MINUTES OF THE SPECIAL MEETING OF THE TRADE POLICY

advertisement

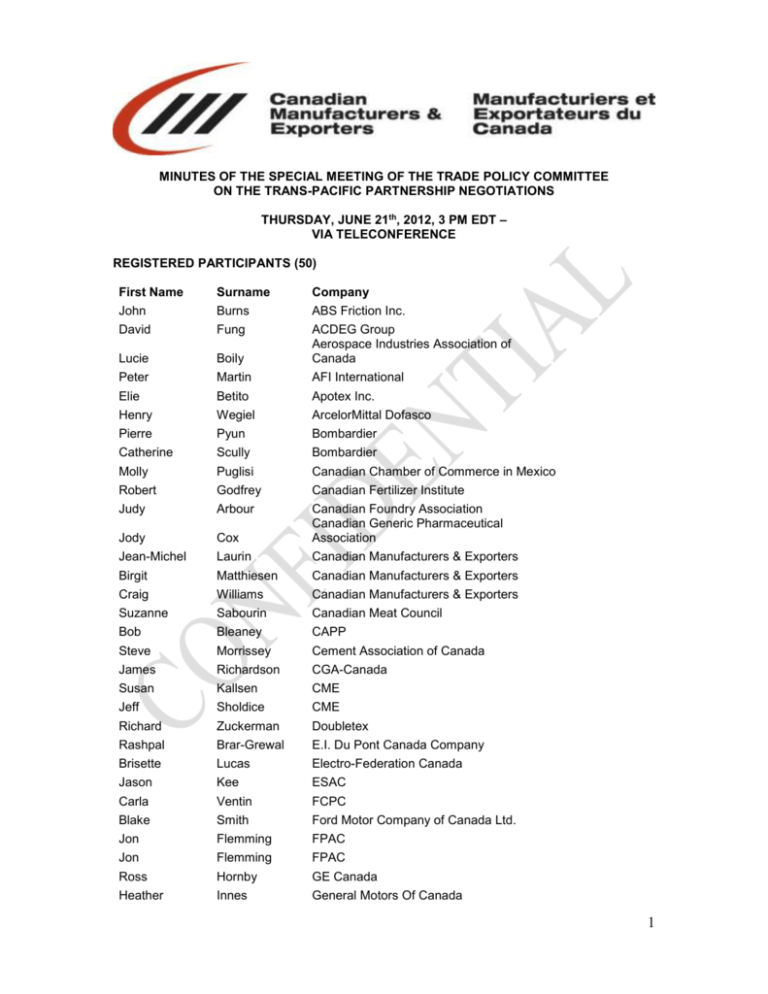

MINUTES OF THE SPECIAL MEETING OF THE TRADE POLICY COMMITTEE ON THE TRANS-PACIFIC PARTNERSHIP NEGOTIATIONS THURSDAY, JUNE 21th, 2012, 3 PM EDT – VIA TELECONFERENCE REGISTERED PARTICIPANTS (50) First Name Surname Company John Burns ABS Friction Inc. David Fung Lucie Boily ACDEG Group Aerospace Industries Association of Canada Peter Martin AFI International Elie Betito Apotex Inc. Henry Wegiel ArcelorMittal Dofasco Pierre Pyun Bombardier Catherine Scully Bombardier Molly Puglisi Canadian Chamber of Commerce in Mexico Robert Godfrey Canadian Fertilizer Institute Judy Arbour Jody Cox Canadian Foundry Association Canadian Generic Pharmaceutical Association Jean-Michel Laurin Canadian Manufacturers & Exporters Birgit Matthiesen Canadian Manufacturers & Exporters Craig Williams Canadian Manufacturers & Exporters Suzanne Sabourin Canadian Meat Council Bob Bleaney CAPP Steve Morrissey Cement Association of Canada James Richardson CGA-Canada Susan Kallsen CME Jeff Sholdice CME Richard Zuckerman Doubletex Rashpal Brar-Grewal E.I. Du Pont Canada Company Brisette Lucas Electro-Federation Canada Jason Kee ESAC Carla Ventin FCPC Blake Smith Ford Motor Company of Canada Ltd. Jon Flemming FPAC Jon Flemming FPAC Ross Hornby GE Canada Heather Innes General Motors Of Canada 1 Jason Easton General Motors of Canada Ltd Larry Martin George Morris Centre gord garner GPA on behalf of Kraft Canada Alison Winsor Halifax Port Authority Paul Brown INVISTA (Canada) Company Ves Sobot IPEX Management Inc Barry Sutton Maple Leaf Foods Brendan Marshall Mining Association of Canada Steven Hogue Pfizer Canada Richard Bertrand Pratt & Whitney Canada Ron Morrison RC Management Terry Plummer RMS - Ross Corporation Rocco Delvecchio Siemens Canada Limited Bob Blackburn SNC-Lavalin International Howard Mains Tactix Public Affairs Kathleen Black The Coca-Cola Company Christian Dube Trillium Medical Technology Association Adam McEniry Vale Dave Johns Winpak Ltd. SPEAKERS/GUESTS (2) Linda Menghetti Emergency Committee for American Trade US Business Coalition for TPP Jayson Myers Canadian Manufacturers & Exporters 1) Introduction Jayson Myers, President & CEO of CME opened the call, welcomed participants and made the following comments: This week’s announcement that Canada and Mexico are now part of TPP is great news for several reasons: The TPP might very well set the standard for how international trade agreements will be negotiated in the future; Can’t run the risk of lessening the benefits of NAFTA now that the US and Mexico are engaged in this major trade initiative; Canada being at the table will ensure the interests of manufacturers with integrated cross-border supply chains are taken into account, and will ultimately benefit from what might become the main vehicle for further trade liberalization in the Asia-Pacific region; and TPP an opportunity to go beyond our NAFTA commitments with the US and Mexico. Thanks to CME members and association partners in Canada, the US and Mexico for their direct efforts making the case for Canada’s inclusion and the building of a stronger North American economy, and for supporting CME’s efforts. CME also expressed its thanks and congratulations to PM Harper, Minister Fast, and officials who’ve helped secure a seat for Canada. Now our real work begins. It’s now up to us to make sure Canada walks the talk when it comes to its level of ambition in TPP. 2 We’re pleased to have Linda Menghetti from ECAT on the call - ECAT has been acting as the Secretariat for the US Business Coalition for TPP. We can’t think of someone better than Linda to bring everyone here up to speed on the status of the negotiations and what US businesses have been trying to accomplish through TPP. 2) Status of Canada’s inclusion in TPP Jean Michel Laurin, Vice President, Global Business Policy for CME briefed participants on the status of Canada’s inclusion in TPP and made the following comments: Tuesday it was announced that all the partners in TPP support Canada joining the negotiations so we now have an invitation to join TPP. Each country now has to follow its own domestic process before it can enter into negotiations with Canada. In most countries this is not an issue – for example Australia and New Zealand just need to notify their Parliament. In the US, the Administration follows the practice (set under fast track even through US Admin doesn’t have fast track authority) of providing a 90-day notification to US Congress. Congress has 3 months to consider and then give a yes or no answer – Congress could ask that limits or restrictions be imposed, so our advocacy efforts in the US aren’t over and must now focus on Congress. Now the question that’s on everyone’s mind is: under what conditions were Canada and Mexico