Chapter 11 solutions.doc

advertisement

CHAPTER 11

PROJECT ANALYSIS AND EVALUATION

Answers to Concepts Review and Critical Thinking Questions

1.

Forecasting risk is the risk that a poor decision is made because of errors in projected cash flows. The danger is

greatest with a new product because the cash flows are probably harder to predict.

2.

With a sensitivity analysis, one variable is examined over a broad range of values. With a scenario analysis, all

variables are examined for a limited range of values.

3.

Accounting break-even is unaffected (taxes are zero at that point).

Cash break-even is lower (assuming a tax credit).

Financial break-even will be higher (because of taxes paid).

4.

It is true that if average revenue is less than average cost, the firm is losing money. This much of the statement

is therefore correct. At the margin, however, accepting a project with a marginal revenue in excess of its

marginal cost clearly acts to increase operating cash flow.

5.

The option to abandon reflects our ability to shut down a project if it is losing money. Since this option acts to

limit losses, we will underestimate NPV if we ignore it.

6.

This is a good example of the option to expand.

7.

It makes wages and salaries a fixed cost, driving up operating leverage.

8.

Fixed costs are relatively high because airlines are relatively capital intensive (and airplanes are expensive).

Skilled employees such as pilots and mechanics mean relatively high wages which, because of union

agreements, are relatively fixed. Maintenance expenses are significant and relatively fixed as well.

9.

With oil, for example, we can simply stop pumping if prices drop too far, and we can do so quickly. The oil

itself is not affected; it just sits in the ground until prices rise to a point where pumping is profitable. Given the

volatility of natural resource prices, the option to suspend output is very valuable.

10. The implication is that they will face hard capital rationing.

11. Euro Disney’s experience illustrates that profitability is everybody’s concern. Finance and marketing are

strongly connected because revenues are the single most important determinant of cash flow and profitability,

and marketing is responsible, in large part, for revenue production. As we have seen in many places, revenue

projections are a key part of many types of financial analysis; such projections are best developed in

cooperation with marketing.

Solutions to Questions and Problems

Basic

1.

a.

b.

c.

Total variable costs = $0.74 + 2.61 = $3.35

Total costs = variable costs + fixed costs = $3.35(300,000) + $610,000 = $1,615,000

QC = $610,000 / ($7.00 – 3.35) = 167,123 units

QA = ($610,000 + 150,000) / ($7.00 – 3.35) = 208,219 units

2.

Total costs = ($10.94 + 32)(140,000) + $800,000 = $6,811,600

Marginal cost = cost of producing one more unit = $42.94

Average cost = total cost/total quantity = $6,811,600/140,000 = $48.65

367

Minimum acceptable total revenue = 10,000($42.94) = $429,400.

Additional units should be produced only if the cost of producing those units can be recovered.

3.

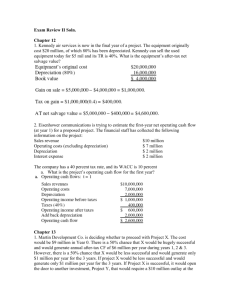

Unit sales

Price/unit

Variable cost/unit

Fixed costs

Scenario

Base

Best

Worst

Unit Sales

90,000

103,500

76,500

Base Case

90,000

$1,850

$160.00

$7,000,000

Lower Bound

76,500

$1,572.50

$136.00

$5,950,000

Unit Price

$1,850

$2,127.50

$1,572.50

Unit

Variable Cost

$160.00

$136.00

$184.00

Upper Bound

103,500

$2,127.50

$184.00

$8,050,000

Fixed Costs

$7,000,000

$5,950,000

$8,050,000

4.

An estimate for the impact of changes in price on the profitability of the project can be found from the

sensitivity of NPV with respect to price: NPV/P. This measure can be calculated by finding the NPV at any

two different price levels and forming the ratio of the changes in these parameters. Whenever a sensitivity

analysis is performed, all other variables are held constant at their base-case values.

5.

a.

b.

c.

