Crain`s Chicago Business May 18, 1987 ServiceMaster sets roach

advertisement

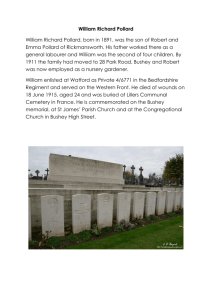

Crain's Chicago Business May 18, 1987 ServiceMaster sets roach-to-riches plan BYLINE: By H. LEE MURPHY SECTION: DIVERSIFIED; Pg. 19 LENGTH: 1132 words Your crabgrass has the whole neighborhood talking, roaches are making their presence felt in the kitchen pantry and that old couch in the family room just doesn't seem to come clean anymore. Where do you turn? Perhaps, sometime soon, it will be to the "carefree home" people. But the carefree home isn't an advertising jingle yet. For now, it's an extraordinary vision that C. William Pollard, president and chief executive of ServiceMaster Limited Partnership, gives form to as he considers a new course of growth for the Downers Grove-based company. "There is a whole range of things inside and around the home that need maintaining, and families who don't have the time or expertise to do the work often don't know whom to call," said Mr. Pollard in an interview after ServiceMaster's recent annual meeting. "Home services is a growing market, and we hope to seize an opportunity there." It's his intention is to keep the firm on an upward path. For almost 15 years, until the early 1980s, ServiceMaster could count on annual revenue and earnings growth exceeding 20%. But stern cost-containment measures in the company's biggest business -- services to hospitals and other health care institutions -- has slowed the march. In 1986, net income remained virtually the same at $32.8 million or $1 a share on a 12% rise in sales to $1.12 billion. Analysts agree that a renewed focus on household services -- combined with the advantages gained from the December conversion to a master partnership -- will help propel ServiceMaster toward Mr. Pollard's lofty goal of $2 billion in revenues by 1990. The carefree home concept has been years in the making. ServiceMaster was founded in the late 1940s as a rug and upholstery cleaner. And with 3,500 franchises today, that's what the public knows it for (though, ironically, the fees and supplies generated by those licensed franchises amount to only 3% of revenues). In March 1985, ServiceMaster took a significant diversification step with the acquisition of Village Green Inc., a small West Chicago-based lawn care company, and has since begun adding a network of service outlets around the U.S. The big plunge came in December, however, with the $165-million purchase of Terminex International Inc. Closely held Terminex, headquartered in Memphis, had revenues of $130 million in 1986, ranking it as the No. 2 pest control company after Orkin Exterminating Co. Terminex has more than 300 service branches and almost 1 million residential customers. Sales are rising some 15% a year, insiders say, and its profit performance -- measured by margins and return on sales -- outranks that of ServiceMaster. Since the acquisition, ServiceMaster has begun quiet tests on a franchised maid service for the residential market, and Mr. Pollard even hints at franchised heating and air conditioning services in the future. "We think there's an advantage in being able to deliver home services with an assurance of consistency and guarantee of performance that a nationally recognized company like ours can offer," he declared. Such services are now commonly available from small local firms -- working women, for instance, have banded together to form loose-knit maid services. Some analysts believe a major corporation could quickly penetrate such a fragmented marketplace. "In hiring a maid, people worry about references and the threat of burglary," pointed out Gary L. Wirt, an analyst with Chicago Corp. "A national company like ServiceMaster could allay those fears. The company already has a recognizable name and a franchise network in place. Now it's a matter of adding more services. Eventually it's possible that ServiceMaster might offer just about anything a homeowner could need. That's an ambitious objective, but then, this is an ambitious company." The Terminex buyout left ServiceMaster in an unfamiliar position, with a pile of debt on its balance sheet. The firm had no significant borrowings for almost 40 years, but then took on $240 million to finance Terminex, another $10 million for the December acquisition of American Food Management Inc., plus costs associated with the legal changeover to partnership status. The last required $38 million for the mandatory repurchase of shares from a profit-sharing plan. Payment on the debt apparently won't be a problem and, considering ServiceMaster's strong cash flow, another $100 million in borrowing would be possible, according to Roger Ervin, a ServiceMaster vice-president. The firm expects to pay out $1.50 per share/unit in dividends to its partners this year, almost 77% of Mr. Wirt's income estimate of $1.95 a share for 1987. "We've always been a high cash-generating business with low capital needs," observed Mr. Ervin. Like Terminex, American Foods, based near St. Louis, was too good an acquisition opportunity to pass up. With annual sales of $40 million, the company supplies food services to more than 100 educational institutions in 23 states. That should complement the 250 school customers for which ServiceMaster already provides custodial and maintenance help. As