Part B, © 2002, Kwan Choi

advertisement

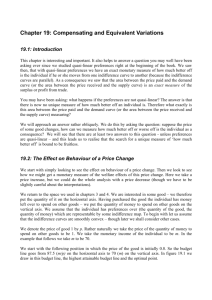

Chapter 4. The Theory of Demand Part B, © 2002, Kwan Choi Shifts in Demand and PED Price elasticity of demand at point c is bc/ac. A clockwise rotation of demand curve sometimes occurs when domestic currency is devalued and the foreign demand curve is expressed in that country’s currency. At what point on the new demand curve will the price elasticity of demand be the same? Make sure that bc/ac = bc'/ac'. At point c, PED is bc/ac. This ratio is the same at point c'. That is, bc'/ac'. 2 Parallel shifts in Demand curve PED at point c is bc/ac = bc'/ac'. Thus on the new demand curve a'b', PEC at point c' is the same as that at point c. 3 All other shifts can be treated as a combination of the three types of shifts, vertical, horizontal or parallel shifts. For instance, in Figure 14, the shift from ab to a'b' can be decomposed into two shifts. First, the shift from ab to ab", and second, the shift from ab" to a'b'. Exercise: Decompose the shift in demand curve and show along the new demand curve where PED will be the same as that at c on the initial demand curve ab. 4 5 Properties of Demand Functions 1. Doubling money income and prices does not affect consumer demand. x( p, M ) x(2 p, 2M ) x(kp, kM ). Example: Consumer demand remains the same whether money income and prices are expressed in terms of USD or CND or Hong Kong dollars. 2. Ordinal Utility If a demand curve x is derived from U(), then it can also be derived from V f (U ), where dV / dU f ' 0. In this case, V is another utility function and is a monotone increasing function of U. Example: u = xy, v = u2. Both u and v yield the same demand functions. 3. Budget Exhaustion M = p 1 x1 + p 2 x2 . ΔM = p1 Δx1 + p2 Δx2 1 = p1 (Δx1/ΔM) + p2 (Δx2/ΔM) εiM (Δxi/ΔM)(M/xi) is income elasticity of demand for xi. 1 = (p1x1/M) ε1M + (p2x2) ε2M. 1 = s1 ε1M + s2 ε2M, si budget share of good i. 6 CONSUMER SURPLUS CS is the difference between the amount of money the consumer is willing to pay and the amount actually paid. Marshallian consumer surplus Consumer surplus = the area below the demand curve. Demand curve = Willingness to pay curve because price is the amount of money the marginal consumer is willing to pay for the good. However, in our society producers are not permitted to discriminate consumers. They cannot charge a higher price to a richer consumer. Producers charge the same price, irrespective of the wealth of consumers. Thus, all consumers, save the marginal consumer, enjoy a surplus, Si = wi – p (his willingness to pay – market price). Consumer surplus is simply the sum of each consumer’s surplus, equal to the area below the demand curve above the market price. 7 Changes in consumer surplus An increase in the market price reduces consumer surplus. For instance, In the 1980s Japanese automobile producers agreed to limit their exports of Japanese automobiles to the US. This agreement raised the price of American automobiles by about $600, and saved some American jobs. However, on average American consumers paid about $150,000 to save one American job because of this Japanese voluntary export restraint. Remark: Consumer surplus is observable and measurable. OPTIONAL TOPICS Compensating Variation Another way to think of the loss or gain to a consumer resulting from a price change is to ask how much income we must give or take away from the consumer after the price change to maintain the same level of satisfaction as before. Let o denote the initial situation and ' denote the final situation after a price 8 change (say only p1 rises) as in Figure 18. The compensating variation for this price change is the additional income that the consumer must receive in order to maintain the same level of utility before the price change. In Figure 18, the initial situation is A. Then price of good 1 rises, rotating the budget line from aa to ac. The new equilibrium occurs at point C and the consumer faces a new relative price, p1' / p2 . (the slope of ac). However, the consumer suffers a reduction in real income. How much compensation does the consumer require in order to maintain the same level of utility as before? This compensating variation is the difference between the two budget lines, ac and bb. If the consumer is compensated the difference (bb – ac), then the consumer’s welfare is unaffected but his consumption will change (from A to B). Remark: This compensating variation for an increase in price is smaller than the cost of living adjustment. In the latter case, the new budget