2.3.1a Monster Life Cycle.doc

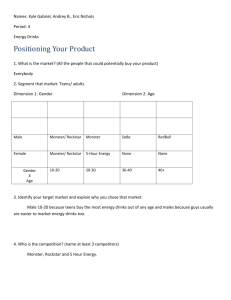

advertisement

Monster Life Cycle The market for energy drinks is dominated by Red Bull. First launched in 1987, its UK sales have grown steadily to reach £234 million in 2012. With the market for energy drinks still rising at 10-15% per year, many other companies are determined to take their share of this success. The attractions are obvious. Not only are sales rising faster than for soft drinks as a whole, but the price per litre is much higher. On December 30th 2012, Tesco charged 49p for a 330ml can of Coca-Cola and £1.58 for 330ml of Red Bull. As the Coca-Cola Company observed the growth of Red Bull during the ‘noughties’, it resolved to launch its own rivals. First came ‘Relentless’ in late 2006, which received its first serious promotional push by being given away at the 2007 Reading and Leeds Music Festivals. Since then it has focused on sponsoring ‘extreme’ sports. As shown in the graph below, Relentless has achieved significant sales, though sales slipped back in 2012 (from £60.3m to £59.3m). Perhaps sensing that Relentless was not the answer, in 2010 Coca-Cola took over the distribution of a U.S. energy drink called Monster. The brand holds a 35% share of the $30bn U.S. market for energy drinks, though there have been questions raised in Congress about the safety of the product. Energy drinks are heavy in three ingredients: caffeine, taurine and sugar. In fact the caffeine level is no higher than in coffee, but the combination of ingredients is thought by some to place it in between alcoholic and soft drinks. Is Monster a real challenger to Red Bull in the UK? With a sales increase of 46% in 2012 compared with 6.5% for Red Bull, Coca-Cola can hope. But the risk must remain that the Monster life cycle will end up following that of Relentless. Time will tell. Questions (25 marks; 30 minutes) 1. Briefly explain the meaning of the term Product Life Cycle. (3) 2. In which stage of its product life cycle was a) Relentless and b) Monster in 2012? (2) 3. Examine two possible extension strategies Coca-Cola might use with Relentless in 2013. (8) 4. Discuss the factors that will influence the future life cycle of Monster in the UK. (12) Marking suggestions: Monster Life Cycle 1. Briefly explain the meaning of the term Product Life Cycle. (3) The theory that every product goes through similar stages of birth, growth, maturity and decline ... ... though decline can be delayed by extension strategies that reinvigorate the product 2. In which stage of its product life cycle was a) Relentless and b) Monster in 2012? (2) Relentless – maturity just edging towards decline Monster – growth 3. Examine two possible extension strategies Coca-Cola might use with Relentless in 2013. (8) An extension strategy needs to be based on a clear understanding about why sales growth has dried up and then devise a medium-long term plan for repositioning the product to make it more attractive to existing customers or give it new attractions to new customers One approach might be to move the brand away from the music festival/extreme sports young image towards a wider market (eg ‘Ever short of energy at work? Then take a break with Relentless’). This could make consumption more of an everyday occurrence (instead of a Saturday night drink); this could boost sales significantly A second approach might be to develop a new ‘cross-over’ Relentless product that offers energy to sportspeople in the way that ‘Lucozade Sports’ currently claims to do; this might broaden the appeal of the brand considerably 4. Discuss the factors that will influence the future life cycle of Monster in the UK. (12) Although it looks as if Monster is in the middle of a sharp growth period, the future pattern of sales should not be taken for granted; when a giant such as Coca-Cola takes over distribution, huge sales increases arise simply from placing the product in more outlets; but when that oneoff boost to sales has finished, there may be little more growth in future So the first factor is whether regular users of energy drinks are keen on Monster and likely to switch to it in future; if Monster is trendier among night-clubbers than Red Bull, continuing sales growth is highly likely; market research can easily answer this question At present Red Bull is the dominant force in the energy drinks market; therefore its marketing policies will be an important factor; if it decides to increase its advertising spending while also upping its investment in Formula 1, perhaps Monster will start to get squeezed out; Coca-Cola has deep pockets, but it will not be willing to put vast sums behind Monster (its sales of £70m compare with over £1,000m for Coca-Cola in the UK) A further factor is the life cycle of energy drinks as a whole; sales have been growing and growing for years without much questioning by the market about their safety or ‘function’; what if people start to question the wisdom of taking in large quantities of caffeine and sugar? If the market slides as a whole, Monster will struggle to buck the trend