Problem Set 4 sols

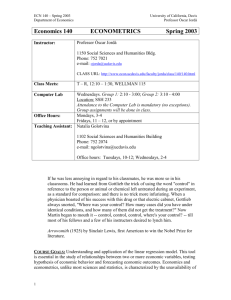

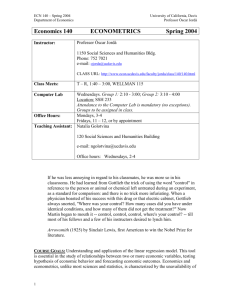

advertisement

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

PROBLEM SET 4 – SOLUTIONS

Part I – Analytical Questions

Problem 1: Consider a stationary autoregressive process A(L)Xt = t and its

corresponding moving average representation, Xt = C(L)t , where C ( L) i 0 Ci Li .

(a) Find the moving average coefficients for an VAR(1) process.

Solution

Because this is a VAR(1), calculation of the MA representation is quite easy. Thus, if

Xt = A1Xt-1 + t, then Ci = A1i.

(b) Show that the moving average coefficients for a VAR(2) can be found recursively

by C0 I ; C1 A1 ; and Ci A1Ci 1 A2Ci 2 for i 2,...

Solution

A stationary VAR has a moving average representation given by X t i 0 Ci t i .

Plugging this formula into that of a VAR(2) such as, X t A1 X t 1 A2 X t 2 t , we

find,

C A1 i 0 Ci t i 1 A2 i 0 Ci t i 2 t ,

i 0 i t i

which can be rewritten as,

0 (C0 I ) t (C1 A1C0 ) t 1 (C2 A1C1 A2C0 ) t 2 ... ,

which delivers the coefficients for each of the epsilon. Since the epsilon can take on

any value in p , each of these coefficients must equal zero. Hence, C0 = I, C1 = A1,

and

Ct A1Ct 1 A2Ct 2

t 2,3,...

1

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

Problem 2: Consider the following bivariate VAR,

yt yy yt 1 ym mt 1 u yt

mt my yt 1 mm mt 1 umt

2

with E (ut ut ' ) y

.

2

m

(a) Find a matrix H, which is lower triangular and ensures that if Hu t t , then

E ( t t ' ) D where D is a diagonal matrix.

Solution

1

For example, H

2

y

0

1

(b) Given this matrix H calculate the structural representation of this VAR.

Solution

yt

mt

y (my

y2 t

yy yt 1 ym mt 1 yt

2 yy ) yt 1 (mm 2 ym )mt 1 mt

y

y

(c) Calculate the VMA representation for the reduced form of this VAR (notice that it

is very simple in this case – don’t apply the usual formulas mechanically!)

Solution

yy ym

yt u yt yy ym u yt 1

...

mt umt my mm umt 1

my mm

k

u yt k

...

umt k

2

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

(d) Calculate the VMA representation of the structural form of the VAR.

Solution

1

0 u

1

0

y t

yt

yy ym u yt 1 ...

1

1

my mm u

umt 2

mt y2

mt 1

y

k

0

1

u

yy

ym

yt k ...

1

2

my mm umt k

y

(e) Under what conditions will the reduced form and the structural form produce

identical impulse response functions?

Solution: The obvious one is = 0. Less obvious, yy ym 0.

(f) Suppose you obtained the structural form as in part (a) but for a system that had

the variable m ordered first. Under what conditions would these two structural

identification schemes deliver the same impulse responses?

Solution: Notice that the matrix H is in this case,

0

1

H

1

2

m

Naturally, = 0, would work, but also, either yy ym 0 or my mm 0.

Problem 3: Consider the following bivariate VAR

y1t 0.3 y1t 1 0.8 y 2t 1 1t

y 2t 0.9 y1t 1 0.4 y 2t 1 2t

with E ( 1t 1 ) 1 for t = and 0 other wise, E ( 2t 2 ) 2 for t = and 0 other wise,

and E ( 1t 2 ) 0 for all t, and . Answer the following questions:

3

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

(a) Is this system covariance-stationary?

Solution

To answer this question, verify the roots of the polynomial

1 0 0.3 0.8

z (1 0.3z )(1 0.4 z ) (0.8 z )( 0.9 z )

0 1 0.9 0.4

1 0.7 z 0.6 z 2

The roots are 0.833 and 2, hence the system is not-stationary.