with Terminex and the carpet care franchises, American Foods will pass on customer leads to ServiceMaster's educational division and vice versa. Both the industrial and educational service segments are growing at a healthy 25% annual clip. ServiceMaster depended on its health care markets for 95% of all revenues at the start of the decade, but with diversification into these newer businesses, that share has fallen to 60% and is likely to recede even further. In the face of cost containment, ServiceMaster has attempted to bundle an entire package of hospital services -- ranging from laundry to energy controls -- but has encountered a tepid response from its 1,000 client hospitals. "Some of these hospitals had been taking one or two of ServiceMaster's services, and now they're being asked to take all six at once, admittedly at a discount," said one analyst. "It's too much expense for them to take on so quickly." Nevertheless, first-quarter results were impressive. Net income leapfrogged 86% to $14.5 million or 46 cents a share on sales of $336.8 million, a 26% increase. The soaring profits were attributed to the firm's partnership status, under which ServiceMaster earnings escape federal tax. Similar corporate conversions to partnerships wouldn't benefit conventional companies that pay out, say, 30% or 40% of income in dividends, analysts assert, since partners are liable for all profits earned by the partnership. It does make sense, though, for service companies with little capital investment. ServiceMaster has historically returned more than 70% of profits to shareholders as dividends. Crain's Chicago Business July 11, 1988 ServiceMaster adds maid franchise firm BYLINE: By H. LEE MURPHY SECTION: SERVICES; Pg. 61 LENGTH: 653 words ServiceMaster L.P. got another foot in the door of American households last week. In a deal that most analysts applauded, ServiceMaster acquired a closely held, Omaha-based franchiser of residential maid services, Merry Maids Inc. The price was $ 25 million, with cash accounting for less than $ 5 million and the rest consisting of a note granting stock conversion rights at $ 29 a share. ServiceMaster stock traded essentially unchanged at $ 27 shortly after the announcement. Within the highly fragmented residential maid industry, estimated at $ 2 billion nationwide, Merry Maids is a modest giant. It had revenues of $ 38 million last year on the strength of 370 franchises in 44 states, ranking it larger than its next three biggest competitors combined. The acquisition isn't expected to significantly affect ServiceMaster's earnings this year. But it marks an important step in the company's ambition to fashion an umbrella of home services. ServiceMaster was founded as a carpet and upholstery cleaner in the late 1940s before turning its attention to maintenance work for hospitals. When growth in that market slowed, the firm acquired, in 1985, a suburban-based lawn care company called Village Green Inc. In December 1986, it purchased for $ 165 million Terminex International Inc., the No. 2 pest control specialist in the U.S. ServiceMaster isn't finished yet. Executives revealed that they'll begin testing a residential appliance service later this year -- guaranteeing maintenance of furnaces, washing machines and refrigerators -- in either Illinois or Tennessee. After that, they hint that water softening and other services may be on tap. A nationwide advertising program is slated to debut next year promoting the carefree home concept under the ServiceMaster banner. Details are sketchy, but it seems likely that the firm will bundle its various programs into a single package at a reduced price. Already, ServiceMaster reaches 2 million residential customers in the U.S. "People are spending more on services for the home all the time," declared C. William Pollard, president and CEO, at the recent annual meeting. "We're positioning ourselves to take advantage of that phenomenon." Knowledgeable observers see a real advantage in a maid service franchise operation. "Maids often serve a home where nobody is around during the day," noted William Sutherland, an analyst at Butcher & Singer Inc. in Philadelphia. "Security is a real issue with the homeowner. A big company like ServiceMaster gives people peace of mind." By the best estimates, the maid service industry is growing roughly 20% annually. In contrast, ServiceMaster's health care revenues have climbed barely 2% or 3% a year since 1985. Even its industrial maintenance segment is rising at just 10% annually -- considered mediocre for a highflier that counted on companywide sales and earnings growth exceeding 20% yearly for the better part of two decades through the early 1980s. Pressures to contain costs in hospitals are likely to keep revenues, and profit margins, relatively depressed in that segment. Mr. Pollard is accorded high marks from Wall Street for steering ServiceMaster beyond that business. Health care once represented more than 90% of sales, but the current ratio is 56%, and could fall to less than half by next year. Said Barrett McGregor, an analyst at William Blair & Col. "If the hospital area doesn't recover dynamically, then it makes sense to continue to diversify into other markets. ServiceMaster has the home virtually surrounded now. This business looks quite promising overall." In