1 - Economics

advertisement

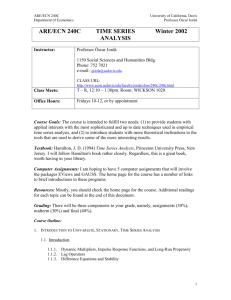

ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà ARE/ECN 240C Instructor: TIME SERIES ANALYSIS Winter 2006 Professor Òscar Jordà 1150 Social Sciences and Humanities Bldg. Phone: 752 7021 e-mail: ojorda@ucdavis.edu CLASS URL: http://www.econ.ucdavis.edu/faculty/jorda/class/240c/240c.html Class Meets: Office Hours: T – R, 2:10 – 4:00*pm. Room: WICKSN 1038 *Please notice the class will typically meet until 4:00pm, rather than 3:30pm. Mondays, 10-12; Wednesdays 1-2pm, or by appointment Textbook: Hamilton, J. D. (1994) Time Series Analysis, Princeton University Press, New Jersey. I will follow Hamilton's book rather closely. Regardless, this is a great book, worth having in your library. I will provide additional references for specific topics but these are easily available through the library or on the web. Assignments: I am hoping to have 5 computer assignments that will involve the packages EViews and GAUSS. The home page for the course has a number of links to brief introductions to these programs. There will also be regular assignments of a more theoretical nature that do not require the use of a computer. Resources: Mostly, you should check the home page for the course. Additional readings for each topic can be found at the end of this document. Grading: There will be three components to your grade, assignments (30%), midterm/s (30%) and final (40%). 1 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà Course Outline: TOPIC 0: REVIEW OF PROBABILITY THEORY Basic Definitions: sample space, -algebra, probability measure, probability space, random variable, distribution function, Borel-measurable functions, expected value. Modes of Convergence: convergence in probability, mean square, almost sure and convergence in law. o Mann-Wald Theorem o Cramer-Wold Theorem o Slutzky’s Theorem Laws of Large Numbers: o Kolmogorov: I and II o Khinchine Central Limit Theorems: o Lindeberg-Levy o Lindeberg-Fuller The Delta Method TOPIC 1: INTRODUCTION TO UNIVARIATE, STATIONARY TIME SERIES Introduction: cross-section vs. time-series Preliminary Concepts: o Lag Operators o White noise, martingales and martingale difference sequences o Autocovariances and autocorrelations o Stationarity: Weak stationarity Strong stationarity Random walks o Ergodicity and the Ergodic Theorem o Uniform-mixing and strong-mixing Central Limit Theorem for Martingale Difference Sequences Central Limit Theorem for Dependent Processes o The Beveridge-Nelson Decomposition Basic ARMA models: o MA, AR, and ARMA models o Common transformations and identification o Wold representation theorem o State-space representation TOPIC 2: LARGE SAMPLE ESTIMATION, HYPOTHESIS TESTING AND FORECASTING Maximum Likelihood, Extremum Estimation, Minimum Distance and GMM o Consistency o Asymptotic Normality MLE for ARMA models o AR ML: exact versus conditional likelihood o MA ML: exact versus conditional likelihood o ARMA ML Review of Numerical Optimization Routines o Newton’s Method o Common algorithms: Newton-Raphson; Quadratic-Hill; Gauss-Newton/BHHH; Marquardt; DFP. o Elements of numerical optimization algorithms 2 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà Statistical Inference o Wald, Likelihood Ratio and Lagrange Multiplier principles o Non-standard tests: QMLE Unidentified parameters under the null Ljung-Box statistic The Bootstrap o Definition and Edgeworth Expansion o The Classical Bootstrap o Applications: Bias reduction Standard error estimation Hypothesis testing Confidence intervals o Bootstrap variations o Bootstrap for time series data Parametric bootstrap Block bootstrap Forecasting o ARMA models o Nonlinear models: Methods Naïve Exact Monte Carlo Bootstrap o Direct Forecasting o Tests of predictive ability TOPIC 3: UNIT ROOTS Detrending Methods: deterministic vs. stochastic trends Asymptotic distribution of the simple trend model Unit Roots o Preliminaries: Brownian motion o Functional central limit theorem: Convergence in law of random functions Convergence in probability of random functions Continuous mapping theorem o The Dickey-Fuller distribution o Functional central limit theorem for