ESSAY I

advertisement

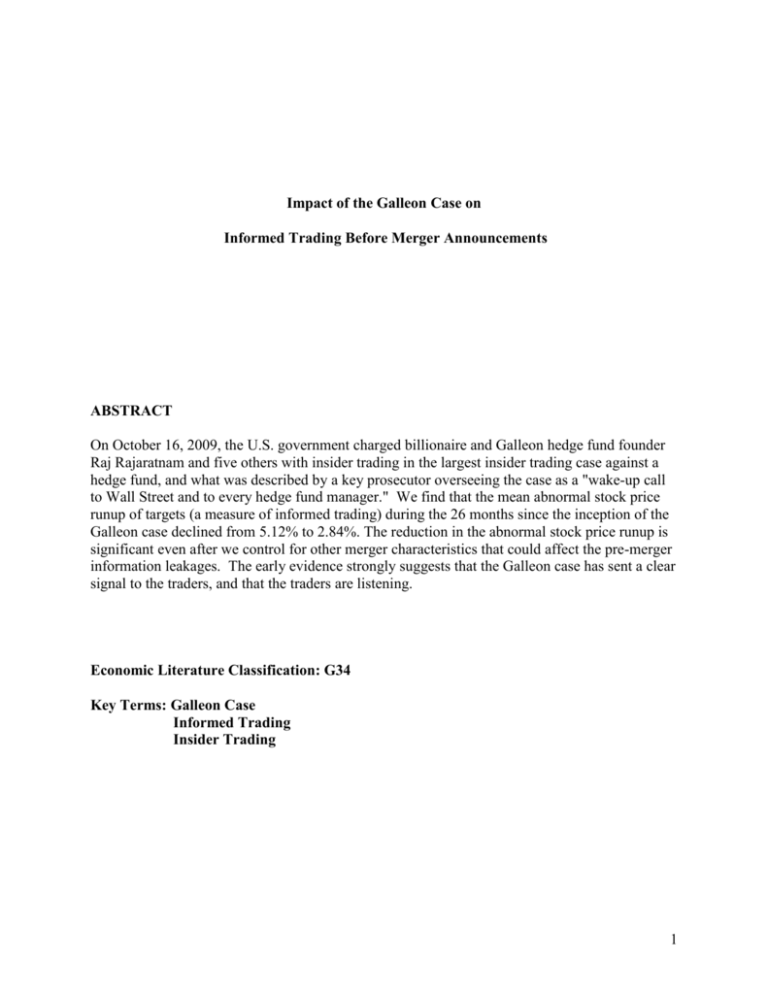

Impact of the Galleon Case on Informed Trading Before Merger Announcements ABSTRACT On October 16, 2009, the U.S. government charged billionaire and Galleon hedge fund founder Raj Rajaratnam and five others with insider trading in the largest insider trading case against a hedge fund, and what was described by a key prosecutor overseeing the case as a "wake-up call to Wall Street and to every hedge fund manager." We find that the mean abnormal stock price runup of targets (a measure of informed trading) during the 26 months since the inception of the Galleon case declined from 5.12% to 2.84%. The reduction in the abnormal stock price runup is significant even after we control for other merger characteristics that could affect the pre-merger information leakages. The early evidence strongly suggests that the Galleon case has sent a clear signal to the traders, and that the traders are listening. Economic Literature Classification: G34 Key Terms: Galleon Case Informed Trading Insider Trading 1 I. INTRODUCTION The abnormal stock price movements in target firms prior to merger announcements may be caused by adept traders who use public information to anticipate which targets will be acquired in the near future, or by traders who possess inside information and engage in insider trading activity. Since the target firms tend to experience a large jump in stock price on the day that a planned merger is announced, traders with inside information about the merger can benefit from taking a long position in the target's shares prior to the announcement. Insider trading (which we define to reflect the illegal use of inside information) may discourage trading in financial markets because it allows some traders to have a comparative advantage over others (see Leland, 1992)1. Studies by Bhattacharya and Daouk (2002), Bushman, Piotroski, and Smith (2005), and Chen and Hao (2011) suggest that insider trading reduces the informational efficiency in a stock market. In addition, bidder firms may incur a higher cost when purchasing targets, because their control premium is applied to a higher market price when insider trading causes an abnormal stock price runup in target firms [see Schwert (1996) and Betton, Eckbo and Thorburn (2008)]. Studies have documented the impact of increased enforcement against insider trading across countries. Bhattacharya and Daouk (2002) find that the first prosecution of insider trading in a country reduces the cost of equity. Bushman, Piotroski, and Smith (2005) find that the initial enforcement of insider trading laws increases the analyst following of stocks. Chen and Hao (2011) find that the enforcement of insider trading laws reduces the gross spreads of ADR initial public offerings. Jayaraman (2011) finds that the increased enforcement of insider trading laws in countries results in higher quality financial reporting. We build on these studies by assessing 1 Some other studies refer to insider trading to represent trading by insiders (mangers or directors). See Tanimura and Wehrly (2012) for a review of regulations imposed on trading by insiders. 2 whether recent efforts by the U.S. government to increase enforcement have reduced the level of insider trading in the U.S. To the extent that regulation can prevent insider trading, it ensures informational efficiency and reduces the costs in the market for corporate control. Prior to 2009, the number of illegal insider trading cases pursued by the U.S. government was quite limited when considering the massive volume of trading in U.S. stock markets. In addition, the penalties to guilty parties resulting from prosecuted cases were generally minor. One possible inference from these results is that existing laws in the U.S. prior to 2009 effectively discouraged illegal insider trading activity, which would explain the limited number of cases. An alternative inference is that the U.S. government did not have the resources to detect insider trading or power to enforce the laws, which allowed insider trading to occur. On October 16, 2009, the U.S. government sent a powerful signal to the U.S. market when it filed charges against the founder of a large hedge fund and five others, and announced its dedication to detect and prosecute insider trading. Its ability to enforce laws was strengthened by the Dodd-Frank Act. Our goal is to determine whether the government's increased efforts, power, and publicity had an impact on the level of insider trading activity prior to merger announcements. We find that the market-adjusted abnormal stock price runup of the target over days -42 to -1 relative to the merger announcement over the 84 months before the Galleon case was 5.12% (14.80% of the total effect that includes the premium offered on the announcement date) and runup over days -30 to -1 was 4.58% or 13.49% of the total effect. By comparison, the mean abnormal stock price runup of the target for mergers over the 26 months following the inception of the Galleon case is 2.84% (or 7.90% of the total effect) for the 42 days preceding the merger 3 and 2.46% (or 6.91% of the total effect) for the 30 days before the merger announcement.2 The reduction in the abnormal stock price runup since the inception of the Galleon case is statistically significant using both parametric and nonparametric tests. In recognition that the change in the target's mean abnormal stock price runup in the period since the inception of the Galleon case could be attributed to factors other than the government efforts or ability to enforce insider trading laws, we apply a multivariate analysis that controls for other factors. Overall, we find that while controlling for other factors, the mean abnormal stock price runup of target firms is significantly lower since the inception of the Galleon case. We believe that the increase in government efforts, tougher insider trading laws (attributed to the Dodd-Frank Act), and the publicity demonstrating the government's effectiveness in prosecuting cases contributed to the reduction in insider trading activity since 2009. II. HYPOTHESIZED IMPACT OF THE GALLEON CASE On October 16, 2009, the U.S. government charged billionaire and Galleon Group LLC hedge fund founder Raj Rajaratnam and five others with insider trading. The case was promoted by the U.S government as the largest insider trading case against a hedge fund3. At the press conference, law enforcement officials stated that the Justice Department, Securities and Exchange Commission, and Federal Bureau of Investigation would be more committed to preventing white collar crime. Preet Bharara, the U.S. attorney and key prosecutor overseeing the case, stated: "This case should serve as a wake-up call to Wall Street and to every hedge fund 2 Using the market model, the 42-day runup before the Galleon case was 5.35% and the 30-day runup was 4.84%. After Galleon, the runup was 0.25% and 0.71% respectively, with the same significance as the market-adjusted model. For the Fama-French model, the run-up was 5.10% and 4.63% before Galleon (same significance) and 0.36% and 0.81% after Galleon (significant at the 10% significance level). From this point forward, we will use the marketadjusted model only to report results unless significant differences are observed between the models. 3 see http://money.cnn.com/2009/10/19/markets/insider_trading_arrests.fortune/. 4 manager." An article in the Business Insider Law Review on October 20, 2009 stated that Bharara "sent chills down the spine of Wall Street by announcing the insider trading charges against Raj Rajaratnam and others." In this article, a defense attorney is quoted as saying "What former Rudy Giuliani did to the mob is what Preet Bharara will do to Wall Street." From the time Bharara took the position until July 2012, 66 people were charged with insider trading, and 60 either pled guilty or were convicted. The Galleon case attracted much attention from financial market participants, as it was given front page coverage by The Wall Street Journal, and other leading financial newspapers.4 Given the substantial amount of media coverage and continuous coverage of the Galleon case, any investors that closely monitor the financial markets and financial news would have been aware of the efforts by the U.S. government to deter insider trading. In addition to the substantial media coverage, the Galleon case was different than previous insider trading cases because it signaled more serious and effective government efforts to detect and prosecute insider trading5. First, the government announced its plans to use wiretap evidence and ultimately demonstrated its ability to use that evidence. Until the Galleon case, wiretap evidence was almost exclusively used in narcotics cases. Second, the Galleon case illustrated how people accused of insider trading may help the government by recording conversations that could implicate others. Third, the Galleon case illustrated the potential exposure of "expert networks" (that provide information to hedge funds) to prosecution or fines. Fourth, the Galleon case demonstrated how effective prosecutors could be, as the vast majority 4 For specific