Wald Press - Spidi - Indian Institute of Management Bangalore

advertisement

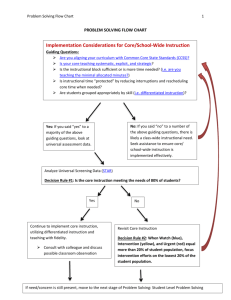

THE US CURRENT ACCOUNT DEFICIT: CAUSES AND CONSEQUENCES SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS OF CONTEMPORARY CONCERNS STUDY TO PROF. RUPA CHANDA ON AUG 28, 2007 BY PRATEEK GUPTA SHIVENDRA PRATAP JADON 0611179 0611190 INDIAN INSTITUTE OF MANAGEMENT, BANGALORE Acknowledgements We are thankful to our CCS Faculty Guide Professor Rupa Chanda for her guidance and support throughout the course of the project. We have benefited immensely from here encouragement and directions for the project. We also acknowledge the authors of the reference papers from whom we may have borrowed some ideas during the course of this study. 2 1 2 3 4 5 6 Introduction ..................................................................................................................... 4 1.1 The US Current Account Deficit: .............................................................................. 4 1.2 Risks to the US economy - Comparison with the Past: ........................................... 5 1.3 Three Perspectives: ................................................................................................. 6 1.3.1 Perspective 1: Widening Trade Deficits .......................................................... 6 1.3.2 Perspective 2: Savings-Investments Balance: ................................................ 6 1.3.3 Perspective 3: Net International Investment-Income Approach: ..................... 7 Perspective 1: Widening Trade Deficits ....................................................................... 8 2.1 The US Trade Balance: ............................................................................................ 8 2.2 Productivity Growth: ................................................................................................. 9 2.3 Consumption Boom and the Wealth effect ............................................................ 11 2.4 An International perspective based on trade flows of goods and services: ........... 13 Perspective 2: Savings Investments Balance ............................................................ 15 3.1 Introduction: ............................................................................................................ 15 3.2 National Income Accounting .................................................................................. 16 3.2.1 Notations used: .............................................................................................. 16 3.2.2 Equations: ...................................................................................................... 16 3.3 Twin Deficits: .......................................................................................................... 17 3.3.1 The early 1980s: ............................................................................................ 17 3.3.2 The 1990s: ..................................................................................................... 19 3.3.3 2000 onwards: ............................................................................................... 21 Perspective 3: Net International Investment-Income Approach .............................. 24 4.1 US Net International Investment Position: ............................................................. 24 4.2 Need for Alternate Analysis: ................................................................................... 26 4.3 Measurement of Dark matter ................................................................................. 28 4.4 Sources of dark matter ........................................................................................... 30 4.4.1 Foreign Direct Investment ............................................................................. 31 4.4.2 Insurance ....................................................................................................... 31 4.4.3 Liquidity.......................................................................................................... 31 4.4.4 Other sources of dark matter ......................................................................... 32 4.5 Stability of dark matter ........................................................................................... 32 4.5.1 Looking at Fundamentals .............................................................................. 32 4.5.2 Historical Evidence ........................................................................................ 33 4.5.3 Time Series Analysis ..................................................................................... 33 4.6 Conclusions and future research ........................................................................... 34 Data Collected ............................................................................................................... 35 General References ..................................................................................................... 36 3 1 Introduction 1.1 The US Current Account Deficit: The US’ record-breaking current account deficit has triggered alarm bells concerning the health of US economy. The huge and growing international trade and current account imbalances, centered on the US external deficits and net debtor position, represent the single greatest threat to the continued stability of the US and world economies. The current account deficit is now larger than it has ever been in the history of US. Economists argue that this could at any time trigger a large and rapid decline in the exchange rate of the dollar that would initiate sharp increases in US inflation and interest rates, bringing on stagflation and quite possibly a deep recession. Even in the absence of such a crisis, continued failure to address the imbalances constructively might lead to a costly adjustment to the US and world economies. Before questioning the sustainability of the deficit, we would first assess its components that have caused the deficit to reach its current size, patterns of foreign investment in the US, and the different ways in which the deficit is financed. The US current account deficit reached $800 billion in 2006. It has exceeded annual rates of $900 billion in a couple of recent quarters. It now accounts for more than 6 percent of GDP (Figure 1). Figure 1: US Current Account Deficit as a % of GDP Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 4 The only effective US policy response to the problem, as its critical contribution to the needed global solution is a conversion of its present (and especially prospective) budget deficits into modest surpluses as in 1998–2001. The possibility of a sharp dollar fall is in fact the greatest short-term risk now emanating from our budget deficits and provides the most compelling reason for urgent action on them.1 1.2 Risks to the US economy - Comparison with the Past: The present US current account deficit is more than double the previous modern record of 3.2 percent in the middle 1980s (as a result of which the dollar dropped by 50 percent against the other major currencies over the three-year period 1985–87). The present current account imbalance has been accumulating for more than a decade, compared with the five-year gestation period to the previous peak. The US economy is presently very close to the full employment levels so that a fall in the US would precipitate