(b) Calculate s

y t s

for s = 0, 1, and 2. What is the limit as s ?

t '

Solution

1 0

0.3 0.8

0.81 0.56

0

; 1

; 2

0 1

0.9 0.4

0.63 0.88

s

0.3 0.8

Clearly, since s

and the process is not stationary, then s .

0.9 0.4

(c) Calculate the fraction of the MSE of the two period-ahead forecast error for

2

variable 1, E y

Eˆ ( y

| y , y ,...) , that is due to 1,t 1 and 1,t 2

1,t 2

1,t 2

t

t 1

Solution

2

2

E y1,t 2 Eˆ ( y1,t 2 | yt , yt 1 ,...) E1,t 2 0.31,t 1 0.8 2,t 1 1 0.32 0.82 2 2.37

The fraction due to 1 is (1 + 0.32)/2.37 = 0.46 or 46%.

Problem 4: Consider the process

y t z t y t 1 1t | | 1

z t z t 1 2 t

| | 1

12

0

t ~ N ; 11

0 12 22

4

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

(a) Derive E ( xt | xt 1 ); V ( xt | xt 1 ) and D( xt | xt 1 ) where D denotes the density

function and xt ' ( yt zt ). Hint: the system can be rewritten in matrix form as

1 yt

0 1 zt 0

0 yt 1 1t

zt 1 2t

Solution

1

Pre-multiply the system by A =

, the inverse of the contemporaneous

0 1

correlation matrix, to obtain,

yt yt 1 u1t

;

zt 0 zt 1 u2t

u1t 1 1t

u 2 t 0 1 2 t

Thus,

y t 1

xt 1 ;

E ( xt | xt 1 )

0 zt 1

E (ut ut ' ) E ( A t t ' A' )

1 11 12 1 0 11 212 2 22 12 22

W .

12 22

22

0 1 12 22 1

Given this expressions for the conditional mean and the variance, and noting that the

u’s are linear combinations of the and therefore are normally distributed, the

conditional distribution D(xt|xt-1) is multivariate normal with conditional mean and

variance given by the expressions derived above.

(b) Assume that xt is stationary. Derive E ( xt ); V ( xt ) and show that

V ( xt ) V ( xt | xt 1 ) is positive definite. What are the implications of this result?

Solution

By stationarity, E ( xt ) E ( xt 1 ) 0 and therefore, E ( xt ) 0 . Similarly,

V ( xt ) V ( xt 1 ) 'W . Since in (a) we calculated that V ( xt | xt 1 ) W , it follows that

V ( xt ) V ( xt | xt 1 ) V ( xt ) ' which is a quadratic form and therefore positive definite

for V ( xt ) 0 . The rational is that the conditional variance uses “more information”

(hence the conditioning) than the unconditional variance.

5

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

Problem 5: Consider the Gaussian linear regression model,

y t x t ' ut

with ut ~ i.i.d. N(0, 2) and ut independent of x for all t and . Define ( ' , 2 )'. The

log of the likelihood of (y1, …, yT) conditional on (x1,…,xT) is given by

T

L( ) (T / 2) log( 2 ) (T / 2) log( 2 ) ( y t x t ' ) 2 /( 2 2 )

t 1

(a) Show that the estimate

T

T

2 log f ( yt | Yt 1 ; )

g ( ; YT )

h( , YT )

ˆ

DT '

(1 / T )

(1 / T )

' ˆT

' ˆ

'

t 1

t 1

T

ˆT

1 T

2

0

T x t x t ' / ˆ T

t 1

’ where

is given by Dˆ T '

uˆt2

1 T 1

0

T t 1 2ˆ T4 ˆ T6

uˆt ( yt x t ' ˆT ) and ̂ T and ˆ T2 denote the maximum likelihood estimates.

Solution

The proof is straightforward by direct differentiation of the likelihood and noticing

T

that

uˆ

t 1

t

0 from the first order conditions.

T

(b) Show that the estimate SˆT (1 / T ) h(ˆ, Yt ) h(ˆ, Yt ) ' is given by

t 1

1 T 2

4

uˆt x t x t ' / ˆ T

T t 1

SˆT

1 T uˆ 3x

t 6t

T t 1 2ˆ T

uˆt3x t

6

t 1 2ˆ T

2 .

2

T

uˆt

1

1

4

T t 1 2ˆ T 2ˆ T2

1

T

T

Solution: this proof is also straightforward once you realize h(ˆ, Yt ) is the score of

the log-likelihood evaluated at the MLE estimates.