details of the Galleon case, see "The Inside Guide to Insider Trading," by C. Winter, D. Glovin, J. Daniel, and D. Yanofsky, Bloomberg Businessweek, March 11, 2011, http://www.businessweek.com/magazine/galleon 5 See "Galleon Insider Trading Conviction Signals Tougher Stance by U.S. Government" by K. O'Brien and A Wasserman, in Hedge Funds Review, June 1, 2011, at http://www.hedgefundsreview.com/hedge-fundsreview/feature/2073992/galleon-insider-trading-conviction-signals-tougher-stance-government 5 of people charged either pled guilty or were convicted. Fifth, penalties to people who pled guilty or were found guilty by the court system were substantial, and much more severe than in most previous insider trading cases. In particular, Raj Rajaratnam, the co-founder of Galleon, was ordered to pay a fine of $92.8 million, and was sentenced to 11 years in prison. This sentence is one of the longest in history for insider trading. We test whether the Galleon case served as a wake-up call to Wall Street, as proclaimed by Preet Bharara. More specifically, we hypothesize that the degree of insider trading prior to merger announcements is reduced since the inception of the Galleon case on October 16, 2009. III. REVIEW OF LITERATURE Studies by Keown and Pinkerton (1981), Gupta and Misra (1988), Schwert (1996), Jabbour, Jalivand, and Switzer (2000), Ascioglu, McInish, and Wood (2002), and Betton, Eckbo, and Thorburn (2008) find clear evidence of positive and significant abnormal stock price movements of the target firm prior to the merger announcement. A limited amount of research has been conducted on the detection and effects of illegal insider trading. Meulbroeck (1992) finds that a substantial portion of the abnormal stock price movements of targets prior to the merger announcement was attributed to insider trading for those mergers in which insider trading was detected by regulators. The abnormal stock price movement may not only be due to insider trades based on information leakages but also due to other traders who detect insider trading activity and take positions in the target firm prior to the announced merger. Gupta and Misra (1988) and Chakravarty and McConnell (1999) find no evidence that that trades by a target's insiders are more influential than other trades. However, Jabbour, Jalivand, and Switzer (2000) find evidence that for a sample of Canadian mergers, the abnormal price movements before the 6 merger announcement are influenced by insider trades. King (2009) also assesses Canadian mergers and confirms the existence of insider trading prior to mergers. Schwert (1996) cites evidence of insider trading to explain the abnormal stock price movements of targets before the merger announcement. He explains that insiders attempt to disguise their trading so that regulators do not detect it. Nevertheless, his analysis of target firms over the 1975-1991 period finds clear evidence of positive and significant abnormal stock price movements of targets prior to the merger announcement, and that this result remains robust even when considering various subsamples sorted by tender offers, type of bidder, type of financing used, and whether anyone was later charged by the Securities and Exchange Commission for insider trading. Studies by Bhattacharya and Daouk (2002), Bushman, Piotroski, and Smith (2005), Chen and Hao (2011), and Jayaraman (2011) confirm that the enforcement of insider trading in various countries can encourage more investor or analyst participation and liquidity in financial markets. Brigida and Madura (2012) find that the mean information leakage (as measured by the target's abnormal stock price runup) prior to announced acquisitions in the U.S. declined following the implementation of the Sarbanes-Oxley Act. They explain that this act made executives more accountable in disclosing information, and could have indirectly deterred insiders from engaging in illegal trading or sharing inside information because of fears that they would be held accountable. In general, the literature confirms that insider trading of target firm shares occurs prior to merger announcements, and that some country regulations have effectively reduced the level of insider trading. Our focus on the tougher U.S. government stance on insider trading and the 7 simultaneous publicity of this stance through the Galleon case contributes to the limited research on enforcement of insider trading laws. IV. METHOD Timing of Events and Signaling To test the impact of the Galleon case, we estimate levels of informed trading (based on the target's stock price runup) since October 16, 2009 when the U.S. government sent a powerful message to investors in its first publicized announcement about the Galleon case. There were subsequent key events associated with the Galleon case, as shown in the timeline on the left side of Figure 1, which may have reinforced the initial signal. The Dodd-Frank Act was passed during the Galleon case, and may have also affected the U.S. government's ability to enforce laws against insider trading. It provided more protection to whistleblowers, and gave more power to the Currency Futures Trading Commission (CFTC) to oversee and prosecute in all derivative markets. Section 1079A of the Dodd-Frank Act requires tougher penalties for crimes such as insider trading. The recommended sentences are longer for more sophisticated illegal insider trading (defined by number of transactions, the value of transactions, and the duration of the insider trading) and for insider trading executed by traders affiliated with a brokerage firm or investment advisory firm6. Because of the stiffer sentences, the Dodd-Frank Act indirectly encourages those who have been charged with insider trading to cooperate with the prosecution as a means of possibly having their sentence reduced. Given that insider trading commonly involves a web of traders, the potential for more willing cooperating witnesses can substantially strengthen the enforcement against insider trading. 6 see http://dealbook.nytimes.com/2012/01/23/greater-penalties-for-insider-trading/ 8 This Dodd-Frank Act allows the SEC to file civil suits to pursue monetary damages beyond requiring inside traders to surrender their profits from the trades. It also allows more administrative powers, as the SEC can now have civil suits heard by administrative judges rather than in the federal court system. The defendants have less power of discovery in these proceedings7. The timing of events related to the Dodd-Frank Act overlapped with those of the Galleon case, as shown on the right side of Figure 1. In fact, the development of laws on financial regulatory reform and consumer protection began in June 2009 (about four months before the inception of the Galleon case) when the White House sent proposals to Congress. However, the Dodd-Frank Act was not initiated to prevent insider trading, and the publicity of the Act during its development was not focused on how it would prevent insider trading. The potential impact of the bill (or Act) on insider trading was not publicized until after the Galleon case began. Therefore, we do not use an earlier date than the inception of the Galleon case to assess an impact on insider trading behavior. Overall, we believe that the inception of the Galleon case signaled the government's efforts to detect and prosecute insider trading, while the passage of the Dodd-Frank Act enabled the government to more effectively enforce insider trading laws. In order to determine whether the tougher government stance and the Galleon case affected insider trading, we measure the abnormal stock price runup of targets prior to their respective merger announcements over a period of 84 months (January 2002-October 2009) before and 26 months (October 2009-December 2011) after the inception of the Galleon case. Sample To investigate our hypothesis, we obtain mergers and acquisitions of majority interest over the period from 07/01/2002 to12/31/2011 from Thompson’s SDC Mergers and Acquisitions 7 See http://www.businessweek.com/stories/2011-03-01/with-dodd-frank-the-sec-goes-after-big-game 9 database (SDC). We focus on targets that were traded on the New York Stock Exchange, American Stock Exchange, and Nasdaq and have a market capitalization of at least $1 million. We then exclude deals in which there were not sufficient stock price data. We also obtain data for the independent variables used in the multivariate analysis from the SDC database. In order to ensure that our sample only includes reliable public merger announcement dates in which new information was released to the market, we eliminate all observations that exhibit an announcement effect on days (0, +1) of less than 5%8. Most studies of mergers find that targets experience abnormal returns of at least 15 percent at the time of the merger announcement, so our screen is intended to detect observations in which the new information is negligible. The inclusion of such observations would bias the estimated abnormal stock price runup downward because the information leakage should be negligible if there is no new information to be released. Our final event study sample contains a total of 2,147 targets that were acquired, 1,730 before the inception of Galleon Case (10/16/2009) and 417 after. The sample for the multivariate analysis is lower due to missing firm-specific information for some observations. It consists of 1,201 total observations, 964 before and 237 after the inception of the Galleon case. Measurement of Runup The abnormal stock price runup has been measured and detected in studies by Keown and Pinkerton (1981), Gupta and Misra (1988), Schwert (1996), Jabbour, Jalivand, and Switzer (2000), and Betton, Eckbo, and Thorburn (2008) as a measure of informed or insider trading prior to the merger announcement. As Keown and Pinkerton (1981) explain, if there is no leakage of information, the mean abnormal stock price returns measured in event time shortly before the merger announcement should fluctuate randomly about zero. If the mean abnormal stock price movement of target firms prior to the merger announcement declined since the 8 As 5% is rather arbitrary, we rerun the models with a cutoff of 1% and 10% with virtually the same results. 