steeper changes in the inflation and interest rates. The problem is exacerbated owing to two structural factors: Firstly, the US current account imbalances have made the US the world's largest debtor. The United States was the world's largest creditor at the time of the imbalances in the 1980s and actually used up its net asset position accumulated over more than half a century. Today, The US has no such cushion. Secondly, the creation of the euro provides a true international financial alternative to the dollar for the first time in a century. The dollar has dominated global finance since the decline of sterling in the early twentieth century, largely because it had no real competition. The creation of the euro eliminates the dollar's currency monopoly, however, because the economy of Euroland is almost as large as that of the United States while its international trade and monetary reserves are even larger. Indeed, euro bonds have attracted more international investment than dollar bonds for the past two years and global holdings of euro currency now exceed those of the dollar. Hence the euro presents, for the first time in modern history, a true alternative to the dollar for footloose international investment that might previously have moved into dollar assets or that might already be invested in dollars.1 1 C Fred Bergsten, The Current Account Deficit and the US Economy, Testimony before the Budget Committee of the United States Senate, February 2001 5 1.3 Three Perspectives: A current account deficit can imply that a country is living beyond its means i.e. consuming more than it is producing. This view implies that the net indebtedness of the nation would continue to increase with widening current account deficits and finally become unsustainable. Alternatively, a current account deficit could mean that a country is an ‘oasis of prosperity’. The proponents of this view argue that the country is actually attracting investments from foreign economies because the country is perceived to deliver higher investment returns at lower risks than other investment destination countries. In the following, we examine several explanations that that have been suggested to account for the burgeoning current account deficit. But we must admit that it is not at all necessary that these explanations be mutually exclusive, nor that they can not be further broken down to several other factors. We first seek to examine the various perspectives in detail. 1.3.1 Perspective 1: Widening Trade Deficits The most common way of explaining the current account deficit is as the difference between a nation’s exports and imports of goods as well as services. Accordingly, the determinants of the current account balance would roughly be the same as that of the trade balance: exchange rates, price levels, and incomes at home and abroad. Thus the expanding current account deficit is largely attributed to the strengthening of the dollar since the mid-1990’s which boosted imports and discouraged exports for the US. We will note how the productivity growth and the consumption boom, through wealth effect contributed in increasing the imports budget of the US economy. This most widely accepted traditional perspective is the one which we will consider first in the following. 1.3.2 Perspective 2: Savings-Investments Balance: According to this perspective, the current account deficit is nothing but the difference between a nation’s investments and its savings. What it essentially means is that if a country is investing beyond what it is saving, then it needs foreign savings to fund the 6 excess investments. This perspective stresses on the decline in the US Gross Savings as a percentage of the GDP over the past ten years even as the investment rates have moved up slightly as the central cause of the huge US current account deficit. An examination of this perspective also involves a study of the twin deficits: budget deficit and the current account deficit. This view takes us back to the discussion of mid-1980s, when the widely prevalent view was that the widening US fiscal deficit is the cause of the current account deficit. We would study the view in detail and finally conclude that the budget deficit has probably been just one of the many factors contributing to the US current account imbalances. 1.3.3 Perspective 3: Net International Investment-Income Approach: Here we would be considering the net US indebtedness and ask the question if it is really unsustainable to service the huge US national debt. We would examine the significant capital gains that have accrued to the US in the past over its investments abroad. We would argue that the official current account statistics might not be a good indication of the evolution of a country’s net foreign assets. We would be redefining the US current account deficit to argue that the US has remained a net economic creditor for the last three decades. We introduce the concept of dark matter2, the difference between the real measure of net foreign assets and that obtained by the current account statistics. These three perspectives might at first seem to be attributing the huge current account deficit levels to distinct factors. But we believe, as we shall note in our conclusion, these are just three different ways of capturing the same fundamental economic developments in the US. 2 Ricardo Hausmann and Federico Sturzenneger, Global Imbalances or Bad Accounting? The Missing Dark Matter in the Wealth of Nations, Working Papers, Center for International Development at Harvard University, January 2006 7 2 Perspective 1: Widening Trade Deficits 2.1 The US Trade Balance: A country’s current account is made up of four components: trade in goods, trade in services, transfer payments, and foreign income payments. In the US, the trade deficit is the largest and fastest-growing part of the overall current account deficit. In fact, fluctuations in the trade deficit are the primary cause of fluctuations in the current account deficit. The income account measures the income payments made to foreigners net of income payments received from foreigners. For the United States, the income account largely reflects interest payments made by the United States on its foreign debt and interest payments received by the United States on its foreign assets. An income deficit arises when the value of income paid by the United States to foreigners exceeds the value of income received by the United States from foreigners. The transfer account measures the difference in the value of private and official transfer payments to and from other countries. The largest entry in the transfer account for the United States is foreign-aid payments. Table 1 shows the trade and current account deficits as a percentage of GDP for ten years from 1997-2006. Table 1: Breakup of US Current Account Deficit Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations The gap between imports and exports of goods and services has continually been increasing over the years, as is evident from Figure 2. As a result, the Trade Deficit has been continually increasing nominally as well as a % of GDP. We also note that 8 the Current Account Deficit is very closely following the Trade deficit. The transfers to the Rest of World (ROW) (Income Payments – Income Receipts + Current Taxes and transfer payments to the ROW) form a very small part of the Current Account Deficit and no distinct trend is visible there. Figure 2: Foreign transactions in the National Income and Product Accounts: Trade Deficit and Current Account Deficit Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 2.2 Productivity Growth: What could be the possible reasons for a continually increasing gap between the imports and exports of goods and services? Widely accepted economic theory predicts that if a country experiences an investment boom due to a rise in productivity growth while its trading partners do not, its current account deficit should widen. Holding all else constant, the increase in productivity raises domestic investment spending, causing total domestic spending to exceed domestic production in the short run. To cover the excess of domestic spending over production, the country imports more goods and services than it exports. In particular, the surge in investment may increase the demand for imported capital goods. 