dependent processes The augmented Dickey-Fuller test: derivation The Phillips-Perron test: derivation o Local-to-unity asymptotics TOPIC 4: COVARIANCE STATIONARY VECTOR TIME SERIES The VAR(p) o Presentation o Stationarity o Wold’s theorem and the VMA representation Heteroskedasticity and Autocorrelation Variance Estimation o Newey-West estimator 3 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà Granger causality and exogeneity MLE of vector processes Structural interpretation of VARs o The impulse response function o The variance decomposition o Identification and Interpretation Inference in VARs Estimation and Inference of Impulse Responses by Local Projections TOPIC 5: GENERALIZED METHOD OF MOMENTS Introduction: classical method of moments GMM o Formulation o Optimal weighting matrix o Asymptotic distribution o Inference: The J-statistic Tests of subsets of orthogonality conditions LR tests o MLE and GMM Wald tests LM tests o Extensions TOPIC 6: COINTEGRATION Motivation: spurious regressions Definition: o Properties o Error correction representation o Granger representation theorem o Phillips triangular representation o Stock-Watson common trends representation Testing o Engle-Granger 2-step cointegration test Corrections for serial correlation Full Information Maximum Likelihood analysis of cointegrated systems o Preliminaries: canonical correlations o Johansen’s test o Concentrating the likelihood o Hypothesis testing TOPIC 7: TIME SERIES MODELS FOR HIGHER MOMENTS AND TRANSITION DATA ARCH models o Relation to ARMA o MLE – GARCH o Testing for ARCH o Extensions ACD models o Specification 4 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà o Estimation ACH models o Presentation o Relation to ACD o Estimation ACI models o Presentation o Relation to ACD o Estimation TOPIC 8: STATE SPACE MODELING AND THE KALMAN FILTER State Space Representation Kalman Filter o Overview o Algorithm o Forecasting MLE with the Kalman filter Asymptotic properties of MLE/QMLE Additional Reading Almost all the material for the class comes from Hamilton's book so you need not worry about the reading list except when indicated in class. The references contained in Hamilton's book are quite comprehensive if you ever need to go deeper into a topic. The references below might be helpful if you have difficulty understanding the material. A * indicates references I find particularly useful. TOPIC 0: REVIEW OF PROBABILITY THEORY *Amemiya, T. (1985), Advanced Econometrics. Cambridge: Harvard University Press. (Chapter 3). [Amemiya] Davidson, James (1994) Stochastic Limit Theory, Oxford: Oxford University Press. Davidson, Russell and James G. Mackinnon (1993), Estimation and Inference in Econometrics. New York: Oxford University Press. (Chapter 4) [Davidson and Mackinnon] *Hamilton, Chapter 7. Hayashi, Fumio (2000) Econometrics. Princeton: Princeton University Press. (Chapter 2) [Hayashi] *White, Halbert (1999) Asymptotic Theory for Econometricians, Revised Edition. San Diego: Academic Press. Chapters 2-5 TOPIC 1: INTRODUCTION TO UNIVARIATE, STATIONARY TIME SERIES Box, G.E.P. and G.M. Jenkins (1976), Time Series Analysis: Forecasting and Control, 2nd ed. San Francisco: Holden Day. Gourieroux C. and A. Monfort (1997), Time Series and Dynamic Models. Cambridge: Cambridge University Press. *Hamilton, Chapters 1-3. 5 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà *Sargent, T. J. (1987), Macroeconomic Theory. Boston: Academic Press. (Chapters 9-11). TOPIC 2: ESTIMATION, INFERENCE AND FORECASTING *Amemiya, Chapter 4. Berkowitz, Jeremy and Lutz Kilian (2000) “Recent Developments in Bootstrapping Time Series,” Econometric Reviews, 19(1), 1-48. *Cameron, A. Colin and Pravin Trivedi (2004) Microeconometrics: Methods and Applications, Chapter 11: Bootstrap. U.C. Davis, mimeo. Clements, Michael P. and David F. Hendry (1998) Forecasting Economic Time Series, Cambridge: Cambridge University Press. *Davidson, R. and J. G. MacKinnon, Chapter 8. *Diebold, F. X. and R. S. Mariano (1995) “Comparing Predictive Accuracy,” Journal of Economics and Business Statistics, 13, 253-263. *Engle, R. F. (1984), "Wald, Likelihood Ratio, and Lagrange Multiplier Tests in Econometrics," Ch. 