BAFI359: Intermediate Corporate Finance

advertisement

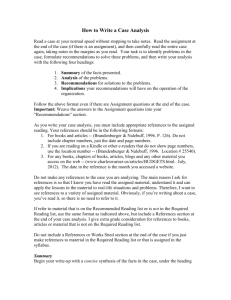

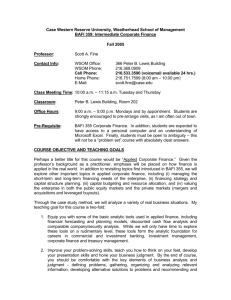

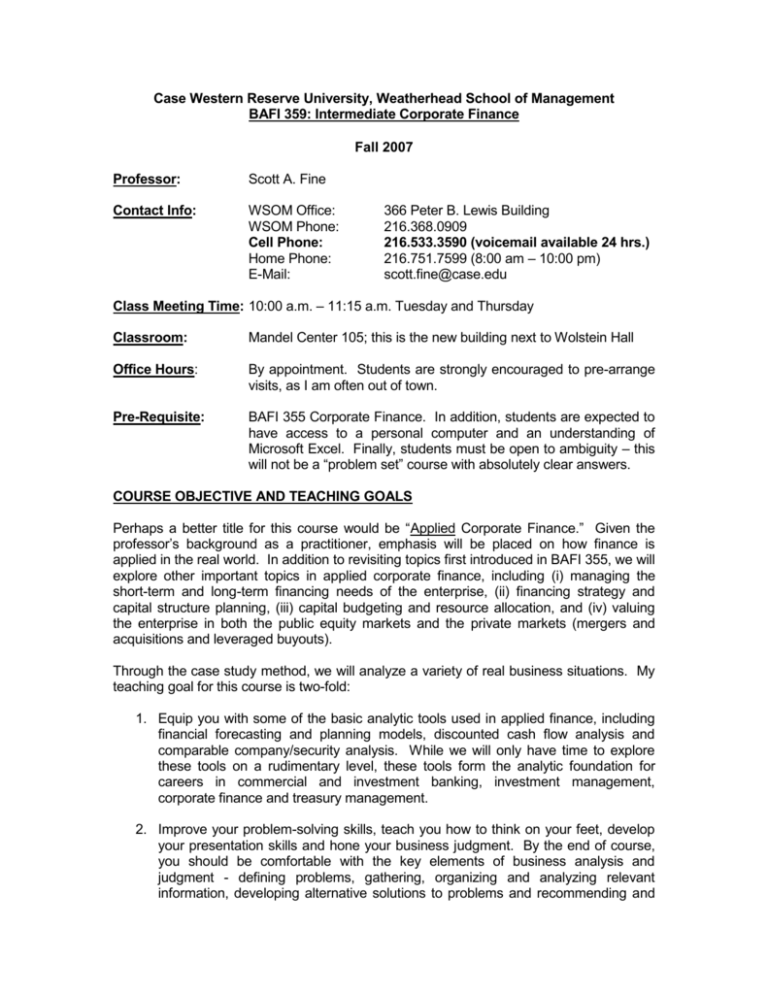

Case Western Reserve University, Weatherhead School of Management BAFI 359: Intermediate Corporate Finance Fall 2007 Professor: Scott A. Fine Contact Info: WSOM Office: WSOM Phone: Cell Phone: Home Phone: E-Mail: 366 Peter B. Lewis Building 216.368.0909 216.533.3590 (voicemail available 24 hrs.) 216.751.7599 (8:00 am – 10:00 pm) scott.fine@case.edu Class Meeting Time: 10:00 a.m. – 11:15 a.m. Tuesday and Thursday Classroom: Mandel Center 105; this is the new building next to Wolstein Hall Office Hours: By appointment. Students are strongly encouraged to pre-arrange visits, as I am often out of town. Pre-Requisite: BAFI 355 Corporate Finance. In addition, students are expected to have access to a personal computer and an understanding of Microsoft Excel. Finally, students must be open to ambiguity – this will not be a “problem set” course with absolutely clear answers. COURSE OBJECTIVE AND TEACHING GOALS Perhaps a better title for this course would be “Applied Corporate Finance.” Given the professor’s background as a practitioner, emphasis will be placed on how finance is applied in the real world. In addition to revisiting topics first introduced in BAFI 355, we will explore other important topics in applied corporate finance, including (i) managing the short-term and long-term financing needs of the enterprise, (ii) financing strategy and capital structure planning, (iii) capital budgeting and resource allocation, and (iv) valuing the enterprise in both the public equity markets and the private markets (mergers and acquisitions and leveraged buyouts). Through the case study method, we will analyze a variety of real business situations. My teaching goal for this course is two-fold: 1. Equip you with some of the basic analytic tools used in applied finance, including financial forecasting and planning models, discounted cash flow analysis and comparable company/security analysis. While we will only have time to explore these tools on a rudimentary level, these tools form the analytic foundation for careers in commercial and investment banking, investment management, corporate finance and treasury management. 2. Improve your problem-solving skills, teach you how to think on your feet, develop your presentation skills and hone your business judgment. By the end of course, you should be comfortable with the key elements of business analysis and judgment - defining problems, gathering, organizing and analyzing relevant information, developing alternative solutions to problems and recommending and defending what you believe to be the best alternative. In most case studies, as in life, critical information will be inconsistent and, at times, incomplete, and there will be plenty of superfluous data (noise). CASE METHOD AND CLASS CONDUCT This will be the first case method class for most of you. As we will discuss during the first class, the case method only works if you come to each class prepared and participate actively during class. The first few cases will be done as a class, with significantly more direction from me than would typically be the case in order to orient you towards this method of teaching. Groups All course work will be done in teams of 3-4 students. Once formed, teams will remain in place for the entire semester. Groups should be formed the first week, and a list of all team members should be submitted to me by the end of class on Tuesday, September 4th. Beginning with Thursday, September 6th, team members should sit together with their groups. This will allow team members to confer with each other during class. Students should also sit in the same seat every class, and prominently display their name cards. Because work will be done entirely in groups, it is important for you to self-police balanced contributions from each group member. Keep in mind that each team member will have particular skill strengths and weaknesses, and that each member will have different peaks and valleys in terms of other demands during the semester. However, over the course of the semester, each team member should strive to make a fair contribution, and to try each role within the group (leader/manager, analyst, writer, editor, secretary). As described in GRADING, part of your grade will be based on peer evaluations within your group. This will provide a direct incentive to remain an active contributor. If you have a free rider in your group, and due warning does not remedy the situation, please have your group bring it to my attention immediately. In extreme cases of differential work efforts within your group, you may be allowed to change your group composition with my express consent, but only after due discussion with and notification of all involved parties. Preparation and Case Write-ups Case write-ups are required for many of the designated cases (see COURSE SCHEDULE), and are due at the beginning of the class in which the assigned case will be discussed. Since preparation and the ultimate write-up will be a group effort, only one write-up should be submitted for each group. Please ensure that each team member has a copy of the write-up that can be easily referred to during the class discussion, including any exhibits and/or analyses. 2 In analyzing each case, you should take the perspective of an advisor to the key decision maker in the case (e.g., Board of Directors, CEO, CFO, general manager, lender, investor). A recommended format for each case write-up is as follows: 1. Statement of the problem – State the main issue(s) as precisely as possible, typically in a few sentences or a paragraph. 2. Facts and assumptions – State the relevant facts of the case. Those facts that are not obvious from the case should be supported either with a calculation in the text or a reference to a supporting exhibit. Clearly state any assumptions, including a justification for your assumptions. This section will typically be about a half-page. 3. Analysis – This contains your analysis of the various courses of action, and should form the body of your write-up. This section will typically be about one and one-half pages. 4. Recommendation and justification – This will generally be about a half-page. Note that these are merely suggested guidelines. The specific situation in each case will dictate overall organization and emphasis. Case write-ups should be typed and stapled. Each write-up should have a cover page with the name of the case, the names of your group members and the date. The body of the write-up should be no more than three written pages, with a maximum of five pages of exhibits to support your recommendation. Exhibits should be clearly marked, and any assumptions you have made should be crystal clear. I am a professor, not a clairvoyant; as a result, I cannot decipher your logic out of thin air. Brevity is preferred; avoid extraneous material. All written assignments and the group presentation should be done to the same standards as a real work setting. In all cases, please proofread your work to check for grammar, spelling, etc. Group Presentations Each group will be responsible for making one class presentation during the semester. When a group is responsible for presenting a case, they will not also be required to submit a write-up. Groups can choose from a list of available cases. This choice must be made by Tuesday, September 11th. The following guidelines should be considering in preparing your group presentation: 1. Presentations should follow the same general guidelines as case write-ups, and should be completed to a standard consistent with what you would present in an actual work situation. Most successful presentations will include an Executive Summary, Issues to Consider (the problem definition), Analysis and Discussion of Alternatives, a Recommendation/Action Plan and, to the extent appropriate, Next Steps/Follow-up Items. As with case write-ups, these topic headings are general guidelines. Each case may require a slightly different outline and focus. 2. The presentation should last no more than 30 minutes, and each group member should be responsible for at least some portion of the presentation, if possible. 3 Experience suggests that each slide will take somewhere between one and three minutes, depending on the content and the presenter. 3. A copy of the presentation should be distributed to the entire class at the beginning of the presentation, including highlights of any analysis, exhibits and recommendations. 