PEPPERDINE UNIVERSITY SCHOOL OF LAW FINAL EXAM

advertisement

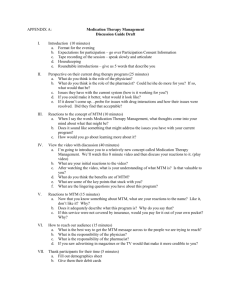

PEPPERDINE UNIVERSITY SCHOOL OF LAW FINAL EXAM: Business Reorganization in Bankruptcy-Essay Portion TOTAL NO. OF QUESTIONS: SPRING 2003 2 TOTAL NO. OF PAGES: 6 (including present value tables) PROFESSOR Scarberry TIME: Two (2) Hours ____________________________________________________________________________ INSTRUCTIONS 1. This portion of the exam consists of two essay questions. The first essay question is shorter than the second and will not count quite as heavily. I suggest you spend fifty minutes on Essay 1 and 70 minutes on Essay 2; the questions will be weighted in that proportion in the grading. These two essays together will count as two-thirds of your final examination grade. The multiple choice section will count one-third. 2. You are permitted to use the casebook, the statutory supplement (annotated as you wish), your notes, any other written or printed material that you wish, and a calculator on this portion of the examination. Note, however, that you will not be able to access any material on your laptop computer during this exam, whether or not you are using ExamSoft. 3. Please use blue or black pen only (unless you are typing or using ExamSoft), and start each question in a separate bluebook. 1 Essay 1 — Fifty Minutes Durin Limited Partnership (DLP) owned the Lonely Mountain Office Tower, a seven story office building. Minas Tirith Mortgage Co. (MTM) financed DLP’s purchase of the Tower in 1995 and had promptly recorded its mortgage on the Tower. For the past several years, Elvish Enterprises (EE) had rented the three top floors, but its lease expired in October, 2002. Elvish Enterprises chose not to renew the lease and instead relocated to the beautiful new Lothlorien Woods Office Center. DLP’s manager (general partner Thorin) had been sure that EE would stay and thus did nothing to arrange for a new tenant; even once EE notified DLP that EE would be leaving, Thorin did not start seeking a new tenant very vigorously, because Thorin thought he could change EE’s mind. That was a very poor business strategy. Once EE actually left, Thorin realized his mistake and diligently sought a new tenant; but the shortfall in rent caused great difficulties. DLP made the November 1 and December 1, 2002 mortgage payments to MTM, but then asked MTM if it would be possible to skip a few months’ payments while a new tenant was found. MTM said “no,” and threatened to foreclose if any payment was missed; MTM also was worried that a check from DLP might bounce, and thus MTM pressured DLP to make the January 1, 2003 mortgage payment by cashier’s check. DLP had never paid by cashier’s check before, but did so on January 1, in order to placate MTM. However, DLP was unable to make the February 1 or March 1, 2003 payments, and MTM began foreclosure proceedings. In response, DLP filed a chapter 11 petition on March 20. As of March 20, the Tower was worth about $3.2 million (three million two hundred thousand dollars), and the amount owed on the MTM mortgage was $3 million. MTM immediately sought relief from the automatic stay in order to foreclose. MTM also sought an order that a trustee be appointed, on the ground that Thorin had mismanaged the Tower. The evidence showed that wear and tear on the Tower would likely cause its value to drop by $20,000 per month. Monthly interest on the mortgage at the contract rate was $15,000 per month. In opposition to the motion for relief from stay, DLP filed written guarantees from Oin and Gloin (two wealthy limited partners in DLP) that the value of the Tower would not drop below $3 million. They promised to pay to MTM any shortfall should the Tower bring less than $3 million at any later sale or should the court value the Tower at less than $3 million in connection with confirmation of a plan. They backed up their guarantee with a first lien on their multimillion dollar real property, the Moria Mine. The court denied both of MTM’s motions. DLP then sought to recover the January 1, 2003 mortgage payment from MTM as an alleged preference; the court ruled against DLP. On June 15, DLP filed a proposed plan that provided for full payment of MTM’s secured claim by monthly payments over 15 years with 4% interest. Four percent was the market rate for a first mortgage in the amount of 80% of the value of an office building like the Tower; of course MTM’s mortgage was for much more than 80% of the Tower’s value. On June 25, MTM once again moved for relief from the automatic stay. Up to this point DLP had made no postpetition payments to MTM. [CONTINUED ON NEXT PAGE] 2 Please discuss the following questions: (1) (2) (3) (4) Did the court rule correctly in denying MTM’s initial motion for relief from the automatic stay? Did the court rule correctly in refusing to order appointment of a trustee? Did the court rule correctly in refusing to avoid the January 1 payment as a preference? Should the court grant MTM’s June 25 motion for relief from the automatic stay? 3 Essay 2 — Seventy Minutes DoodleCorp (DC), a corporation all of whose stock was owned by Betty Yankee, operated a wholesale art supply business. DC would buy several hundred thousand dollars of art