9 Thus, acceleration in productivity should result in a net capital inflow (corresponding to the current account deficit) and an appreciation of the country’s currency. For the most part, developments in the U.S. economy in the nineties conform to these predictions from economic theory. The expansion of the US economy in the 1990s was quite exceptional. Growth was at its highest level and unemployment fell to its lowest level for a generation.3 No such trend in productivity growth was observed in other industrialized countries despite their facing the same decrease in Information and Communication Technology prices. This was attributed to extensive workplace innovations and a favorable regulatory environment in the US in the 1990s, particularly with regard to growing businesses. For two decades for the period 1975-1995, the US labor productivity growth (Non-Farm business sector) was 1.5 per cent annum. In the period from 19962000, the productivity growth increased by at least a percentage point. This marked increase in productivity growth was a key component of what many commentators suggested was a ‘new economy’.4 Age composition effects, wage subsidies and the high efficiency of job matching ensured a steep decline in the levels of equilibrium unemployment. The actual unemployment rate was 7.2 per cent in 1985, 5.6 percent in 1995 and 4.0 percent in 2000. The numbers suggest that the equilibrium unemployment fell in the 1990s. The New economy was characterized by capital deepening, primarily in IT capital, with increases in Total Factor Productivity Growth in IT and some other sectors.5 Moreover, the rise in investment spending was accompanied by an increase in U.S. capital goods imports as a share of GDP. The U.S. current account deficit widened as U.S. productivity growth accelerated and unemployment plummeted. However, the developments from 2000 till date do not approve of this explanation. As we note in Figure 3, during the period 1997-2006, the consumer goods growth surpasses the capital goods growth. 3 Lisa M Lynch & Stephen Nickell, Rising Productivity and Falling Unemployment: Can the US experience be sustained and replicated?, May 2001 4 Stuart Berry & David England, Has there been a Structural Improvement in US Productivity?, Bank of England Quarterly Bulletin, Summer 2001 5 Nicholas Crafts, The Solow Productivity paradox in Historical Perspective, London School of Economics, November 2001 10 Figure 3: Break-up of Imports of Goods Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 2.3 Consumption Boom and the Wealth effect A more plausible explanation is offered by considering the fact that during the 1990s, a bull market in U.S. stocks dramatically increased the net worth of U.S. households. The values of both the S&P 500 and the Dow Jones Industrial Average more than tripled from 1990 to 1999. The decline in the personal savings rate in the US since 1984 was largely due to significant capital gains in corporate equities over the period.6 Table 2: Personal Savings as a percentage of Disposable Personal Income Source: Personal Income and its Disposition Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 6 F Thomas Juster, James P Smith, Frank Stafford, The Decline in Household Saving and the Wealth Effect, April 2004 11 We note in Table 2 that the Personal Consumption expenditures as a percentage of the Personal Disposable Income have been increasing over the period, so much so that the Personal Outlays almost equal the Disposable Personal Income in 2006. Thus the surge in wealth due to the stock market led to a consumption boom in the United States, through the so-called wealth effect.7 From 1995 to 1999, real consumer spending grew 4 percent per year, compared to an average of just 2.6 percent per year over 1980-94. During the consumption boom of the late 1990s, U.S. consumers satisfied part of the increased demand for goods and services with imports, purchasing more and more goods from foreign sources. Table 3 shows that the import of goods as well as services has been continually increasing as a percentage of the GDP for the past 10 years while the exports have remained more or less flat. Table 3: Exports and Imports of Goods and Services as a % of GDP Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations If a country increases its demand for imports due to a consumption boom, basic economic theory predicts that the country’s current account deficit should widen and its currency depreciate. Keeping all other variables unchanged, if the demand for imports rises in a nation, the trade deficit should increase, in turn causing the current account deficit to worsen. Also, the increased expenditure on foreign goods implies increased demand for foreign currencies, putting downward pressure on the domestic currency relative to the value of the foreign currencies. While the US current account deficit did worsen in the period, the USD remained relatively stable in the period. This is accounted for by the fact that there has been a 7 Jill A Holman, Is the Large US Current Account Deficit Sustainable?, Economic Review, Federal Reserve Bank of Kansas City, First Quarter, 2001 12 counteracting economic force pushing the USD upwards. The trend productivity growth pushed the USD upward while increased consumer spending on imports exerted a downward pressure on the USD. In combination, consumers’ increased demand for imports and the productivity-driven surge in investment spending accounted qualitatively for the recent behavior of the external sector of the U.S. economy. Both factors helped push the U.S. current account deficit higher.7 2.4 An International perspective based on trade flows of goods and services: This perspective focuses on the forces that drive export and import flows and provides an explicit role for foreign demand for goods and services. This alternative framework allows us to examine how global and national GDP growth, as well as the exchange rate, can affect the current account. It also allows us to consider the impact on trade and the current account of structural factors such as comparative advantage and globalization. A useful starting point for this perspective is a model in which growth of national income and changes in relative prices drive trade flows. The underlying theory is that exports grow faster when foreign income grows faster and when the relative price of exports to competing goods and services in the destination market falls. Imports grow faster when domestic income grows faster and when the relative price of