asked to join TPP? We know that Tuesday’s announcement happened as a result of intense negotiations in the preceding days. Canada and Mexico were made an offer that Mexico accepted – Canada renegotiated the language. Two issues have been reported – one is agreeing to what was already agreed by the nine countries – the other more contentious issue concerns whether Canada can veto commitments made in the coming months before it has seat at the table. One of the concerns the current nine parties had expressed is they don’t want new entrants to delay negotiations. They wanted assurances that new entrants were fine with their approach in dealing with key negotiating chapters. Also that they were fine with the existing list of chapters. The only chapter that has been closed so far is the non-controversial SME chapter so a lot of the work remains to be done. We understand PMO, Minister Fast’s office and top trade negotiators know these conditions and are having discussions on this issue. They won’t share much information at this point – this is politically sensitive and I believe they also need to coordinate with the US on messaging. We’ll communicate those details to CME members as soon as possible. 3) Status of TPP negotiations and key issues for US Business Coalition for TPP Linda Menghetti, Vice President at the Emergency Committee for American Trade briefed participants on the status of the TPP negotiations ahead of the upcoming 13th round of the negotiations, and the priority issues for the US business community. She made the following comments: On process: Earlier this year the US Trade Representative said he wanted the negotiations to conclude by December 2012. US business supports the rapid conclusion of negotiations as they don’t want TPP to become the next Doha or FTAA. US business is very welcoming of Canada and Mexico as it will help achieve more ambitious results. The next rounds of negotiations are scheduled for July 2-10 in San Diego and in September (timing and location TBC). Canada and Mexico won’t be at there at least for July. The 13th round in San Diego will focus on closing more negotiating chapters. The SME chapter is the only one currently closed. Less controversial chapters will be dealt with in San Diego. The US might want to wait before dealing with more contentious ones such as the SPS (Sanitary and phytosanitary standards) chapter since having Canada on board defending a similar position would help strengthen the US position. 3 TPP is called a 21st century agreement because it seeks to address a wider range of trade barriers than traditional FTAs. It is a huge priority for the US business community seeking more market liberalization as it is the only active US trade negotiation. Negotiating priorities for US business A comprehensive agreement on market access and core rules. No major products/rules should be left off the table. USTR does not want to reopen market access with the four (now six with Canada and Mexico) countries with whom it already has an FTA. For example, the US doesn’t want to open its sugar market to Australia (this was left out of their bilateral FTA). TPP therefore currently has a multilateral and bilateral tariff schedules on market access. US business has a different view and would like to have those agreements expanded to areas where the US has sensitivities. On trade facilitation, the KORUS (Korea-US Free Trade Agreement) is a model that TPP seeks to improve on. On supply chain, the objective is to have metrics in place to measure progress made so that products can move more quickly and efficiently, that standards can be met more easily, etc. On regulatory cooperation, some areas such as wine and medical devices will have specific annexes at the end of the agreement, but at the moment little is being done on regulatory coherence. The goal here is to have all countries adopt a transparent regulatory process where stakeholders can participate in the regulatory policymaking process. On intellectual property protection, this is an area of high importance and interest to the technology, scientific, food, industrial goods, content and videogame industries. The US is in a difficult position as it is asking for a strong IP chapter. KORUS is the model the US would like to replicate in TPP. The TPP Coalition is very active on this front. Some TPP countries don’t share the same view on copyright protection and data protection for pharmaceutical products. This chapter is the one with the most unresolved issues, and there are many questions concerning Canada’s approach on these issues, especially on copyright. On investment, the TPP uses a negative list approach that allows countries to take specific exceptions. Trade deals negotiated since NAFTA have tended to favour governments more than NAFTA’s Chapter 11 does. The US is pursuing Investor-State in TPP