Harley Davidson - Fisher College of Business

advertisement

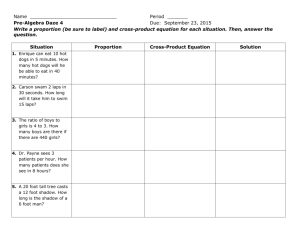

Stock Analysis Report: Harley Davidson Chad Combs Finance 824 6/1/2004 TABLE OF CONTENTS I. Summary of Recommendation – Page 1 II. Brief Company Overview – Pages 1-2 III. Economic Analysis – Pages 2-5 IV. Industry Analysis – Pages 5-6 V. Growth Drivers/Catalysts/Positive Issues – Pages 6-8 VI. Risks/Concerns – Pages 8-10 VII. Sources of Growth – Pages 10-15 VIII. Financials – Pages 15-19 IX. Valuation – Pages 19-21 X. Conclusion – Pages 22-23 I. Summary of Recommendation Recommendation: Market-weight Reasoning: Increasing Market Demand: The motorcycle market is growing both domestically and internationally. Harley is well poised to take advantage of international opportunities that may present themselves. Draining Affect of Excess Cash: Harley is cash rich firm with very little debt. However Harley has no idea what to do with their extra money. They need to find strategic measures to determine how to invest the cash for that it is obtaining a smaller rate of return (2%) compared to the ROE of its core business (29%). This excess cash is diluting the returns of the firm. Revenue Should Increase: Harley is committed to expanding and as long as the increases to production will give them overall increases in revenue. Catalysts: 1. Positive Demographics 2. Strong Brand Name 3. Good Management Team Target Price: II. $58.40 Brief Company Overview/Description Harley-Davidson, Inc. (HDI) is the parent company for the group of companies doing business as Harley-Davidson Motor Company, Buell Motorcycle Company and HarleyDavidson Financial Services. Harley-Davidson Motor Company produces heavyweight motorcycles and offers a line of motorcycle parts, accessories, apparel and general merchandise. It manufactures five families of motorcycles: Touring, Dyna Glide, Softail, VRSC and Sportster. Buell Motorcycle Company produces sport motorcycles, including four big-twin XB models and the single-cylinder Buell Blast. Buell also offers a line of motorcycle parts, accessories, apparel and general merchandise. Harley-Davidson Financial Services provides wholesale and retail financing and insurance programs, primarily to Harley-Davidson/Buell dealers and customers.1 Harley Davidson’s market capitalization is presently hovering around 17 billion which makes them the largest player in their industry. Harley Davidson’s motorcycles are as much of an image as they are a machine. Harley’s management realizes this and they work to protect their brand name as much as anyone in the market. Harley brand is recognizable by most non-riders as they license their name for merchandising for t-shirts, jewelry, leather goods, toys, and numerous other products. The company even has a restaurant in Las Vegas that carries its namesake. It is rather obvious that Harley Davidson’s ability to grow and manage its brand name is the sustainable competitive advantage that they have over the rest of the market. The following companies are the major competitors of Harley-Davidson, Inc.:2 Everett Smith Group Honda Motor Co., Ltd. Bayerische Motoren Werke AG Kawasaki Heavy Industries, Ltd. State Farm Insurance Companies Suzuki Motor Corporation Travelers Property Casualty Corp. Yamaha Corporation Allstate Corporation Ohio Casualty Corporation Polaris Industries Inc. Huffy Corporation Leucadia National Corp. Selective Insurance Group Yamaha Motor Co., Ltd. Optima Batteries ADAC Plastics, Inc. Creative Foam Corporation III. Economic Analysis Economic Outlook The economic landscape is presently changing. The Fed has recently lowered interest rates to one of the lowest rates ever. Over the last year and a half the Fed has had 1 2 Yahoo finance Business Source Premier increasing concerns of deflation but recent turns of events have shown economy strengthening despite still being valued rather weekly to its potential. In this recovery period we can expect interest rates to rise as the Fed will try to spur inflation and the overall economy back to normal. The Fed will be slightly restrictive though as rates will rise but they will be careful to do it slowly to nurture the market back to health. This combined with this being an election year (Greenspan is still taking heat for George H.W. Bush’s loss in ‘92) I expect small increases in the interest rate before the end of the year. It is never good to make any drastic changes to the economy and I expect a deliberate and slow process back to a normal interest rate and economic environment. Below is a summary of key economic predictors for the rest of 2004 and the future3: Projected Annual Forecast Average 2004 Nominal GDP (Billions of dollars) 10,980 2005 20062009 20102014 11,629 12,243 14,686a 18,266b Nominal GDP (Percentage change) 4.8 5.9 5.3 4.7 4.5 Real GDP (Percentage change) 3.2 4.8 4.2 2.8 2.5 GDP Price Index (Percentage change) 1.6 1.1 1.1 1.8 1.9 Consumer Price Indexc (Percentage change) 2.3 1.6 1.7 2.2 2.2 Unemployment Rate (Percent) 6.0 5.8 5.3 5.1 5.2 Three-Month Treasury Bill Rate (Percent) 1.0 1.3 3.0 4.5 4.6 Ten-Year Treasury Note Rate (Percent) 4.0 4.6 5.4 5.5 5.5 