10 inception of the Galleon case, this would provide evidence in support of our hypothesis. Assuming that the level of legal informed trading prior to merger announcements is unchanged, any reduction in the target stock price runup since the Galleon case should be attributable to a reduction in illegal insider trading. Following Schwert (1996), we measure the abnormal stock price runup of the target for an event window of (-42, -1) relative to the merger announcement date t = 0. We also consider shorter windows of (-30, -1) and (-10, -1) as robustness checks. For each target firm, we apply the market-adjusted model to calculate abnormal returns. We use an estimation period of 255 days, up to day -46 before the merger announcement with a minimum of 30 days necessary for estimation. The abnormal stock price movement on any particular day for the target in event time is measured as the actual target return minus its estimated return based on model estimates. The abnormal stock price runup is measured as the accumulation of the daily abnormal stock price movements over the period used to measure the runup prior to the merger announcement. For robustness checks, we also consider the market and the Fama-French three-factor models to derive the abnormal stock price runup of target firms. Stock price data are from the Center for Research in Security Prices (CRSP). We also consider an alternative measure of the abnormal stock price runup for the target before the merger announcement (referred to as the proportional abnormal stock price runup), which is measured in proportion to the total stock price runup that includes the announcement effect9: Proportional abnormal stock price runup=CAR (-42 to -1) ÷ CAR (-42 to +1) (1) 9 King (2009) refers to the proportional runup as the run-up index. He applies this measurement to his sample of Canadian mergers and also estimates it for previous related studies on U.S. mergers. 11 Two targets could experience the same abnormal stock price movement before their respective merger announcements, but have different proportional abnormal stock price runups. For example, if a firm experiences an abnormal stock movement of 5% before a merger and its total stock price runup (including the announcement effect) is 40%, then the abnormal stock price runup represents 12.5% of the total effect (computed as 5% divided by 40%). However, if another firm experiences the same abnormal stock price runup but its total stock price effect was 20%, its abnormal stock price runup represents 25% of the total effect (computed as 5% divided by 20%). The proportional abnormal stock price runup is also derived for the two shorter windows, 30 days and 10 days prior to the merger announcement. If there was no leakage of information prior to the merger announcement, the entire effect of the merger announcement on the stock price should occur at the time of the announcement (days 0, +1). The proportional runup measures the proportion of the total stock price effect on the target that is attributed to informed trading10. Multivariate Analysis Studies by Muelbroeck (1992), Jayaraman, Frye, and Sabherwal (2001), Acharya and Johnson, 2010, Brigida and Madura (2012) and others offer insight on how the target's abnormal stock price runup can be influenced by characteristics of the bidder or the target. We attempt to control for these characteristics while testing whether the abnormal stock price runup is reduced since the inception of the Galleon case. In this way, we are trying to ensure that any effect since 10 For some observations, there was a negative total effect (abnormal runup plus premium), so that the measure of the proportional runup was not meaningful. Therefore, we deleted these observations when using proportional runup as a dependent variable. The percent of the sample with a negative proportional run-up increased by12% from before to after Galleon for the 42-day window (from 11% to 23%), by 6% for the 30-day window and by 9% for the 10-day window. The percentage difference is significant in all three cases (p-value of 0.0031, 0.0844 and 0.0194 respectively). This may be interpreted as additional evidence that less information is revealed prior to merger announcements in the post Galleon period. 12 the Galleon case is not simply caused by changes in other variables that could influence the abnormal stock price runup. All data for these variables are compiled from the SDC database. We include four variables about the target that could influence the abnormal stock price runup of the target: (1) a target high-tech dummy (TECH) that reflects more asymmetric information and therefore more potential for leakage (see Kohers and Kohers, 2001), (2) target size (SIZE), measured as natural logarithm of the target’s market capitalization four weeks prior to the acquisition announcement as an alternative measure of asymmetric information (see Muelbroek (1992)), (3) a dummy variable (OPTIONS) reflecting the availability of target stock options which could attract more inside traders (see Jayaraman, Frye, and Sabherwal (2001), and (4) (RUMOR), a dummy variable acknowledging the existence of a publicized rumor about the target being a takeover candidate (which might have resulted from an information leakage) prior to the merger announcement. We also include five bidder variables that could influence the abnormal stock price runup of the target: (1) a dummy variable (HOSTILE) representing hostile bidders, which may more effectively keep their plans hidden about their pursuit of the target, (2) a dummy variable (PE) representing private equity bidders, which have an incentive to pursue targets without leaking the information (see Brigida and Madura, 2012), (3) a dummy variable (BORROW) indicating if the bidder borrows funds to finance the acquisitions, which spreads information to more intermediaries and could cause an information leakage (see Acharya and Johnson, 2010), (4) a dummy variable (MULTBID) representing the existence of multiple bidders for the target, which may result in more information leakages (see Archarya and Johnson, 2010), and (5) a dummy variable, (TOEHOLD), which indicates targets for which bidders held at least 5 percent of the shares of the target before the announcement date, and therefore might be more likely candidates 13 for a takeover. In addition to the characteristics of the target or bidder, we also include a control variable, (ACTIVITY), to represent merger activity in a particular quarter, since higher activity could cause more information leakages before mergers. In addition, insider trading might be more prevalent during a period in which there is much merger activity because regulators may not be able to closely monitor the trading behavior for most of the target firms. To control for the effects that might be caused by the financial crisis, we assign a dummy variable (CRISIS) that is set equal to 1 for targets acquired during the crisis period. While definitions of the crisis period may vary, we use the period from December 2007 to June 2009, which is in accordance with the weakest period resulting from the crisis according to the National Bureau of Economic Research.11 We apply a multivariate model, in which the dependent variable is the abnormal stock price runup for each target firm i. The independent variables include a dummy variable (GALLEON) to indicate if the merger announcement occurred after the inception of the Galleon case, and the control variables described above. Runupi= β0 + β1 GALLEON + β2 TECH+ β3SIZE+ + β4OPTIONS+ β5RUMOR+ β6HOSTILE+ β7PE+ β8BORROW+ β9MULTBID+ B10 TOEHOLD +B11 ACTIVITY + β12 CRISIS +εi (2) We also wish to determine whether these control variables that cause a relatively large amount of informed trading in the target stock prior to the merger announcement in the period before the Galleon case cause a more pronounced decline in informed trading since the inception of the Galleon case. Deals with characteristics that would normally result in a high abnormal runup (our measure of the magnitude of informed trading) should exhibit the most pronounced decline in runup since the inception of the Galleon