but it is a contentious issue with some TPP members. On procurement, the TPP Coalition is seeking the same outcome as the US-Australia FTA. On Rules-of-Origin, the TPP Coalition is promoting rules that will simplify compliance. Finally all partners in TPP want this to be a living agreement – it will not be able to deal with all issues on regulatory coherence and supply chain, so will have to be revisited and improved as time passes. Questions and Answers Q: Since the US Administration does not have fast track authority, is there a chance that when TPP goes to Congress for approval it might want to reopen the agreement, especially if it deals with sensitive issues such as agricultural subsidies? A: US business is hoping the Administration will have Trade Promotion Authority after the 2013 election. The last time it was granted, it was difficult for US business to say why it mattered – this wouldn’t be the case now with TPP being finalized. Q: Would Canada be allowed to be an observer in the coming negotiating rounds? A: There have never been observers in TPP. There is no observer status but Canada and Mexico are currently in a unique position so a precedent could be set. Q: Does TPP deal with the movement of business people? A: Most countries in TPP want to put this issue on the table except the US – the US Judiciary Commission does not want immigration issues on the table. US business strongly supports dealing with the movement of people but this won’t get traction before the November election. Q: Was Japan invited? Did they simply not accept the conditions set for new entrants? A: The word is that Japan didn’t officially request to join TPP. The reality is that Japan has to deal with a range of domestic issues and would have to do more than anyone else to open up their 4 markets. These are tough issues to deal with domestically. Some in the US like auto industry said didn’t want to have Japan in. ECAT wants to see them in only if they put everything on the table. Q: Which conditions did Canada have to accept to join TPP? A: We heard from USTR that conditions for new entrants are that they don’t slow down the negotiations, and don’t ask to reopen issues that had already been dealt with. Q: What is being pursued on IP for pharmaceuticals and where do things stand? A: A starting point for the US is the language in the IP chapter of KORUS. On the USTR website they also have a paper on IP for pharmaceuticals that provides more information. Some of the issues include data protection for biologics. What US business expects is that IP protection applies to other countries – in many countries they have good IP rules but weak data protection or marketing approval rules. Q: We heard that is in the cases where two TPP members also have a bilateral FTA, the two countries would be free to decide whether to apply TPP or the bilateral agreement (e.g. NAFTA). Is this true? A: This is an ongoing issue. US business wants to see the more liberalizing agreement take precedence. This issue won’t be resolved until everything is finalized. Q: How can the US pursue its objectives to open access to dairy in Canada if they are not willing to provide expanded market access in their own sensitive areas? Are those who stand to lose louder than those who stand to win? What kind of political impetus is there behind TPP? A: There is broad support from the US Business community. Having Canada and Mexico at the table will help enhance that. Some sectors won’t be interested before Japan’s invited to join the negotiations. Some sectors and labour unions are strongly opposed to TPP Q: Will antidumping rules be included in TPP? A: The US never included antidumping in any of its FTAs outside of the WTO, except for NAFTA Chapter 11. Dispute settlement has been discussed but again KORUS should be seen as the basis of what the US is pursuing. One objective is to ensure that State-Owned Entreprises don’t distort the market – there are still many questions about what this actually means. 4) Closing remarks Jean Michel Laurin thanked Linda Menghetti for her remarks, and all participants for joining the call. He mentioned that with this call today CME is starting to turn its attention to defining a common agenda for Canadian businesses and ensuring we can hit the ground running once Canada formally has a seat at the negotiating table. CME looks forward to continuing to work with members to ensure Canada’s participation in TPP delivers tangible benefits to Canadian manufacturers and exporters. CME’s work in the coming weeks and months will focus on advocating for Canada’s inclusion with US Congress, defining a common agenda and set of common negotiating objectives for Canadian business, and coordinating our approach with government. 5) Adjournment There being no further items of discussion, the meeting was adjourned at 4:10 pm EDT. 5