Figures determined form the Congressional Budget Office http://www.cbo.gov/showdoc.cfm?index=1824&sequence=0 3 Tax Bases (Percentage of GDP) Corporate book profits Wages and salaries 7.7 8.1 10.8 9.9 9.1 46.3 45.9 46.1 46.4 46.4 844 948 1,319 1,359a 1,670b 5,087 5,333 5,639 6,823a 8,476b Tax Bases (Billions of dollars) Corporate book profits Wages and salaries Economic Sector Analysis During a recovery/interest rate rising environment certain stocks sector typically fare better than others. Consumer discretionary goods and companies usually feel the wrath of consumers tightening their spending habits. However, with that restrictive attitude many investors turn their eyes to consumer staples stocks which are comprised of companies who sell products that consumers consistently need to operate in their daily lives. Market Style Analysis The market has recently been growing and after 4 years or so of a recession after the tech bubble burst in the late 90’s I believe that investors are finally ready to invest eagerly again. The growth mentality will not be in the same manner as it was in the late 90’s though. I consider the market to be in more of a cautioned growth phase as indicators show growth (like the increasing Dow Jones average) but any type of bad news could cause investors to get shaky. We are just building the foundation for an effective growth market some time from now. Typically during Fed tightenings the market falls very slightly, however I believe the market is so depressed and performing so weakly to its potential that this period will be more conducive to growth. This type of market is indifferent to Harley Davidson. Consumer Discretionary stocks will be hurt and I expect HDI to feel part of the blow in that respect but Harley’s recent success should carry them through this cautious market during which interest rates are rising. IV. Industry Analysis Industry Life Cycle/Growth Style Harley Davidson competes in a mature industry life cycle. Harley Davidson is grossing almost 5 billion a year as they are definitely producing strong recurring cash flows. The motorcycle industry is older and the product is not in the market acceptance phase, however companies are still searching for new niches to offer unique offerings and that ability could give a company a huge advantage. This industry operates in more of a cyclical manner as their revenues and earnings often perform during certain cycles better than others. This is particularly true in an interim period when the Fed is between easing and tightening. Cyclical and consumer discretionary stocks typically perform rather well during this time. Industry Position Depending on which source you look at Harley is in one of two industry groups. According to Stock Val HDI is in Consumer Products (031) and according to Yahoo! Finance they are in Recreational Products. Their standing within their industry depends on which of the groups you are looking at. They are far and above the largest company in the Recreational Products in regards to market cap as they are approximately 10B larger than their nearest competitor (Mattel Inc.). In the Consumer Products (031) industry group they are the 3rd largest company in regards to market cap only being elapsed by Philips Electronics and Matsushita Electric Industrial Inc. Harley’s ROE % is among the highest in the recreational products group. V. Growth Drivers/Catalysts/Positive Issues4 Last year Harley was able to spur growth due to creating interest in the firm by celebrating its 100th Anniversary. There were celebrations all around the world that included more than a million people in attendance. Last year Harley Davidson owners showed their love for their product. However Harley just does not plan to grow based off celebrating its past. It is aggressively looking towards its future and completing its growth plan of satisfying demand for 400,000 motorcycles by 2007. The goal at the end of 2004 is to sell 317,000 motorcycles. Harley is we on their way to that goal in the first quarter as they hit their production target which will be a good foundation to reach that goal by year end. Higher Margin Sales There is evidence to suggest that sales of the company’s higher margin products are increasing at a faster rate than lower margin products. This trend is expected to continue in the future. This presents Harley-Davidson with a major opportunity to increase profits if it could refocus some of its sales and marketing efforts on the higher margin products to capitalize on the increase in demand. The company’s higher margin products include Custom and Touring motorcycles, while lower margin products include the company’s Sportster range. Increasing Market and Strong Demographics 4 Business Source Premier, Company Profiles Sales in the worldwide motorcycle retail industry and the US motorcycle retail industry are expected to increase in the future. Harley-Davidson should try to position itself to be able to capitalize on the increase in demand by making sure that production can meet demand. The company’s sales and marketing efforts should also be geared to generating demand for the Harley-Davidson