Teamwork and the Financial Performance of Firms

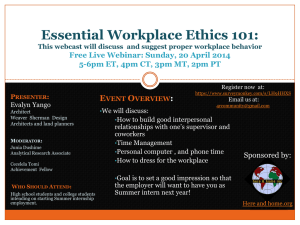

advertisement