imports to domestic goods and services falls. Domestic demand growth has deteriorated in many countries because of varying combinations of an increase in savings rate and a decline in investment. This weakening of foreign spending has increased the supply of capital available to the US and exerted downward pressure on the US interest rates and upward pressure on the USD. Some of the largest industrial economies of the world have been running huge current account surpluses while experiencing low growth. In fact, since 1999, the developing nations have, in general, been running current account surpluses with the industrial nations, primarily the US.8 For reasons not clearly understood, the US income elasticity for imports is significantly greater than the foreign income elasticity for US exports (familiarly 8 Roger W Ferguson, US Current Account Deficit: Causes and Consequences, Economics Club of the University of North Carolina, April 2005 13 known as the Houthakker–Magee effect).9 It was first noted in 1969 and it was observed that the elasticity of U.S. exports with respect to foreign economic growth is less than the elasticity of U.S. imports with respect to domestic economic growth. That is to say, US growth sucks in more imports than their growth sucks in exports. Balanced growth for US would thus mean a deteriorating current account deficit, i.e., if the US economy and the rest of the world grow at the same rate, then the US current account deficit will continue to widen, unless the exchange value of the dollar depreciates noticeably. Keeping in view the current trends of US economy, growth is likely to be unbalanced in a way that exacerbates the situation. And even with balanced growth, there are likely to be unbalanced impacts on imports and exports. In every study where goods and services are aggregated, the U.S. income elasticity for imports of goods and services is significantly greater than the foreign income elasticity for U.S. exports of goods and services, as already pointed out above. For example, Hooper, Johnson and Marquez (1998) found that the long-run elasticity of U.S. exports of goods and services with respect to foreign national income was 0.80, while the long-run elasticity of U.S. imports of goods and services with respect to U.S. national income was 1.80. The asymmetry of how U.S. income affects imports and how world income affects U.S. exports means that if the U.S. economy and the rest of the world grow at the same rate, the current account deficit will continue to widen, unless the exchange value of the dollar persistently depreciates. The examination of the slump in foreign domestic demand in detail and the export and import elasticity data for the US required a study of the export import data of all the trading partner nations of the United States. This was considered beyond the scope of this report. 9 Catherine L Mann, The US Current Account, New Economy Services, and Implications for Sustainability, Institute for International Studies, European Forum, Stanford University, 2002 14 3 Perspective 2: Savings Investments Balance 3.1 Introduction: This perspective on the current account deficit is based on the domestic National Income and Product Accounts and shows how patterns of domestic savings and investment are reflected in the trade and current account balances.10 In the national accounts framework, it is an identity that domestic production in an economy must equal spending plus the trade balance. In the case of a trade deficit, a nation's spending will exceed its domestic production, which yields the observation that in essence, the United States has been ‘spending beyond its means’. Domestic private saving + trade deficit = government budget deficit + private investment During the 1980s, expansionary fiscal policy through large budget deficits yielded robust domestic spending that supported both, the growth of US GDP and increased imports. Thus, the trade deficit was driven by the budget deficit. The budget deficits and the current account deficit were called the twin deficits because both increased or decreased by about the same amount and were driven by the same fundamentals. However in the 1990s, efficiencies increased, productivity of US assets increased and the foreign inflow in the US economy zoomed. Thus, it was the private investment which drove the trade deficit, rather than government spending. In the past ten years, as discussed earlier, the consumption boom in the US propelled by the wealth effect also accounts for the increased inflow of goods and services. Specifically, the fiscal explanation of the current account deficit fails altogether in explaining the increasing current account deficit in the late 1990s, even as the budget account was in surplus. Internationally, countries like Germany and Japan have had huge current account surpluses even as they sustain substantial budget deficits. Thus it is quite clear through empirical as well as theoretical evidence, that there is no clear connection between the fiscal and the current account deficits and that the fiscal deficit is just one of the many reasons affecting the current account balance.8 10 Catherine L Mann, Perspectives on the US Current Account Deficit and Sustainability, The Journal of Economic Perspectives, Summer 2002 15 3.2 National Income Accounting 3.2.1 Notations used: Y C I G TR TA NX Yd Sg Sf Sp = S as the Total Output of an economy, or equivalently its GDP as the Consumption Spending by the household sector as the Gross Private Domestic Investment as the Government Spending on goods and services as the Net Transfer Payments by the Government as the Taxes collected by the Government as the Net Exports of an economy as the Personal Disposable Income as the negative of budget deficit, or equivalently as, Government Savings as the negative of net exports, or equivalently as, Savings from rest of world as the total private savings 3.2.2 Equations: Using these definitions, we can write the GDP of an economy as a derivative of the identity that states output produced equals output sold. Output sold can be written in terms of the components of demand as the sum of consumption, investment spending, government spending and net exports. This gives us (1). A part of income is spent on taxes and the private sector receives net transfers in addition to National Income. Thus we derive Disposable Income as in (2). It is the disposable income that is spent on Consumption and Savings as stated by (3). Combining (2) and (3) we get (4); which can be rewritten as (5). Substituting right hand side of (5) in (1) and rearranging, we get (6). Using notations above, (6) can be rewritten as (7). The first set of term on the right hand side of (6) denotes the excess of government spending over its receipts. The second term denotes the excess of exports over imports. Thus, identity (6) states that the excess of private savings over investment of private sector is equal to the government budget deficit plus the trade surplus. This is the classical Twin Deficit identity (7), that is, Investment in any economy equals Private Savings plus Government Savings plus Savings from rest of the world. 