brand in the expanding market. Brand Harley-Davidson is one of the world’s most dominant brands, consistently ranking among the top 10 most recognized brands in the United States. We believe that Harley is an impressive consumer product company, as its customer base tends to highly enthusiastic about its motorcycles’ distinctive design, styling, and sound, as well as the individualistic, rugged American lifestyle the brand embodies. The company continues to foster its distinctive image through its rider clubs, product marketing, strategic agreements, and licenses.. Growth Through Re-investment Harley-Davidson has chosen to invest in the company to fuel organic growth rather than see the company grow through acquisitions. The organization’s investment in its production and marketing operations will enable Harley-Davidson to lower costs and increase profits in the future as its operations will be leaner and more cost effective than those of their rivals. Management Team Harley Davidson’s management has been described as being one of the top teams in the business. Harley has experienced 18 years of continuous record revenue and earnings. Not many companies can make statements like those and Harley’s ability to do so does not come from just being lucky. Harley’s management is always pushing Harley to further their processes and better control their inventories. Many of Harley’s top managers have been around since the early to mid nineties which I think is a perfect time to be with the firm. Harley Davison was not a public firm until the mid 1980’s. Many of the older management would probably not be effective in the new environment within the public sector. It seems that many of the older managers are no longer with Harley and they have been replaced by younger mangers with more public company experience. One of the great efforts for Harley is to increase their exposure abroad as they have not yet become as strong of a brand globally as they are domestically. They have successfully hired strategic managers who are familiar with the world markets. The bios of many of their top managers shows them having marketing and sales management experience with firms like Land Rover where those individuals would of accumulated a lot of knowledge about the European motor vehicles market and how to approach it. CEO Jeffrey Bleustein (part of the team that executed Harley’s leveraged buyout in 1981) and his team have been with Harley for many years and have consistently created shareholder value (HDI has outperformed the S&P 500 in seven of the past 10 years). Through controlled production, savvy marketing, and customer loyalty programs, management has nurtured the Harley brand.5 Management also has a incentive to perform as about 50% of senior management’s pay is incentive based. I always like compensation structures such as these as managers that have skin in the game are continually motivated to building the most efficient company possible. Below is a table that shows the power of performance in relation to several managers pay. VI. Risks/Concerns6 Competition The heavyweight (651+cc) motorcycle market is highly competitive. The company’s major competitors are based outside the US and generally have financial and marketing resources that are substantially greater than those of the company. They also have larger worldwide revenue and are more diversified than the company. In addition to these larger, established competitors, the company has competitors in the US. The US competitors generally offer heavyweight motorcycles with traditional styling that compete directly with many of the company’s products. These competitors currently have production and sales volumes that are lower than the company’s and do not hold a significant market share. The company’s competitors include Honda, BMW, Suzuki, Kawasaki and Yamaha. All of these companies will combine to take away sales and market share from Harley Davidson. Harley-Davidson is also facing growing competition from companies such as Ducati, Triumph and Aprilia in the European market. Fluctuations in currencies and interest rates The company’s earnings are affected by fluctuations in the value of the US dollar against foreign currencies, predominately in European countries and Japan, as a result of the sales of its products in foreign markets. Fluctuations in the value of foreign currencies cause the company’s earnings to both rise and fall. HDFS earnings are affected by changes in short-term interest rates as a result of its securitization transactions, its borrowings under a bank credit facility and the issuance 5 6 JP Morgan Equity Report Investext Plus of commercial paper. HDFS utilizes interest rate swap and treasury rate lock agreements to reduce the impact of fluctuations in interest rates. Threats from own brands HarleyDavidson is competing against its own 100th anniversary model in terms of pricing. Such models enjoyed a 3.4% increase in price during fiscal 2003 and the continued popularity of these models combined with the interest created by the introduction of the new Sportster models is expected to reduce the selling price of