13 in Handbook of Econometrics, Vol. II, eds. Z. Griliches and M.D. Intrilligator, Amsterdam: North-Holland. Giacomini, R. and H. White (2004) “Tests of Conditional Predictive Ability,” UCLA manuscript. *Granger, C. W. J. and P. Newbold, (1986) Forecasting Economic Time Series. Academic Press. *Granger, C. W. J. and Timo Terasvirta (1993) Modelling Nonlinear Economic Relationships, Oxford: Oxford University Press, Chapter 8. *Greene, W. H. (1997) Econometric Analysis, 4th Edition. New Jersey: Prentice Hall. (Chapter 5). Hall, Peter (1992) The Bootstrap and Edgeworth Expansions, New York: Springer-Verlag. Horowitz, J. L. (2001) “The Bootstrap,” Handbook of Econometrics, volume 5. Amsterdam: North-Holland. *Hamilton, Chapters 4-5. *Newey and McFadden (1994) “Large Sample Estimation and Hypothesis Testing,” in The Handbook of Econometrics, v. 4. Amsterdam: North-Holland. *West, K. D. (1996) “Asymptotic Inference about Predictive Ability,” Econometrica, 64, 1067-1084. TOPIC 3: UNIT ROOTS Brockwell, P.J. and R. A. Davis. Time Series: Theory and Methods. Springer-Verlag. Cavanagh, C. L., G. Elliott, and J. H. Stock (1995) “Inference in Models with Nearly Nonstationary Regressors,” Econometric Theory, v11, 1131-1147. * Davidson, J. (1994) Stochastic Limit Theory. Oxford; Oxford University Press. Dickey, D. A. and W. A. Fuller (1979), " Distribution Estimators for Autoregressive Time Series with a Unit Root," Journal of the American Statistical Association, 74, 437-431. Fuller, W. A. Introduction to Statistical Time Series. Wiley series in Probability and Statistics. John Wiley. *Hamilton, Chapters 15-17. Phillips, P.C.B. (1986), "Time Series Regression with Unit Roots," Econometrica, 55, 227302. 6 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà *Phillips, P.C.B. (1987) “Towards a Unified Asymptotic Theory for Autoregression,” Biometrika, 74, 535-47 Phillips, P.C.B. (1998), "New Tools for Understanding Spurious Regressions," Econometrica, 66, 1299-1236. *Stock, J. H. (1994), "Unit Roots, Structural Breaks, and Trends," in Handbook of Econometrics, Vol. IV, eds. D. McFadden and R. F. Engle. Amsterdam: North-Holland. * Tanaka, Katsuto, (1996) Time Series Analysis. New York: John Wiley (Chapter 3 and Chapter 9). TOPIC 4: COVARIANCE STATIONARY VECTOR TIME SERIES Demiralp S. and K. D. Hoover, (2003), “Searching for the Causal Structure of a Vector Autoregression,” Oxford Bulletin of Economics and Statistics, 65(0), 745-67. Den Haan, W. J. and A. Levin, (1997), " A Practioner's Guide to Robust Covariance Matrix Estimation," Handbook of Statistics 15 (Chapter 12, 291-341) *Den Haan, W. J. and A. Levin, (1996), " Inferences from Parametric and Non-Parametric Covariance Matrix Estimation Procedures," NBER Technical Working Paper 195. Both papers can be downloaded from: http://weber.ucsd.edu/~wdenhaan/papers.html *Engle, R. F., D. F. Hendry, and J.-F. Richard, (1983), "Exogeneity," Econometrica, 51, 277305. *Granger, C. W. J. (1980), "Testing for Causality: A Personal Viewpoint," Journal of Economic Dynamics and Control, 2, 329-352 Granger, C. W. J. (1989), Modelling Economic Series, Oxford: Oxford University Press. *Hamilton, Chapters 10-11. *Hendry, D. F. (1995), Dynamic Econometrics, Oxford: Oxford University Press. Hoover, K. D. and S. M. Sheffrin, (1992), " Causation, Spending, and Taxes: Sand in the Sandbox or Tax Collector for the Welfare State?" American Economic-Review; 82(1), 22548. *Jordà, O (2005) “Estimation and Inference of Impulse Responses by Local Projections,” American Economic Review, March. Newey W. N. and K. D. West (1987), "A Simple Positive Semi-Definite Heteroskedasticity and Autocorrelation Consistent Covariance Matrix," Econometrica, 55, 703-708. *Reinsel, G. C. (1993), Elements of Multivariate Time Series Analysis, New York: SpringerVerlag. Swanson, N. R. and C. W. J. Granger, (1997), "Impulse Response Functions Based on a Causal Approach to Residual Orthogonalization in Vector Autoregressions," Journal of the American Statistical Association, 92(437), 357-367. TOPIC 5: GENERALIZED METHOD OF MOMENTS *Hamilton, Chapter 14. *Hayashi, Chapters 3-4. *Wooldridge, Jeff (2002) Econometric Analysis of Cross Section and Panel Data, chapter 14 TOPIC 6: COINTEGRATION *Engle, R. F. and C. W. J. Granger, (1991), Long-Run Economic Relationships, Oxford: Oxford University Press. 