Oligopoly and collusion

advertisement

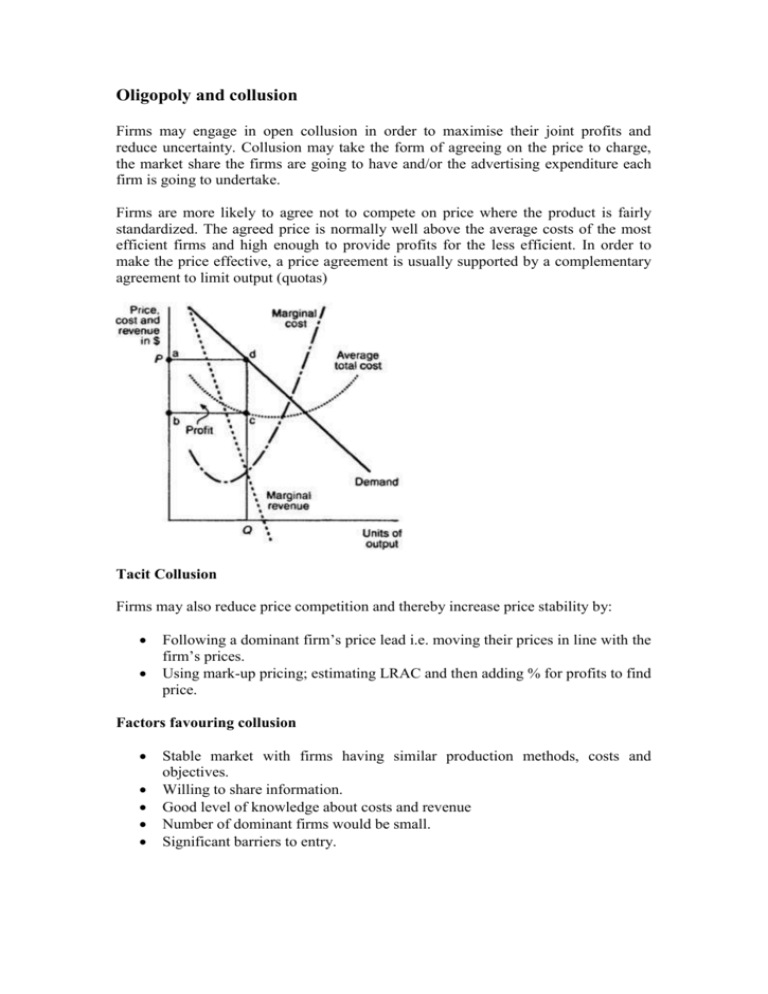

Oligopoly and collusion Firms may engage in open collusion in order to maximise their joint profits and reduce uncertainty. Collusion may take the form of agreeing on the price to charge, the market share the firms are going to have and/or the advertising expenditure each firm is going to undertake. Firms are more likely to agree not to compete on price where the product is fairly standardized. The agreed price is normally well above the average costs of the most efficient firms and high enough to provide profits for the less efficient. In order to make the price effective, a price agreement is usually supported by a complementary agreement to limit output (quotas) Tacit Collusion Firms may also reduce price competition and thereby increase price stability by: Following a dominant firm’s price lead i.e. moving their prices in line with the firm’s prices. Using mark-up pricing; estimating LRAC and then adding % for profits to find price. Factors favouring collusion Stable market with firms having similar production methods, costs and objectives. Willing to share information. Good level of knowledge about costs and revenue Number of dominant firms would be small. Significant barriers to entry. Reasons for collusion breaking down Market conditions change Unpopularity with consumers Risk investigation and penalties Firms cheat on agreement Non-collusive behaviour Firms that do not collude will have to consider carefully other firms’ reactions before changing their prices. May be reluctant to change their price for fear of how rivals may react. Sweezy’s Kinked Demand Curve Elastic part: oligopolist fear that if it raise price, competitors will not follow suit and market share will be lost. Inelastic part: oligopolist believes that if it cuts price his rivals will follow suit and he will gain relatively little in the way of additional sales. A firm may be prepared to undertake a price lowering policy if: It believes its costs are lower than its rivals If it has reserves it can draw on. It can cross subsidize this company with funds from other firms it owns. Game Theory illustrates the tendency for oligpolists to adopt the relatively safe but second best strategy.