the first quarter, ServiceMaster's revenues rose 9% to $ 368.0 million, while earnings increased 8% to $ 15.7 million or 50 cents a share. Mr. Sutherland of Butcher forecasts 1988 profits of $ 2.10 a share, up strongly from $ 1.52 last year. Crain's Chicago Business June 5, 1989 ServiceMaster heads back to home care BYLINE: By H. LEE MURPHY SECTION: SERVICES; Pg. 28 LENGTH: 872 words ServiceMaster L.P. has just about figured out how to take over the modern American home. Downers Grove-based ServiceMaster started with carpet cleaning in the late 1940s, then steered a detour to hospital management services beginning in the 1960s. But as that market has gone soft in the past decade, the company has turned its focus back to the home, launching a series of acquisitions of smaller firms offering such services as lawn care, insect control and house cleaning. Now comes one of the most significant deals yet, one that will virtually complete the "carefree home" vision that ServiceMaster President and CEO C. William Pollard has harbored for at least several years. The company announced an offer last month to buy California-based American Home Shield Corp. for $ 87 million. At the recent annual shareholders meeting, it was revealed that the transaction is likely to close by August. American Home Shield will bring on line the last major at-home service that ServiceMaster had earlier targeted for development. On the strength of warranty contracts it sells to homeowners, American Home services large appliances, ranging from furnaces and air conditioners to washers and dryers. ServiceMaster expects to take the concept national in short order, with prospects for quick growth and profits rated very good. "American Home has great synergy with our existing home services," Mr. Pollard said in an interview. "With the addition of that company we'll have most of the home services we've wanted in place. The home suddenly looks like an oasis to ServiceMaster after the beating its health care business has absorbed. In 1980, health care represented more than 90% of both revenues and profits. But the share for both has dipped to below 50% recently. The reason: federal legislation in 1983 dictated a more regulated health care market, which curtailed ServiceMaster's growth opportunities. Indeed, 10% of all U.S. hospitals have closed since 1980. ServiceMaster manages such services as housekeeping, plant maintenance and food preparation at more than 1,100 of the 4,500 hospitals that have survived. But few new accounts have been added, while the company has had to cut margins to keep some of its old customers. In 1988, profits in the division fell 10% as sales increased 2% to roughly $ 824 million. Jeanine Heller, an analyst at Stifel Nicolaus & Co. in St. Louis, projected that the hospital business will grow at a meager 2% to 5% annual pace in the near term. Those are grim prospects for a company that, up until the mid-1980s, was accustomed to growth of close to 20% annually. Indeed, ServiceMaster's revenues in 1988 (not including franchisees' sales) advanced just 7% to $ 1.53 billion, as net income rose 8% to $ 64.6 million or $ 2.02 per partner's share. Management saw this fix coming and has been praised for its diversification efforts. ServiceMaster's first stroke was to acquire in 1985 a West Chicago-based lawn care firm called Village Green Inc. In late 1986 came the big purchase, for $ 165 million, of Terminex International Inc., the No. 2 pest control specialist in the U.S. behind Rollins Inc.,'s Orkin division. Last year, the company added Omaha-based Merry Maids Inc. (for $ 25 million), the leading franchisor of maid services. But they haven't been quite enough. Mr. Pollard has pursued an ambition to offer a full umbrella of at-home services. To that end, ServiceMaster began testing a home appliance warranty business last year in Memphis. The test was encouraging, yet ServiceMaster couldn't see an easy way to take the idea national. Then American Home, traded over-the-counter and based in Santa Rosa, Calif., popped into view. The Memphis operation will be folded into American Home soon after the acquisition is complete. American Home, with sales of $ 63.7 million last year, serves more than 170,000 customers in 38 states, though close to half of them are in California. ServiceMaster already has its foot in the door in some 2.3 million U.S. houses with at least one service. With even a modest rate of referrals to the new appliance warranty division, prospects for growth are tantalizing. "ServiceMaster will certainly expand American Home's market focus," observed Todd Richter, an analyst at Dean Witter Reynolds Inc. American Home is already profitable, but "ServiceMaster should be able to sharply accelerate American Home's earnings growth," Mr. Richter said. A national TV advertising program still in the planning stages is expected to lend strong support to the company's strategy. Ms. Heller of Stiffel Nicolaus believes the bundled consumer service businesses will grow annually at a 12% to 15% clip. Merry Maids could be the star, she asserted, with revenues rising by one-third last year and probably more than 20% this year and again next year. Overall, the analyst estimated ServiceMaster's earnings rising about 7% this year to $ 2.15 a share, while a more vigorous 10% gain to $ 2.35 is