7 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà *Johansen, S. (1995), Likelihood-Based Inference in Cointegrated Vector-Autoregressive Models, Oxford: Oxford University Press. Hamilton, Chapters 19-20. *Sims, C. A., J. H. Stock and M. W. Watson, (1990), "Inference in Time Series Models with some Unit Roots," Econometrica, 58, 113-44. Watson, M. W. (1994), "Vector Autoregressions and Cointegration," in Handboof of Econometrics, Vol. IV, eds. D. McFadden and R. F. Engle. Amsterdam: North-Holland. TOPIC 7: TIME SERIES MODELS FOR HIGHER MOMENTS AND TRANSITION DATA Bergin, Paul R. and Òscar Jordà (2001) “Measuring Monetary Policy Interdependence,” Journal of International Money and Finance, v. 23, n. 5, 761-83.. Engle, Robert F. (1995) ARCH. Selected Readings, Oxford: Oxford University Press. Engle, Robert F. and Jeffrey R. Russell (1998) “Autoregressive Conditional Duration: A New Model for Irregularly Spaced Transaction Data,” Econometrica, V. 66, N. 5, 1127-1162. *Hamilton, James D. and Òscar Jordà (2002) “A Model for the Federal Funds Target,” Journal of Political Economy, vol. 110, n. 5, 1135-1167. *Hamilton, Chapter 21. Jordà, Oscar Holly Liu and Jeffrey Williams (2002) “Non-institutional Market Making Behavior: The Dalian Futures Exchange,” U.C. Davis, mimeo. *Marcellino, Massimiliano and Òscar Jordà (2002) “Modelling High-Frequency FX Data Dynamics,” Macroeconomic Dynamics, v.7, 618-635. TOPIC 8: STATE SPACE MODELING AND THE KALMAN FILTER *Hamilton, Chapter 13. *Hamilton, J. D. (1994), "State-Space Models," in Handbook of Econometrics, Vol. IV, R. F. Engle and D. L. McFadden, eds. Amsterdam: North-Holland. Harvey, Andrew C. (1989), Forecasting Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge University Press. 8 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà TIME SERIES ECONOMETRICIANS IN DAVIS Arthur M. Havenner, Professor, Department of Agricultural and Resource Economics. o Web-site: http://www.agecon.ucdavis.edu/Faculty/Art.H/Havenner.html o Research Interests: Econometrics, both classical and time series analysis, involving any aspects of hypothesis testing, policy simulation / optimal control, and forecasting. If you have any questions about State Space modeling and the Kalman filter, he is your man. o Book: Applications of Computer Aided Time Series Modeling, M. Aoki and A. Havenner, (eds.). Berlin: Springer-Verlag, 1997. Prasad Naik, Assistant Professor, Graduate School of Management. Although professor Naik is formally professor in Marketing, he has a lot of experience in time series modeling, forecasting and control. o Web-site: http://www.gsm.ucdavis.edu/Faculty/Profiles/Naik/ o Research Interests: advertising strategy, consumer choice behavior, sales forecasting, dynamic market response models. o Representative Publication: "Partial Least Squares Estimator for Single-Index Models, with Chih-Ling Tsai, Journal of the Royal Statistical Society, Series B, 2000, Vol. 62, No. 4 Aaron Smith, Assistant Professor, Department of Agricultural and Resource Economics. o Web-site: http://asmith.ucdavis.edu o Research Interests: In econometrics, forecasting time series processes using nonlinear models and measuring the distance between unknown distributions. In finance, studying excess volatility and bubbles in equity markets. o Representative Publication: “Stochastic Permanent Breaks” (with Robert Engle), Review of Economics and Statistics, 81(4): 553-574, 1999. Robert Shumway, Professor, Department of Statistics. o Web-site: http://anson.ucdavis.edu/faculty/shumway.html o Research Interests: applications of multivariate spectral analysis to high dimensional problems in discrimination and clustering for multivariate time series and to linear filter contrasts arising in a multivariate analysis of variance. Analysis of incomplete data that can be modeled in terms of linear and nonlinear state-space models. o Books: Shumway, R.H. (1988). Applied Statistical Time Series Analysis. Englewood Cliffs, New Jersey: Prentice Hall. Shumway, R.H. & Stoffer, D. S. (2000). Time Series Analysis and Its Applications. New York: Springer. Chih-Ling Tsai, Professor, Graduate School of Business. o Web-site: http://www.gsm.ucdavis.edu/Faculty/Profiles/tsai/ o Research Interests: application of statistics in business, regression diagnostics, model selection, optimal design. o Books: Regression and Time Series Model Selection, with Allan McQuarrie, World Scientific, 1998. 