16 3.3 Y = C + I + G + NX (1) Yd = Y + TR – TA (2) Yd = C + S (3) C + S = Yd = Y + TR – TA (4) C = Yd – S = Y + TR - TA – S (5) S – I = (G + TR – TA) + NX (6) Sp + Sg + Sf = I (7) Twin Deficits: 3.3.1 The early 1980s: In the early 1980s, USA experienced both Federal and Current Account Deficits. Moreover, their magnitudes and direction were strongly correlated. The strongly prevalent view then was that the current account deficit was caused by the widening US budget deficit (The twin deficit hypothesis). These rising deficits were a major concern because each implied a growing debt burden and growing investment-service payments. Particular attention was focused on current account deficit as it implied that investment service payments are, in fact, funneled out of domestic economy. Thus, it was generally thought that external deficit was to be scaled down and the clearest available tool seemed to be a reduction in federal deficit. However, during the 1990s, federal deficit was finally brought under control and it even showed a surplus; but current account balance showed no similar trend. The current account deficit increased at a more rapid pace than before. 17 The factual evidence of these two successive periods is interesting, with respect to the behavior of current account balance in US, and we will analyze in more detail the reasons for the apparent ‘twinning’ of these two deficits in the 80s and then their apparent ‘untwining’ in the 1990s. From accounting identity (6), we note that if private savings and domestic investment are about equal, or at least move by about the same amount, then the fiscal and external deficits would be twins—about the same size and moving in the same way. This is what which happened for a few years in the early 80s, as shown below in Figure 4. Figure 4: Net Private Savings and Investment as % GDP in 1980s Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations The above behavior of Savings and Investment patterns leads us to predict that the current account deficit and the budget deficits must have moved closely in tandem over the period 1980-1987. This indeed was the case as we note in Figure 4. Apart from the relations implied by the Accounting Identities, other economic reasons were also at work in the 1980s. An expansionary fiscal policy (high budget deficit) coupled with a tight monetary policy lead to persistently high interest rates. These rates, together with growing US economy encouraged investment in US and Dollar assets, leading to an appreciation of Dollar. This, in turn, deflated the US exports, while, on the other hand, imports increased on the back of a sharply accelerating GDP growth as the US economy burst out of a recession. Hence the external deficit grew larger on account of pressures originating from the appreciation 18 of the dollar as well as from the robustness of the expansion. The deficits were thus twinned through the mechanism linking fiscal deficit to interest rate regime to exchange rate to current account deficit. Figure 5: Budget deficit and Current Account Deficit twinned in 1980s Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations The above analysis also suggests an explanation to the uncoupling of the two deficits since the late 1980s onwards. One reason might be that there were many changes in the behavior of Private Savings and Investment. Another might be that the supposedly tight linkages between the Fiscal deficit, Interest rates, Exchange Rates and Current Balance were, after all, not as tight as previously thought. 3.3.2 The 1990s: In the early 1990s, private savings in the US economy started going down even as the government savings improved. However, taken together the National Savings (Private plus Government Savings) were not sufficient to meet the Investment demand in the country and so the current account deficit increased to fill this gap. In addition, the savings rate for households, which is one component of private savings, declined dramatically. This, taken together with the massive Investment Demand of US economy from the early 90s onwards, ensured the high and persistently increasing levels of Current Account Deficit in US, even as the federal deficit was shrinking. 19 A factor that may be responsible for simultaneous increase in Investment and decrease in Private Savings is the dramatic increase in the value of companies’ equity, which comes from the continued robust growth of the US economy and the attractiveness of the US stock markets to domestic and international investors alike. The US savers who hold the highest fraction of their wealth in portfolio investments have tended to save a smaller fraction of their income as the perceived value of their wealth increased and they grew more confident of the future value of their wealth thus driving them to reduce their savings. At the same time, the climate of robust consumption and low inflation encouraged business investment, so that the savingsinvestment imbalance widened. Figure 6: Net Private Savings and Investment as % GDP in 1990s Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations We note in Figure 6 that the Savings and Investments did not move in tandem in the 1990s and hence there is no reason for us to expect that the budget and current account deficits would be coupled, as is evident from Figure 7. Earlier we had outlined the tight linkages between macroeconomic parameters which indicated the simultaneous rise in Federal and External Deficit. However, in the early 90s this linkage was shown to be weaker than previously thought. With the federal deficit under control, the upward pressure on the interest rates lessened and the value of Dollar depreciated to some extent. However, with the beginning of Stock Market 20 Bull run in the early 90s, foreign investors developed a massive appetite for the US assets. These investments in the US market and Dollar assets resulted in an appreciation of Dollar in spite of the decreasing federal deficit. Thus, the exports remained costlier, the increasing perception of wealth triggered a massive consumption binge in the US economy, imports rose sharply and so, the External deficit worsened even more. Figure 7: Budget deficit and Current Account Deficit untwinned in 1990s Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations As a final look at history, we studied the variation of federal and current balance over past 50 years. Looking at this data it is reasonably clear that the two deficits are not as close as they seem to be in near past. Long periods of current account surpluses coincided with moderate budget deficits in the 1950s and 1960s, and the very large fiscal deficits in the 1970s coincided with only negligible current account deficits. In this light, the twin deficits of the 1980s appear more an aberration than a common occurrence. 