DOC File: Size 145 KB (148992 bytes) Click Here

advertisement

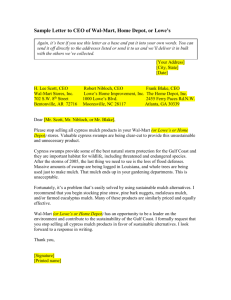

Table of Contents 1.0 INTRODUCTION .................................................................................... 3 2.0 INDUSTRY STRUCTURE .................................................................... 3 3.0 GENERAL ENVIRONMENT ................................................................ 5 3. 1 D em og r a ph i c Se gm e nt ........................................................................................................ 5 3. 2 Ec on om i c S eg me nt ................................................................................................................. 6 3. 3 S oc io -C u lt u r al S e gm e nt .................................................................................................... 6 3. 4 Te ch n ol o gi c a l Se gm e nt ...................................................................................................... 6 3. 5 G l ob a l Se gm e n t ......................................................................................................................... 7 4.0 PORTER’S FIVE FO RCES OF COMPETITION ......................... 7 4. 1 Th r e at o f Ne w Ent r a nt s ..................................................................................................... 7 4. 2 B a r g ai n i ng Po w er of Su p pl i e rs ................................................................................... 8 4. 3 B a r g ai n i ng Po w er of B uy e rs ......................................................................................... 8 4. 4 Th r e at s o f S ub st it ut e P ro d uct s .................................................................................. 8 4. 5 I nt e ns i ty o f R i va l r y A m on g C om p et it or s .......................................................... 9 4. 6 St r at e gi c I m pl ic at i o ns ........................................................................................................ 9 5.0 COMPETITOR ANALY SIS ................................................................. 9 5. 1 H o me De po t ................................................................................................................................ 10 5. 2 Lo w e’ s .............................................................................................................................................. 11 5. 3 A m az on ............................................................................................................................................ 11 5. 4 O t he r ................................................................................................................................................. 11 6.0 INTERNAL ANALYSI S ...................................................................... 12 6. 1 R es o ur ce s ..................................................................................................................................... 12 6. 3 C a p ab i l it i es ................................................................................................................................. 13 6. 4 C or e Co mp et e nc y ................................................................................................................... 13 Competition & Strategy John Molson COMM 401 School of Business 6. 5 A tt r ac ti ve i nd us t ry .............................................................................................................. 13 6. 6 V a l u e C h a in A n a ly s is .......................................................................................................... 14 6. 7 V R IO A n al y s is ........................................................................................................................... 15 6. 8 St r at e gi c I m pl ic at i o ns ...................................................................................................... 16 7.0 BUSINESS LEVEL S TRATEGY ...................................................... 16 8.0 PERFORMANCE MEAS URES .......................................................... 17 9.0 STRATEGIC IMPLICATIONS ........................................................ 17 10.0 ALTERNATIVES ................................................................................ 18 10 .1 A lt e rn a ti v e I – S el l a nd E x i t t he In d us t ry ................................................. 18 10 .2 A lt e rn a ti v e I I – P u rc h a se o r d e ve l op a D i st r ib ut i o n C h a nn e l . 19 10 .3 A lt e rn a ti v e I I I - M ov e i nt o t h e E -B u s in e s s s e rv ic e in d us tr y ..... 19 10 .4 A lt e rn a ti v e I V – A pp r o ac h L o w e’ s ..................................................................... 20 11.0 RECOMMENDATIONS .................................................................... 21 12.0 CONCLUSION ..................................................................................... 21 13.0 EPILOGUE ............................................................................................ 22 14.0 APPENDIX - ARTICLES ................................................................ 