case. To test this effect, we expand the 11 We also recognize that the Sarbanes-Oxley Act could have reduced the abnormal stock price runup of target firms (see Brigida and Madura (2012)). However, we do not include it in our analysis because our entire sample period is after the implementation of that act. 14 multivariate model by adding interaction terms between the GALLEON dummy variable (denoted as G when used within interaction terms) and each of the independent variables using the equation below12. The coefficient of each interaction term can indicate whether targets associated with particular characteristics that tend to result in higher abnormal runups experience a more pronounced reductions in information leakage (as measured by the runup) since the inception of the Galleon case. Runupi= β0 + β1 GALLEON + β2 TECH+ β3SIZE+ + β4OPTIONS+ β5RUMOR+ β6HOSTILE+ β7PE+ β8BORROW+ β9MULTBID+ B10 TOEHOLD +B11 ACTIVITY + β12 CRISIS + β13 TECH*G + β14 OPTIONS*G + β15 RUMOR*G + β16 HOSTILE*G + β17 BORROW*G + β18 MULTIBID*G + β19 TOEHOLD*G + β20 ACTIVITY*G+ β21 CRISIS*G +εi (3) V. RESULTS Descriptive Statistics Our samples for both the event study and the multivariate analyses are summarized in Table 1, by year. The merger observations are scattered somewhat evenly over time. The number of mergers per year as a proportion of the total sample in the event study ranges from 8.06% in 2004 and in 2009 to 14.02% in 2007. For the multivariate analysis, the proportions range from 7.66% in 2010 to 13.41% in 2007. Overall, about 80% of our sample occurs before the Galleon case and about 20%, after. In Table 2 Panel A, we provide descriptive statistics for the variables used. This table illustrates how some of the characteristics that we believe could influence the degree of the target's stock price runup have changed for the participating targets or bidders over time. In particular, since the inception of the Galleon case, there is a significantly higher proportion of 12 The interaction terms SIZE*G and PE*G are not included in the equation below because they are highly collinear with other variables in the model. 15 mergers involving technology targets, rumors, borrowed funds and private equity bidders. In addition, there is a significantly lower proportion of mergers involving targets that have listed options. We first compare the measures of the target's abnormal stock price runup over the periods before and after the inception of the Galleon case. However, some characteristics of targets and bidders involved in mergers have changed over time. Therefore, we also apply a multivariate analysis to test for the change in abnormal runup since the inception of the Galleon case, while controlling for other characteristics. Results of Univariate Analysis Table 3 compares the target's abnormal stock price runup before versus after the inception of the Galleon case. Panel A presents the results obtained by using the market-adjusted model. The mean abnormal stock price runup of targets is 5.12% and 4.58% respectively for the (-42, -1) or (-30, -1) windows in the 2002-2009 period prior to the Galleon case, and is statistically significant. We break down the (-42, -1) window further into (-42, -31), (-30, -11), and (-10, -1) windows in order to evaluate abnormal movements within intervals of the long window. Notice that the abnormal runup is negligible on average during the (-42, -31) window, but is 2.30% and significant on average during the (-30, -11) window, and is 2.29% on average and significant during the (-10, -1) window. By comparison, the mean abnormal stock price runup of targets is 2.84% and 2.46% respectively for the 42- and 30-day windows after the inception of the Galleon case. A breakdown of intervals within the long window shows that the mean runup is a negligible 0.38% 16 within days (-42, -31), is 0.91% and marginally significant within days (-30, -11), and is 1.55% and statistically significant within days (-10,-1). In general, the results show that the abnormal stock price runup is more pronounced when using a longer window prior to the merger announcement. This inference is consistent with other studies such as those by Schwert (1996) and King (2009), who detect abnormal movements in the stock price of the target well before day -10 or even day -20 relative to the announcement date. Insiders that are aware of potential mergers may prefer to trade as early as possible because they do not want to attract attention to themselves and because they do not want to lose their informational advantage. For this reason, longer windows such as (-42, -1) or (-30, -1) are more appropriate to fully capture information leakages prior to the merger announcement. To test our hypothesis regarding the effect of the Galleon case on informed trading, we report t and z-statistics to compare the runup before versus after the inception of the Galleon case in the last two columns of Panel A. For all three windows that measure runup ending at day -1, the difference in the estimated mean runup is significantly lower (at the .01 level for the longer window and at 0.05 for the shorter window) since the inception of the Galleon case. A nonparametric (Wilcoxon) test is also applied, with qualitatively similar results. These results offer preliminary support for our hypothesis that informed trading is reduced since the inception of the Galleon case. Changes in the mean abnormal runup could decline simply because the abnormal return at the time of the announcement declined. In this case, one might argue that even though the preannouncement information leakage (a proxy for informed trading) declined, it may be proportionately just as large as it was before. That is, if there is less information content, there is less that can be leaked. The total abnormal return consisting of the pre-announcement (42-day) 17 abnormal runup plus the abnormal return at the time of the announcement up to day +1 of the target in the pre-Galleon period is 34.49% on average, while the total abnormal return in the post-Galleon period is 35.98% on average. Since the total effect is virtually identical, the decline in the abnormal runup since the inception of the Galleon case is not attributed to a decline in the total announcement effect. Moreover, we find that that the mean proportional runup before the inception of the Galleon case is 14.80% and 13.49% respectively for the 42 and 30 days before the merger announcement, while the mean proportional runup since the inception of the Galleon case is 7.90% and 6.91% respectively13. In rough terms, univariate results suggest that the mean abnormal runup was reduced by about half of its norm since the inception of the Galleon case, and since the total effect (runup plus announcement effect) remained somewhat stable over the two periods, the mean proportional runup was also reduced by about half of its norm since the inception of the Galleon case. From this point forward, we give more attention to the abnormal runup. Overall, the univariate results strongly support our hypothesis of a reduced level of informed trading since the inception of the Galleon Case. Furthermore, the means that we estimated are not strongly influenced by outliers. For the post-Galleon period, with the exception of 2 negative numbers lower than -50% and two positive number greater than +50 (one is greater than +100%), the runup for all other targets is in the range of -48% to +50%, with the majority of numbers between -10% and +30%14. The majority 13 The runups for windows (-42, -31) and (-30, -11) are estimated only for an interval and do not estimate the entire runup preceding the announcement. Therefore, the proportional runup is not meaningful for those windows, and the interpretation is not comparable to the other windows. For this reason, we report the proportional runup results as NA (not applicable) for those windows. 14 In total, we eliminate 12 outliers from further analysis, the 4 post-Galleon outliers mentioned above and 8 preGalleon outliers with runups lower than -50% and greater than +50%. 