D = $924,000/6 = $154,000 per year

QA = ($800,000 + 154,000)/($34 – 19) = 63,600 units

DOL = 1 + FC/OCF = 1 + FC/D = 1 + [$800,000/$154,000] = 6.195

OCFbase = [(P – v)Q – FC](1 – t) + tD

= [($34 – 19)(130,000) – 800,000](0.65) + 0.35($154,000) = $801,400

NPVbase = –$924,000 + $801,400(PVIFA15%,6) = $2,108,884.43

Say Q = 135,000:

OCFnew = [($34 – 19)(135,000) – 800,000](0.65) + 0.35($154,000) = $850,150

NPVnew = –$924,000 + $850,150(PVIFA15%,6) = $2,293,377.96

NPV/S = ($2,293,377.96 – 2,108,884.43)/(135,000 – 130,000) = +$36.8987

If sales were to drop by 500 units, then NPV would drop by $36.8987(500) = $18,449.35

v = $18: OCFnew = [($34 – 18)(130,000) – 800,000](0.65) + 0.35($154,000) = $885,900

OCF/v = ($885,900–801,400 )/($18 – 19) = –$84,500

If variable costs fell by $1 then, OCF would rise by $84,500

6.

OCFbest = {[($34)(1.1) – ($19)(0.9)](130K)(1.1) – 800K(0.9)}(0.65) + 0.35(154K) = $1,472,785

NPVbest = –$924,000 + $1,472,785(PVIFA15%,6) = $4,649,729.34

OCFworst = {[($34)(0.9) – ($19)(1.1)](130K)(0.9) – 800K(1.1)}(0.65) + 0.35(154K) = $219,585

NPVworst = –$924,000 + $219,585(PVIFA15%,6) = –$92,984.37

7.

(1): QC = $16M/($2,000 – 1,675) = 49,231

(2): QC = $60,000/($40 – 32) = 7,500

(3): QC = $500/($7 – 2) = 100

QA = ($16M + 7M)/($2,000 – 1,675) = 70,769

QA = ($60,000 + 150,000)/($40 – 32) = 26,250

QA = ($500 + 420)/($7 – 2) = 184

8.

(1): QA = 125,400 = ($175,000 + D)/($34 – 26)

(2): QA = 140,000 = ($3M + 1.25M)/(P – $50)

(3): QA = 5,263 = ($145,000 + 90,000)/($100 – v)

D = $828,200

P = $80.36

v = $55.35

9.

QA = [$4,000 + ($9,000/3)]/($65 – 33) = 219

NPV = 0 implies $9,000 = OCF(PVIFA16%,3)

QF = ($4,000 + $4,007.32)/($65 – 33) = 250

QC = $4,000/($65 – 33) = 125

OCF = $4,007.32

DOL = 1 + ($4,000/$4,007.32) = 1.998

10. QC = FC/(P–v); 12,000 = $110,000/(P – $20); P = $29.17

QA = (FC+D)/(P–v); 18,000 = ($110,000 + D)/($29.17 – 20); D = $55,060

I = (D)(N); I = 5($55,060) = $275,300

368

OCF = $275,300/(PVIFA18%,5) = $88,034.84

Qf = ($110,000 + 88,034.84)/($29.17 – 20) = 21,596

11. DOL = %OCF/%Q; %OCF = 3[(36,000 – 30,000)/30,000] = 60.00%

The new level of operating leverage is lower since FC/OCF is smaller.

12. DOL = 3 = 1 + $150,000/OCF;

New OCF = $75,000(1.50) = $112,500

OCF = $75,000

New DOL = 1 + ($150,000/$112,500) = 2.333

13. DOL = 1 + ($30,000/$63,000) = 1.47619

%OCF = DOL(%Q) = 1.47619(.042857) = 6.32651%

DOL at 7,300 units = 1 + ($30,000/$66,985.70) = 1.4479

%Q = (7,300 – 7,000)/7,000 = 4.2857%

New OCF = $63,000(1.0632651) = $66,985.70

14. DOL = 3.5 = 1 + FC/OCF; FC = (3.5 – 1)$9,000 = $22,500

%Q = (11,000 – 10,000)/10,000 or (9,000 – 10,000)/10,000 = ±10.0%

%OCF = 3.5(± 10.0%) = ± 35%

OCF at 11,000 units = $9,000(1.35) = $12,150; OCF at 9,000 units = $9,000(0.65) = $5,850

15. DOL at 11,000 units = 1 + $22,500/$12,150 = 2.8519

DOL at 9,000 units = 1 + $22,500/$5,850 = 4.8462

Intermediate

16. a.

b.

c.