Harley’s new heavyweight models to a figure below the other models. The continued popularity of the 100th anniversary could result in losses of sales and could reduce R&D usefulness in the shortterm. Slowing Production and EPS Growth and Narrowing of Supply/Demand Gap HDI has slowed its production rate each of the past five years and recently announced that it planned to grow production at 7-9% over the next several years. The greatest risk to the stock may be that the company’s production growth may need to continue to slow given what looks to be a narrowing of the supply/demand gap. A slower production rate would likely slow earnings growth and hamper margin expansion and the rate at which HDI can expand its returns. Growth Rate There are also question marks surrounding the sustainability of Harley-Davidson’s current 15% annual growth rate. It is unlikely that this growth rate will be sustainable in the future and any reduction in growth rates could affect investor confidence and stock prices. Currently the only way that Harley-Davidson could maintain its current growth rate would be if the heavyweight motorcycle market grew by 11% per year for the next 10 years. Registration for heavyweight motorcycle bikes has grown at 4% over the last 30 years and at 12% for the last 10 years.7 Harley has little room to maneuver and any mistake they make could hurt them drastically. Aggressive Shipments and Damage to the Brand The growth of Harley-Davidson is a result of aggressive growth could ultimately damage the Harley-Davidson brand in the eyes of consumers. High retail inventory has led to unprecedented levels of promotional activity. For example, during 2003 excess inventory of the 100th year models led several dealers to advertise below recommended prices, a trend which has continued into 2004. These conditions have led to used bikes holding less value. Harley’s have traditionally retained their value, a feature that has historically made Haley an attractive purchase. Over the past year it has been noticed that pricing on used Harley’s have declined in some areas another factor that reduce overall brand value in the future. JP Morgan Equity Research http://proxy.lib.ohiostate.edu:2852/getPDF?repNum=9556289&appUI=itweb&date=1086050760&digest=B930B DFF54D8E9174D55A1FD44A021B0 7 Supplier Network Maintenance Harley-Davidson is reliant on maintaining good relationships with its suppliers. On average, Harley-Davidson motorcycles contain around 2,500 parts that are supplied by 700 direct national suppliers of which around 200 are key suppliers. The hefty number of suppliers could give Harley-Davidson large and complex co-ordination problems and a problem with only one of the company’s suppliers could result in a slow down in production. Buell’s Operating Performance Harley-Davidson’s Buell subsidiary is not currently profitable. This lack of profitability may be affecting the whole company’s gross margin. Harley-Davidson has invested lots of capital in the Buell subsidiary and still maintains that the subsidiary will achieve profitability and meet targets in the medium to long term. Buell’s recent decline in sales is a problem that is being traced back to the introduction of two new product lines in the third quarter of 2003 which retail for higher prices than previous Buell models and could therefore be detracting from sales. VII. Sources of Growth8 Capital Expansion Harley has a plan to produce 400,000 units by 2007. This production amount is a significant increase over what they produced throughout the last decade. This growth does not happen overnight. There are certain figures that show that Harley has planned for this increase for quite some time. Below is a graph of the capital expenditures for Harley for the last 10 years. Capital expenditures were significantly higher in 2001 and 2002 which shows that Harley could have been building up infrastructure to allow for their future growth plans. 8 Investext Plus Growth in Harley will come from their expansion in production. With increased production Harley will be able increase revenue year to year till 2007. International Opportunities Harley operates mainly in three international markets; Europe, Asia, and Latin America. Even though international shipments are only 25% of total production, this relatively untapped segment could be a potential huge growth opportunity in the future. Below is a graph of the market share for each of the large motorcycle manufacturers in Europe. Harley has increased its market share steadily over the last few years however most European riders enjoy more performance orientated bikes which is not Harley’s specialty. Although we believe that Harley will continue to be challenged in Europe by stricter noise emission standards (larger Harleys often have to be modified to meet European restrictions) and varying consumer preferences, the company will continue trying to export its brand with an image of a rugged American lifestyle. Management believes that Europe offers excellent growth opportunities, especially for Buell’s performance bikes and the V-Rod. Growth in Europe is also likely to come from the