3.3.3 2000 onwards: Looking at the savings and investment data, we note that there is no clear trend. About the best explanation we can offer at this date is that the downward trend in the 21 Private Savings is more or less continuing from the 90s. Coinciding with another Bull Run in the US market after 2002, we note that the decrease in savings appears to be driven by the same Macroeconomic causes as in the 1990s’ Bull Run. However, as we note from figure 8, the Private Savings and Investments appear to be moving together approximately. This would again imply a coupling of the federal and current account deficit, which indeed is visible in Figure 9. As we have noted earlier, this is because of the accounting identity (7), whereby, if private savings and investments move by approximately the same amounts, the current account deficit and the budget deficit tend to move together. Figure 8: Net Private Savings and Investment as % GDP in 2000s Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations Figure 9: Budget deficit and Current Account Deficit twinned in 2000s 22 Source: Saving and Investment in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 23 4 Perspective 3: Net International Investment-Income Approach 4.1 US Net International Investment Position: The Current Account Deficit is causing the net indebtedness of the US economy to rise more rapidly than the income. In 1985, the US Net International Investment Position was roughly zero because its foreign assets were about equal to its foreign liabilities. By 1995, this investment position had deteriorated to about negative 5 percent of the GDP and is currently close to negative 20 per cent of the GDP (Table 4 and Figure 10). Table 4: US Net International Investment Position (USD billions) Source: International Investment Position Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations Figure 10: US Net International Investment Position Source: International Investment Position Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 24 Over past 30 years, the cumulative Current Account Deficit has totaled roughly 5.6 trillion US Dollars. This has given rise to concerns that the massive financing required to keep on paying for such a widening gap can not be sustained indefinitely and there will be a readjustment in the world economy. The possible scenarios include the collapse of dollar, increase in interest rates and a consequent sharp global recession. Figure 11 shows the trends in the yearly as well as the Cumulative Current Account Deficit over past 30 years. There are fears that if the current account deficits continue to boost the US indebtedness, then the cost of servicing this position would become unsustainable. Many economists argue that this clearly implies that the current account would have to be adjusted to ensure that excessive debt levels are not maintained. Fig 11: Variation in Current Account Deficit, Yearly and Cumulatively, over past 30 years Source: Foreign Transactions in National Income and Product Accounts Tables, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations The increasingly unbalanced position of the US (and the world) raises an important question: why such a large and increasing deficit has not led to any visible crisis, and why the world is willing to lend to the US at surprisingly low interest rates? While some have directed attention to the low personal savings rate of the typical US consumer, others explain the persistence of the imbalances by stating that it is the official sources that are keeping demand for US securities artificially large. But this 25 explanation is at odds with the conundrum: why would the creditor foreign governments buy into capital losses? 4.2 Need for Alternate Analysis: To illustrate the need for an analysis in the commonly held world view, let us start by reviewing some facts. The Bureau of Economic Analysis (BEA) indicates that back in 1976 the US had about 165 billion dollars of Net Foreign Assets (that is the difference between the foreign assets owned abroad and the local assets owned by foreigners). These assets rendered a net return of about 16 billion dollars. Between 1976 and 2006, the US accumulated a current account deficit of 5.6 trillion dollars. We should expect then that the net foreign assets of the US would fall by that amount, to say, minus 5.4 trillion. If it paid 5 percent on that debt, the net return on its financial position should have moved from a surplus of 16 billion in 1982 to minus 254 billion dollars a year in 2006. But the number for 2006 is still a positive 43 billion (Table 5)! (Even though the Net International Investment Position of the US is at a whopping debt of negative 2.6 trillion dollars (Table 4), the net returns on this debt (i.e. the Net International Income) are a positive 43 billion USD). This means that the US has spent 5.6 trillion dollars more than it has earned (which is what the cumulative current account deficit implies) almost for free. This inconsistency between the flow and stock data has been growing steadily over the last twenty years. Table 5: Net International Investment Income Calculations Source: International Investment Position Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 26 To respond to the incongruence of the flow and the asset data two answers have been suggested. One states that the US has benefited from what the BEA estimates to be about 3.0 trillion dollars of net capital gains so that instead of owing 5.6 trillion, it owes 2.6 trillion USD (as at the end of 2006). However, the capital gains story cuts the puzzle only in half, leaving other half to be explained. The second answer stresses the fact that the US earns a higher return on its holdings of foreign assets than it pays to foreigners on its liabilities. A careful description can be found in Gourinchas and Rey (2006) who document this differential return by estimating how the gross returns have evolved. Figure 3 shows that this differential has been fairly persistent over the years. Figure 12: Return Differential of US over past 30 years Source: Gourinchas P O, and H Rey (2006) “From World Banker to World Venture Capitalist: US External Adjustment and the Exorbitant Privilege”, Clarida, R. (ed.) G7 Current Account Imbalances: Sustainability and Adjustment, the University of Chicago Press, forthcoming. . Both explanations raise further questions. First if there have been significant capital gains on US foreign assets then we need to understand where those large capital gains come from, since due to an absence of any clear movement in USD over past years, exchange rate route is unlikely to be involved. On the other hand if US investments 27 are earning consistently higher rates abroad, then the question arises that why this trend is continuing in this age of global investing and free capital movement. To handle these questions, Cline introduces the concept of present value of net income, to show that the United States has remained an “economic” net creditor throughout the last three decades. He states this is the result of the difference between the returns on US assets abroad and the return of foreigner’s assets in US. 11 Hausmann further argues that the inconsistency between flow and stock data can be explained by two complementary phenomena: 1. Firstly, net foreign assets may not be properly measured because of a very strict set of accounting rules that may not capture the true earning potential of the assets. 