4. You should provide one organized copy of important backup materials to me, in addition to a copy of the presentation you provide to the class. 5. Presentations should be made using Microsoft PowerPoint. If you are not familiar with how to use PowerPoint, use this assignment as an opportunity to learn about its user-friendly features. As an alternative, overhead transparencies are acceptable along with other visual displays of information and analysis. 6. Although your presentation will, no doubt, contain summary conclusions from your analysis, you should be prepared to review your analysis in detail, including detailed Excel calculations. Please note that the non-presenting teams will still be required to submit a case write-up. During the presentation, these teams will play the role of the key decision maker. Class members, using their own case write-ups and any notes taken during the presentation, should be prepared to actively question those making the presentation. Throughout the case presentation and the critique, the non-presenting class members have the responsibility of raising questions or making relevant observations. I may call on nonpresenting class members at random during presentations. WORK FLOW AND GRADING I suspect that the work flow in this course will be a unique experience for many of you. To a certain extent, you will be allowed to customize the concentration of your work load during the term. After some initial practice cases that we will do as a class and some computer sessions, we will begin our hardcore case discussions. Like Vin Diesel, they will come Fast and Furious, usually one per week. In total, there will be eleven cases eligible to be written up. Of these, four must be written up by your group per the specifications set forth in “Preparation and Case WriteUps” above. One must be done as a presentation with your group per the specifications set forth in “Group Presentations”. One must be done individually by each member of your group per the same specs as a group write-up. This will essentially serve as a take-home midterm, and allow me to directly measure individual performance. The remaining five must be outlines of the case in terms of the problem(s) at hand, the range of alternatives that need to be evaluated, the type of analysis that you’d undertake, etc. The purpose of submitting these is to prove to me you’ve read the case in preparation of our class discussion. These will be graded with more leniency than a full write-up. One outline should be submitted by the entire group. The eligibility of each case for a written write-up (WU), presentation (P) or individual write-up (I) are designated next to each case in the more detailed work plan that follows. 4 There are several other requirements that I will impose. Each team should review their work load in other classes during the term, and decide which four cases they want to write-up, which case they want to present, and which case they want to write-up individually. Preferences for your group should be submitted no later than Tuesday, September 11th. You should include first and second choices for presentations and individual write-ups. You should also include a prioritized list of the next three cases you’d write-up beyond the four you submit. I’m asking you to do this so we have enough teams that have fully prepared each case. I will post the allocation of assignments no later than Thursday, September 13th. If you have any major problems with final assignments, you must let me know that day. Once we have finalized assignments, they will not be changed during the term. Finally, for the group write-ups, each member will be responsible for doing the primary writing on at least one case and the primary analysis on another case, and the member responsible for each of these should be clearly marked on the cover page of the writeup. Your grade will be based on the following: Case Write-ups Presentation Individual Case Write-up Outlines Class Participation Peer Review 40% 15 20 5 10 10 (Four, each worth 10%) (One) (One) (Five, each worth 1%) (I will focus on both quality and quantity) (Based on an evaluation form) To make the grading more equitable and to assist in addressing the free rider problem, each student will complete a peer review for other members of their group. The reviews will be kept confidential. A