IRR = 0%;

IRR = –100%;

IRR = R%;

payback = N years;

payback = Never;

payback < N years;

NPV = I [(1/N)(PVIFAR %,N) – 1]

NPV = – I

NPV = 0

17. OCF @ 110,000 units = [($26 – 18)(110,000) – 185,000](0.66) + 0.34($420,000/3) = $506,300

OCF @ 111,000 units = [($26 – 18)(111,000) – 185,000](0.66) + 0.34($420,000/3) = $511,580

Sensitivity =OCF/Q = ($511,580 – 506,300)/(111,000 – 110,000) = +$5.28

OCF will increase by $5.28 for every additional unit sold.

18. DOL @ 110,000 units = 1 + ($185,000/$506,300) = 1.3654

Qa = [$185,000 + ($420,000/3)]/($26 – 18) = 40,625

DOL @ 40,625 units = 1 + ($185,000/$140,000) = 2.3214

19. a.

b.

c.

d.

20. a.

Sales = 160(1±0.10) = 176, 144; variable costs = $14,000(1±0.10) = $15,400, $12,600

Fixed costs = $150,000(1±0.10) = $165,000, $135,000

OCFbase = [($19,000 – 14,000)(160) – $150,000](0.65) + 0.35($680,000/4) = $482,000

NPVbase = –$680,000 + $482,000(PVIFA15%,4) = $696,099.57

OCFworst = [($19,000 – 15,400)(144) – $165,000](0.65) + 0.35($680,000/4) = $289,210

NPVworst = –$680,000 + $289,210(PVIFA15%,4) = +$145,688.29

OCFbest = [($19,000 – 12,600)(176) – $135,000](0.65) + 0.35($680,000/4) = $703,910

NPVbest = –$680,000 + $703,910(PVIFA15%,4) = $1,329,647.82

Say FC are $160,000:

OCF = [($19,000 – 14,000)(160) – $160,000](0.65) + 0.35($680,000/4) = $475,500

NPV = –$680,000 + $475,500(PVIFA15%,4) = $677,542.21

NPV/FC = ($677,542.21 – 696,099.57)/($160,000 – 150,000) = –1.856

For every dollar FC increase, NPV falls by $1.86.

Qc = $150,000/($19,000 – 14,000) = 30

Qa = [$150,000 + ($680,000/4)]/($19,000 – 14,000) = 64

At this level of output, DOL = 1 + ($150,000/$170,000) = 1.8824

For each 1% increase in unit sales, OCF will increase by 1.8824%.

NPVbase = –$3,500,000 + 840,000(PVIFA16%,10) = $559,911.08

369

b.

c.

21. a.

b.

$2,500,000 = ($140)Q(PVIFA16%,9) ; Q = $2,500,000/[140(4.6065)] = 3,876

Abandon the project if Q < 3,876 units, because NPV(abandonment) > NPV (project CF’s)

The $2,500,000 is the market value of the project. If you continue with the project in one year, you

forego the $2,500,000 that could have been used for something else.

Success: PV future CF’s = $140(7,500)(PVIFA16%,9) = $4,836,871.07

Failure: PV future CF’s = $140(3,500)(PVIFA16%,9) = $2,257,206.50

Expected value of project at year 1 = [($4,836,871.07+2,257,206.50)/2]+840,000= $4,387,039

NPV = –$3,500,000 + (4,387,039)/1.16 = $281,930

If we couldn’t abandon the project, PV future CF’s = $140(3,500)(PVIFA 16%,9) = $2,257,206.50

Gain from option to abandon = $2,500,000 – 2,257,206.50 = $242,793.50

Option is 50% likely to occur: value = (.50)($242,793.50)/1.16 = $104,652.37

22. Success: PV future CF’s = $140(15,000)(PVIFA16%,9) = $9,673,742.14

Failure: from #20, Q = 3,500 < 3,876 so you will abandon the project; PV = $2,500,000

Expected value of project at year 1 = [($9,673,742.14 + 2,500,000)/2] + 840,000 = $6,926,871.07

NPV = –$3,500,000 + (6,926,871.07)/1.16 = $2,471,440.58

If no expansion allowed, PV future CF’s = $140(7,500)(PVIFA16%,9) = $4,836,871.07

Gain from option to expand = $9,673,742.14 – 4,836,871.07 = $4,836,871.07

Option is 50% likely to occur: value =(.50)(4,836,871.07)/1.16 = $2,084,858.22

Challenge

23.

The marketing study and the research and development are both sunk costs and should be ignored.