2. Secondly, foreigners may hold the assets of a country in spite of its lower return because they may feel that these assets have other factors which make them attractive. Thus, this return differential is an equilibrium phenomenon.2 4.3 Measurement of Dark matter The concept of current account is related to the change in the net asset position of a country. However as we have already pointed out above that from the standard accounting rules, capital gains and return differentials can be substantial making the relationship between the current account and the change in net foreign assets quite weak. Thus an alternative way of measuring the current account is by defining the Current Account as the change in the Net Foreign Asset position; when the assets are measured in a different way from the standard accounting rules. Thus, following the convention of Hausmann (2006), the stock of Net Foreign Assets (NFA) was measured as the capitalized value of the Net Investment Income (NII), discounted at a constant rate of interest r as in (1). (A constant rate of return was used as it is generally agreed that in the global economy each financial claim appears twice: as an asset in one country and a liability in another. So a constant rate helps to value that claim equally in both countries. Also, the choice of a constant rate is 11 Cline, W, The United States as a Debtor Nation, Institute for International Economics, Washington DC, 2005 28 justified so that it is the changes in the income flow of the assets that determine the value and not the fluctuations in the price-earnings ratios). The superscript DM refers to dark matter, the difference between the real measure of net foreign assets and that obtained by the current account statistics. Here the assets are measured from their returns and not from adding the current account imbalances. So, the current account is redefined as the change in net foreign assets; here CAt denotes the Current Account Balance. NFAt stands for the official measure of net foreign assets. The assets are allowed to be mismeasured, with µt indicating the error in measurement. In addition we assume assets to yield a rate of return r’ different from the constant rate used for discounting. NFAtDM = NIIt/r CAt= NFAtDM - NFAt-1DM (1) = (NIIt - NIIt-1 )/r (2) DM = NFAtDM - NFAt = NIIt/r - NFAt = r’(NFAt + µt )/r - NFAt = r’µt/r + (r’-r) NFAt/r (3) It is easily noticed that this method of valuing assets is remarkably similar to valuing a company by P/E method, which is to choose a Price to Earnings ratio and multiply its earnings with it. Thus a question may be raised on the validity of this method as earning of any single year are, in general, unreliable indicators of the earning potential of a company. But since we are, in effect, averaging over the entire economy and dealing with average of past 30 years or so, this method may be taken as reasonably reliable. The two terms in the last expression of equation (3) show that dark matter may have two origins: 1. The capitalized return to unaccounted assets 29 2. Return “privileges”. There are many reasons why assets in equilibrium may yield different returns, however the most convincing reason in the case of the US appears to be the sale of embedded services. To put it more simply, the difference in returns is interpreted as the price paid by the market for the insurance sold i.e. foreigners are willing to invest in the US at a lower rate because of the insurance provided on the assets. In fact, this is exactly what is done in standard GDP estimation as many components of GDP are estimated by assimilating return differentials to the sale of specific services, exactly the same way in estimating Dark Matter. So, while in US national accounts, the return differential is used to value financial services, we use the same methodology to return differential in assets to value insurance services. In this case we can say the US and Switzerland are selling insurance abroad, in the same way banks sell financial services by paying a lower rate on their deposits. This interpretation is useful because Firstly there has been a growing awareness that intangible capital is an important source of income. It has been argued that the US national income accounts miss about 800 billion a year in intangible capital, and thus underreport the total capital stock of the economy in close to 3 trillion dollar.12 Accordingly, it is reasonable to assume that this capital will generate steady income. So, it may be argued that income view offers a reliable method to measure Current Account changes. Secondly, since we are arguing that return differentials correspond to purchase and sale of implicitly embedded services, they must be taken into account when we are considering global balances and trying to estimate the advantages or disadvantages of local assets through the capitalization of these return differentials. 4.4 Sources of dark matter There are at least three main factors that account for the accumulation of dark matter and they all involve a persistent return differential between assets and liabilities. The 12 Corrado, Carol, Charles Hulten & Daniel, Sichel, Intangible Capital and Economic Growth,Federal Reserve Board, Washington. No. 24, 2006 30 difference in returns may originate in three main sources: a return differential for FDI investments, the sale of insurance, and the provision of liquidity services. 4.4.1 Foreign Direct Investment FDI is perceived to be a source of dark matter as it involves the idea that FDI abroad serves as a method of spreading ideas and technical know-how that is usually poorly accounted for and thus due to the difficulty of tracking the value of trade of these services abroad, it is very probable that numbers underestimate the net worth of the companies. Thus FDI abroad can be looked as a channel of export of these unaccounted services by headquarters to the affiliates around the world. However, studies estimating the presence of Dark Matter via FDI channel suffer from many ambiguities, mostly related to the problem of breakdown of assets, their income trends over past years, and the nitty gritty of commodity level analysis required. 4.4.2 Insurance The second channel arises due to the inherent stability factors of an economy. These factors allow a country to either sell some of its stability to the world or to diversify some of its instability. Thus countries having more sound economic fundamentals may enjoy a return differential and unstable countries will pay for such insurance. For example, Kugler and Weder have studied these return differentials for Switzerland and they find that the return differential originated in Switzerland’s neutrality during that war, and has remained very strong and persistent since.13 Some other studies also point to an evidence of rate differential in US. The common buzz word ‘flight to quality’ captures this effect and explains the significantly lower interest rates paid by the US. In fact, it could be argued that this benefit may have further increased after 9/11 as the US is still the economy that can better deal with the global implications of such threats. 4.4.3 Liquidity The third channel is related to the provision of liquidity services, basically through the use of a foreign currency or paying a premium for purchasing instruments in liquid financial markets. Thus, third source of dark matter is the unaccounted value of the 13 Kugler, P & B Weder, International Portfolio Holdings and Swiss Franc Returns, Mimeo University of Mainz, 2004 31 liquidity services provided by some countries by having foreigners accumulate their currency as liquid means of transactions, and thus, paying no interest on this, the source country can accumulate current account deficits without deteriorating its net investment income account. This so-called seignorage, or the unmeasured provision of liquidity services is a source of dark matter. However, some studies have pointed that this is a relatively unimportant source of Dark Matter.14 4.4.4 Other sources of dark matter Two other important sources of dark matter are debt relief and more interestingly, trade access through capital restriction. It has been argued that the imbalance comes from peripheral countries adopting export led strategies with undervalued pegged exchange rates and capital controls. In this approach, dubbed Bretton Woods II, some countries are willing to purchase US assets at lower (expected) returns as part of an implicit contract with the US by which they are guaranteed access to its goods market, in other words they would be “purchasing” the access to the US market, another form of trading dark matter.14 4.5 Stability of dark matter If we want to determine whether the US current account deficit is sustainable or not, we have to take a look at the reliability of Dark Matter keeping the net asset position of the US stable as in this view, exports of dark matter are compensating the large current account deficits in the US. This will, in turn, depend on how stable are the underlying assets and their earning potential. There are basically three ways of assessing whether dark matter exports of the US will continue to be present in the future. 