addition of dealerships; the upgrading of existing dealerships in size, appearance, and layout, with greater emphasis on parts and accessories; and an increase in production. Although Harley will become a market leader in Europe—at least not for quite some time (barring an acquisition)—the company can still continue to expand its business at a reasonable clip. That increase in market share would do a lot for Harley’s bottom line as just 9% of Harley’s overall revenues come from Europe. Below is a graph of the heavyweight market share for the Asian market. This market is a smaller motorcycle market on the whole and has been less exposed to Harley for a shorter period of time. However as the graph shows, Harley has a strong presence in Asia with 25% of the heavyweight market. This strong market share and strong branding among the customers there leaves a lot of room to grow in this area of the world. Harley believes that the Asian market offers an attractive long-term opportunity but that economic uncertainty could continue to crimp near-term prospects. As a result, the company plans to expand its Asian business slowly by adding dealers and by increasing production. The last are Harley operates in is Latin America. There is not much information on the Latin American market but from what I found it seems that there are three primary Latin American motorcycle markets—Argentina, Brazil, and Mexico—and that Honda is a dominant leader. Harley currently has 30 dealerships and six alternate retail outlets in the region, and in 1998 it established a knockdown facility in Manuas, Brazil, to assemble motorcycles. This plant should significantly reduce tariffs, which should make Harley’s bikes more affordable in Brazil. The plant began production in 1999 and produces a slightly fewer than 1,000 units each year. Harley plans to focus its Latin American operations on Mexico and Brazil and believes that Latin America will be a growth market as the company expands production and adds dealerships. Latin America is a good opportunity as well for that if they can obtain a high market share early their strong branding could carry them to future success. Harley-Davidson’s Other Related Businesses In addition to its motorcycles, Harley-Davidson sells parts and accessories and it operates its Harley-Davidson Financial Services finance subsidiary. All of these businesses contribute to Harley’s ability to fully service each customer. These businesses are growing fast and contribute to the company’s bottom line. Harley-Davidson sells genuine aftermarket motor parts and motor accessories through its Parts and Accessories division. The division offers service and replacement parts for new and used Harley-Davidson motorcycles, including out-of production models. The products are sold out of Harley’s dealer network and are a growth segment for the company. Since 1986, the parts and accessories business has grown at a 19.4% compound annual rate. We project that parts and accessories growth will outpace motorcycle revenue growth as management concentrates on building the division’s market share (which it estimates at 66%) and on getting to its customers early. Harley has had several successes in licensing its brand, including the Harley-Davidson Café and Mattel’s Power Wheels bike. Parts and accessories continues to experience rapid growth. The parts and accessories business carries higher margins than any other revenue stream, which is positive because the company’s parts and accessories revenue growth should exceed production growth. Below is a table showing this steady growth in this area since 2000 with estimates for all of 2004 and 2005. Harley-Davidson Financial Services Harley-Davidson Financial Services (HDFS) is the finance subsidiary of HarleyDavidson, offering services under the name Harley-Davidson Credit and Insurance. The subsidiary offers dealers floor plan and traditional financing; real estate, computer, and showroom remodeling loans; and insurance brokerage products. On the retail side, HDFS offers installment loans for new and used motorcycles, insurance brokerage services, and extended warranty agreements. We view HDFS as an integral part of Harley-Davidson, as it builds the Harley franchise by offering one-stop shopping to customers. HDFS’s services are available to all Harley dealers in North America, and European dealers are served through a European joint venture. Approximately 70-75% of Harley-Davidson customers use financing, with an average loan balance and length of approximately $14,000 and 76 months (paid down in 4.0-4.5 years), respectively. In 2003, all of its dealers were able to use HDFS’s services, and the division financed 38% of new HarleyDavidson motorcycles sold in the United States (approximately 50% of all bikes financed). HDFS produces 15% of the company’s operating income. Most analysts project annual revenue growth within the range of 30% for 2004 and 20% for 2005. Last year was a very strong one for HDFS, with the segment growing 61.1%. The growth came from a combination of performance pricing, or offering A credit-rated customers better loan rates that increased