Sales

New clubs

Exp. clubs

Cheap clubs

Var. costs

New clubs

Exp. clubs

Cheap clubs

$600 50,000 = $30,000,000

$1,000 (– 12,000) = –12,000,000

$300 10,000 =

3,000,000

$21,000,000

$240 50,000 = $12,000,000

$550 (–12,000) = –6,600,000

$100 10,000 = 1,000,000

$6,400,000

The half-year rule has been incorporated into the calculation of the annual CCA.

Year 1

Year 2

Year 3

Sales

$21,000,000

$21,000,000

$21,000,000

Variable costs

6,400,000

6,400,000

6,400,000

Fixed costs

7,000,000

7,000,000

7,000,000

CCA

2,310,000

3,927,000

2,748,900

EBIT

5,290,000

3,673,000

4,851,100

Taxes

2,116,000

1,469,200

1,940,440

Net income

$ 3,174,000

$2,203,800

$2,910,660

To accurately calculate the payback period, we need to estimate the operating cash flows in the first three

years. These can be determined from the relationship:

OCF1 = NI + D = (S – C)(1 – Tc) + D × Tc = $3,174,000 + 2,310,000 = $5,484,000

OCF2 = NI + D = (S – C)(1 – Tc) + D × Tc = $2,203,800 + 3,927,000 = $6,130,800

OCF3 = NI + D = (S – C)(1 – Tc) + D × Tc = $2,910,660 + 2,748,900 = $5,659,560

The initial cost is made up of the cost of the plant and equipment plus the increase in net working capital

= $15.4M + 0.9M = $16.3M

370

Payback period = 2 + 4,685,200/5,659,560 = 2.83 years

To find the NPV and IRR we need the after-tax net revenue each year as well as the present value of the CCA

tax shield and the initial and ending cash flows.

After-tax net revenue year 0 = -$15,400,000 – 900,000 = -$16,300,000

After-tax net revenue years 1-7 = (S – C)(1 – Tc) = ($21,000,000 – 13,400,000)(1 – 0.4) = $4,560,000

Ending cash flows (year 7) = recovery of NWC + salvage value = $900,000 + 2,000,000 = $2,900,000

PV of CCATS = 15,400,000(.3)(.4) x (1 + .5(.14))

.14 + .3

1 + .14

-2,000,000(.3)(.4) x

1

.14 + .3

(1.14) 7

= $3,724,121

NPV = –$16.3M + $4.56M(PVIFA14%,7) + $3,724,121 + $2.9M/1.147 = $8,137,739

To simplify the IRR calculation, it is assumed that CCA tax shield cash flows are as risky as the cash flows for

the company’s overall operations. Accordingly, the appropriate discount rate for these particular cash flows is

the company’s cost of capital. The PV of CCATS is thus the same as for the NPV calculation.

NPV = 0 = –$16.3M + $4.56M(PVIFAIRR%,7) + $3,724,121 + $2.9M/(1 + IRR)7 = 32.17%

A more precise value for the IRR can be obtained using a spreadsheet program like Excel wherein potential

IRR values are input (trial and error) until a solution is obtained. It can be shown that the NPV= 0 when

IRR = 28.944554%.

24.

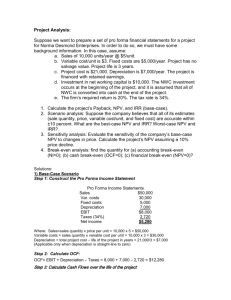

Unit sales (new)

Price (new)

VC (new)

Fixed costs

Sales lost (expensive)

Sales gained (cheap)

Base Case

50,000

$600

$240

$7,000,000

12,000

10,000

Lower Bound

45,000

$540

$216

$6,300,000

10,800

9,000

Best case

Sales

New clubs

Exp. clubs

Cheap clubs

Var. costs

New clubs

Exp. clubs

Cheap clubs

Year 1

Sales

Variable costs

Fixed costs

CCA

$660 55,000 = $36,300,000

$1,000 (–10,800) = – 10,800,000

$300 11,000 =

3,300,000

$28,800,000

$216 55,000 = $11,880,000

$550 (–10,800) = – 5,940,000

$100 11,000 = 1,100,000

$7,040,000

$28,800,000

7,040,000

6,300,000

2,310,000

371

Upper Bound

55,000

$660

$264

$7,700,000

13,200

11,000

EBIT

13,150,000

Taxes

5,260,000

Net income

$ 7,890,000

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax shield

and the initial and ending cash flows. Compared to the previous problem, only the after-tax net revenue for

years 1-7 change.

