Lecture 1

advertisement

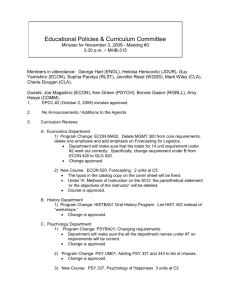

EC 201 Cal Poly Pomona Dr. Bresnock Lecture 1 What is Economics? Here are a couple of definitions. It is a social science concerned with the efficient use of limited, or scarce, resources to achieve maximum satisfaction of human material wants. (typical texts) An analysis of choice making. (Bresnock) What is ECON 201? ECON 201 introduces you to what economists call “the economic way of thinking”. This is the logic of incentives -- benefits and costs -- that economist use every day to understand the millions of decisions consumers, business, and governments make. The goal of Economics A170 is to provide this basic framework of incentives, and help you practice and understand it. Understanding the basic logic of economic incentives at the level of the individual decision maker will help you enormously in learning economics in all future courses. Fundamental Economic Problem Unlimited Wants Demands vs Limited Resources > Supplies Scarcities Consumer Decision – maximizing satisfaction given their limited income, or budget. Producer Decision – maximizing profit given their limited resources. Government Decision – maximizing net benefits to society given limited budgets. Private Sector = Consumers + Producers + Public Sector = All Levels of Government Mixed Market Economy , i.e. U.S. Types of Economies Transitional Economies – Eastern Europe, China Pure Market (Capitalism) Hong Kong, Singapore, Australia, Ireland, New Zealand, U.S, Canada, Denmark, Switzerland, U.K. Pure Command (Communism) North Korea, Zimbabwe, Cuba, Myanmar (Burma), Eritrea, Venezuela, Congo, Libya ECON 201 Lecture 1 Dr. Bresnock Pure Market – private property rights and decentralized decision making coordinated through markets. Pure Command – state ownership and control of economic resources and central planning. Resources – also known as inputs. An input is also referred to as a “factor of production” if it earns income over and over again, i.e. labor and capital equipment are used repeatedly in production whereas other inputs, i.e. electricity, cloth, are used only once. I. Human Resources A. Labor – many types. See “occupational triangle” below. Notice that there are more plentiful workers in the unskilled category. Consequently the wage for those workers will be quite low. At the top of the triangle there are far fewer workers in the “G” (short for genius or someone with unique talents), and such persons receive rather high salaries. “M & P” represents managers and other professional persons. G M&P Skilled Semi-Skilled Unskilled Note also that the Human Capital of the workers increases greatly as the workers move higher on the occupational triangle. Human capital is a measure of the workers education, training and skills. B. II. Entrepreneur – creative genius, the person or persons who put together all of the production inputs and produce a marketable product. Non-Human Resources A. Capital – tools, equipment, aka “investment goods”. Not stocks and bonds (which are financial capital), and not money. (Financial resources are used to purchase physical productive inputs; they are a medium of exchange not a productive input.) 2 ECON 201 Lecture 1 B. Dr. Bresnock Land -- “Natural Capital”. Environmental and natural resource endowment, i.e. air and water resources, forests, fish, minerals and materials, energy resources, species, agricultural products, land. Consumer Goods and Services 1. 2. 3. Durable Goods – i.e. TVs, cars, washing machines, refrigerators, stoves, furniture; relatively stable expenditure pattern over last 70 years. Non-Durable Goods – i.e. food, clothing, small appliances, cleaning products, footwear, beverages; decrease in expenditure pattern over last 70 years. Services – i.e. dental work, manicures, car repairs, child care, health care, laundering, home repairs; increase in expenditure pattern over last 70 years. Public Goods and Services 1. 