the company’s market share of Harleys financed (from about 20% of all Harley bikes in 2000 to 29% in 2001 to 35% in 2002, to 44% in 2002, and to 47% in 2003), and from gains on securitizations due to falling interest rates. Below is the graph showing the shift to better credit risk customers. Below is graph that shows how Harley benefited from gains on securitization. The graph represents HDI’s current year gain as a percent of loans sold. All the previous bullet points show arenas in which either facilitate or may play a role in the future growth prospects of the firm. These areas are all attractive and after reading about the plans of management it is easy to get overzealous about the ability for Harley to grow. Harley’s main focus needs to be to hit its production and sales objectives. Those outcomes will make or kill this business. Many of the aforementioned points are just ancillary business that can be used as satellites to spurn growth forward. With that being said, if Harley is able to achieve the core business goals they have set before them then the successful implementation of the previously mentioned points will help Harley grow into an excellent company. Market Penetration9 Above I spoke about the problem with the possible supply/demand gap getting smaller and the concerns that stem of from that development. The concerns are real however 9 Harley Davidson 2003 10-k Harley could possibly offset those concerns with increased market penetration. Market share increases are always a challenge for an entrenched competitor that is operated off expected process that have been developed over many years. However, Harley has made some changes recently that lead me to believe that they could possibly increase their market penetration, especially domestically, in an effort to spur on growth. Harley has put an emphasis on their new Sportster bike which comes in at the low end of the Harley’s line on cost and is targeted to younger, non experienced riders. Harley has experienced growth within this product line as shown below and if that continues to grow Harley could find itself motivating a bunch of new riders to become Harley people. This increased market share could offset the negative effects of a closing in the supply and demand gap and become a source of growth overall. Worldwide Motorcycle Unit Shipments 2003 Touring motorcycle units Custom motorcycle units* VRSC motorcycle units 82,577 135,954 15,451 2002 70,713 123,761 18,008 Increase % Change 11,864 12,193 (2,557) 16.8 9.9 (14.2) Sportster motorcycle units 57,165 51,171 5,994 11.7 Harley-Davidson ® motorcycle units 291,147 263,653 27,494 10.4 Buell motorcycle units Total motorcycle units 9,974 301,121 10,943 274,596 (969) 26,525 (8.9) 9.7% VIII. Financials Overall Performance10 The graph below shows the stock performance of Harley Davidson vs. the S&P 500 and the Dow Jones Industrial average since its IPO in the mid-1980’s. The chart shows the remarkable continual growth of the firm, however when a firm holds up its end of the bargain (18 consecutive annual earnings and revenue records) the market rewards it. The question facing Harley now is can they continue this upward trend. The following will be the financial data that will support my conclusion to that question. 10 Yahoo Finance Income Statement11 Harley has a fairly simple consolidated income statement. The growth in earnings in previous years has come from the high double digit growth in Revenue from year to year. Amazingly over this time SG&A Expense has stayed fairly consistent over this time. Cost of Goods Sold growth rates were also lower than the revenue percentile increases every year for the last few years as well. Increased earnings thus looks to be from Harley’s ability to advantageously add revenue each year combined with capacity additions that allow HDI to operate with more economies of scale. The economies of scale let HDI’s costs to be better managed year to year as they are growing at a rate below what revenue is. The graph below shows this consistent revenue growth and how it grows at a higher rate than its costs (COGS and SG&A). 11 StockVal Dupont Analytics ROE is looked at by many as a measure of profitability. Some question whether this is an appropriate measure or not. Regardless of the ratios overall value, Harley’s ROE can still provide value information. In the last few years ROE has been stabilized as Harley is consistently achieving a ROE in the high 20th percentile. 10-15 years ago ROE was inconsistent and it definitely did not appear in the percentile that it continually ends up presently. This shows that their processes and strategy has gotten them to a point of normalized high returns. Their continual increase in their ROE is also impressive due to the fact of how little leveraged they are. Many companies increase their ROE by investing borrowed dollars and then receiving returns greater than the borrowing rate. By Harley not growing and stabilizing ROE in this manner it shows that they are a profitable company. Another figure in the graph above that I would like to draw focus to is the asset turnover ratio (sales/assets). This ratio has been steadily decreasing over time. I believe this ratio will continue to decrease as Harley is now focused on increasing production. This could be risk as revenues could build up and be a large cost to the company. Harley’s ability to efficiently manage inventories could make or break them in this expansionary period. Cash Flow12 Analysts expect Harley-Davidson to generate $673 million in free cash flow in 2004 and $792 million in 2005 after paying its dividends. Harley has a history of generating strong free cash flow (see table below), which we attribute to its high margins, high returns, and strong earnings growth. 