6

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

Q / 2

0

(c) Show that the p lim( SˆT ) p lim( Dˆ T ) where

for

1 /( 2 4 )

0

Q p lim( 1 / T )t 1 x t x t '.

T

Solution:

The proof requires the following intermediate results: p lim

1

T

T

t 1

uˆt2 2 ;

1 T

uˆt 0 . Direct application of conventional asymptotic results delivers the

T t 1

desired result.

p lim

(d) Consider a set of m linear restrictions on of the form R = r for R a known

ˆ D̂ , the Wald

( m k ) matrix and r a known ( m 1) vector. Show that for

T

T

1 g ( )

g ( )

ˆ

test statistic given by T g (ˆT ) '

'

T

' ˆT ' ˆT

1

g (ˆ ) is

T

identical to the Wald test form of the OLS 2 test given by

1

(R ˆ r )' s 2 R(x ' x ) 1 R' (R ˆ r ) with the OLS estimate of the variance

T

sT2

T

T

T

T

replaced with the MLE ˆ .

2

T

(e) Show that when the lower left and upper right blocks of Ŝ T are set to their plim of

zero, then the quasi-maximum likelihood Wald test of R = r is identical to the

heteroskedasticity-consistent form of the OLS 2 test given by

ˆ 1

ˆ Q

ˆ 1 / T )R' 1 (R ˆ r )

(R ˆ r )' R(Q

T

T

T

T

T

7

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

II – Empirical Questions

VARs

The goal of this exercise is to program a simple estimation routine in GAUSS that allows

you to compute impulse response functions. Then you can check your results against

those reported in EViews.

The data that we will use for this analysis is contained in the file ps4.csv and it contains

the following variables:

Column 1: logarithm of nonagricultural payroll employment. Use mnemonic EM.

Column 2: logarithm of personal consumption expenditures deflator (1996 = 100).

Use mnemonic P.

Column 3: Annual growth rate of the index of sensitive materials prices issued by

the Conference Board. Use mnemonic PCOM.

Column 4: Federal funds rate. Use mnemonic FF.

Column 5: ratio of nonborrowed reserves plus extended credit to total reserves.

Use mnemonic NBRX.

Column 6: Annual growth rate of M2. Use mnemonic DM2.

The data is recorded at a monthly frequency and the sample spans January 1960 to

February 2001. These data correspond to the paper “Monetary Policy and the Term

Structure of Nominal Interest Rates,” by Charles L. Evans and David A. Marshall,

Carnegie-Rochester Conference Series on Public Policy, 1998, v. 49, 53-111. The sample

obviously expands the original sample to 2001. I have taken the liberty to transform the

data for you so you need not worry about further manipulations. You may consult this

paper to understand the purpose of the transformations and the type of experiments that

Evans and Marshall (1998) consider. For the homework exercise, however, the goal is

more modest.

Questions:

(a) Load the data in EViews and estimate this VAR with a lag length of 6. Compute

the impulse responses to a shock in the variable FF using the Wold causal order

implied by the order in which I reported the variables. To make sure you are

doing things properly, subsample the data so as to match Evans and Marshall and

make sure that you can replicate their results.

(b) Now write code in GAUSS that will allow you to:

a. Estimate by OLS the reduced form VAR. Hint: notice that you can

estimate the whole system in one shot by noticing that in the reduced form

VAR, Yt X t B U t , where X t {1, Yt 1 ,..., Yt p }' (so that Y is a

(T p ) n vector, X is a (T p ) (1 np ) matrix, and B is a

(1 np ) n ), B can be estimated as: Bˆ ( X ' X ) 1 X ' Y .

8

ARE/ECN 240C Time Series Analysis

Fall 2002

Professor Òscar Jordà

Economics, U.C. Davis

b. Calculate the variance-covariance matrix of the residuals of this VAR and

compute the Choleski decomposition. Use this decomposition to obtain the

structural VAR.

c. Compute the impulse responses of all the variables in the VAR to a shock

in the variable FF. Make sure that you display these impulse responses and

ensure that you replicate those you obtain in EViews.

d. Compute standard errors for the impulse responses using two alternative

methods: (i) a Monte-Carlo method and (ii) a bootstrap. Both methods are

described in the last two paragraphs of page 337 of Hamilton’s book.

Make sure that these computations also match those available in EViews.

My advice is that you polish your programming skills a bit by using “procs” stored in an

auxiliary .src file so that you can keep track of all of these tasks and to save these routines

for yourself in case you need them in the future. Otherwise this program is likely to take

several pages of code and then it becomes difficult to manage.

9