peer review form will be provided to you towards the end of the semester, and should be returned to me by the end of the last class. CASES AND READINGS You should purchase a Course Packet and Case Textbook. The Course Packet can be picked up from Tedda Nathan, the BAFI Department Administrator, in Room PBLB 371. The packet costs $15.00. You can either give Tedda cash or a check made payable to “Case.” These materials contain all of the required cases and most of the supplemental reading materials for the course. I will hand out questions for consideration for each of the assigned cases. I will also hand out directions to access links to exhibits in spreadsheet format, when available. I will hand out supplemental reading information from time-totime. Many of the cases will be taken from an excellent introductory level case study book: Bruner, Robert F., Case Studies in Finance: Managing for Corporate Value Creation, 5th Edition (New York: McGraw-Hill Irwin, 2003) The publisher has agreed to custom print the cases selected from this book so that you don’t need to purchase the entire book. This specialty publication is only available at the CWRU Bookstore. Bruner updated many of his cases this year, so don’t buy a used textbook. If you can find an inexpensive copy of Bruner’s textbook, all of the Bruner cases 5 are contained in this book. Note that in either event, you’ll still need to buy the CWRU Notes since there are other readings and cases. I also encourage you to use reference materials when preparing the cases. The following two books are appropriate reference books: Brigham, E.F. and J.F. Houston, Fundamentals of Financial Management, Concise 4E, (Orlando: Harcourt, 2003) (a new fifth edition was printed, but you can use your old copy from BAFI 355) Ross, S.A., R.W. Westerfield and J. Jaffe, Corporate Finance (New York: The McGraw-Hill Irwin, 2005) I would also strongly encourage all students to read The Wall Street Journal on a daily basis, as well as weekly periodicals such as Business Week, Fortune and Forbes. IMPORTANT NOTE REGARDING ACADEMIC INTEGRITY Please be very careful that you do not plagiarize any material. There is a big difference between discussing a problem or a general approach or analysis, and copying detailed elements of other individuals’ write-ups. I expect all students to fulfill the objectives of the CASE Statement of Ethics. (If you are a new student to CASE and not aware of this statement, please consult the instructor or the CASE website for a copy at http://studentaffairs.case.edu/office/integrity/policy.html.) If there is a suspicion of a violation of academic integrity within the course, I will follow the official CASE protocols for academic infractions as detailed in the University General Bulletin. Please do your utmost to uphold professional conduct that you can be proud of. COURSE SCHEDULE AND ASSIGNMENTS The following schedule describes the topics to be covered as well as reading and/or case study assignments. Reading and case studies are listed on the date they will be discussed in class. As a result, all case write-ups are due at the beginning of class on the date listed. There will be no exceptions to this policy. This schedule is subject to change. I will hand out a new schedule if we veer from this plan. Note that a designation of (CT) indicates that the case or note in question is item number “x” in the case textbook, and a designation of (CP) indicates that the item is contained in the course packet. With respect to assignments, a designation of WU signifies that a case write-up can be submitted. A designation of P signifies that the case is an option for the group presentation. A designation of I signifies that the case is an option for an individual write-up by group members. Tues. August 28th Required Reading: Course Overview and Introduction to Case Method “Note to the Student: How to Study and Discuss Cases” (CT) “Ethics in Finance” (CT) 6 Thurs. August 30th Case: Setting Overall Themes (Practice Case Discussion) “Warren E. Buffett, 2005” (CT1) Note: I will hand out a sample case write-up at the end of the class to illustrate what my expectations are for your work. You should still prepare for this case as though you needed to write it up. Tues. September 4th Case: Thurs. September 6th Financial Analysis and