphur coal was seen as one possible option - but converting to other low/non-sulphur fuels was the main option that the generators would adopt in 1990s, building new generating capacity, using "cleaner" natural gas as the fuel.” 3 From 2001, this policy within the EU has been revised in two ways, with the revised Large Combustion Plants Directive (2001) and from 2005 the EU Emissions Trading Scheme (EU EAT). The former, according to the International Energy Agency’s (IEA) Clean Coal Centre, is aimed at reducing further the emissions of NOx and SO2, so that OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 7 “The requirements of the revised LCPD for existing facilities mean that by 2016,all major pulverised coal fired power plants will have to install FGD (for >90% removal of SO2) and SCR (for >85% NOx removal)” 4. As the IEA point out this alone leads to a significant increase in the cost of using coal. In addition, from 2008 the second phase of the EU EAT scheme came into force. This scheme is aimed at pricing the use of carbon as a polluter into the price of energy usage. As coal as a fuel source was rated the highest emitter of carbon, it further disadvantages coal as a feed stock for energy production. The IEA go on to summarise the current position as “In the shorter term, the combined impact of the EU ETS and the revised LCPD is a key factor, which must be considered, that is creating uncertainties with regard to the future life of fossil-fuel based, especially coal-fired, power stations”. 5 These factors are affecting the use of coal and will continue to influence coal as a choice for a feed stock in the future. However the future use of coal is even cloudier, given the uncertainty over whether Carbon Capture will work (see below). These concerns have had three affects on the UK Coal Industry. The first change has been the relative decline in importance of coal as a feed stock in meeting Britain’s energy needs as cheaper gas gained market share. Secondly the domestic production of Britain’s coal declined even faster than coal’s share of the domestic energy market. Lastly the sourcing of domestically produced coal has changed. Deep mined coal now accounts for less than 50% of domestically produced coal whilst opencast’s share of the domestic market has grown. This is mainly due to deep mined coal being relatively more expensive to produce than surface mined coal. Each of these trends is looked at more closely below. Table 1 below illustrates how coal consumption has changed over the last twenty years. In that time coal consumption has fallen by 45% and its share of the energy supplied market has fallen by 47%. Since 1999 a degree of stability has been established, possibly caused by a rise in the price of gas thus making the relative price of coal cheaper. However, this degree of OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 8 stabilisation in the share that coal has taken of the domestic market has not meant a renaissance for Britain’s domestic coal industry. Table 1 UK CONSUMPTION OF COAL AS A PRIMARY FUEL 1988 – 2008 YEAR IN MILLION TONNES 6 % SHARE OF ENERGY SUPPLIED 1989 108.1 31.7 1994 82.1 23.6 1999 56.5 15.9 2004 61.3 16.7 2006 68.1 18.7 2008 58.9 16.9 Table 2 CHANGES IN THE SOURCING OF COAL CONSUMED IN BRITAIN MILLION TONS (thousand tonnes) YEAR DOMESTIC 7 % OF COAL PRODUCTION CONSUMED IMPORTED % OF COAL COAL CONSUMED (est.) (est.) 1989 99820 89 12137 11 1994 49785 76 15896 24 1999 37077 65 20293 35 2004 25096 41 36153 59 2006 18079 26 50529 74 2008 17604 29 43875 71 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 9 Statistics about the sourcing of this coal reveal that as the market for coal has shrunk, imports of coal have tended to replace the domestically produced coal consumed in Britain as Table 2 shows. Over the last twenty years imports have risen by 361%, whilst domestic coal production has fallen by 82%. The third change to note in these changes to the supply of coal in Britain has been the relative increasing importance of the role opencast coal plays in supplying Britain’s energy needs. As Table 3 makes clear, as Britain’s domestic coal production has declined, an increasing share of that production has been met by opencast coal production. Since 2005 the bulk of the domestic production has been met by opencast production in three of the last four years (2005, 2007 and 2008). The conclusion from this section is clear, that a sustainable domestic coal industry seems to be dependent on increasing the proportion of coal produced by opencast methods. Table 3) THE SOURCING OF BRITAIN’S COAL PRODUCTION (thousand tonnes) 8 YEAR DEEP- MINED 1989 79762 80 18657 19 99820 1994 31854 64 16804 34 49785 1999 20888 56 15275 41 37077 2004 12542 50 11993 48 25096 2005 9563 47 10445 52 20498 2006 9444 52 8635 48 18075 2007 7674 46 8866 54 16504 2008 8096 46 9509 54 17604 JAN – JUNE 3801 44 4844 56 8,645* 2009 % (est.) OPENCAST % (est.) TOTAL 5) POLLUTION ISSUES AND FUTURE TRENDS IN THE DEMAND FOR COAL OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 10 In light of what has already been discussed the major factors influencing the future demand for coal for electrical production is going to be determined by both pollution control issues and attempts to reduce energy consumption. These trends are now the subject of The Energy Markets Outlook reports, co produced by the Government and Ofgem since 2007. (The role of The Energy Markets Outlook reports is explained in Section 6). The two latest reviews of the demand for coal for generation purposes show significantly different projections for coal consumption after 2016. The 2008 reports lowest of six estimates was for the demand for coal for generating purposes could fall from approximately 48m tonnes in 2016 to approximately 19m tonnes in 2017.9 This lowest estimate was from the Coal Forum Generation Sub Group and it was