4.5.1 Looking at Fundamentals Perhaps the most important factor to analyze is the underlying fundamental reasons for the existence of dark matter and to determine whether they will continue to hold. We should focus on the rate of innovation and creativity of the corporate sector, on 14 Dooley, Michael, David Folkerts-Landau & Peter Garber, The Revised Bretton Woods System, International Journal of Finance and Economics, 2004, v9(4,Oct), 307-313 32 the role of the dollar as a leading global currency of choice, or on the economic stability of the US economy. If these fundamentals remain stable, we will expect the return differential to remain stable too. As global markets increase in size, the differential will act on a larger base, thus leading to increases in dark matter exports. 4.5.2 Historical Evidence Another alternative is to look at historical evidence. An analysis of the UK at the end of the 19th century, as well as the US in the post war period, points to the fact that yield differentials declined over time. Also, these differentials are for the US, and were for the UK, fairly stable as a share of GDP. In the case of the UK the process continued up until an abrupt collapse at the outbreak of World War I, leaving open the question as to what would have happened if such event had not occurred.15 (.) 4.5.3 Time Series Analysis Finally, a third alternative is to look at the time series properties of dark matter stock over recent years. This is done in Figure 4 below. The stock stands now at around 35 percent of GDP. Figure 13: Variation in Dark matter for past 30 years Source: International Investment Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations 15 Meissner C and A Taylor, Losing our Marbles in the New Century?, The Great Rebalancing in Historical Perspective, Mimeo LSE, 2006 33 Table 6: Dark Matter Calculations Source: International Investment Table, BUREAU OF ECONOMIC ANALYSIS, US DEPARTMENT OF COMMERCE and authors’ calculations Since 1977 it has fallen only in 8 years and the largest drop, which took place in 1994, was barely of 3% of GDP. In short it would take an unprecedented deterioration of the value of dark matter to even approximate the net asset position that today worries analysts. 4.6 Conclusions and future research In a nut shell our story is that the income generated by a country’s financial position is a good measure of the true value of its foreign assets. Once assets are revalued, the data seems to indicate that a distorted picture of current account imbalances may have been given by the official statistics. We find that US has been accumulating a large amount of unaccounted net foreign assets which allow it to have a net income on its foreign asset position which has been fairly stable over the last 30 years. The difference with the accounting data comes from a multitude of reasons like mismeasurement of assets, the unaccounted export of intangible assets, and sale of insurance and liquidity services. These factors relate to characteristics of the US that cannot be easily replicated elsewhere, and explains why the US looks like a smart investor. Thus the discussion on the instability of global imbalance should also focus on the sources of dark matter: the stability of the US economy, its role as a source for ideas, or its implicit liquidity and insurance services. But these issues have not been the central issues of the debate that have focused mostly on domestic savings. Thus this can be a very productive future direction of research. Also as pointed out above, a very detailed breakdown of FDI by sector, commodity and a cross section of countries is essential to fully explore this avenue of Dark Matter generation. But, from this model of Current Account Balance, it is clear that the imbalances present in the global system are not as sharp as commonly stated, indeed if they are truly present at all, and so the ensuing correction, if it happens at all, will be a very benign one. 34 5 Data Collected The following data has been collected for the years 1997 through 2006 from the National Income and Product Accounts, US Bureau of Economic Analysis (http://www.bea.gov/national/nipaweb/SelectTable.asp?Selected=N): For all analysis above, these data sets have been used. 1. Gross Domestic Product 2. Gross Domestic Income by Type of Income 3. Personal Income and Its Disposition 4. Personal Consumption Expenditures by Major Type of Product 5. Personal Income and Its Disposition by Households and by Nonprofit Institutions Serving Households 6. Government Current Receipts and Expenditures 7. Government Consumption Expenditures and Gross Investment 8. Foreign Transactions in the National Income and Product Accounts 9. Exports and Imports of Goods and Services by Type of Product 10. Saving and Investment 11. Private Fixed Investment by Type 35 6 General References Other than those mentioned inline in the report, the following are the general references used: 1. The Global Saving Glut and the US Current Account Deficit – Speech by Federal reserve Board Governor Ben Bernanke. http://www.federalreserve.gov/boarddocs/speeches/2005/200503102/default.h tm 2. The Current Account Deficit and the US Economy – C. Fred Bergsten, Peterson Institute (Testimony before the Budget Committee of the United States Senate, February 1, 2007). http://www.petersoninstitute.org/publications/papers/paper.cfm?ResearchID=7 05 3. The US Current Account Deficit and the Global Economy – A Per Jacobsson Foundation Lecture by Lawrence H Summers, President of Harvard University and former secretary of the US Treasury www.perjacobsson.org/2004/100304.pdf 4. How Dangerous is the US Current Account Deficit – Economic Policy Lecture Series Speech by William Poole, President, Federal Reserve Bank of St. Louis http://www.stlouisfed.org/news/speeches/2005/11_09_05.htm 5. Book: Is the US Trade Deficit Sustainable – Catherine L Mann 6. Book: The US as a debtor nation – William R Cline 7. Can America still compete or does it need a new Trade Paradigm – Policy briefs in International Economics by Martin Neil Baily and Robert Z Lawrence 8. Global Imbalances: Time for Action – Policy Brief, Peterson Institute for International Economics, Alan Ahearne and William R Cline 9. The US Trade Deficit: A disaggregated perspective – Working Paper Series by Catherine L Mann and Katharina Pluck 10. The Unsustainable US Current Account Position revisited – Maurice Obstfeld and Kenneth Rogoff 11. The US Imbalancing Act: Can the Current Account Deficit continue? – Mckinsey Global Institute 36