18 of targets experience a positive runup in the post-Galleon period, which serves as an additional indicator that the lower post-Galleon runups are not driven by extreme negative outliers. Because our sample period begins in 2002, our pre-Galleon period is much longer than our post-Galleon period. We repeat our measurement of the target abnormal stock price runup based on a shortened pre-Galleon period from August 2007 to October 2009, which represents a 26-month period similar in length to the post-Galleon period. This pre-Galleon period contains 443 acquisitions, compared to 417 acquisitions that occurred since the inception of the Galleon case. Panel B of Table 3 compares results for runup between the shortened pre-Galleon period and the period since the inception of the Galleon case. Similar to the previous results, the target's mean abnormal stock price runup for the (-42, -1), (-30, -1), and the (-10, -1) windows is significantly reduced since the inception of the Galleon case based on parametric and nonparametric tests. These results are consistent with those in Panel A of Table 3. Panel C of Table 3 shows the abnormal trading volume during the windows used to measure runup (based on the entire sample period). In the period before the inception of the Galleon case, there is strong evidence that the trading volume was abnormally high during the runup period for the 30 and the 10-day windows. However, since the inception of the Galleon case, the (-10, -1) window is the only window that shows a significantly higher volume trading compared to the market (at the .10 significance level). Thus, the abnormally large trading volume of the target during the runup period prior to the merger announcement decreased since the inception of the Galleon case, which complements our preliminary support of our hypothesis that the stock price runup has decreased since the inception of the Galleon case. 19 We entertain the possibility that signals about deterring insider trading were emitted at the initial development stage of the Dodd-Frank Act, which occurred before the first public announcement about the Galleon case. During the period from June 2009 when proposals of the Dodd-Frank Act were developed to October 16, 2009 when the first Galleon announcement occurred, there were 66 merger announcements. We apply our method separately to that period and find that the market-adjusted mean abnormal return is 4.86%, 4.08%, and 3.27% for the 42, 30- and 10-day windows respectively. These results are qualitatively similar to our previous findings for the mean abnormal runup before the inception of the -Galleon case. Thus, we see no evidence that the level of informed trading was reduced at the initial development stage of the Dodd-Frank Act. Results of Multivariate Analysis While we have conducted analyses to assess the effects since the inception of the Galleon case for target subsamples matched by a particular merger characteristic, we also want to conduct an analysis that accounts for various characteristics simultaneously. For this purpose, we apply our multivariate model to assess the relationship between the GALLEON dummy variable and the abnormal stock price runup of the target (the dependent variable) while controlling for other characteristics that could affect the runup. Results from applying our multivariate model are disclosed in Tables 5 and 6. We show results when measuring the target's abnormal stock price runup over the windows (-42, -1), (-30, -1), and (-10, -1). The results are segmented into columns, with each column distinguished by the specific window used to measure the dependent variable. Table 4 presents the results for the models that incorporate a dummy variable to distinguish the periods before versus after the inception of the Galleon case, while Table 5 20 presents the results for the models that also include interaction terms to measure the change in sensitivity following the inception of the Galleon case. We use ordinary least squares (OLS), and apply White's test (White, 1980) for heteroscedasticity in the residuals of each linear regression model. We also estimate the model using weighted least-squares and find similar results. When using the abnormal runup of the target over the (-42, -1) window, the coefficient for the GALLEON variable is -5.56% (significant at the .01 level), which implies that the abnormal runup declined by an estimated 5.56 percent since the inception of the Galleon case when accounting for all other control variables. Using the same interpretation for the other two multivariate models, the coefficients for the GALLEON variable suggest that the abnormal runup over the 30 day window declined by 4.38 percent and the abnormal runup over the 10-day window declined by 1.72 percent since the inception of the Galleon case, when accounting for control variables. These results are consistent with the earlier comparison of the mean target stock price runup before versus after the inception of the Galleon case shown in Table 3, but are more convincing because they simultaneously account for several control variables that could also have an impact on the target stock price runup. In addition to the Galleon effect, a number of control variables used to account for target or bidder characteristics explain variation in the abnormal stock price runup of targets. The TECH variable is positive and significant at the .10 level or better for the two shorter windows, suggesting that high-tech firms have a significantly higher abnormal stock price runup than nonhigh-tech firms. The SIZE variable is negative and significant in all three models, which is consistent with the notion that the abnormal runup is lower for relatively large targets. This can be explained by the higher visibility and the lower information asymmetry associated with large 21 companies. The OPTIONS variable is positive and significant for the model using the shortest window to measure abnormal stock price runup, which reflects a higher runup in targets for which there are traded options. The RUMOR variable is positive and significant in all models, consistent with argument that the abnormal runup is higher when a publicized rumor (potential leakage) about the target has occurred prior to the merger announcement. The PE variable is negative and significant (at the .10 level) in two of three models, offering modest support for the argument that the abnormal runup is less pronounced when private equity firms are in pursuit of the target. The MULTBID variable is positive and significant in all three models, which suggests a greater abnormal stock price runup (greater leakage of information) when there are multiple bidders. The F-statistics for all three multivariate models applied in Table 4 are significant at the .01 level or better. Table 5 presents results from applying a multivariate analysis that includes interaction terms for each independent variable with the Galleon dummy variable. We removed the interaction term between SIZE and GALLEON because it was highly collinear with SIZE. We also removed the interaction term between PE and GALLEON because it was highly collinear with PE. Our expanded model that includes interaction terms measures the change in sensitivity of the abnormal stock price runup to each variable following the inception of the Galleon case. Put another way, this model attempts to pinpoint if the reduction in abnormal stock price runup is more pronounced in merger announcements involving targets or bidders with particular characteristics. In Table 5, the results for the variables without the interaction terms are similar to the results disclosed in Table 4. Most importantly, the GALLEON variable remains negative and 22 significant in all models. The only notable difference is that the PE variable, which was marginally significant in Table 4, is no longer significant in Table 5. There are four interaction terms that are significant as shown in Table 5. The interaction of the TECH variable with the Galleon dummy variable (denoted as G when used in interaction terms) is negative and significant in the models in which runup is used as the dependent variable, which suggests a more pronounced decline in abnormal stock price runup for targets in the hightech sector. Just as the positive and significant coefficient of the TECH variable by itself suggests a more pronounced runup for tech targets, the negative and significant coefficient of the interaction term for the TECH variable suggests a more pronounced reduction in abnormal runup of tech targets since the inception of the Galleon case. The interaction term for the OPTIONS variable is negative and significant for one model (the (-10, -1) window), and that is the only model in which the OPTIONS variable by itself is positive and significant. Thus, the coefficient implies a more pronounced reduction in the abnormal runup for that window for targets that have traded options. Just as the positive and significant coefficient of the RUMOR variable by itself suggests a more pronounced runup for targets subject to rumors, the negative and significant interaction term for the RUMOR variable implies a more pronounced reduction in the abnormal runup for targets subjected to rumors since the inception of the Galleon case. Similarly, just as the positive and significant coefficient of the MULTBID variable by itself suggests a more pronounced runup for targets subjected to multiple bids, the negative and significant interaction term for the MULTBID variable implies a more pronounced reduction in the abnormal runup for targets subjected to multiple bidders since the inception of Galleon case. 23 Overall, every interaction term that is significant is countering the relationship of the variable by itself with the abnormal runup. All three models shown in Table 5 are significant, with F-statistics significant at the .01 level or better. Since it is possible that the control variables have a different impact on the proportional runup than they had on the runup, we also replicate the models using a proportional runup proxy as the dependent variable, defined as the abnormal runup divided by the total effect (abnormal runup plus announcement effect) for the same windows. Results are disclosed in Table 6. The coefficients for the GALLEON variable are -0.7460, -0.3823, and -0.4216 for the 42-, 30-,and 10-day windows, significant at the .05 level for the longest window and at the 0.10 level for the other two windows, even when accounting for specific target and bidder characteristics. Thus, the abnormal runup not only declined in absolute terms (as shown in Table 4) but also as a proportion to the total effect on the target firm. There is modest evidence in Table 6 of the same SIZE, RUMOR, and MULTBID effects that were shown in Table 4 when using abnormal stock price runup as the dependent variable. Results for the control variables in Table 6 are generally not as strong as they were when using the abnormal stock price runup as the dependent variable, but the F-statistic for each model is significant. Table 7 provides results when including the interaction terms of the control variables with the GALLEON variable. The coefficient of the GALLEON variable remains negative but it is only significant in the (-30, -1) model. The coefficient of RUMOR is positive and significant in all models. The coefficient of TECH is positive and significant in the two longer models. These results are consistent with the results shown in Table 5 when using abnormal stock price runup as the dependent variable. Most other variables (including the interaction terms) are not significant, although the model F-statistics are significant. 