based on an estimate of the full effects of the Large Combustion Plants Directive taking effect after 2016, and having no new Carbon Capture and Storage (CCS) or CCS ready power generating stations on stream. By 2009 it seems, the picture has changed dramatically in favour of coal. The 2009 report paints a very different picture, partly because it includes assumptions on future coal consumption generated by the four new commercial sized CCS demonstration generating plants which the Government is committed to enabling with a subsidy – one of which at Hatfield in Yorkshire has already been agreed in principle. In the 2009 report all of the projections presented assume the effectiveness and commercial viability of CCS techniques and here the lowest project demand for coal in 2016 is for approximately 30 - 33m tonnes annually from 2016 to 2021. Even the most optimistic projections expect the demand for coal for generating purposes to decline from nearly 60m tonnes in 2008 (Table 1) to 42 -40m tonnes between 2016 -2020 10 It seems that there are no projections currently for the use of coal if CCS technology does not prove itself to be viable either practically or commercially. On the ‘old’ pollution issues to do with reducing Nitrous Oxide and Sulphur Dioxide emissions generators will either favour low sulphur imported coal or all coal burning power stations will have to fit the technology to remove Nitrous Oxide or Sulphur Dioxide, which will increase to cost of using coal. This may mean, all else being equal, that this will reduce the demand for coal. On the ‘new’ pollution issue, that of Carbon Capture and Storage, the more optimistic forecasts put forward in the 2009 Energy Markets Outlook report can be criticised as this technology has yet, ironically, to pass its acid OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 11 test of being commercially viable. Perhaps the safest forecast is still that for 19m tonnes by the Coal Forum in the 2008 report. As a further indication of the degree of uncertainty about the future demand for coal, McCloskey’s, who publish leading titles on the state of the coal industry and organise an annual Coal UK Conference and Dinner, indicates the following in its statement advertising its 2010 event “The UK has both the only coal industry in Western Europe that could have a long-term future and the biggest market for imported coals in the Atlantic sector. However, the UK is also the focus of intense inter-fuel competition and of deep uncertainty about the future demand for coal.” 11 Another additional development which may result in a reduction in the demand for mined coal to be used for generating purposes was announcements made by Clean Coal plc not only for licences to explore the extent of off shore coal reserves amenable to be used for Underground Coal Gasification in the Solway Firth, off the coast of North East England, Humberside and Swansea Bay 12. If the initial investigation shows that these reserves can be exploited in an environmentally safe way and it is commercially viable then these reserves alone could meet 5% of Britain’s energy needs. These developments have not been included in the Energy Markets Outlook report for 2009. So far there is no indication whether this new technological development, if successful, will replace all or some of indigenous coal production, especially opencast production. This discussion of past pollution issues suggests that there is likely to be a continuing decline in the demand for coal and that this level of demand is difficult to predict until the Carbon Capture and Storage systems prove themselves to be commercially viable. Even then newer technologies such as Underground Coal Gasification could have a significant impact on the future need for mined coal for generating purposes. However the perceived need to ensure a secure energy supply could increase domestically produced coal’s share of the declining market for coal as Section 7 indicates. A future report in this series should look further at the future demand for coal topic so that an estimate can be given for the demand for coal when the following factors, for example, can be addressed: The impact of the revised LCPD when it takes full effect in 2016 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 12 The above plus evidence that carbon capture works or does not work The impact of attempts to make more efficient use of the energy network such as the ‘intelligent grid’ idea The increasing impact of renewable and bio-fuels Consumers reducing their consumption of electricity. The development of alternative technologies for using coal for generation purposes in situ This is going to be an increasingly important issue for those communities facing new opencast mining applications for sites that, if the planning application was granted, would still be coaling during and after 2016. 6) SHORT TERM SECURE ENERGY SUPPLIES AND THE FUTURE DEMAND FOR COAL Since 2001 this issue has become of increasing importance to the Government which realised that unless it took action Britain would face an energy crisis caused by the convergence of a number of factors, namely the decline in indigenous gas supplies and the need to replace ageing coal and nuclear generating capacity. Although new generating capacity has come on stream it is all gas powered and while this helped to reduce the degree of pollution it has made Britain increasingly dependent on imported gas, especially Russian gas which is not thought to be a reliable source of supply. The first report in this series outlined how this growing realisation by the Government has affected Planning Inquiry decisions on opencast mining applications 13 and influenced MOPG writing a Supplementary Submission 14 opposing UK Coal plc’s Minorca application challenging the ‘Need for Coal’ arguments. In that Supplementary Submission