After-tax net revenue year 0 = -$15,400,000 – 900,000 = -$16,300,000

After-tax net revenue years 1-7 = (S – C)(1 – Tc) = ($28,800,000 – 13,340,000)(1 – 0.4) = $9,276,000

Ending cash flows (year 7) = recovery of NWC + salvage value = $900,000 + 2,000,000 = $2,900,000

PV of CCATS = $3,724,121

NPV = –$16.3M + $9.276M(PVIFA14%,7) + $3,724,121 + $2.9M/1.147 = $28,361,385

Worst case

Sales

New clubs

Exp. clubs

Cheap clubs

Var. costs

New clubs

Exp. clubs

Cheap clubs

$540 45,000 = $24,300,000

$1,000 (– 13,200) = – 13,200,000

$300 9,000 =

2,700,000

$13,800,000

$264 45,000 = $11,880,000

$550 (– 13,200) = – 7,260,000

$100 9,000 =

900,000

$5,520,000

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax shield

and the initial and ending cash flows. Compared to the previous problem, only the after-tax net revenue for

years 1-7 change.

After-tax net revenue year 0 = -$15,400,000 – 900,000 = -$16,300,000

After-tax net revenue years 1-7 = (S – C)(1 – Tc) = ($13,800,000 – 13,220,000)(1 – 0.4) = $348,000

Ending cash flows (year 7) = recovery of NWC + salvage value = $900,000 + 2,000,000 = $2,900,000

PV of CCATS = $3,724,121

NPV = –$16.3M + $0.348M(PVIFA14%,7) + $3,724,121 + $2.9M/1.147 = -$9,924,601

25. Price = $700

Sales

New clubs

Exp. clubs

Cheap clubs

Var. costs

New clubs

Exp. clubs

Cheap clubs

Year 1

Sales

Variable costs

Fixed costs

CCA

$700 50,000 = $35,000,000

$1,000 (– 12,000) = –12,000,000

$300 10,000 =

3,000,000

$26,000,000

$240 50,000 = $12,000,000

$550 (–12,000) = –6,600,000

$100 10,000 = 1,000,000

$6,400,000

$26,000,000

6,400,000

7,000,000

2,310,000

372

EBIT

10,290,000

Taxes

4,116,000

Net income

$ 6,174,000

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax shield

and the initial and ending cash flows. Compared to the previous problem, only the after-tax net revenue for

years 1-7 change.

After-tax net revenue year 0 = -$15,400,000 – 900,000 = -$16,300,000

After-tax net revenue years 1-7 = (S – C)(1 – Tc) = ($26,000,000 – 13,400,000)(1 – 0.4) = $7,560,000

Ending cash flows (year 7) = recovery of NWC + salvage value = $900,000 + 2,000,000 = $2,900,000

PV of CCATS = $3,724,121

NPV = –$16.3M + $7.56M(PVIFA14%,7) + $3,724,121 + $2.9M/1.147 = $21,002,654

NPV/P = ($21,002,654 – 8,137,739)/($700 – 600) = $128,649.15

For every dollar increase (decrease) in the price of the clubs, the NPV increases (decreases) by $128,649.15.

Quantity = 49,000

Sales

New clubs

Exp. clubs

Cheap clubs

Var. costs

New clubs

Exp. clubs

Cheap clubs

Year 1

Sales

Variable costs

Fixed costs

CCA

EBIT

Taxes

Net income

$600 49,000 = $29,400,000

$1,000 (– 2,000) = –12,000,000

$300 10,000 =

3,000,000

$20,400,000

$240 49,000 = $11,760,000

$550 (–12,000) = –6,600,000

$100 10,000 = 1,000,000

$6,160,000

$20,400,000

6,160,000

7,000,000

2,310,000

4,930,000

1,972,000

$ 2,958,000

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax shield

and the initial and ending cash flows. Compared to the previous problem, only the after-tax net revenue for

years 1-7 change.

After-tax net revenue year 0 = -$15,400,000 – 900,000 = -$16,300,000

After-tax net revenue years 1-7 = (S – C)(1 – Tc) = ($20,400,000 – 13,160,000)(1 – 0.4) = $4,344,000

Ending cash flows (year 7) = recovery of NWC + salvage value = $900,000 + 2,000,000 = $2,900,000

PV of CCATS = $3,724,121

NPV = –$16.3M + $4.344M(PVIFA14%,7) + $3,724,121 + $2.9M/1.147 = $7,211,465

NPV/Q = ($7,211,465 – 8,137,739)/(49,000 – 50,000) = $926.27

For an increase (decrease) of one set of clubs sold per year, the NPV increases (decreases) by $926.27.