9 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà TIME SERIES TOPICS Here is a potpourri of other topics that we will not discuss in class. There is no particular order and were possible, I enclose relevant references. Time Series Topics in Finance Campbell, John Y., A. W. Lo, and A. C. MacKinlay, (1997), The Econometrics of Financial Markets. Princeton University Press. Mills, T. C. (1993), The Econometric Modelling of Financial Time Series. Cambridge University Press. ARCH Models and Stochastic Volatility Models Engle, R. F. (1995), ARCH Selected Readings, Oxford University Press Shepard, N., S. Kim., and S. Chib (1998), “Stochastic Volatility: Likelihood Inference and Comparison with ARCH Models,” Review of Economic Studies, 65, 361-393. Continuous Time Models Bergstrom, A. R. (1990), Continuous Time Econometric Modelling, Oxford University Press. Neural Networks White, H. (1992), Artificial Neural Networks: Approximation and Learning Theory. Blackwell Publishers. Time Series Duration Models Engle, R. F. and J. R. Russell, (1998), “Autoregressive Conditional Duration: A New Model for Irregularly Spaced Transaction Data,” Econometrica, V. 66, N. 5, 11271162. Jorda, O. and M. Marcellino, (2000), “Stochastic Processes subject to Time Scale Transformation: An Application to High Frequency FX Data,” Macroeconomic Dynamics, v. 7, 618-635. Long Memory Models Journal of Econometrics, (1996), Volume 73, Issue 1, July. This issue is a monograph on Long Memory Models and is edited by Richard T. Baillie and Maxwell L. King. Time Series Topics in Macroeconomics Nonlinear Time Series Models Granger, C. W. J. and T. Terasvirta (1993), Modelling Nonlinear Economic Relationships, Oxford University Press. 10 ARE/ECN 240C Department of Economics University of California, Davis Professor Òscar Jordà Markov Switching Regimes Models Hamilton, J. D. (1989), “A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle,” Econometrica, 57(2), 357-384 Kim, C. J. and C. R. Nelson, (1999), State Space Models with Regime Switching, MIT Press. Threshold Autoregressive and Smooth Transition Models Tong, H. (1983), Threshold Models in Non-Linear Time Series Analysis, SpringerVerlag Terasvirta, T. (1994), “Specification, Estimation and Evaluation of Smooth Transition Autoregressive Models,” Journal of the American Statistical Association. Structural Break Testing Bai, J. and P. Perron, (1998), “ Estimating and Testing Linear Models with Multiple Structural Changes,” Econometrica, 66(6), 47-78. Causality in Macroeconomics Demiralp, S. (2000), The Structure of Monetary Policy and Transmission Mechanism, UC Davis Thesis. Hoover, K. D. (2001), Causality in Macroeconomics, Cambridge University Press. Other Topics Time Aggregation Jorda, O. and M. Marcellino, (2004), “Time Scale Transformations of Discrete Time Processes,” Journal of Time Series Analysis, v. 25, n. 6, 873-894. Simulation Methods for Time Series Models Kim, C. J. and C. R. Nelson, (1999), State Space Models with Regime Switching, MIT Press. Gourieroux, C. and A. Monfort, (1996), Simulation Based Econometric Methods, Cambridge University Press. Bootstrap in Time Series Berkowitz, J. and L. Kilian (2000), “Recent Developments in Bootstrapping Time Series,” Econometric Reviews, 19(1), 1-48. Spectral Analysis and Wavelets Percival, D. B. and A. T. Walden, (2000), Wavelet Methods for Time Series Analysis, Cambridge University Press Dynamic Panel Data Models Arellano, M. and B. Honore, (1999), “Panel Data Models: Some Recent Developments,” prepared for the Handbook of Econometrics, Vol. 5. Additional Resources I recommend that you visit Eric Zivot’s home page. He has collected numerous interesting links if you are interested in time series. This is his web-site: http://faculty.washington.edu/ezivot/econ584/econ584.htm 11