24 VI. SUMMARY On October 16, 2009, the U.S. government charged billionaire and Galleon hedge fund founder Raj Rajaratnam and five others with insider trading in what was the largest insider trading case against a hedge fund. At the press conference, law enforcement officials stated that the Justice Department, Securities and Exchange Commission, and Federal Bureau of Investigation would be more committed to preventing white collar crime. Preet Bharara stated: "This case should serve as a wake-up call to Wall Street and to every hedge fund manager." Furthermore, the Galleon case signaled how the government could use wiretap evidence in insider trading cases, rely on people accused of insider trading to implicate others, and prosecute expert networks that provide information to hedge funds. We assess whether the government's increased efforts and power to prosecute illegal insider trading activity along with the increased publicity due to the Galleon case had an impact on the level of informed trading activity prior to merger announcements. We find that the mean abnormal stock price runup of targets during the 84 months before the inception of the Galleon case was 5.12%, while the mean abnormal stock price runup of targets over the following 26 months was 2.84%. Second, we apply this same type of comparison to subsamples based on particular characteristics of targets and bidders, and confirm a significant decline in the mean abnormal stock price runup of targets since the inception of the Galleon case. Third, we apply a multivariate analysis to the entire sample in order to re-test the Galleon effect, while controlling for other merger characteristics that could affect the pre-merger information leakages, and find additional support that the target stock price runup is significantly reduced since the inception of the Galleon case even after controlling for these characteristics. 25 A reduction in the stock price runup of targets could reflect a decline in trading by adept traders who use publicly available information to anticipate mergers, or a decline in illegal insider trading by other traders who capitalize on inside information. We have no reason to believe that the government's efforts to enforce insider trading laws should discourage adept traders who use publicly available information to anticipate mergers. Therefore, we believe that the reduction in informed trading is attributed to a reduction in illegal insider trading. The continual string of guilty pleas tied to Galleon could have reinforced the initial signal that the U.S. government can effectively prosecute illegal insider trading, and therefore could have resulted in a more sustained impact on insider trading behavior. To the extent that the provisions of the Dodd-Frank Act enabled the U.S. government to be more effective, it deserves some of the credit for these results. While the government continues to file new charges of insider trading, many of the cases (including the recent large case filed on November 20, 2012 against SAC Capital) reflect alleged insider trading prior to the Galleon case15. A 26-month period since the inception of the Galleon case is too short to draw final conclusions. Moreover, the U.S. government's enforcement of insider trading laws could be redirected over time in response to budget conditions and greater concerns about other criminal activity such as cybercrime16. Nevertheless, in response to Preet Bharara's public warning that the Galleon case should serve as a wake-up call to investors who engage in insider trading, the early evidence strongly suggests that the Galleon case has sent a clear signal to the traders, and that many of the traders are listening. 15 See http://online.wsj.com/article/AP5478dbceba6741eba834917902f08acb.html regarding allegations of $276 million in illicit gains as a result of insider trading. 16 http://dealbook.nytimes.com/2012/06/15/victory-spurs-speculation-on-bhararas-next-move/ 26 VII. REFERENCES Acharya, V. V. and T.C. Johnson, 2010, “More Insiders, More Insider Trading: Evidence from Private Equity Buyouts”, Journal of Financial Economics, 98, 500-523. Ascioglu, N. A., T.H. McInish, and R.A. Wood, 2002, Merger Announcements and Trading. Journal of Financial Research, 25, 263–278. Barclay, M., and J. Warner, 1993, “Stealth trading and volatility: Which trades move prices?”, Journal of Financial Economics 34, 281-305. Betton, S., B. Eckbo, and K. Thorburn, 2008 ” Markup Pricing Revisited” Working Paper. Bhattacharya, U., and H. Daouk, 2002, "The World Price of Insider Trading." The Journal of Finance, 57, 75-108. Brigida, M., and J. Madura, 2012,”Sources of Target Stock Price Run-up Prior to Acquisitions”, Journal of Economics and Business, 64, 185-198. Bris, A., 2005, “Do Insider Trading Laws Work?”, European Financial Management, 11, 267312. Bushman, R., J. Piotroski, and A. Smith,2005, "Insider Trading Restrictions and Analysts' Incentives to Follow Firms." The Journal of Finance 60, 35-66. Chakravarty, S., and J.J. McConnell, 1999, “Does Insider Trading Really Move Stock Prices?”, Journal of Financial and Quantitative Analysis, 34, 191-209. Chen, Q., and H. Hao, 2011. "Insider Trading Law Enforecement and Gross Spreads of ADR IPOs." Journal of Banking & Finance 35, 1907-1917. Gupta, A., and L. Misra, 1988, “Illegal Insider Trading: Is It Rampant Before Corporate Takeovers?” Financial Review 23, 453-464. Jayaraman, S., 2011, "The Effect of Enforcement on Timely Loss Recognition: Evidence from Insider Trading Laws." Journal of Accounting and Economics, in press. Jabbour, A., A. Jalilvand, and J. Switzer 2000, “Pre-bid Price Runups and Insider Trading Activity: Evidence from Canadian Acquisitions”. International Review of Financial Analysis, 9, 21-43. Jayaraman, N., M. B. Frye, and S. Sabherwal, 2001, “Informed Trading Around Merger Announcements: An Empirical Test Using Transaction Volume and Open Interest in Options Markets”, Financial Review, 36, 45-74. 27 Keown, A.J., and J.M. Pinkerton, 1981,” Merger Announcements and Insider Trading Activity: An Empirical Investigation”, Journal of Finance, 36, 855-869. King, M., 2009, “Prebid Runups Ahead of Canadian Takeovers: How big is the Problem?" Financial Management, 39, 699-726. Kohers, N., and T. Kohers, 2001, “Takeovers of Technology Firms: Expectations vs. Reality”, Financial Management, 30, 35-54. Leland, H., 1992, "Insider Trading: Should It Be Prohibited?" Journal of Political Economy, 100, 859-887. Meulbroek, L., 1992,” An Empirical Analysis of Illegal Insider Trading”, Journal of Finance, 47, 1661-1699. Schwert, G.W., 1996, “Markup Pricing in Mergers and Acquisitions”, Journal of Financial Economics, 41, 153-192. Tanimura, J. K. and E.W. Wehrly, 2012, The Effects of Insider Trading Restrictions: Evidence from Historical Dividend Initiations and Omissions, Journal of Financial Research, 35, 1–28. White, H., 1980, “A Heteroskedasticity-consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity”, Econometrica, 48, 817–838. 28 Figure 1: Timelines for the Galleon Case and the Dodd-Frank Act 06/09 10/16/09 11/05/09 A federal judge ruled that the U.S. government would be allowed to use wiretap recordings as evidence in the Galleon case. 01/08/10 A consultant who was a former director at McKinsey & Company pleads guilty to providing Raj Rajaratnam with inside information. 02/06/10 A former executive of Intel pleads guilty to passing inside information on to Raj Rajaratnam. A former executive of IBM pleads guilty to securities fraud and conspiracy for passing information on to a hedge fund executive, who passed the information on to Raj Rajaratnam 04/27/10 11/24/10 07/21/09 A version of the Wall Street Reform and Consumer Protection bill was introduced in the House of Representatives. 