12 Investext Plus If the figures above hold true Harley will continue to build its cash balance to $2.1 billion at year-end 2004 and $2.9 billion at year-end 2005. Harley has very little debt, so I don’t expect it to reduce its debt/capital ratio very much in the next few years. The above table includes debt from HDFS, much of which is collateralized by the company’s bikes—an asset that has solid resale value. Excluding HDFS, HarleyDavidson is essentially debt free. With the company’s cash balance projected to grow to $2.1 billion by year-end 2004, Harley-Davidson management can pursue several strategic alternatives. I think they are unlikely to pay down debt (they are not highly leveraged, some debt is not bad), and management has indicated that it is unlikely to make an acquisition in the near term. Management will presumably continue to pay the company’s dividend, and hopefully increase it further, or buy back shares. However, over the longer term management will have to find an outlet for its cash or be forced to accept lower returns, as its cash balance earns a return of about 2%, which compares with an ROE of 29% from its core business. Forecast Annual revenue and EPS has regularly expanded at high double digit rates from year to year for almost 20 years. However, Harley is now on the brink of a change. Many analysts have seen a narrowing of the supply and demand gap for Harley. Part of the way they keep the mystic of their bikes is by always having more demand for bikes than there are bikes to have. This high supply/demand gap thus drives up margins. Harley over the last 5 years has been consistently slowed its production rate presumably to keep this gap in check. However, after the recent announcement of the growth targets for the firm, Harley must grow its production at 7-9% over the next few years. This is a risk as this growth in production will only constrict the supply/demand gap more. I believe that margins will be affected by this decision and Harley will struggle to obtain the revenue and earnings increases that they are accustomed too. A failure in reaching the levels laid out in its growth plan or a disruption in production would also spell disaster for more high earnings growth. Overall Harley will struggle to keep their mystic as more and more bikes will be injected into the mainstream motorcycle community. While this hurts margins I believe production economies will aid them. However with margin not being able to rise at their normal levels Harley’s EPS and revenue expansions will slow. I believe that Harley’s EPS will grow by 20% in 2004 and by 18% in 2005. I believe that revenue will continue to be strong and will be aided by increased productivity and economies of scale gains with their increase in production effort. I foresee revenues growing by 10% in 2004 and by 12% in 2005. I believe Harley will achieve regular revenue growth all the way till 2007 where they plan to meet their production objective. IX. Valuation13 Below is an analysis of HDI’s historical valuation on a P/E, relative P/E, and FV/EBITDA basis, noting that the stock is trading below its historical averages. That said, given the expected slower growth rate moving forward, the stock’s valuation probably needed to contract. In the future, I expect HDI to trade at or slightly above a market multiple, based on the state of retail inventory, at least over the next few years. HDI Is Trading Below Its Historical Averages Below is Harley’s absolute P/E multiple versus its one-, three-, five-, and 10-year averages, based on current consensus 12-month earnings estimates. Note that the stock’s multiple steadily increased until it peaked at 45.8 times in September 2000. Its P/E multiple has contracted significantly over the past 12-24 months. HDI is currently trading at 18.3 times our 2004 EPS estimate, below its three- and 10-year average of 26.1 times, its five-year average of 29.9 times and its one-year average of 19.0 times. HDI Is Trading Below Its Historical Relative P/E Multiple The graph below is HDI’s P/E relative to the multiple of the S&P 500 based on current consensus 12-month earnings estimates. Like its absolute multiple, HDI’s relative 13 Investext Plus multiple had steadily increased until last year. The stock is currently trading at 110% of the S&P 500’s P/E multiple on 2004 EPS estimates—which is below its three-, five-, and 10-year averages, and slightly above its one-year average. HDI Is Trading Below Its Average FV/EBITDA Multiple Below is HDI’s