likely in 1990. The first quarter ended March 31 was a mild disappointment, with operating revenues up just 5% to $ 384.6 million; earnings rose 4% to $ 16.4 million or 50 cents per share. Crain's Chicago Business June 4, 1990 New ServiceMaster chairman foresees more diversification; But partnership status continues to haunt stock price BYLINE: By TOM ANDREOLI SECTION: Pg. 36 LENGTH: 876 words The future for ServiceMaster L.P. holds two certainties: The first is an aggressive new chairman who promises to further diversify the $ 1.6-billion management and services company. The second is the same old humble stock price, unless the company moves ahead with a major restructuring. As of June 1, C. William Pollard, 51, became ServiceMaster's chairman while retaining his responsibilities as president and CEO. Mr. Pollard succeeded Kenneth T. Wessner, 68, chairman since 1981, who pioneered the Downers Grove-based company's health care operations. Mr. Wessner will remain at the company as vice-chairman. The line of succession was hardly unexpected. With Mr. Pollard as CEO during the '80s, ServiceMaster reconfigured itself through a series of acquisitions, going from a company wholly dependent on the flagging hospital market to a powerhouse in the education, industrial and consumer services fields. Among the biggest recent deals was last year's $ 87-million purchase of Santa Rosa, Calif.based American Home Shield, which guarantees and services major appliance for homeowners in 38 states. The acquisition rounded out a three-year buying spree in which ServiceMaster also gobbled up Memphis-based Terminex International Inc., an extermination firm, for $ 165 million, and Merry Maids Inc., a home cleaning company based in Omaha, for $ 25 million. By yearend, ServiceMaster's consumer and commercial services segment, which has its headquarters in Memphis, is expected to account for 40% of all revenues. In the first quarter, ServiceMaster reported revenues of $ 432.0 million, a 12% increase over the year-earlier period. Profits rose 2% to $ 16.7 million, or 53 cents per share. In 1989, ServiceMaster posted profits of $ 68.0 million, or $ 2.10 per share, a 5% increase over the year before. Total revenues also rose 5%, to $ 1.61 billion. "They already appear to have gotten some benefit from American Home Shield," said Steven Bernard, an analyst with Edward D. Jones & Co. in St. Louis. "I don't know if they've completely turned the corner," Mr. Bernard added. "But they've made a positive upturn in the consumer areas, and the hospital area doesn't appear too bad. In fact, it seems to be holding its own." Overall this year, Mr. Bernard projected a 7% rise in per-share earnings to $ 2.25. Gerald S. May, an analyst with PaineWebber Inc. in New York, also projected a solid showing for 1990, with earnings up 10% to $ 2.30 per share. However, despite steady, sometimes spectacular year-to-year increases in revenues and profits over the late '80s, ServiceMaster's stock has been a dog. Its price continues to languish in the $ 21 range, although the company estimates its intrinsic value at between $ 32 and $ 36. The most obvious reason is ServiceMaster's partnership form. Just before Congress passed the Tax Reform Act of 1986, the company reorganized itself as a limited partnership, thereby avoiding income taxes until it reverts to corporate status on Dec. 31, 1997. Shareholders have benefited to the tune of $ 161 million in cash distributions since the reorganization, equaling 52% of all cash distributions paid since the company went public in 1962. But the benefits apparently have not offset the negative image of partnership in the eyes of most institutional investors, who now hold less than 8% of ServiceMaster's shares. "There are accounting and mechanical issues associated with the partnership form that make investors treat it like the plague, even if a stock is incredibly attractive otherwise," said Dean Witter Reynolds Inc. analyst Todd Richter. Again this year, the stock price was the leading issue at ServiceMaster's annual meeting, held in early May. "For the long-term shareholder, there can be confidence that the intrinsic value (eventually) will be reflected in market value," Mr. Pollard told shareholders. "Patience will pay a return." The company's primary option for a quick fix of its stock price would be to re-incorporate before the mandatory 1998 deadline, Mr. Pollard added. But if the company did that, it would suffer substantially reduced cash flow as a result of corporate taxes. Between now and the end of 1997, Mr. Pollard estimated, the cash flow penalty would be as high as $ 200 million. Shareholders would have to forgo the huge payouts of recent years as the company diverted funds to keep up payments on its $ 383 million in debt, amassed during the '80s. "The business continues to generate extraordinary flow returns," said Mr. Pollard. "The partnership at this time appears to be the most efficient form to maximize the use of this cash." In statements last month, the company said it is also considering spinning off some of its operations or selling convertible debentures. Mr. Pollard has said he would not rule out future acquisitions using the cash flow made possible under the partnership, given "the right strategic fit." Neither Mr. Pollard nor any analyst appeared too concerned