12/11/09 House of Representatives approves Wall Street Reform and Consumer Protection bill. 05/20/10 Senate approves Wall Street Reform and Consumer Protection bill. President Barrack Obama signs the Wall Street Reform and Consumer Protection Act (also referred to as Dodd-Frank Act) into law. Raj Rajaratnam (founder of Galleon fund) and five others are charged with insider trading. 14 more are charged in Galleon case. 11/24/09 03/29/10 President Obama proposed that new laws be developed for financial reform and consumer protection. Galleon trader pleads guilty to securities fraud and conspiracy Court backs use of wiretap evidence in Galleon case. 06/21/10 29 12/10/10 An attorney for a law firm pleads guilty to passing on inside information in the Galleon case. 01/19/11 A hedge fund executive pleads guilty to passing inside information on to Raj Rajaratnam 01/24/11 An attorney for a law firm pleads guilty to passing on inside information in the Galleon case Two former Galleon employees plead guilty to securities fraud and conspiracy. The SEC charges Rajat Gupta (a former director of P&G and Goldman Sachs and a former consultant for McKinsey) with passing inside information on to Raj Rajaratnam. 01/27/11 03/01/11 04/21/11 2011 An attorney of a law firm pleads guilty to securities fraud and conspiracy in the Galleon case. 05/01/11 Raj Rajaratnam is found guilty on all 14 counts of securities fraud and conspiracy. Raj Rajaratnam is sentenced to 11 years in prison, is fined $10 million, and is required to forfeit $53.8 million in trading profits. 10/03/11 30 Table 1. Number and Percentage of Mergers by Year (used for the event study and for the multivariate analysis). 2002 Number for Event Study Analysis 198 Percentage of Total for Event Study Analysis 9.22% Number for Multivariate Analysis 126 Percentage of Total for Multivariate Analysis 10.49% 2003 229 10.67% 122 10.16% 2004 173 8.06% 110 9.16% 2005 211 9.83% 108 8.99% 2006 260 12.11% 153 12.74% 2007 301 14.02% 161 13.41% 2008 216 10.06% 114 Year 17 2009 173 8.06% 2010 211 2011 175 Total 9.49% 18 101 8.41% 9.83% 92 7.66% 8.15% 114 9.49% 2,147 100% 1,201 100% Before Galleon 1,730 80.58% 964 80.27% After Galleon 417 19.42% 237 19.73% Table 2. Panel A. Descriptive Statistics for Target and Bidder Characteristics Before and After the Galleon Case. The percentages represent the frequency with which specific merger characteristics occurred before and after the Galleon case. The t-test is based on the difference between the two periods (before and after). * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Variable Before Galleon After Galleon t-test for the Difference Target high tech 44.19% 55.77% 4.21*** Target with listed options 84.48% 61.54% 11.65*** Rumor about target merger 5.00% 9.13% 2.66** Hostile bidder 6.47% 3.11% 1.10 Private equity bidder 6.85% 14.88% 2.72*** Bidder used borrowed funds 9.18% 13.46% 1.99** Multiple bidders 9.00% 9.24% 0.27 Toehold acquisition 3.43% 3.20% 0.51 17 18 For 2009, 142 mergers were announced before and 31 after the inception of the Galleon case (10/16/2009). For 2009, 70 mergers were announced before and 31 after the inception of the Galleon case (10/16/2009). 31 Table 3. Runup and Volume Before and After the Inception of the Galleon Case. The runup for mergers is measured before and after the inception of the Galleon case based on alternative measures and estimated over alternative windows. . * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Panel A: Market-Adjusted Model Applied to Entire Sample Period (2002-2011)19 Window Used to Measure Runup Runup Before Galleon Proportional Runup Before Galleon (-42, -1) 5.12% *** 14.80% 2.84%*** 7.90% Pre-Galleon Minus Post-Galleon Runup (using parametric t-test, unequal variances) 5.587*** (-30, -1) 4.58% *** 13.49% 2.46%*** 6.91% 5.514*** 4.046*** (-10, -1) 2.29% *** 7.21% 1.55%** 4.47% 3.429*** 2.192** 0.54% NA 0.38% NA 1.750** -0.651 (-30, -11) 2.30% *** NA 0.91%* NA 4.440*** 3.279*** N 1,730 1,730 417 417 (-42, -31) Runup After Galleon Proportional Runup After Galleon Pre-Galleon Minus Post-Galleon Runup (using Wilcoxon z-test) 3.812*** Panel B: Market-Adjusted Model Robustness Test (Applied to Shorter Pre-Galleon Period) The results in this panel are based on a pre-Galleon window that includes 26 months before October 19, 2009. Runup Before Galleon Aug 2007-Oct 2009 Proportional Runup Before Galleon Runup After Galleon Proportional Runup After Galleon Differences in Runup (using parametric t-test, unequal variances) Difference in Runup (using Wilcoxon ztest) (-42, -1) 4.27%* 10.02% 2.84%*** 7.90% 4.4874*** 2.693*** (-30, -1) 5.37%*** 11.14% 2.46%*** 6.91% 4.9630*** 4.635*** (-10, -1) 2.08%*** 8.04% 1.55%** 4.47% 2.4962** 2.404** (-42, -31) -1.10% NA 0.38% NA 0.2421 -1.459 (-30, -11) 3.29%*** NA 0.91%* NA 4.1029*** 4.176*** N 443 443 417 417 Window Used to Measure Runup 19The results for the equally weighted portfolio are in line with the results from the value weighted portfolio are as follows: before Galleon (-42, -1)=4.89%, (-30, -1)=4.46%, (-10, -1)= 2.36%, (-42, -31)=0.43% , and (30, -11)=2.11%, all significant at the 1% significance level except (-42, -31), which is insignificant. After Galleon: (-42,-1) = 2.19%, (-31,-1) = 2.16%, (-10,-1) = 1.47%, all significant at the 1% significance level, (-42,-31)=0.03%, insignificant and (-31,-11)=0.69%, significant at the 5% significance level. 32 Panel C: Volume Event Study Applied to the Entire Sample Period (2002-2011) Market-Adjusted Model, Log-Transformed Value-Weighted Volume Index Window Used to Measure Runup (-42, -1) Volume Cumulative Abnormal Before Galleon 219.30% Volume Cumulative Abnormal After Galleon 192.19% Percent Difference in Cumulative Abnormal Volume (After-Before) -27.11% (-30, -1) 201.51%** 141.03% -60.48% (-10, -1) 129.21%*** 84.46%* -44.75% (-42, -31) 17.78% 51.16% +33.38% (-30, -11) 72.67% 56.57% -16.11% N 1,730 417 33 Table 4. Results of Multivariate Analysis. The dependent variable is the runup. Three windows are used: (-42, -1), (-30, -1), and (-10, -1). The model is represented in equation (2). GALLEON = dummy variable assigned a value of 1 if the merger announcement occurs after the inception of the Galleon case, and zero if the merger occurs before the inception of the Galleon case, TECH = dummy variable assigned a value of 1 if the target is in a high-tech industry and 0 otherwise, SIZE = natural logarithm of the target’s market capitalization four weeks prior to the acquisition announcement, OPTION = dummy variable assigned a value of 1 if there are listed stock options traded on the target’s stock and 0 otherwise, RUMOR = dummy variable assigned a value of 1 if rumors about potential mergers were present and 0 otherwise. HOSTILE = dummy variable assigned a value of 1 if the takeover effort is hostile or unsolicited and 0 otherwise, PE= dummy variable assigned a value of 1 if the bidder is a private equity firm and 0 otherwise, BORROW=dummy variable assigned a value of 1 if the bidder used borrowed funds for the acquisitions and 0 otherwise, MULTBID= dummy variable assigned a value of 1 if there was more than one bidder present and 0 if there was only one bidder, TOEHOLD=dummy variable assigned a value of 1 if bidders held at least 5 percent of the shares of the target before the announcement date, ACTIVITY=natural logarithm of the total number of mergers announced in the quarter in which the firm merger was announced, and CRISIS=dummy variable assigned a value of 1 when the announcement occurred during the financial crisis, from December 2007 to June 2009 and 0 otherwise. * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Variable Dependent Variable=Runup (-42, -1) Dependent Variable=Runup (-30, -1) Dependent Variable=Runup (-10, -1) Intercept 33.1286 (0.012)** 33.2794 (0.024)** 5.7399 (0.402) GALLEON -5.5569 (0.000)*** -4.3851 (0.000)*** -1.7177 (0.001)*** TECH 1.7163 (0.148) 1.9115 (0.058)* 1.3419 (0.038)** SIZE -1.4726 (0.000)*** -1.2603 (0.000)*** -0.9040 (0.001)*** OPTIONS -0.8868 (0.599) - 0.5325 (0.714) 2.6989 (0.001)*** RUMOR 6.9017 (0.002)*** 6.6368 (0.006) *** 4.8554 (0.081)* HOSTILE 1.6486 (0.606) 1.5197 (0.595) 1.8124 (0.334) PE -2.4260 (0.266) -3.3065 (0.087)* -2.2911 (0.069)* BORROW 1.3550 (0.271) 0.0155 (0.988) -0.1999 (0.695) MULTBID 4.7742 (0.020)** 4.8172 (0.010)*** 3.0219 (0.030)** TOEHOLD -7.0502 (0.441) -10.6237 (0.388) -1.4846 (0.758) ACTIVITY 3.3897 (0.132) 3.2980 (0.079) -0.0542 (0.961) CRISIS 3.2767 (0.190) 3.4166 (0.118) 0.2460 (0.861) Adjusted R-squared 0.0577 0.0659 0.0559 F-Statistic 7.05 (0.000)*** 7.44 (0.000)*** 3.92 (0.0000)*** N 1201 1201 1201 34 Table 5. Results of Multivariate Analysis That Includes Interaction Terms. The dependent variable is the runup. For each dependent variable, three alternative windows are used: (-42, -1), (-30, -1), and (-10, -1). The model is represented in equation (3). GALLEON = dummy variable assigned a value of 1 if the merger announcement occurs after the inception of the Galleon case, and zero if the merger occurs before the inception of the Galleon case, CRISIS= dummy variable assigned a value of 1 if the merger announcement occurs between December 2007 and June 2009, TECH = dummy variable assigned a value of 1 if the target is in a high-tech industry and 0 otherwise, SIZE = natural logarithm of the target’s market