document, MOPG challenged two possible definitions of the ‘Need for Coal’ argument, Security of Supply and Energy Security. As far as the Security of Supply argument went MOPG argued that “ ‘Security of Supply‘ targets are not specified in Government guidance. It seems that there is an intention to build up stocks of coal at power stations to counter act any interruption in either imported coal or gas supply. OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 13 However no targets have been published for these coal stocks. There must be a ceiling to how much coal can be stored for the following reasons: Unless there is some form of subsidy the generating companies are paying for coal they are not using. Limited storage area capacity To offset the risk of spontaneous combustion and it is expensive to manage large stocks of coal3 Without knowing the answer to whether we do or do not have adequate coal stocks at generating stations, we do not know if we have ‘security of supply’. ‘Security of supply’ can also refer to the medium term, in that strategic coal reserves can be protected in the ground by managing development on and close to them. If this definition is considered, then there is a strong argument for leaving the coal in the ground where it can be reserved for a “National Emergency”. This would ensure that coal is available when it is most valuable both to the mining company and the country.” 15 The idea behind this first definition about Security of Supply stems from the events leading up to the Miners Strike of 1984 / 85, when the national amount of stockpiled coal reached nearly 60m tonnes 16. 80m tonnes of coal was used by generating companies In 1982, just over 17, making it an average coal burn of 219,178 thousand tonnes of coal a day. (80,000,000 ÷ 365) A rough estimate suggests that a secure supply at the end of 1983 amounted to 273 days or 9 months supply (60m tonnes ÷ 219,178 = 273) The nearest we can get to estimating a current equivalent figure is to repeat the exercise with more up to date figures. In 2008 power stations burnt 47.801m tonnes of coal 18, making the average coal burn 130,962 thousand tonnes of coal a day (47,801,000 ÷365=130,962). The level of coal stocks held at power stations by September 2009 had risen to 22.894m tonnes 19. These stocks represented 172 days or 6 months supply of coal. (22,894,000). Moreover these coal stocks are increasing. Since January 2008 they have increased from 10.303m tonnes to 22,894m tonnes an increase of 12.591m tonnes – or an average increase of nearly 600,000 tonnes a month (22,894,000-10,303,000=12,591,000÷21= 599,714 tonnes). Projecting this rate of increase forwards 9 months supply of coal at generating stations, 35,850,000m tonnes (47,801,000÷4x3) will be reached in 21 months time, in May 2011. However, since March 2009, there has been an even more rapid OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 14 increase in coal stocks from 13.594m tonnes to 22.894m tonnes, an increase in 7 months of 9.300m tonnes, averaging 1.329m tonnes a month.19 At this rate of increase the 9 months figure of 35.850m tonnes will be reached much earlier, in June 2010 (2,591,000÷1,329,000=9 months). As at September 2009, there is no immediate threat to the security of supply. A later indication was that stockpiles of coal were expected to increase during the winter of 2009 /10 as it looked as though gas would be a cheaper fuel to use as the ‘base load’ fuel for producing more than 50% of the UK electricity supply during this winter.20 7) ENERGY SECURITY AND THE 20m TONNE TARGET FOR INDIGENOUS COAL PRODUCTION Energy Security has been a growing issue of national importance to the Government since the turn of the century. The recent Energy White Paper, “Meeting the Energy Challenge” set out, as its goal, a strategy of how in the future Britain was to achieve Energy Security and contribute to lessening the risk of Climate Change. In the Executive Summary security of supply was defined as “The UK faces two main security of supply challenges: • our increasing reliance on imports of oil and gas in a world where energy demand is rising and energy is becoming more politicised; and, • our requirement for substantial, and timely, private sector investment over the next two decades in gas infrastructure, power stations; and electricity networks. We need to manage the potential risks associated with higher imports of fossil fuels. These include: • increased competition for energy resources in the face of growing global energy demand; • reserves becoming increasingly concentrated in fewer, further away places; • the need to purchase supplies from markets which are neither transparent nor truly competitive; and • the possibility that there will be insufficient investment in key producer countries in new oil and gas production.” 21 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 15 Most of the discussion about secure energy supplies concerns the risks being associated with being import dependent for gas and oil from areas of the world which are increasingly distant and politically unstable. 22 Coal is mentioned specifically in paragraphs 4.25 – 4.31 and arguably the most important paragraphs are these “4.29 The Coal Forum 23 does not discuss commercial matters, though the Forum has acted as a catalyst for meetings between producers and generators outside the Forum, which have generated a wider appreciation of the long-term investment needs of mine operators. The Coal Forum will publish an interim overview report in summer 2007. 4.30 Emerging findings from the Coal Forum suggest that continuing access to supplies of UK produced coal benefits both the generating industry and other industrial coal users; such supplies can help to manage any potential risk to supplies from international coal markets. 