valuation on a firm value-to-EBITDA basis, showing that the stock has traded at an average FV/EBITDA multiple of 15.4 over the past five years. The stock currently trades at a FV/EBITDA multiple of 11.0, which is significantly below historical levels prior to 2003. HDI Deserves to Trade at a Premium to the S&P 500 To determine whether Harley-Davidson should trade at a premium to the S&P 500, I have compared its earnings growth, ROE, and debt/capitalization ratios to those of the S&P 500. Harley-Davidson deserves to trade at a premium to the market because the company has consistently outperformed the index. The company’s dominant brand, high earnings visibility, pricing power, and strong free cash flow and returns add to the company’s advantages over the S&P 500, in our view. Although we believe the valuation needed to contract based on what we believe will be a slower growth rate moving forward, we think that over the longer term, HDI is likely to trade at a slight premium to the market based on its still-high earnings growth, expected 25% return on capital, healthy balance sheet, and premium brand. Price Momentum Below is the price momentum graph for Harley Davidson. This graph shows that Harley may be slightly overvalued as their price is slightly over their moving average and they are minimally overbought. HARLEY-DAVIDSON INCORPORATED (HDI) 67 StockVal ® 58 62 58 54 54 50 50 46 43 46 43 40 40 37 35 37 35 32 30 32 30 PRICE 57.5 DATE 05-28-2004 28 28 26 The Ohio State University Fisher College of Business 24 1999 2000 2001 2002 2003 26 24 2004 +2 +2 +1 +1 0 0 -1 -1 -2 -2 PRICE MOMENTUM INDEX (OVERBOUGHT/OVERSOLD) X. Conclusion Market-weight I believe that Harley Davidson should presently be market-weighted. This recommendation is based on Harley’s outlook being a strong one, however I do not believe that they will be able to perform at the level that they have over the last 18 years. Growth will slow as will earnings. Their increased production plan is ambitious and will cause them issues in controlling revenue and the supply/demand gap. Overall however, Harley is a very efficient company that is controlled by management that time and time again execute when they are called upon. I would not be surprised if they found a way to overcome some of the challenges that are before them and outperform my own and others expectations. However I believe that the safe bet is to hold the stock for now till we see how they perform over the next few months along their growth plan and a few other metrics. Pros Revenue Should Increase: Harley is committed to expanding and as long as the increases to production will give them overall increases in revenue. HDI is Under-Valued: Harley is trading below its absolute and relative P/E historical averages. It is also trading below its Average FV/EBITDA Multiple. All of this information points to the fact that the stock may be undervalued in investors mind. Increasing Market Demand: The motorcycle market is growing both domestically and internationally. Harley is well poised to take advantage of international opportunities that may present themselves. Growth in Other Related Businesses: HDFS and Harley’s Part’s and Accessories Division are growing at high rates and look to continue that growth in the near future. These businesses will then act like satellite growth measures that will help alleviate the core motorcycle business from growing at exorbitant levels. Cons Narrowing of Supply/Demand Gap: This gap is lessening which could possibly hurt margins as explained in my analysis above. This fact shows that Harley may need to slow production again to get this gap intact. However, Harley is going in a different direction and drastically expanding production. This change in pace could have negative affects on the firm. Draining Affect of Excess Cash: Harley is cash rich firm with very little debt. However Harley has no idea what to do with their extra money. They need to find strategic measures to determine how to invest the cash for that it is obtaining a smaller rate of return (2%) compared to the ROE of its core business (29%). This excess cash is diluting the returns of the firm. Buell is Holding Harley Back: Buell has not acted like the complementary product that Harley envisioned. I like the idea that their product lines are diversified into sport bikes bit their sales are decreasing and Buell is hampering the growth prospects of the whole firm. Controlling Inventories: Inventory control is an issue now but with their growth plan being imminent measures will need to be taken to manage these even more. Dividend Discount Model14 Assumptions: Annual Dividend (DPS): .4 Required Rate of Return (Ks): risk free rate= .01 + market risk premium= .07 * beta= 1.2 Growth Rate in Dividends (g): 6% Value of Stock = 11.7647 This shows that the stock is overvalued. This could be due to people willing to pay a premium for the Harley brand and a quality product. However this model will probably show a better value in the future as many people expect dividends to increase as Harley has a lot of extra cash. Target Stock Price Stock Price = $58.40 14 TheMotleyFool.com