ECONOMIC ANALYSIS WRITE-UP

ECONOMIC FORECAST

DUE: TUESDAY OCTOBER 10 TH 20 pts

FORMAT:

1 ½-2 pages typed

Short introductory paragraph which summarizes the current state of the U.S. economy

Remainder of paper should be your economic forecast for the U.S. economy over the next year

Attach Indicator Grid to the back of paper

Do not use “I” statements in your forecast (no writing in 1 st person!)

ASSIGNMENT:

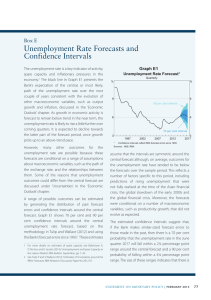

SUMMARIZING THE CURRENT STATE OF U.S. ECONOMY:

Write a short paragraph which summarizes the state of the U.S. economy mentioning the statistics from your Grid, such as:

GDP, Unemployment, CPI, Price of Oil, level of short term interest rates (controlled by Fed), Housing Market

Some use of actual #’s would help here….

DEVELOPING A THESIS:

Ask yourself the following questions:

Do you feel GDP will increase or decrease from its current growth levels?

Do you feel unemployment will increase or decrease?

Do you feel short term interest rates (controlled by Fed) will rise or fall?

Do you feel the housing market will continue to weaken? The price of oil ?

Finally, are you worried about rising inflation ?

WRITING YOUR FORECAST:

For writing your summary simply try to “weigh & balance” the positives versus the negatives for the U.S. economy.

In particular, think in terms of the circular flow of the economy. Do not explain to me what GDP is! Your paper should focus on high level ANALYSIS! Ask yourself the following questions:

Which factors will help the economy? Hurt it?

Which factors are more important than others?

What is the risk you see in the overall economy? What “unforeseen” event could hurt the economy?

Which indicators are at, above or below their target levels (or speed limit levels)?

Try to reach a “forecast” in terms of the overall economy. Your forecast should be based on the “assumptions” you make and will be graded in terms of economic logic—not whether your forecast turns out to be correct.

Analysis example: “Assuming the price of oil continues to remain below $65/barrel, the U.S. economy should avoid falling into a recession during 2007.” Although the Federal Reserve has significantly increased interest rates, they still remain relatively low based on historical levels. For this reason, the consumer is likely to continue to spend during 2007 at reasonably high levels.