4.31 Making the best use of UK energy resources, including coal reserves, where it is economically viable and environmentally acceptable to do so, contributes to our security of supply goals. The Government believes that these factors reflect a value in maintaining access to economically recoverable reserves of coal” The detail of what this all means in terms of the demand for coal and, especially for opencast coal and new planning applications, is not to be found in this White Paper but in papers from the Coal Forum, the annual Energy Markets Outlook Reviews and The Energy Security Report produced in 2009. The Coal Forum has been pressing the Government to make a public statement about the need to mine 20m tonnes of coal per annum, For example the 2008 Coal Forum Review contained the following observation of what this could mean in terms of opencast mining. “A reasonable assessment of ongoing production rates from surface mining of between 10-12 mtpa would suggest that operators will need to prepare and submit an increased number of planning applications than has been the case in recent years. The potential for high and sustained world coal prices suggest that operators may very well accept the risk of initial refusal and the subsequent additional cost of appeal, albeit reluctantly. However, it is in OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 16 everyone’s interest to engage all affected and involved parties at the earliest possible opportunity. The MPA (the local authority responsible for Mineral Planning decisions) in particular should have an integral and even earlier role in this regard in their preparation and identification of mineral development documents.” 24 In addition, a presentation by the Coal Authority on meeting the future demand for coal made at the first meeting of the Coal Forum 14/11/2006 indicated the following “The Challenge – Production of 20 mtpa of indigenous coal to 2017. 1. The challenge can be met - but! 2. £ 326m investment to produce additional 60mt of deep mine output (up to 2017) - 50mt after 2017. 3. 60mt of replacement opencast coal needs planning consent (to 2017). 4. Generally, sites will need to be smaller and low impact. 5. 60+ planning consents will be needed. 6. Recognition by generators of the production target.” 25 So in the medium term it seems the bulk of indigenous coal production is going to be from opencast coal, which is likely to initially be between 50 and 60% of the production, meaning that planning approval would have to be on average for 10 new opencast mines each year between 2007 and 2017. The Energy White Paper created a new body, the Energy Markets Outlook 26 to review, on an annual basis, how to achieve future energy security. This meant assessing the future demand for coal and other energy sources. In the 2008 report the following statement about opencast coal appeared “6.6.4 The surface mining industry aims to maintain production through a five-year rolling site replacement programme which requires a sufficient flow of planning consents for new mines. Few sites in production now have sufficient reserves to be active beyond 2012, but there are extensive unworked shallow coal reserves suitable for surface mining, subject to approvals within relevant minerals planning guidance. 26 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 17 It therefore seems that energy security issues are now being used to justify granting planning permission for new opencast mines in order that UK coal producers can assure generating companies that they will be able to provide indigenous coal for up to 5 years in the future. This reinforces the arguments already made by MOPG about the interdependence between Planning Policy and Energy Policy in its Further Response Submission 27 Since then further indications about the expected role for opencast coal in meeting the UK’s energy needs have been noticed. The Right Honourable Malcolm Wicks M.P.(ex Energy Minister appointed by the Prime Minister as his Special Representative on International Energy, an official new Government post) published his own independent report on Energy Security in August 2009. This report contained important comments on issues related to opencast coal. Chapter 3 “What the Global Trends Imply for the Medium-and Longer Term Energy Security” has Figure 39 “ UK Production and Consumption of Coal 1995 – 2025” shows UK Coal production falling from 40m tonnes in 1995 to 20m tonnes around 2008 and then stabilising at around this level for the foreseeable future.28 Later when discussing if, in the medium term, the UK could achieve a greater degree of energy independence Wick’s makes the following comment with regard to coal 3.46” Could expanded use of UK coal replace gas in power generation? With much greater investment and a different approach to opencast mining, the UK could potentially produce as much coal as it is forecast to consume in 2020 but it is difficult to envisage how consumption could be expanded further without relying on imports and there would also be environmental implications from both increased production and consumption of coal.” 29 In the chapter which discusses the ‘Actions we could take within our own Borders’, Wicks makes these further comments about the future role of coal and the demand for coal “6.24 Given the abundance of proven coal reserves and its relative low cost OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 18 and flexibility to meet fluctuations in demand for power, I believe that there is a long term future for coal in the UK’s energy mix.. Indeed, given the importance of supply diversity to our security, it would be foolish to abandon coal. However that future is contingent on coal being able to be part of our low carbon future. It must be part of the solution, not as now part of the problem. 