2. Pure Public –goods and services only produced by government, i.e. national defense, lighthouses, Quasi-Public -- goods and services produced in part by government and in part by the private sector, i.e. education, housing, medical care, Key Microeconomic Questions 1. What to Produce? How are finite resources allocated to satisfy infinite societal wants/demands? Choices made by consumers, firms, and government. These choices are constrained by either limited monetary budgets or physical resources. 2. How to Produce? Efficiency goal. The way the market economy manages to use the power of self-interest for the good of society (aka “invisible hand concept” A. Productive, or Technical Efficiency – achievement of maximum output with full usage of all inputs at lowest production cost. Focuses on physical efficiency. B. 3. Allocative Efficiency – production of the combination of goods and services that people prefer given their income. Focuses on market analysis. Goods and services are produced up to the point where the marginal benefit to consumers is equal to the marginal cost of producing them. How to Distribute? Equity, or fairness, goal. But who determines what is fair? Distribution of goods and services depends on the distribution of income. Those with more income receive a larger share of goods and services in general. Positive vs. Factual What is, Was, or will be Empirical analysis Normative Analysis Subjective What should or ought to be Intrusion of value judgment 3 ECON 201 Lecture 1 Dr. Bresnock Micro vs. Macroeconomics Microeconomics analyses the behavior of specific economic units, i.e. how does an individual consumer decide how to spend his/her income, how does a business firm determine what to produce. Macroeconomics analyzes the behavior of an entire economic system, i.e. aggregate economic analysis, study of U.S. economy as a whole Key Macroeconomic Issues A. B. C. Stable Prices – low inflation Full Employment – low unemployment Sustainable Economic Growth – that is consistent with low inflation and low unemployment (Real GDP on vertical axis in %) 4 ECON 201 Lecture 1 Dr. Bresnock United States Economic Growth 2.3% 14,000.0 3.1% 12,000.0 3.1% 10,000.0 3.3% 8,000.0 4.4% 6,000.0 4,000.0 2,000.0 3.26% 0.0 1959 1964 1969 1974 1979 1984 1989 1994 1999 2004 Unemployment (vertical axis in %) appears below. 5 ECON 201 Lecture 1 Dr. Bresnock 6 ECON 201 Lecture 1 Dr. Bresnock Unemployment Data Data on unemployment rates from the BLS for August 2010, 2012, 2013 and 2014, provided the following data for the top and bottom states ranked by unemployment rate. Top 5 2010 2012 Nevada Michigan California Rhode Island Florida D.C. Illinois Kentucky Mississippi 14.4% 12.7% 13.1% 9.0% 12.4% 10.9% 11.8% 10.9% 11.7% 9.9% 9.9% 2013 2014 Bottom 5 2010 2012 2013 2014 9.5% 9.0% 8.9% 9.1% 8.5% 7.7% 8.0% 9.0% 3.7% 4.5% 4.6% 5.7% 6.0% 3.2% 4.2% 4.0% 5.2% 5.0% 8.7% 9.2% 7.4% 8.7% 7.8% 7.4% North Dakota South Dakota Nebraska New Hampshire Vermont Wyoming Hawaii Iowa Louisiana Utah 3.0% 3.8% 4.2% 5.0% 4.6% 4.6% 4.3% 2.6% 3.6% 3.6% 4.7% 3.7% 4.2% 4.6% 4.4% 4.5% 3.9% The top 10 unemployment rates for metro areas (BLS, 2010, 2012, and 2013) are: El Centro, CA Yuma, AZ Yuba City, CA Merced, CA Modesto, CA 2010 2012 2013 30.3% 26.4% 26.1% 28.7% 24.5% 34.5% 19.0% 18.8% 14.0% 18.9% 19.5% 14.6% 17.6% 16.9% 12.9% Stockton, CA Visalia-Porterville, CA Fresno, CA Chico, CA Bakersfield-Delano, CA Hanlon-Corcoran, CA 2010 17.4% 16.9% 16.2% 16.0% 16.0% 2012 16.6% 17.3% 16.9% 13.7% 15.0% 16.9% 2013 12.8% 13.8% 12.5% 10.8% 11.6% 12.6% much further down the list are: Riverside-San Bernardino-Ontario, CA Las Vegas-Paradise, NV LA-Long Beach-Santa Ana, CA Oxnard-Thousand Oaks-Ventura, CA SF-Oakland-Fremont, CA San Diego-Carlsbad-San Marcos, CA San