DIPCoprGov.doc

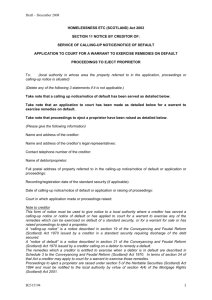

advertisement