6.25 By 2016, we will have seen a third of the UK’s coal fired power plants close due to the Large Combustion Plant Directive (LCPD), with further closures likely to follow under the proposed Industrial Emissions Directive, so it is the right time to be thinking and acting radically on the UK coal policy. CCS could enable new coal plants to be part of the low carbon economy but the technology has never been tested on a commercial scale and as a complete process on a power station. The UK is taking a leading role in developing this and the Budget announced plans to make funding available for up to four demonstration plants. The Government is treating this with the urgency it needs, and is consulting on a proposed new financial and regulatory framework for coal power stations that will explore the pathway from CCS demonstration to deployment. 6.26 If CCS does enable resurgence in the use of coal, as part of a low carbon electricity mix, then the UK will need to consider where to obtain additional coal from. As set out in Chapters 2 and 3, importing coal does not give rise to the same energy security issues as gas (or oil), but it will support security if we can have a balance of sources of supply, including a strong domestic component. With major investment in both deep mines and planning permission to exploit further surface mines, UK coal production could be retained at current levels of around 20 million tonnes per year through to at least 2025.” 30 What was initially a target set by the Coal Forum to judge its own performance against the need to produce 20m tonnes of indigenous coal, is becoming accepted as an ‘official’ target. From the point of view of those opposing opencast mine applications, this development, if true, has serious consequences for those opposing current and future planning applications. Doubt surrounds whether this is can genuinely be an ‘official’ target: if the 10 new opencast sites a year indicated by the Coal Authority in its 2006 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 19 presentation from 2017 to 2025 are taken as a reliable estimate, a total of 180 new opencast sites would need to get planning permission between 2007 and 2025. Further evidence about this apparent creeping collusion about 20m tonnes of coal being an ‘official target’ which those applying for planning permission for new opencast mines could possibly use for future applications was supplied in the 2009 Energy Markets Outlook report, published in December 2009, where the following additional statement to the five – year rolling programme appears. 6.6.6 The recent report – ‘Energy Security: a national challenge in a changing world’- by the Prime Minister’s Special Representative on International energy, Rt. Hon. Malcolm Wicks MP identified that indigenous coal production could be maintained at around 20 million tonnes per annum through to at least 2025 with major investment in deep mines and planning permission to exploit further surface mines.” 31 By default it seems that a new policy for opencast coal production is taking shape which, if not challenged, will prejudice groups trying to oppose new opencast mine applications efforts before they even start. They will be in a ‘Catch 22’ situation where the new ‘Need for Coal’ argument could be wheeled out to justify every new application. As these recent developments directly affect the current (at the time of writing, January 2010) Minorca application, we had been in close touch with our late local M.P. David Taylor on this issue. On the 24/11/09 during a debate on Energy and Climate Change Mr Taylor asked this question of Ed Milliband in the House of Commons “With 800 million tonnes of coal in north-east Leicestershire ready to be extracted, I would be the first to support the advance of clean coal technology, but does the Secretary of State recognise that in the interim, there is a risk of an expansion of open-cast coal, which is one of the most environmentally damaging activities that we can see in the midlands of England? That should be headed off, should it not? OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 20 Edward Miliband (Secretary of State, Department of Energy and Climate Change; Doncaster North, Labour) “It is important to say that the position on open-cast mining has not changed and the planning guidance has not changed. The Government's position is as it has been. It is for that planning guidance to be properly interpreted.” 32 Up to November 2009 then there is no official Government target for UK coal production, but it may just be a matter of time. This is why MOPG began to develop its counter arguments. 33 8) DEEP MINES AND FUTURE COAL SUPPLY On the eve of Coal Industry’s de-nationalisation, 15 deep mines were working.34 Since then deep mines have continued to close, their owners claiming exhaustion of reserves, geological difficulties or flooding as the cause. The question of why this is the case and why future coal needs cannot be met from current or new deep mines is very relevant. The 7 deep mines left in England are expected to meet between 40 -50% of our future coal needs – but only as long as they do not meet new geological problems. If they did, and their owners, including UK Coal plc, closed these pits, then opencast coal production could be expected to increase dramatically. The second determining issue is the price of coal, which does fluctuate over time. The more expensive coal becomes the more likely will be the prospect of deep mine investment to extend the life of a mine. The cheaper coal becomes the more likely the prospect of the closure of deep mines as it becomes uneconomic to extend the life of a mine by accessing new seams New deep mines are even more unlikely. The reason for this is the costs involved in sinking a new shaft down to the coal. One of the more recent reports on this topic, published in the Financial Times in 2004, suggested that the costs would be between £300 and £350m and take up to eight years