Value Creation (Practice Case Discussion) “Warren Buffett, 2005” Continued Financial Analysis and Forecasting (Lecture and Computer Excercise) Required Reading: “Note on Financial Forecasting” (CP) Case: “The Body Shop International PLC 2001: An Introduction to Financial Modeling” (CT7) Note: Although a case write-up is not required, it is important for all students to do the casework, since it is an important analytic framework for the remainder of the term. This is also a good time for groups to begin working together. Tues. September 11th Financial Analysis and Forecasting (Case) Continued Analysis and Discussion of “The Body Shop” Thurs. September 13th Required Reading: Debt Financing (Lecture) Lecture Notes, TBD “Note on Bank Loans” (CP) Review BAFI 355 Material on Bonds Tues. September 18th Case (WU): Debt Financing – Structuring Long-Term Loans (Case) “Padgett Paper Products Company” (CT8) Thurs. September 20th Working Capital Management (Lecture) Suggested Reading: “Working Capital Management” section from Finance Reference book (e.g., Chapter 16 from Brigham and Houston) Tues. September 25th Case (WU): Thurs. September 27th Debt Financing – Managing Seasonal Working Capital Needs (Case) “Kota Fibres, Ltd.” (CT9) Cost of Capital (Lecture) 7 Required Reading: “”Best Practices” in Estimating the Cost of Capital: Survey And Synthesis” (CT12) Suggested Reading: “Cost of Capital” chapter from Finance reference book Tues. October 2rd Case (WU): Cost of Capital (Case) “Nike, Inc.: Cost of Capital” (CT13) Thurs. October 4th Required Reading: Equity Valuation (Lecture) Lecture Notes, TBD Suggested Reading: Chapter 9 from Brigham and Houston (Stock Valuation) Tues. October 9th Case (WU, P): Equity Valuation (Case) “JetBlue Airways IPO Valuation” (CT26) Thurs. October 11th Capital Budgeting and Resource Allocation (Computer Exercise) “The Investment Detective” (CT17) Case: Note: This case should be done by all students, either individually or in groups, but does not need to be turned in. Suggested Reading: “Capital Budgeting” chapter from Finance reference book Tues. October 16th Case (WU, P, I): Cost of Capital (Case) “Teletech Corporation 2005” (CT15) Thurs. October 18th Case (WU, P, I): Capital Budgeting and Resource Allocation “Euroland Foods S.A.” (CT23) Tues. October 23rd FALL BREAK; NO CLASS Thurs. October 25th Required Reading: Capital Structure (Lecture) “Capital Structure” chapter from Finance reference book “An Introduction to Debt Policy and Value” (CT28) Note: We will review the problems presented in this note. Please come to class having prepared answers. Tues. October 30th Case (WU, P, I): Capital Structure (Case) “The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of Capital” (CT30) Thurs. November 1st Required Reading: Corporate Financial Policy (Lecture) “Structuring Corporate Financial Policy: Diagnosis of Problems and Evaluation of Strategies” (CT29) Tues. November 6th Corporate Financial Policy (Case) 8 Case (WU, P, I): Thurs. November 8th “Deluxe Corporation” (CT31) Dividend Policy (Lecture) “Dividends” chapter from Finance reference book Lecture notes to be distributed. Tues. November 13th Case (WU, P, I): Dividend Policy (Case) “Gainesboro Machine Tools Corporation” (CT25) Thurs. November 15th Required Reading: Mergers and Acquisitions (Lecture) I will post a presentation on Blackboard, which will form the bulk of the lecture. The presentation will cover M&A analytics. “Mergers” chapter from Finance reference book Tues. November 20th Case (WU, P, I): Mergers and Acquisitions (Case) “Yeats Valves and Controls Inc.” (CT42) Thurs. November 22nd THANKSGIVING HOLIDAY; NO CLASS Tues. November 27th Merger Simulation Materials handed out in class in the prior week Thurs. November 29th Required Reading: Leveraged Buyouts and Private Equity (Lecture/Lab) Lecture Notes to be distributed. We will most likely meet in the Computer Lab. We will most likely have a guest. We will work on the LBO model in class. “Technical Note on LBO Valuation” (CP) “Treasures in the Junkyard”, by Roy C. Smith, Chapter 7 in The Money Wars, Truman Tulley Books, 1990. (CP) Tues. December 4th Case: (WU, P) Leveraged Buyouts and Private Equity (Case) Palamon Capital Partners/TeamSystem S.p.A” (CT44) Thurs. December 6th Class Wrap-Up; Revisiting “Berkshire Hathaway” NO FINAL! 9