line must go through the initial consumption point A, parallel to bb. 9 10 The relationship between compensating variation and cost of living adjustment is reversed for a decrease. Compensating variation is more accurate than the cost of living adjustment. However, the former is unobservable whereas the latter is observable or measurable. Equivalent Variation We may also ask a different question. How much income is the consumer willing to give up (or willing to accept) before the price change in order to prevent the change in the relative price? Equivalent variation uses the utility of the current situation (after the price change) as the basis. If the utility level were restricted to the current level, the consumer would be willing to pay the difference (aa – bb) in order to prevent the relative price change. 11 Remark: This equivalent variation in income (for a price increase) is larger than the cost of living adjustment. In the latter case, the new budget line goes through the new consumption point C. The relationship between equivalent variation and the cost of living adjustment is reversed for a price decrease. However, the former is unobservable whereas the latter is measurable. 1.The Equivalent Variation (EV) for the price change (p1 p1') is equal to the Compensating Variation (CV) for the reverse price change, i.e., (p 1 p1'). 2.CV (p1 p1') = EV(p1 p1') if income effect is zero. INDIRECT UTILITY FUNCTION Usually, utility is expressed in terms of the goods consumed as in U ( x1 , x2 ), which is called a direct utility function. Demand functions are expressed in terms of prices and income. For instance, demand for the two goods are written as x1 ( p1, p2 , M ) and x2 ( p1 , p2 , M ). Since utility depends on the quantity of the two goods, which in turn depend on the prices and income, utility ultimately depends on prices and income. Thus, utility can be expressed in terms of the ultimate variables, prices and income. When this is done, it is called an indirect utility function. V p1 , p2 , M U x1 ( p1 , p2 , M ), x2 ( p1, p2 , M ). Using the indirect utility function, the compensating variation for the price change (p1 p1') is defined by: V p1' , p2 , M CV V p1 , p2 , M . Similarly, the equivalent variation in income for the price change (p1 p1') is defined by: V p1' , p2 , M V p1 , p2 , M EV . Compensating Variation, Equivalent Variation and Consumer Surplus There are three different measures of consumer’s benefit or loss from a price change: CV, EV, and CS. In the absence of income effects, they are all equal. 12 CV and EV are two different, but accurate, measures of gains or losses from a price change. They differ because CV uses as basis the utility before the price change and EV uses the utility after the price change. The fundamental problem with these two measures is that they are not observable. On the other hand, CS is not accurate, particularly when the income effect is large. However, CS is observable from the demand curve. This is one reason why it is popular. Bandwagon Effects So far we have assumed that an individual’s demand for a good depends only on his income and prices. In a modern society, consumers often react to the behavior of other consumers. In the absence of envy, Chinese demand for TV may be given by: X a bp. (1) America’s demand for TV may be given by Y A Bp. (2) The two demand curves show no dependence. Firms often tout their own products by saying that their product is popular in America, and hence Chinese should also purchase the product. You can see this phenomenon in Japan and other countries. Youngsters now want to copy Beckham’s crescent hairdo after he led his team to victory against Argentine on June 8, 2002. Similarly, many Japanese consumers purchase Levi jeans because Americans do. In this case, Japan’s demand for X can be written as: X a bp cY , where c > 0 measures the bandwagon effect. Snob Effects Among the rich consumers, one may also observe the snob effects. Rich consumers often try to distinguish their lifestyles by not consuming the products that are popularly demanded. Rich American or Hong Kong consumers may not purchase hamburgers or steaks that everybody else purchases. Rich American consumers are more willing to try sushi than average 13 (3) Americans. In the presence of snob effects, consumer demand for a product can be written X a bp sY , where s > 0 measures the snob effect and Y is the amount other consumers or the rank and file consumers purchase. Rich Hong Kong consumers may not drink Coca-cola because all other consumers purchase it. 14 (4)