to develop. Currently, it seems, no British company would be willing or indeed capable of taking on such a financial burden especially with the current state of uncertainty over the future demand for Coal.35 A future report in this series will focus on recent developments in UK Coal plc, Britain’s largest coal producer. OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 21 Unless there is some public subsidy new deep mines are unlikely. Evidence for this view comes from the Minutes of Evidence from the Trade and Industry Select Committee Report on the 2007 Energy White Paper. Mr Darling the then Energy Secretary was asked a question on this topic by Judy Mallaber MP “Q22 Judy Mallaber: There is not a role for government in encouraging further exploitation of our coal reserves in deep coal mining. Mr Darling: You could only do that by subsidising it.” 36 Unless there is this subsidy, the Minutes of Evidence from another Trade and Industry Select Committee Report in 2006 suggest that by 2021 -2026 our deep mines will either be uneconomic or exhausted and that it will be opencast coal underwriting the UK’s Energy Security policy 37. A recent check on mining company web sites shows the following position: Table 4) LIFE EXPECTANCY OF ENGLISH DEEP MINES DEEP MINE COMPANY 38 LIFE EXPECTANCY + NOTES Daw Mill UK Coal plc 2028 Kellingley UK Coal plc 2019 Wellbeck UK Coal plc 2017 Thorsley UK Coal plc 2017 Harworth UK Coal plc mothballed Hatfield Powerfuel plc 2022 39 (will need £100m investment to extend mines life) Maltby Hargreve’s Services plc 2017 -2025 This situation may occur earlier than this, given recent experience of closing deep mines, If any of them shut even more opencast coal production is likely. 9) THE MYTH ABOUT ‘CLEAN’ COAL This analysis suggests that the British public are not being told the full story about how ‘clean’ the coal is that is being be used to generate electricity now OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 22 and in the future. This report’s contention is that the Government is locking us into sustaining an energy mix which relies on the continuing provision of opencast coal to provide the mainstay of domestic coal production for the foreseeable future. By only stressing the promise of lowering carbon emissions during the combustion process the Government lulls the public into a false sense of energy security as if coal is readily found in some pristine state lying on the surface and all that needs to be done is to collect nature’s bounty. In the opinion of those opposed to Opencast Mining, by relying on opencast coal for it’s Energy Security, the Government is allowing opencast operators to ‘borrow’ large tracts of the countryside, often in remote places where to transport the coal they have to use road transport, rip the countryside apart, create holes up to 200 metres deep, on sites that can be larger than Minorca’s at over a mile long and half a mile wide, destroy natural habitats, create noise and dust in a tranquil area, blight the lives of thousands of people all to produce ‘Clean’ Coal. Clean Coal? It is hardly that. Operators of such sites will argue that they minimise the disturbance and over time restore the countryside – if they didn’t they would not get planning permission. Nevertheless, this domestically produced opencast ‘Clean Coal’ is produced by one of the most environmentally damaging forms of land use which disrupts the lives of local communities. The tragedy of pursuing this policy is that many more communities are likely to find they are going to be asked to pay the price of having Dirty Coal produced on their doorstep whilst the Government and the generators only want to praise the virtues of ‘Clean Coal’. It should also be noted that imported Coal may not be any cleaner in this sense either. Beynon, Cox and Hudson noted back in 1999 that the development of large opencast sites especially in South Africa was one of the causes for closing deep mines in the UK in the 1970’s. South Africa is still a major source of imports of coal to the UK today.40 10) FUTURE AREAS THAT MAY FACE OPENCAST MINING APPLICATIONS BETWEEN NOW AND 2025 This analysis suggests that between now and 2025 that an informal target of 20m tonnes of UK coal production exists. As yet it is not official Government OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 23 policy, but since this figure has now appeared on two official publications it may just be a matter of time before a coal operator tries to argue in new application that such a target exists. If this is the ambition, then the proportion of this figure to be met from opencast mining is between 50 and 60%, or10 -12m tonnes of coal for the next 15 years. After that it seems it will be met only from opencast coal reserves. If we look to the historical record for where opencast mining has occurred or where known reserves of shallow coal exist in the UK it suggests which parts of the country will be likely to experience anew opencast mining applications Counties (England) Co Durham, Cumbria, Derbyshire, Leicestershire, Northumberland, Shropshire, Staffordshire and Warwickshire Unitary Authorities (England) Barnsley, Bolton, Gateshead, Newcastle Upon Tyne, Leeds, Rotherham, St Helens, Stoke on Trent, Sunderland, Wakefield, Walsall and Wigan, Counties (Scotland) Borders, Clackmannanshire, Dumfries & Galloway, East Ayrshire, Falkirk, Fife, Midlothian, North Lanarkshire, South Lanarkshire and West Lothian. Unitary Authorities (Scotland) Falkirk and Perth & Kinross Counties (Wales) Carmarthenshire, Flintshire and Powys Unitary Authorities (Wales) Blaenau Gwent, Bridgend, Merthyr Tydfil, Neath Port Talbot and Wrexham. 