over ServiceMaster's ability to handle its debt at current cash flow levels. But for now, according to Mr. Bernard of Edward D. Jones, ServiceMaster is like the traditional utility best for income investing. Crain's Chicago Business May 16, 1994 ServiceMaster puts faith in consumer biz; Targeting higher-margin services for growth BYLINE: By MICHAEL FRITZ SECTION: Pg. 12 LENGTH: 834 words ServiceMaster L.P., the Downers Grove-based maintenance company that emphasizes its religious underpinnings, is continuing its coversion from a respectable institutional cleaning firm to a robust provider of consumer services. Although ServiceMaster's core business of institutional cleaning, laundry and food service still led company revenues with sales of $ 1.8 billion last year, the higher margins of its consumer services group now drive earnings. With first-quarter net income up 16% to $ 24.5 million, the company recently reported its most profitable first quarter since the firm was founded in a Chicago brewery in 1947. Last year's net income excluding restructuring and unusual charges -- totaled $ 145.9 million, or $ 1.90 a share, up 20% on an 11% increase in sales, which reached $ 2.76 billion. The company's consumer-oriented TruGreen-ChemLawn lawn care unit, Terminix pest service and several other home cleaning and appliance warranty businesses produced more than half of last year's operating income on just 34% of revenues. Seven years ago, consumer services contributed only 10% of operating income, and it's here that the prospects for growth are richest, ServiceMaster Chairman William Pollard told shareholders at the recent annual meeting. Of the more than 50 million U.S. households, 60% represent dual-income families with an everincreasing demand for time-saving services. And with 4.5 million homeowners signed up as customers, ServiceMaster has just begun to mine this fertile market. The success of the company's expanding consumer business goes back to the 1980s, when Mr. Pollard recognized the potential for a slowdown in its traditional hospital maintenance business. He expanded the consumer business through a series of strategic acquisitions and began seeking new institutional customers, such as schools and nursing homes. The company's lower-margin institutional business now represents 64% of total revenues, vs. nearly 90% seven years ago. "Because their base businesses are doing so well, they can take time to pick acquisitions carefully and don't get caught overpaying for them," said Todd Richter, a Dean Wilter Reynolds analyst in New York. Last August, ServiceMaster paid $ 82.5 million for VHA Long Term Care, the largest private manager of nursing homes. The company expects VHA to produce sales and earnings growth of 25% to 30% annually over the next five years. However, one of the biggest contributors to ServiceMaster's success is ChemLawn, acquired from Ecolab Inc. for $ 103 million in 1992. Combining ChemLawn with its TruGreen lawn care unit two years ago, ServiceMaster trimmed overhead 35% by shuttering ChemLawn's Columbus, Ohio, headquarters and eliminating more than 200 middle-managers. The company achieved further savings by cutting 202 TruGreen-ChemLawn branch offices to 167. Out in the field, the company instituted an incentive pay plan and put more effort into planning truck routes so lawn crews spend less time driving between customers. Together, these changes helped boost work crew productivity by 26%, according to Donald Karnes, division president. With cost savings realized, ServiceMaster rolled back TruGreen-ChemLawn's prices 10% last year and increased prepaid discounts. Result: The lawn care unit's customer base rose 13% in 1993 to 2.2 million. "Management has been exceptional at building these businesses internally while also integrating acquisitions by getting rid of redundant operations and improving the quality of surviving operations," said credit analyst Wesley Moultrie with Duff & Phelps Corp. in Chicago. Mr. Karnes expects to reap additional savings by upgrading the lawn care service fleet with smaller, more efficient trucks. The new vehicles use a dual-line injection system that allows crews to apply more spot treatments and fewer chemicals than conventional broadcast applications. Last month, ServiceMaster announced plans to repurchase up to $ 30 million of its stock. While the buyback represents only 1.5% of shares outstanding, it "sends a message to the investment community that management believes the company's shares are underpriced and that future earnings are headed higher," said Mr. Moultrie. That message is most likely aimed at institutional investors, who were net sellers of ServiceMaster in the last half of 1993, according to Value Line Investment Survey. Though the sales were likely due to profit-taking, ServiceMaster executives remain concerned that the company's status as a limited partnership creates a hurdle for institutional investors, such as pension and mutual funds, to invest in the company. ServiceMaster is scheduled to convert to a corporation in 1997, but continues to look at whether it should do so sooner. Said Chief Financial Officer Ernest Mrozek, "We have to keep asking ourselves if the substantial economic savings from not having to pay taxes compensate for the fact that institutional money is harder to draw."