capitalization four weeks prior to the acquisition announcement, OPTION = dummy variable assigned a value of 1 if there are listed stock options traded on the target’s stock and 0 otherwise, RUMOR = dummy variable assigned a value of 1 if rumors about potential mergers were present and 0 otherwise. HOSTILE = dummy variable assigned a value of 1 if the takeover effort is hostile or unsolicited and 0 otherwise, PE= dummy variable assigned a value of 1 if the bidder is a private equity firm and 0 otherwise, BORROW=dummy variable assigned a value of 1 if the bidder used borrowed funds for the acquisitions and 0 otherwise, MULTBID= dummy variable assigned a value of 1 if there was more than one bidder present and 0 if there was only one bidder, TOEHOLD=dummy variable assigned a value of 1 if bidders that held at least 5 percent of the shares of the target before the announcement date, ACTIVITY=natural logarithm of the total number of mergers announced in the quarter in which the firm merger was announced and CRISIS=dummy variable assigned a value of 1 when the announcement occurred during the financial crisis, from December 2007 to June 2009 and 0 otherwise The interaction terms are shown as the name of the variable * G (which reflects the GALLEON variable). * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Variable Intercept Dependent Variable=Runup (-42, -1) Dependent Variable=Runup (-30, -1) Dependent Variable=Runup (-10, -1) 8.608 (0.374) 4.1567 (0.611) 6.3496 (0.314) GALLEON -8.669 (0.011)** -6.3275 (0.023)** -4.3271 (0.051)* TECH 2.9661 (0.0815) * 2.6803 (0.061)* 2.0245 (0.023)** SIZE -1.8782 (0.000)*** -1.5805 (0.000)*** -1.2018 (0.001)*** OPTIONS -2.3721 (0.525) 1.1208 (0.724) 4.9798 (0.004)*** RUMOR 14.5256 (0.002)*** 14.4148 (0.007)*** 11.0618 (0.076)* HOSTILE -3.2670 (0.505) -3.3035 (0.452) 2.9241 (0.303) PE -0.6794 (0.146) -0.3048 (0.689) -0.6539 (0.238) BORROW 2.6809 (0.186) 0.6539 (0.693) 0.2383 (0.781) MULTBID 6.1294 (0.029)** 6.1416 (0.016)** 3.6226 (0.045)** TOEHOLD 9.2964 (0.199) 13.3112 (0.197) -3.6881 (0.231) ACTIVITY 3.4979 (0.192) 3.5886 (0.106) 0.1279 (0.922) CRISIS 2.8258 (0.270) 3.1196 (0.164) 0.1810 (0.900) TECH*G -2.9291 (0.088)* -2.7563 (0.072)* -2.2988 (0.018)** OPTIONS*G 2.5596 (0.494) -1.1959 (0.710) -4.4334 (0.012)** RUMOR *G -4.5361(0.002)*** -4.3268 (0.007)*** -1.0589 (0.077)* HOSTILE*G -24.5096 (0.351) -5.2460 (0.245) -3.5478 (0.202) BORROW*G -2.7968 (0.169) -0.8174 (0.625) -0.4208 (0.635) MULTBID*G -6.1228 (0.030) ** --6.3034 (0.014)** -3.5307 (0.052)* 35 TOEHOLD*G 1.2589 (0.834) 0.9964 (0.667) 1.1238 (0.708) ACTIVITY*G 3.5303 (0.129) 3.5006 (0.135) -0.9137 (0.533) CRISIS*G 1.1698 (0.348) 1.0812 (0.411) 0.9215 (0.612) Adjusted R-squared 0.0693 0.0782 0.0767 F-Statistic 4.75 (0.0000)*** 4.77 (0.0000)*** 2.74 (0.0001)*** N 1201 1201 1201 36 Table 6. Results of Multivariate Analysis Using Proportional Runup as the Dependent Variable. For each dependent variable, three alternative windows are used: (-42, -1), (-30, -1), and (-10,-1). The model is represented in equations (2). GALLEON = dummy variable assigned a value of 1 if the merger announcement occurs after the inception of the Galleon case, and zero if the merger occurs before the inception of the Galleon case, CRISIS= dummy variable assigned a value of 1 if the merger announcement occurs between December 2007 and June 2009, TECH = dummy variable assigned a value of 1 if the target is in a high-tech industry and 0 otherwise, SIZE = natural logarithm of the target’s market capitalization four weeks prior to the acquisition announcement, OPTION = dummy variable assigned a value of 1 if there are listed stock options traded on the target’s stock and 0 otherwise, RUMOR = dummy variable assigned a value of 1 if rumors about potential mergers were present and 0 otherwise. HOSTILE = dummy variable assigned a value of 1 if the takeover effort is hostile or unsolicited and 0 otherwise, PE= dummy variable assigned a value of 1 if the bidder is a private equity firm and 0 otherwise, BORROW=dummy variable assigned a value of 1 if the bidder used borrowed funds for the acquisitions and 0 otherwise, MULTBID= dummy variable assigned a value of 1 if there was more than one bidder present and 0 if there was only one bidder, TOEHOLD=dummy variable assigned a value of 1 if bidders that held at least 5 percent of the shares of the target before the announcement date, ACTIVITY=natural logarithm of the total number of mergers announced in the quarter in which the firm merger was announced and CRISIS=dummy variable assigned a value of 1 when the announcement occurred during the financial crisis, from December 2007 to June 2009 and 0 otherwise. * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Variable Dep. Var.=Proportional Runup (-42, -1) Dep. Var.=Proportional Runup (-30, -1) Dep. Var.=Proportional Runup (-10, -1) Intercept -0.429 (0.588) 0.4691 (0.767) 0.2564 (0.676) GALLEON -0.7460 (0.016)** -0.3823 (0.086)* -0.4216 (0.069)* TECH -0.0309 (0.860) -0.0053 (0.311) 0.0670 (0.523) SIZE 0.0466 (0.347) -0.0054 (0.932) -0.0367 (0.0184)** OPTIONS -0.5242 (0.136) 0.2313 (0.379) 0.0476 (0.763) RUMOR 0.6097 (0.013)** 0.0657 (0.751) -0.1380 (0.591) HOSTILE -0.9815 (0.048)** -1.1648 (0.211) 0.2152 (0.605) PE 2.0539 (0.123) 4.0387 (0.240) -0.7199 (0.346) BORROW -0.2433 (0.054)* -0.0841 (0.627) 0.4617 (0.249) MULTBID 0.3342 (0.014)** 0.3004 (0.069)* 0.4471 (0.246) TOEHOLD 0.3508 (0.492) -1.0567 (0.261) 0.0402 (0.924) ACTIVITY 0.1081 (0.639) 0.1211 (0.550) 0.0624 (0.684) CRISIS 0.0460 (0.494) 0.0622 (0.556) -0.0112 (0.904) Adjusted R-squared 0.0244 0.0193 0.0312 F-Statistic 2.46 (0.0244)** 2.11 (0.0314)** 2.96 (0.015)** N 1116 1120 1162 37 Table 7. Results of Multivariate Analysis That Includes Interaction Terms Using Proportional Runup as the Dependent Variable. For each dependent variable, three alternative windows are used: (-42, -1), (-30, -1), and (-10,-1). The model is represented in equations (3). GALLEON = dummy variable assigned a value of 1 if the merger announcement occurs after the inception of the Galleon case, and zero if the merger occurs before the inception of the Galleon case, CRISIS= dummy variable assigned a value of 1 if the merger announcement occurs between December 2007 and June 2009, TECH = dummy variable assigned a value of 1 if the target is in a high-tech industry and 0 otherwise, SIZE = natural logarithm of the target’s market capitalization four weeks prior to the acquisition announcement, OPTION = dummy variable assigned a value of 1 if there are listed stock options traded on the target’s stock and 0 otherwise, RUMOR = dummy variable assigned a value of 1 if rumors about potential mergers were present and 0 otherwise. HOSTILE = dummy variable assigned a value of 1 if the takeover effort is hostile or unsolicited and 0 otherwise, PE= dummy variable assigned a value of 1 if the bidder is a private equity firm and 0 otherwise, BORROW=dummy variable assigned a value of 1 if the bidder used borrowed funds for the acquisitions and 0 otherwise, MULTBID= dummy variable assigned a value of 1 if there was more than one bidder present and 0 if there was only one bidder, TOEHOLD=dummy variable assigned a value of 1 if bidders that held at least 5 percent of the shares of the target before the announcement date, and ACTIVITY=natural logarithm of the total number of mergers announced in the quarter in which the firm merger was announced, and CRISIS=dummy variable assigned a value of 1 when the announcement occurred during the financial crisis, from December 2007 to June 2009 and 0 otherwise. The interaction terms are shown as the name of the variable * G (which reflects the GALLEON variable). * = significance at .10 level; ** = significance at .05 level; *** = significance at .01 level. Variable Dep. Var.=Proportional Runup (-42, -1) Intercept -0.7759 (0.356) 1.8100 (0.222) Dep. Var.=Proportional Runup (-30, -1) -0.1895 (0.800) Dep. Var.=Proportional Runup (-10, -1) GALLEON -2.6829 (0.640) -8.4118 (0.081)* -0.991 (0.841) TECH 0.0937 (0.038)** 0.0751 (0.049)** -0.0050 (0.881) SIZE -0.0079 (0.492) -0.0182 (0.091)* -0.0182 (0.024)** OPTIONS -0.0921 (0.232) 0.0140 (0.850) 0.0033 (0.933) RUMOR 0.4421 (0.000)*** 0.3906 (0.000)*** 0.2881 (0.000)*** HOSTILE -0.1584 (0.236) -0.0273 (0.852) -0.0084 (0.994) PE -1.3880 (0.363) -3.7807 (0.275) -1.5331 (0.397) BORROW 0.0026 (0.971) -0.0180 (0.768) -0.064 (0.055)* MULTBID 0.0610 (0.543) 0.0715 (0.371) 0.0708 (0.111) TOEHOLD 0.5779 (0.453) -1.7396 (0.236) 0.2226 (0.759) ACTIVITY 0.0958 (0.265) 0.0180 (0.764) 0.0184 (0.687) CRISIS 0.0437 (0.475) 0.0622 (0.193) 0.0504 (0.199) TECH*G -0.4592 (0.386) 0.1301 (0.793) 0.1233 (0.597) OPTIONS*G -0.7679 (0.228) 0.1490 (0.420) 0.0893 (0.750) RUMOR *G 0.127 (0.775) -0.6522 (0.230) -0.7026 (0.122) HOSTILE*G -2.1470 (0.044)** -2.07393 (0.2007) 0.7108 (0.472) BORROW*G 0.6924 (0.045)** -0.094 (0.780) 0.9593 (0.293) 38 MULTBID*G 1.0654 (0.004)** 0.4472 (0.262) 1.4145 (0.447) TOEHOLD*G 0.1379 (0.668) 0.0812 (0.998) 0.2714 (0.118) ACTIVITY*G 0.3416 (0.788) 0.8494 (0.534) -0.1211 (0.832) CRISIS*G 0.0312 (0.775) 0.0410 (0.668) 0.2227 (0.129) Adjusted R-squared 0.0421 0.0367 0.0337 F-Statistic 3.65 (0.0000)**** 2.53 (0.0002)*** 1.73 (0.0234)** N 1116 1120 1162 39