Jose-Sunnyvale-Santa Clara, CA Santa Rosa-Petaluma, CA San Luis Obispo–Paso Robles, CA 2010 15.1% 14.8% 12.5% 11.3% 10.8 % 10.8% 2012 12.4% 13.1% 11.0% 9.7% 8.7% 9.3% 2013 11.0% 9.7% 9.8% 8.0% 6.9% 7.8% 7.2% 7.1% 6.9% County Unemployment from the CA Employment Development Department (EDD) appears below as of August 2010, 2012, and 2013. (Note: EDD also reports on the % change in employment for 2006 to 2016 for the occupations that are forecast to have the fastest job growth by area.) Los Angeles Orange Ventura San Bernardino Riverside San Diego 2010 13.0% 9.6% 11.2% 14.2% 15.3% 10.6% 2012 12.1% 8.0% 9.6% 12.3% 12.6% 9.3% 2013 10.1% 6.2% 7.8% 10.4% 10.4% 7.4% 7 ECON 201 Lecture 1 Dr. Bresnock (Also see the attached figure and link that gives recent trends in California and U.S. unemployment rates up to July 2014.) Go to: http://www.calmis.ca.gov/file/lfmonth/calmr.pdf This site update the data above through July 2014. As of July 2014 the CA unemployment rate was 7.4% while the U.S. unemployment rate was at 6.2%. The following tables give rankings of full-time average annual earnings for the top ranked occupations in selected years. 8 ECON 201 Lecture 1 Dr. Bresnock Table 1. Twelve high-paying full-time(1) occupations that were ranked in the top 20 in 1997 and 2005, percent change in earnings, National Compensation Survey 2005 data Hourly earnings(2) Occupation (1997 data) 1997 ranking Occupation (2005 data) 2005 Relative ranking Mean error(3) Mean weekly hours Percent change 19972005 Airplane pilots and navigators 1 Airplane pilots and navigators 1 $97.51 13.0 23.5 51.3 Law teachers 2 Economics teachers 2 66.23 19.2 42.8 30.4 Chief executives and general administrators, public administration 3 Judges 3 61.38 11.1 39.8 44.0 Economics teachers 4 Physicians 4 61.34 11.0 41.9 63.6 Judges 6 Agriculture and forestry teachers 6 55.12 23.5 34.6 31.4 Agriculture and forestry teachers 7 Law teachers 7 55.10 15.3 38.9 -6.1 Physics teachers 8 Physics teachers 8 53.20 8.5 38.7 31.7 Medical science teachers 11 Chief executives and general administrators, public administration 10 52.11 6.3 42.8 1.9 Physicians 12 Medical science teachers 11 51.79 10.2 45.7 34.4 Dentists 14 Lawyers 12 50.89 4.9 41.5 46.8 Managers, marketing, advertising, and public relations 18 Dentists 14 46.30 11.0 41.3 26.1 19 Managers, marketing, advertising, and public relations 17 45.33 4.2 41.2 Lawyers 30.0 Source: Changes in Occupational Ranking and Hourly Earnings, 1997-2005 by John E. Buckley, Bureau of Labor Statistics, August 29, 2007. The table on the next page appears in "Ranking of Full-time Civilian Occupations by Hourly and Annual Earnings, July 2009 by John E. Buckley (Bureau of Labor Statistics, p. 2) and gives the top ranked occupations by annual earnings for 2009. This report also includes the rankings of the bottom occupations. 9 ECON 201 Lecture 1 Dr. Bresnock Hourly Earnings Rank (4) Annual Earnings Rank (4) 3 1 1 Annual Earnings (Mean) Average Annual Hours Obstetricians and gynecologists $279,635 2,637 2 Anesthesiologists 271,264 2,400 6 3 Chief executives 192,780 2,271 5 4 Internists, general 181,081 2,009 4 6 Law teachers, postsecondary 152,540 2,119 8 7 Psychiatrists 149,866 1,981 9 8 Dentists, general 145,458 2,049 18 9 Pediatricians, general 126,955 2,240 2 10 Airline pilots, copilots, and flight engineers 125,431 1,110 10 11 Health specialties teachers, postsecondary 124,357 1,805 15 12 Engineering managers 120,429 2,117 20 13 Lawyers 118,241 2,123 26 14 Economists 114,498 2,145 24 15 Computer and Info. system managers 114,064 2,089 16 Securities, commodities, and financial services sales agents 114,064 2,089 25 17 Computer and information scientits, research 113,901 2,106 17 18 Physicists 113,817 2,007 16 19 Judges, magistrate judges, and magistrates 109,842 1,935 27 20 Petroleum engineers 109,635 2,074 23 Occupation 10