supplies each month from manufacturers on 60 to 90 days’ unsecured credit. DC would typically ship $30,000 to $40,000 of supplies per month to each of its ten major customers, who would then be obligated to pay DC for the supplies within 60 days of shipment. All of this was in line with typical practices of other wholesale art suppliers. Finagle Finance Co. (FFC) had a properly perfected security interest in DC’s inventory of art supplies and in DC’s accounts receivable (including, according to their agreement, “after-acquired inventory and after-arising accounts”). DC got into financial trouble, but managed to stay out of bankruptcy for a while due to a $400,000 loan from Joanna Yankee, Betty’s sister. To convince creditors to give DC a chance, Joanna agreed with DC that Joanna’s loan would not be paid back until and unless all other creditors had been paid in full. DC continued to lose money, and on November 1, 2001, DC filed a chapter 11 petition. During November, 2001, DC continued to sell art supplies to its major customers on 60 days’ credit, although orders were only half to two-thirds as large as they had been in the past. (Some of the customers were worried that DC would go out of business; thus they started finding other suppliers.) The only supplies DC bought during November were $50,000 worth of supplies from one manufacturer that was willing to sell to DC on 60 days’ unsecured credit, even though DC was in chapter 11. DC also had several pieces of used equipment (a forklift, several power saws, etc.) that were not subject to any liens and that DC did not think it would need. DC had never sold any equipment before, but, in order to raise cash, DC sold the used equipment on November 20, 2001, for its fair market value, $15,000. DC did not ask court approval, nor did it notify FFC or anyone else, before buying and selling the art supplies, and selling the used equipment, during November, 2001. In December, 2001, FFC claimed that DC’s actions during November were in violation of the Bankruptcy Code. FFC also claimed that its security interest extended to the $50,000 in art supplies DC bought during November, and thus that FFC had a lien on those supplies. The court decided these and other matters, and gradually DC turned its business around. Assume it is now late December 2002. DC finally is ready to seek confirmation of a plan of reorganization. The court has determined that FFC is owed $2 million, and that its collateral is worth $1.5 million. The only other prepetition claims are $8 million in unsecured trade claims and Joanna’s $400,000 unsecured claim. Among other terms, the plan provides that FFC’s secured claim will be in its own class, Class 1; that all general unsecured claims (other than Joanna’s) will be in Class 2; that Joanna’s unsecured claim will be in Class 3; and that Betty’s stockholder’s interest will be in Class 4. The claim in Class 1 will be paid by five yearly payments of $366,000 each, which is sufficient to pay off a $1.5 million debt at a fair market interest rate of 7%. Class 2 claims will receive $5 cash, a $15 promissory note at a fair market rate of interest, and one share of stock in the reorganized DC, for each $100 of claim. For her Class 3 claim, Joanna will receive merely 4,000 shares of stock in the reorganized DC. Betty will receive nothing on account of her Class 4 stock, and her stock will be canceled. The reorganized DC will have no debts other than the debts owed to FFC and to Class 2 claim holders as provided in the plan. Assume FFC makes the section 1111(b)(2) election. 4 DC’s expert testifies that the present value of the anticipated free cash flows from DC’s business for the five year projection period (Jan. 1, 2003 to Dec. 31, 2007) is $2 million. Projected earnings before interest for the fifth year are $800,000; to get to that figure, projected expenses were of course subtracted from projected revenues, and the expenses included a projected $200,000 in depreciation and amortization. The expert testifies that DC’s cost of capital (or discount rate, or the rate of return an investor would demand who would buy DC’s assets free of debts) is about 16%. EBITDA multiples for four comparable companies are 5, 6, 6, and 7. There are no unneeded, surplus assets. Please discuss the following questions: (1) (2) (3) (4) (5) (6) Which, if any, of DC’s postpetition actions during November, 2001, violated DC’s obligations under the Bankruptcy Code? Was FFC correct in its claim that it had a lien on the art supplies DC bought during November, 2001? Based on the testimony of DC’s expert, what is the reorganization value of DC? Please use the discounted cash flow method, and use both methods we considered for calculating the residual value as part of the discounted cash flow method. Assume the reorganization value of DC is $5 million, and that the court confirms DC’s plan. What will be the value of a share of stock in the reorganized DC? Does the plan treat FFC’s secured claim class, Class 1, fairly and equitably? Does the plan treat Class 2 fairly and equitably? Will that matter if Class 2 accepts the plan? 5

![Masood Textile Mills [Erum Zahoor]](http://s2.studylib.net/store/data/005544654_1-c63f8378e6188468be9b937fd88ad22c-300x300.png)