A Product's Life Cycle

advertisement

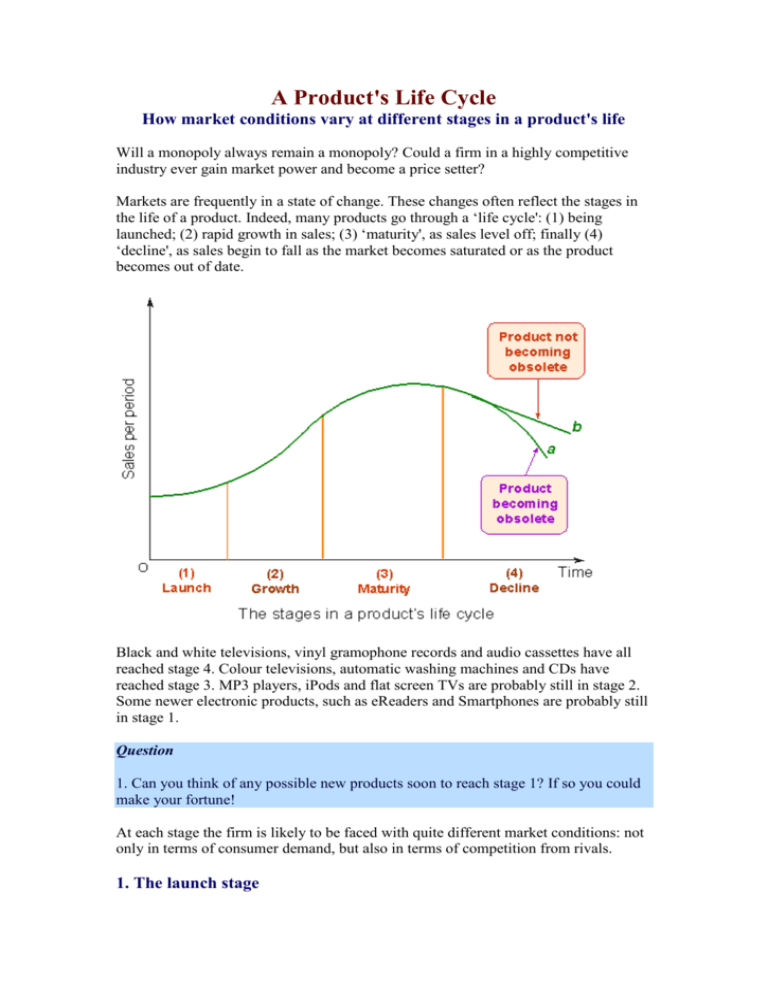

A Product's Life Cycle How market conditions vary at different stages in a product's life Will a monopoly always remain a monopoly? Could a firm in a highly competitive industry ever gain market power and become a price setter? Markets are frequently in a state of change. These changes often reflect the stages in the life of a product. Indeed, many products go through a ‘life cycle': (1) being launched; (2) rapid growth in sales; (3) ‘maturity', as sales level off; finally (4) ‘decline', as sales begin to fall as the market becomes saturated or as the product becomes out of date. Black and white televisions, vinyl gramophone records and audio cassettes have all reached stage 4. Colour televisions, automatic washing machines and CDs have reached stage 3. MP3 players, iPods and flat screen TVs are probably still in stage 2. Some newer electronic products, such as eReaders and Smartphones are probably still in stage 1. Question 1. Can you think of any possible new products soon to reach stage 1? If so you could make your fortune! At each stage the firm is likely to be faced with quite different market conditions: not only in terms of consumer demand, but also in terms of competition from rivals. 1. The launch stage In this stage the firm will probably have a monopoly, (unless there is a simultaneous launch by rivals). Given the lack of substitutes, the firm may be able to charge very high prices and make large profits. This will be especially true if it is a radically new product - like the ball-point pen, the pocket calculator and the home computer were. Such products are likely to have a rapidly expanding and price-inelastic demand. The danger of a high price policy is that the resulting high profits may tempt competitors to break into the industry, even if barriers are quite high. As an alternative, then, the firm may go for maximum ‘market penetration’: keeping the price low to get as many sales and as much brand loyalty as possible, before rivals can become established. Which policy the firm adopts will depend on its assessment of its current price elasticity of demand and the likelihood of an early entry by rivals. 2. The growth stage Unless entry barriers are very high, the rapid growth in sales will attract new firms. The industry becomes oligopolistic. Despite the growth in the number of firms, sales are expanding so rapidly that all firms can increase their sales. Some price competition may emerge, but it is unlikely to be intense at this stage. New entrants may choose to compete in terms of minor product differences while following the price lead set by the original firm. 3. The maturity stage Now the market has grown large there are many firms competing. New firms – or, more likely, firms diversifying across into this market – will be entering to get ‘a piece of the action'. At the same time the growth in sales is slowing down. Competition is now likely to be more intense and collusion may well begin to break down. Pricing policy may become more aggressive as businesses attempt to hold on to their market share. Price wars may break out, only to be followed later by a ‘truce' and a degree of price collusion. It is in this stage particularly that firms may invest considerably in product innovation in order to ‘breathe new life' into old products, especially if there is competition from new types of product. 4. The decline stage Eventually, as the market becomes saturated, or as new superior alternative products are launched, sales will start to fall. For example, once most households had a fridge, the demand for fridges fell back as people simply bought them to replace worn-out ones, or to obtain a more up-to-date one. Initially in this stage, competition is likely to be intense. All sorts of price offers, extended guarantees, better after-sales service, added features, etc, will be introduced as firms seek to maintain their sales. Some firms may be driven out of the market, unable to survive the competition. After a time, however, the level of sales may stop falling. Provided the product has not become obsolete, people still need replacements. This is illustrated by line b in the diagram. The market may thus return to a stable oligopoly with a high degree of tacit price collusion. Alternatively the product becomes obsolete (line a), and sales dry up. Firms will leave the market. It is pointless trying to compete. Questions 2. In what stages of their life cycle are the following products?: Typewriters; satellite navigation systems; coal; clockwork watches; jeans; hybrid cars; bicycles. Why might products have a ‘rebirth'? What would the chart of their life cycle look like? 3. What alternatives are open to a firm which finds its product moving into stage 4? How does this apply to the products listed above that have reached stage 4 or are about to?