41 Additions ought to be made to this English list, one is Nottinghamshire, where evidence has emerged last year that UK Coal plc is prospecting in the area of Cossall and Telford and Wrekin as an addition to the Unitary Authority list as UK Coal plc gained permission for an opencast site at Huntington Lane. 42 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 24 In addition to these traditional areas associated with the ‘old’ areas of coal mining, in Northern Ireland communities around Ballymoney, North Antrim have known of the possibility of open casting for ‘brown’ coal, lignite. This would be a major development if it went ahead as plans from the developers have included building a 500kw power station close to the site which would burn the 660m tonne lignite deposit for up to 30 years, but so far the local people through the Collective Objection to Lignite Development (COLD) campaign have halted this proposal.43 In light of this evidence, it may be appropriate to suggest that the Energy and Climate Change Select Committee ask for further information on the issue of whether, in the foreseeable future, the fulfilment of Britain’s Energy Security policy is going to be dependent just on the production of opencast coal which will affect one or more of the local authority areas listed above. © Stephen Leary References 1) ”Coal, Collusion and Communities”, Steve Leary, Minorca Opencast Protest Group, October 2009. See http://www.leicestershirevillages.com/measham/mopg-reports.html 2) Coalfields Research Programme Papers: “Discussion Paper No 1: The Decline of King Coal”, H Beynon, A Cox & R Hudson, Cardiff School of Social Science, 1999. Table 1: UK Inland Consumption of Primary Fuels Percentage shares (energy supplied basis), p 2, See http://www.cardiff.ac.uk/socsi/contactsandpeople/huwbeynon/coalfie lds-research-programme.html 3) Coalfields Research Programme Papers: “Discussion Paper No 1: The Decline of King Coal”, H Beynon, A Cox & R Hudson, Cardiff School of Social Science, 1999. Table 1: UK Inland Consumption of Primary Fuels Percentage shares (energy supplied basis), p 10, See http://www.cardiff.ac.uk/socsi/contactsandpeople/huwbeynon/coalfie lds-research-programme.html OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 25 4) International Energy Agency Profiles: “European legislation (revised LCPD and EU ETS) and Coal: PF 07-03”, IEA Clean Coal Centre, 2007. See http://www.ieacoal.org.uk/publishor/system/component_view.asp?LogDocId=81592&Ph yDocID=6248 5) International Energy Agency Profiles, et al 2007 http://www.ieacoal.org.uk/publishor/system/component_view.asp?LogDocId=81592&Ph yDocID=6248 6) Table1.1.1” Inland consumption of primary fuels and equivalents for energy use 1970 -2008. Energy Statistics: Total Energy, DUKES Long Term Trends” (internet only) Department of Energy and Climate Change, September 2009. See: http://www.decc.gov.uk/en/content/cms/statistics/source/total/total.aspx 7) Figures based on 2.1.1 “Coal production and stocks 1970 to 2008”. Estimated percentages by the author. Energy Statistics: Total Energy, DUKES Long Term Trends (internet only). Department of Energy and Climate Change, September 2009. See: http://www.decc.gov.uk/en/contrereatedent/cms/statistics/source/total/tot al.aspx 8) All figures except for 2009 based on 2.1.1 “Coal production and stocks 1970 to 2008”. Energy Statistics: Total Energy, DUKES Long Term Trends (internet only). Department of Energy and Climate Change, September 2009. (Estimated percentages by author. *2009 figures for 1st six months only. Figures based on Table 2.1 Supply and Consumption of Coal. (Estimated percentages by author). See: http://www.decc.gov.uk/en/content/cms/statistics/source/coal/coal.a spx OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 26 9) Coal Demand for Power Generation, Chart 6.3, “Energy Markets Outlook”, December 2008, Department of Energy and Climate Change. See http://www.berr.gov.uk/files/file49406.pdf 10)Coal Demand for Power Generation, Chart 6.3, “Energy Markets Outlook”, December 2009, Department of Energy and Climate Change. See http://www.decc.gov.uk/en/content/cms/what_we_do/uk_supply/mar kets/outlook/outlook.aspx 11) As seen on the McCloskey Group web page for conferences on 20/12/09. See: http://conf.mccloskeycoal.com/story.asp?storycode=64666 12) ”North Sea coal could be burnt underground”, Robin Pagamenta, The Times On Line, 9/12/09. See http://business.timesonline.co.uk/tol/business/industry_sectors/natural_res ources/article6949322.ece 13) ”Coal, Collusion and Communities”, Steve Leary, Minorca Opencast Protest Group, October 2009. See http://www.leicestershirevillages.com/measham/mopg-reports.html 14) “Further Response to Application by UK Coal Mining Limited The Former Minorca Colliery Coal and Fireclay Surface Mining Scheme. Application Number: 2009/c088/07”, Stephen Leary, December 2009 http://www.leicestershirevillages.com/measham/mopgs-response-andobjections-to.html 15) “Further Response to Application by UK Coal Mining Limited The Former Minorca Colliery Coal and Fireclay Surface Mining Scheme. Application Number: 2009/c088/07” p 3 16) “Coal Production and Stocks, 1970-2008” (DUKES 2.1.1.) Internet Only Department of Energy and Climate Change. See OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 27 http://www.decc.gov.uk/en/content/cms/statistics/source/coal/coal.aspx 17) “Inland Consumption of Solid Fuels 1970 -2008” (DUKES 2.1.2) Internet Only. Department of Energy and Climate Change See http://www.decc.gov.uk/en/content/cms/statistics/source/coal/coal.aspx 18) Table 2.5 “Coal Consumption”, Monthly Tables http://www.decc.gov.uk/en/content/cms/statistics/source/coal/coal.aspx 19) “Stocks of Coal at end of Period”, Stocks of Coal (Monthly Figures), Department of Energy and Climate Change. See http://www.decc.gov.uk/en/content/cms/statistics/source/coal/coal.aspx 20) “RPT–Gas sidelining coal in UK power generation-Centrica”, Reuters 2/12/09. See http://uk.reuters.com/article/idUKGEE5B10ZK20091202 21) “Meeting the Energy Challenge, A White Paper on Energy”, Executive Summary, p 19. See http://www.decc.gov.uk/en/content/cms/publications/white_paper_07/whit e_paper_07.aspx 22) Meeting the Energy Challenge op cit para 1.14 -1.18 and 4.03 – 4,10. 