Crenshawplanning.doc

advertisement

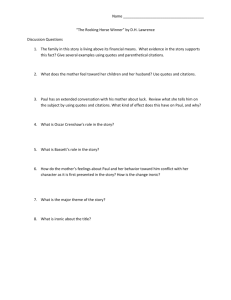

Crenshaw ToolMaster Hardware Analysis of Performance and Pro Forma Business Planning A Mini-Case Analysis By Steven C. Isberg, Ph.D January 2003 Overview In January 1999, Bill Crenshaw decided to open a hardware store in his hometown of Jacksonville, Florida. Mr. Crenshaw had developed experience in operating a hardware store when he was assistant manager of an Ace Hardware store for five years after graduating from college. He began his work by conducting a personal survey of hardware stores in and around the Jacksonville area, completing a map showing all existing store locations. Based on his study of the map, he identified three areas in which there appeared to be a need for more stores. One of the areas had a prime location available in an established shopping center directly across from an access ramp for the local interstate, I-10. After identifying these three locations, Mr. Crenshaw contacted representatives of four major national hardware store co-operatives, Ace, TruServ, HWI-Do It, and ToolMaster (the coops). The coops are associations of members who combine for the purposes of increasing their buying power. This enables them to more effectively compete with operations such as The Home Depot and Lowes, who operate under a warehouse retailing concept. Coop members typically do not stock lumber and building supplies such as concrete in large quantities, as would a Home Depot, but they carry complete lines of tools, hardware and lawn and garden supplies. The coops also assist their members in obtaining lower cost financing for their business operations, and provide support in the form of promotion and advertising programs. Mr. Crenshaw obtained market studies and proposals from all four coops, and he decided to join the ToolMaster group based on the attractiveness of the entire package. The sales, profit and advertising budget, along with some industry benchmarking information, are included in Exhibit 1 of the attachments. Background on the Retail Hardware Industry Historically, the retail hardware industry had been composed of smaller “mom and pop” stores and coop members. The popularity of the warehouse retailing concepts developed in the 1970’s and 80’s brought new entry into the industry in the form of larger operations such as Home Depot and Lowe’s. Taking advantage of their size, these warehouse retailers were able to offer broader selections of tools and other hardware and lumber products at lower prices than their smaller competitors. Entry of these larger providers put pressure on the smaller operations, and as a result, many of the “mom and pop’s” began to close. Pressure was also felt by the coops, who found it hard to compete with the larger operations in spite of the buying power they had established. In addition to its broad selection and price leadership, The Home Depot offered a customer service feature as well, which had been the competitive advantage of the smaller operations. By the end of the 1990’s many of the coops had merged or ceased operations as the warehouse retailers increased their market shares. Given the level of competition in the industry, smaller retailers and coop members have looked to develop niches in the form of special customer services, limited local competition, rental departments and/or service to unique customer groups. While the coops still rely upon customer service as a key differentiating feature, larger operations such as The Home Depot were leveling the playing field in that area. Crenshaw ToolMaster Hardware’s Entry Strategy There were two elements to Bill Crenshaw’s entry strategy. First, the chosen location for his retail store was in a “fringe” neighborhood served by relatively fewer other providers. The nearest Home Depot was over six miles away, and there were no other stores within the three and one half-mile radius considered to be the competitive zone. Second, Mr. Crenshaw spent the majority of the later part of 1999 soliciting commercial business from local companies and government agencies. He had been successful in landing several large commercial accounts that would be ready to do business when he opened on or about 1 January 2000. There were both good and bad features to his choice of a location. The shopping plaza, Bragg Center, was conveniently located near the I-10 interchange, making it easy for both retail and commercial customers to access the store. The negative aspect of the location was that it was in the center of a lower middle to lower class neighborhood where there had been a decline in the population over the previous five years. Studies had shown that the likelihood of success increased if population in the local area was rising rather than declining. Business planners typically looked for 2-4% population growth over the five years prior to opening. Population in the area around Bragg Plaza had been contracting at a rate of 3% over the five years prior to opening. There were, however, plans to build several new residence complexes in the area, and Mr. Crenshaw felt that this would restore population growth to the area. Opening the Store Mr. Crenshaw was able to secure an “interest only” line of credit to fund the purchase of initial inventory and other needed items. The initial level of this line was $200,000, but the lender agreed to increase it annually depending upon Crenshaw’s sales and profit performance. As part of the coop, Crenshaw was also able to purchase inventory on account with fairly generous terms. The credit period was a full 60 days. He also invested substantial equity capital of his own, and secured equity contributions from several different family members, retaining 85% ownership of the company for himself. For tax purposes, the company was structured as a Subchapter S Corporation, meaning that the company itself did not pay taxes. Taxes were assessed on any funds taken out of the business as either salary or dividends by Mr. Crenshaw and the other owners. Crenshaw ToolMaster Hardware opened for business on 2 January 2000. Mr. Crenshaw continued to add inventory until he reached the target opening level of $240,000, in early May. After May, most of his additions to inventory were to replace units sold. To manage inventory, Mr. Crenshaw installed a point of sale (POS) computer operating system. As inventory was received, SKU numbers and cost values were inputted into the system. As items were scanned at checkout, the system determined the sale price by reading the SKU number and applying a preset mark-up to provide a target gross profit margin. Target gross profit margins varied by product class. Some margins were as high as 400% on smaller items (e.g., plumbing parts). For larger items where customers were more price-conscious, gross profit margins were lower. Performance for the First Year Crenshaw did not meet its projected sales goals and ended up with a negative net income for its first year of operation. About 50% of its sales were from its commercial customers, who paid on account. The rest were cash and credit card sales, in which the latter cleared almost immediately. The income statement and balance sheets showing the results are included in Exhibit 2. As a result of Crenshaw’s performance, the credit line provider allowed an increase of only $50,000 in the credit line for the year 2001, and the interest rate would increase to 12.50%. If Crenshaw moved closer to its sales goals and made profits in 2001, the increase would continue annually thereafter. Mr. Crenshaw signed a ten-year lease on his store space. The lease provides for annual increases of 3% in the rent payments. You have been called in by the Jacksonville Chamber of Commerce to serve as a consultant to Mr. Crenshaw to help him properly manage and grow his business. In this capacity, you are to complete the following tasks: 1. 2. 3. Conduct an analysis of the business situation and financial statements, determining the main reasons for Crenshaw’s failure to meet sales goals and make a profit. Create a four-year pro forma forecast assuming that the problems you have identified can be corrected. Show how much additional external funding is required to operate the business for the next four years. Write a brief (two page max.) memo summarizing your findings and making appropriate recommendations to Mr. Crenshaw. Include your ratios and forecasts as exhibits in the form of attachments to the memo.