Teamwork and the Financial Performance of Firms

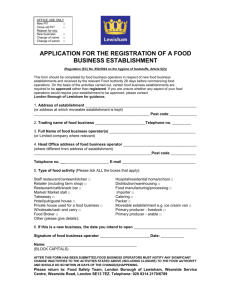

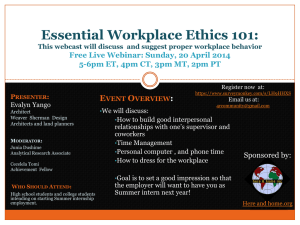

advertisement