26. a. From the tax-shield definition of OCF:

OCF = [ (P–v)Q – FC ](1–Tc) + TcD ; (OCF–TcD)/(1–Tc) = (P–v)Q – FC

{FC + [(OCF– Tc D)/(1–Tc)] }/(P–v) = Q

b. Qcf = {$500,000+[– 0.4(700,000)/0.6]}/(40,000–20,000) = 1.67

373

Qacc = {$500,000+[(700,000–700,000(0.4))/0.6]}/(40,000–20,000) = 60

OCFfinc = $3,500,000/PVIFA20%,5 = $1,170,328.96; thus Qfinc = 99.19

c. At the accounting break-even point, net income = 0, so OCF = NI+D = D

Qacc = {FC+[(D–TcD)/(1–Tc)]}/(P–v) = (FC+D)/(P–v) = (FC+OCF)/(P–v)

The tax rate has cancelled out in this case.

27.

DOL = %OCF / %Q = {[(OCF1 – OCF0)/OCF0] / [(Q1 – Q0)/Q0]}

OCF1 = [(P – v)Q1 – FC](1 – Tc) + TcD; OCF0 = [(P – v)Q0 – FC](1 – Tc) + Tc D;

OCF1 – OCF0 = (P – v)(1 – Tc)(Q1 – Q0)

(OCF1 – OCF0)/OCF0 = (P – v)( 1– Tc)(Q1 – Q0) / OCF0 ;

[(OCF1 – OCF0)/OCF0]/[(Q1 – Q0)/Q0] = [(P – v)(1 – Tc)Q0]/OCF0 =

[OCF0 – TcD + FC(1 – Tc)]/OCF0 ;

DOL = 1 + [FC(1 – Tc) – TcD]/OCF0

28. a.

We can calculate the OCF year-by-year, allowing for the half-year rule and a CCA that is calculated on a

declining balance basis.

CCA1 = (1,500,000/2)(.2) = $150,000

CCA2 = (1,350,000)(.2) = $270,000

CCA3 = (1,080,000)(.2) = $216,000

CCA4 = (864,000)(.2) = $172,800

CCA5 = (691,200)(.2) = $138,240

OCF1

OCF2

OCF3

OCF4

OCF5

= [($230 – 200)(35,000) – 300,000](0.62) + 0.38($150,000) = $522,000

= [($230 – 200)(35,000) – 300,000](0.62) + 0.38($270,000) = $567,600

= [($230 – 200)(35,000) – 300,000](0.62) + 0.38($216,000) = $547,080

= [($230 – 200)(35,000) – 300,000](0.62) + 0.38($172,800) = $530,664

= [($230 – 200)(35,000) – 300,000](0.62) + 0.38($138,240) = $517,531

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax

shield and the initial and ending cash flows.

After-tax net revenue year 0 = -$1,500,000 – 450,000 = -$1,950,000

After-tax net revenue years 1-5 = (S – C)(1 – Tc) = ($8,050,000 – 7,300,000)(1 – 0.38) = $465,000

Ending cash flows (year 5) = recovery of NWC + salvage value = $450,000 + 500,000 = $950,000

PV of CCATS = 1,500,000(.2)(.38) x (1 + .5(.13))

.13 + .2

1 + .13

-500,000(.2)(.38) x

1

.13 + .2

(1.13)5

= $263,084.

NPV = –$1,950,000 + $465,000(PVIFA13%,5) + $263,084 + $950,000/1.13 5 = $464,218

b.

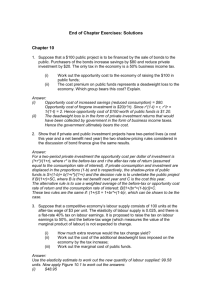

Item

Initial cost ($)

Salvage value ($)

Price ($)

NWC ($)

Base case

1,500,000

500,000

230

450,000

Worst case

1,725,000

425,000

207

472,500

Best case

1,275,000

575,000

253

427,500

CCA1,worst = (1,725,000/2)(.2) = $172,500.

Proceed in the same way to calculate the CCA in each of the remaining 4 years.

