Competitive advantage is an essential part of strategic management

Define and briefly discuss what is meant by competitive advantage. Do the dimensions of time and space determine an organisation’s prevalence within its competitive domain?

Name: David Patel

Student number: P98254936

Course: Business Information Systems

Date of submission: Monday November 5 th

2001

Question number: 4

I am writing this essay to fulfil my Strategic Management module requirements by looking into competitive advantage and how a firm can gain and sustain it. I looked into how the factors of time and space can contribute toward competitive advantage thereby defeating competitors. I have concluded that time and space can contribute towards success, but only firms that compete distinctively will prevail.

Competitive advantage is an essential part of strategic management and there is a lot of literature covering this subject area. However, competitive advantage is rather hard to define and it has even been described as the Holy Grail, “…it is highly desirable, hard to define or measure, and may even be imaginary” (Macmillan and Tampoe) 2000.

Competitive advantage can be gained through a variety of methods including branding, product and cost differentiation, and through well-established and innovative products. Other factors such as perceived quality and value along with high levels of customer service could all contribute in gaining a competitive advantage.

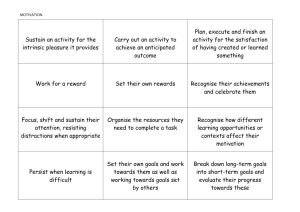

Resources within the organisation have to be managed efficiently and effectively to ensure that the lowest possible costs are incurred and can lead other beneficial factors (see Figure 1).

Once a competitive advantage has been gained, it is important to sustain it for as long as possible, as it enables a firm to earn above-average returns on their product or service, thus recouping any initial high costs and earning higher profit margins.

“Just because a firm is able to use its resources and capabilities to develop a competitive advantage does not mean it will be able to sustain it” (Hitt, Ireland and Heskisson) 2001.

Sustainability of organisations distinctive competencies can be determined by two factors, durability and imitability. Durability is the rate at which a firm’s core competencies (unique resources and experience) depreciate or become obsolete and innovation can always make a competitor’s product obsolete or even irrelevant. 3Dfx Interactive were well established in the PC gaming graphics card market since 1994. Their ‘Voodoo’ range dominated the market until 1998. Then, along came nVidia with their highly superior ‘GeForce’ range that utilised cutting-edge technology. This lead to the eventual dissolution of 3Dfx last

September and ironically the directors approved the sale of its assets to nVidia (3dfx

Interactive), 2000.

Imitability is the way in which organisations core competencies can be copied. This is important as any product can be imitated, either through re-engineering or engineering around the patent, as is the case with Dyson’s ‘Dual Cyclone’ patent, which has now been copied by Samsung’s ‘Wind Tunnel’ technology. Hoover tried to imitate with their ‘Triple

Vortex’ technology, but were found to be patent infringing (Dyson), 2000.

The forces of time can also help an organisation to achieve competitive advantage. Over time firms can gain recognition through the use of branding. Once your brand has become recognisable it becomes a great asset, as it is easier to sustain compared with any of the other factors concerned with competitive advantage. More importantly, branding is an intangible resource; its imitability is highly reduced. It has become widely acknowledged “…a brand generates an identifiable stream of earnings over time” (Hitt, Ireland and Heskisson) 2001.

Therefore brand value is a huge asset as future profits can almost be guaranteed and it is important to manage this asset properly so as to sustain it for as long as possible. Branding can also allow you to diversify, as is the case with Virgin, because of their brand name and image, they were successfully able to diversify into music stores, produce ‘coca-cola’, and more recently, the mobile phone market.

Time of entry into a market can also contribute to competitive advantage. The actual time taken to produce the end product and release it into the market enables you to become the first mover and take initial competitive action. For example two years ago three game consoles were in development by Sony, Nintendo and Microsoft. Sony has already released their console (Playstation 2) and is gaining competitive advantage by gaining a huge customer loyalty base and successfully earning above-average returns before any of the other manufacturers can respond. This creates entry barriers for both Nintendo and Microsoft, in fact it has been stated that “Microsoft could lose as much as $2 billion on Xbox--potentially selling the game console at a loss for three years or more--before breaking even in fiscal

2005” (Becker), 2001. However, over time this kind of competitive advantage becomes harder to sustain, and being a first mover also involves obvious risks.

Space is another important consideration of competitive advantage. In terms of actual physical space, a firm has to have enough space to stock and hold the products that they produce, or have enough space to provide a service. A firm will then require effective distribution channels to supply their goods to their customers. A problem that can arise with space is whether the retail outlet has enough space to stock their product. Phillip Morris, a tobacco firm in the U.S. for example, actually compensated retailers for stocking their products over rival products (Hitt, Ireland and Heskisson) 2001.

Geographical space is again an important issue. Location is paramount, as potential customers will need easy access to gain use of your product/service. If you are located somewhere where your target market doesn’t exist then your business is likely to be unsuccessful (although this could draw new customers).

Space can also be defined by its market space and size, i.e. strategic space. The bigger a firm is, the more immense its marketing power is. This creates entry barriers for any smaller firms who wish to compete. Microsoft is a good example of this, they have a ‘monopoly’ over the

PC operating system market and competitors such as Linux and Sun Microsystems find it difficult to compete.

Strategic alliance can help overcome this problem, as well as vertical integration, diversification, mergers and acquisitions. By using these strategies a firm can “…leverage their resource and capability advantages in other strategically related business activities”

(Barney), 1996. A recent merger includes Hewlett-Packard and Compaq, who have joined together to create a bigger market force and has been described as “a decisive move that positions us to win by offering even more value to our customers and partners” (Hewlett-

Packard Company) 2001. Clearly, they feel that this will create a competitive advantage.

In conclusion, competitive advantage does exist, it is real, but it still remains a dream for many firms. There is no one perfect strategy of gaining and sustaining competitive advantage. Being more proficient with business practice is no longer enough; neither is having that ‘killer’ product. Over time, organisations build upon their core competencies, creating intangible assets, they acquire and gain space, and these factors ultimately lead to success. An amalgamation of all these techniques will provide a firm with their own way of doing things, their own system. It is these firms that can compete in a distinctive way, which will eventually prevail.

Bibliography

BARNEY, J.B. (1996), Gaining and Sustaining Competitive Advantage, United States of

America, Addison-Wesley Publishing Company.

BECKER, D. (2001), Will Xbox drain Microsoft?

[online]. Available from: http://news.cnet.com/news/0-1006-200-5041881.html [accessed 22/10/01].

Dyson (2000), Injunction granted against Hoover [online]. Available from: http://www.dyson.com/news/content.asp?sysPage=135 [accessed 1/11/01].

Hewlett-Packard Company (2001), Hewlett-Packard And Compaq Agree To Merge,

Creating $87 Billion Global Technology Leader [online]. Available from: http://www.hp.com/hpinfo/newsroom/press/04sep01a.htm [accessed 9/10/01].

HITT, M.A., DUANE, R. and HESKISSON, R.E. (2001), Strategic Management

Competitiveness and Globalisation , 4 th

Edition, United States of America, South-Western

College Publishing.

ROWE, A.J., MASON, R.O., DICKEL, K.E., MANN, R.B. and MOCKLER, R.J. (1994),

Strategic Management A Methodological Approach, United States of America, Addison-

Wesley Publishing Company.

3dfx Interactive (2000), Press Release 15 December, 2000 - 3dfx Announces Three Major

Initiatives To Protect Creditors and Maximize Shareholder Value [online]. Available from: http://www.3dfx.com/rel-15dec_2.htm [accessed 19/10/01].