23) The role of the Coal Forum has already been explained in “Coal, Collusion and Communities” pgs 3-4. Steve Leary, Minorca Opencast Protest Group, October 2009. See http://www.leicestershirevillages.com/measham/mopg-reports.html 24) The Coal Forum 2008 Review, Department of Energy and Climate Change. See http://www.decc.gov.uk/en/content/cms/what_we_do/uk_supply/energy_mi x/coal/uk_forum/uk_forum.aspx OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 28 25) “The Coal Resource”, presentation by Albert Schofield, Coal Authority at the first meeting of the Coal Forum 14/11/2006. See http://webarchive.nationalarchives.gov.uk/+/http://www.berr.gov.uk//ener gy/sources/coal/forum/meetings/page37296.html 26) “Meeting the Energy Challenge” op cit para 4.36-4.37, op cit 27) “Energy Markets Review 2008, Department of Energy and Climate Change p 86. See http://www.decc.gov.uk/EN/Search.aspx?Search=energy%20markets%20outl ook&AllWords=True&PageNumber=1&ResultsOnPage=10 28) “Further Response to Application by UK Coal Mining Limited The Former Minorca Colliery Coal and Fireclay Surface Mining Scheme. Application Number: 2009/c088/07” p 2 http://www.leicestershirevillages.com/measham/mopgs-response-andobjections-to.html 29) “Energy Security A National Challenge in a Changing World”, Rt. Hon. Malcolm Wicks M.P. Department of Energy and Climate Change, Graph 39 Figure 39 p 70 http://www.decc.gov.uk/en/content/cms/what_we_do/change_energy/int_e nergy/security/security.aspx 30) Op Cit p 80. 31) Op Cit p 109. 30) Energy Markets Outlook, p 85, December 2009, Department of Energy and Climate Change. See http://www.decc.gov.uk/en/content/cms/what_we_do/uk_supply/markets/o utlook/outlook.aspx 32) “Energy and Climate Change & Environment Food and Rural Affairs, Debate on the Address”, 24th November 2009, House of Commons. See OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 29 http://www.theyworkforyou.com/debates/?id=2009-11-24b.405.3#g410.5 33) “Further Response to Application by UK Coal Mining Limited The Former Minorca Colliery Coal and Fireclay Surface Mining Scheme p 3-4. Application Number: 2009/c088/07”, Stephen Leary, December 2009 http://www.leicestershirevillages.com/measham/mopgs-response-andobjections-to.html 34) Coalfields Research Programme Papers: “Discussion Paper No 1: The Decline of King Coal”, H Beynon, A Cox & R Hudson, Cardiff School of Social Science, 1999. p 11. See http://www.cardiff.ac.uk/socsi/contactsandpeople/huwbeynon/coalfields -research-programme.html 35) “Fuel prices raise hopes for future of coal mining operations in UK” Financial Times 23/8/04. See http://www.minesandcommunities.org/article.php?a=1912 36) Coalfields Research Programme Papers: “Discussion Paper No 1: The Decline of King Coal”, H Beynon, A Cox & R Hudson, Cardiff School of Social Science, 1999. P 5.See http://www.cardiff.ac.uk/socsi/contactsandpeople/huwbeynon/coalfields -research-programme.html 37) Trade and Industry Select Committee : Minutes of Evidence Energy White Paper 21/6/07, 38) Trade and Industry Select Committee: Minutes of Evidence, Dependence on Gas and Coal Imports, 20/6/06, where the then Chief Executive of UK Coal plc, Gerry Spindler predicted that unless coal prices rose substantially that the deep mines could close in ten to twenty years. See http://www.publications.parliament.uk/pa/cm200506/cmselect/cmtrdind/1 123/20ju0601.htm OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 30 39) Current sources of information on the life expectancy of English Deep mines can be found on the following web sites: UK Coal plc – Deep Mines http://www.ukcoal.com/dm-locations Powerfuel – Media Centre http://www.powerfuel.plc.uk/id16.html Hargreves – 2009 Annual Report 2009 p 13 http://www.hargreavesservices.co.uk/uploads/2009annualreport.pdf These sites were consulted on 5/1/2010 for this information. 40) Authors estimate based on figures from an undated Powerfuel press release “Hatfield resumes production”. See http://www.powerfuel.plc.uk/id16.html 41) “Summary of information on coal for land-use planning purposes”. 2006 British Geological Survey, 39pp. (CR/06/107N) (Unpublished) . Information based on amalgamating information from Table 5 Permitted reserves of coal in working opencast sites and those not yet worked at 31st December in year stated (2003-2005) p18 and Appendix 4 Opencast Coal Production by MPA and Country 1997 – 2006. Chapman, G.R.; Highley, D.E.; Cameron, D.G.; Norton, G.E.; Taylor, L.E., and P.A. Lusty. http://nora.nerc.ac.uk/7454/ 42) “Action group launched against opencast mine plan” Nottingham Evening Post 14/10/09 and “Telford coal mine wins the go ahead” 8/10/09 Telford Journal. See http://www.telfordjournal.com/2009/10/08/telford-coal-mine-wins-thego-ahead/ and http://www.telfordjournal.com/2009/10/08/telford-coal-mine-wins-thego-ahead/ 43) Lignite Collective Objections to Lignite Development. See http://www.justsaynotolignite.co.uk/index.html PAST AND FUTURE REPORTS IN THIS SERIES Research Report 1 Coal, Collusion and Communities, October 2009 OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 31 This paper explores why, from the adoption of the revised Minerals Planning Guidance 3 (MPG3) up to October 2009, coal operators have been increasingly successful at winning appeals for opencast mines in England and the possible implications this has for future planning applications. See the following web page in order to download a copy http://www.leicestershirevillages.com/measham/mopg-reports.html Forthcoming Research Report 3 UK Coal plc- An Alternative Report. Research Report 4 Current Title: Collisions of Interest, Planning Policy and Opencast Coal. OPENCAST COAL: ITS ROLE IN PROVIDING UK ENERGY SECURITY PAGE 32