OCF1,worst = {[207 – 200](35,000) – 300,000}(0.62) + 0.38($172,500)

374

= $31,450

Proceed in the same way to calculate the OCF in each of the remaining 4 years.

To find the NPV in the worst-case scenario, we need the after-tax net revenue each year as well as the

present value of the CCA tax shield and the initial and ending cash flows based on the worst-case

assumptions.

After-tax net revenue year 0 = -$1,725,000 – 472,500 = -$2,197,500

After-tax net revenue years 1-5 = (S – C)(1 – Tc) = ($7,245,000 – 7,300,000)(1 – 0.38) = -$34,100

Ending cash flows (year 5) = recovery of NWC + salvage value = $472,500 + 425,000 = $897,500

PV of CCATS = 1,725,000(.2)(.38) x (1 + .5(.13))

.13 + .2

1 + .13

-425,000(.2)(.38) x

1

.13 + .2

(1.13)5

= $321,296

NPVworst = –$2,197,500 – $34,100(PVIFA13%,5) + $321,296 + $897,500/1.135 = -$1,509,015

CCA1,best = (1,275,000/2)(.2) = $127,500.

Proceed in the same way to calculate the CCA in each of the remaining 4 years.

OCF1,best = {[253 – 200](35,000) – 300,000}(0.62) + 0.38($127,500)

= $1,012,550

Proceed in the same way to calculate the OCF in each of the remaining 4 years.

To find the NPV in the best-case scenario, we need the after-tax net revenue each year as well as the

present value of the CCA tax shield and the initial and ending cash flows based on the best-case

assumptions.

After-tax net revenue year 0 = -$1,275,000 – 427,500 = -$1,702,500

After-tax net revenue years 1-5 = (S – C)(1 – Tc) = ($8,855,000 – 7,300,000)(1 – 0.38) = $964,100

Ending cash flows (year 5) = recovery of NWC + salvage value = $427,500 + 575,000 = $1,002,500

PV of CCATS = 1,275,000(.2)(.38) x (1 + .5(.13))

.13 + .2

1 + .13

-575,000(.2)(.38) x

1

.13 + .2

(1.13)5

= $204,871

NPVbest = –$1,702,500 + $964,100(PVIFA13%,5) + $204,871 + $1,002,500/1.135 = $2,437,451

29. Q = 36,000: OCF1 = [($230 – 200)(36,000) – 300,000](0.62) + 0.38($150,000) = $540,600

The OCF for each of the remaining four years of the project can be found in the same way.

OCF/Q = ($540,600 – 522,000)/(36,000 – 35,000) = +$18.60

To find the NPV we need the after-tax net revenue each year as well as the present value of the CCA tax shield

and the initial and ending cash flows.

After-tax net revenue year 0 = -$1,500,000 – 450,000 = -$1,950,000

After-tax net revenue years 1-5 = (S – C)(1 – Tc) = ($8,280,000 – 7,500,000)(1 – 0.38) = $483,600

Ending cash flows (year 5) = recovery of NWC + salvage value = $450,000 + 500,000 = $950,000

PV of CCATS = $263,084.

375

NPV = –$1,950,000 + $483,600(PVIFA13%,5) + $263,084 + $950,000/1.13 5 = $529,639

NPV/Q = ($529,639 – 464,218)/(36,000 – 35,000) = +$65.42

You wouldn’t want Q to fall below the point where NPV = 0:

$464,218 = $65.42(Q) ; Q = 7,096; Qmin = 35,000 – 7,096 = 27,904

0 0.38 150,000

OCF - T x D

300 ,000

1 - 0.38

1

T

6,935 .48

30. For year 1: At Qc, OCF1 = 0: Q c

P-v

230 - 200

For year 1: Qa = [$300,000 + $150,000]/($230 – 200); Qa = 15,000

From #29, Qf = 27,904

FC

31. For year 1: DOL1 = 1 + [$300,000(1 – 0.38) – 0.38($150,000)]/ $522,000 = 1.24713

Thus a 1% rise leads to a 1.24713% rise in OCF. If Q rises to 36,000, then

Q = (36,000 – 35,000)/35,000 = 2.857%, so %OCF = 2.857%(1.24713) = 3.563%

From #29, OCF/OCF = ($540,600 – 522,000)/$522,000 = 0.03563

In general, if Q rises by 1 unit, OCF rises by 3.563%.

376