23 Group 5 -2- Competition & Strategy John Molson COMM 401 School of Business 1.0 Introduction Home Improvement was launched in late October of 1999 as an online home improvement retail outlet. Founded by Richard Shane, the company changed the Chief Executive Officer (CEO) after three months of operations. The new CEO Hal Smith had experience with Home Depot and helped his former employer Bass Pro Companies double its size partially through internet expansion. Home Improvement was primarily funded by an angel investor Mike Santullo and other venture capitalists. Home Improvement houses a strong technical team which designed and maintained its website, which allowed them to make rapid changes and save costs. The company’s goal is “…providing a customer experience second to none in the online DIY (Do-it-Yourself) category”(p.405)1. Home Improvement’s principle issue is high costs. Customer acquisition and shipping costs are presently so high that it jeopardizes the firm’s ability to continue, as stated in the case a going concern: “… our current customer acquisition cost is around $800. The lifetime value of the customer doesn’t support that cost” (p.413)2. During the holiday season Home Improvement offered a promotion in which orders over $50 received free second-day air shipping. This cost them approximately 28.3% of revenue; whereas, their mark-up was only 17.4%, meaning that for every dollar the company had in sales, they immediately lost nearly 11 cents in shipping. This does not include any other expenses such as payroll and marketing. Additionally, the introduction of new players in the online market such as Home Depot and Amazon, who had much stronger distribution channels, meant the competition was going to get even fiercer. 2.0 Industry Structure The DIY home improvement market generated $172 Billion in 1999 and had an annual growth rate of 5 to 10% throughout the 1990’s. Home centres such as Home Depot made up 40% of the market with Home Depot capturing 23% and Lowe’s netting 10%. There were no other home centres that accounted for more than 3% of the market; however, Ace Hardware had over 5000 franchise stores located in suburban shopping areas. The owners had flexibility in product and service offerings and benefited from nationally coordinated purchasing and marketing campaigns. Hitt et Al. Strategic Management: Competitveness and Globalization – Cases. Second Canadian Edition. Toronto. 2006. 2 Hitt et Al. Strategic Management: Competitveness and Globalization – Cases. Second Canadian Edition. Toronto. 2006. 1 Group 5 -3- Competition & Strategy John Molson COMM 401 School of Business In 1999 the 32 largest, publicly-held e-commerce corporations had revenues that amounted to $4 billion. However, the top five accounted for 75% of that number. While the internet market is booming, customer acquisition rates were extremely high and customer switching costs were significantly low because of the speed at which consumers could compare prices of generic products, with the competition being just a click away. Out performance could only be achieved by price or service in order to retain customers. Being ‘in the middle’ would not be suitable in this industry. The key to cutting costs was having a superior distribution channel in place. Amazon was well known for having one of the best online retailer distribution channels. This allowed them to be competitive in terms of pricing. The alternative was to differentiate oneself from the competition. Successful online sites didn’t only provide a product they provided a customer service package, which may have included live chat support, advice from experts, product reviews from other professionals and/or other consumers etc/ The issue with differentiation was that while one site may have provided these services, it was simple enough to get the information you needed and then shop elsewhere for a better price. While the industry looked attractive according to the industrial organization (I/O) model, in reality it was not so perfect. Individuals were more likely to make purchases by touching, feeling and holding the product to test its weight and grip. While a picture may be worth a thousand words for the eyes, it provided nothing for the other senses. Making a profit online was not impossible but it was extremely difficult at that time. Of the major internet companies only eBay managed to make a profit for the year ending September 1999. Proper distribution networks were a must and companies without them were be bogged down by shipping costs especially when considering products were big and heavy. While negotiation may have been difficult or impossible in person, buyers regained some of their lost power online by comparing prices. Many consumers were limited by slow dial-up connection speeds which prevented them from taking advantage of some of the more advanced features such as home project videos because it took too long to load on the websites. Security was still an issue. Many people used the internet for gathering information but they were reluctant to give their credit card numbers and other personal information online. Finally, the sellers and producers of products could eliminate the middle man and sell their products directly to consumers at low cost using the internet. Group 5 -4- Competition & Strategy John Molson COMM 401 School of Business For example, why buy a Black and Decker drill from Home Depot when you could buy it directly from them at a lower price. To better understand the threats and opportunities facing Home Improvement an analysis of the external environment consistent with the I/O model is presented. Doing so required the analysis of the Porters’ five forces model. Finally, this section is concluded with the assessment of the competitors. 3.0 General Environment The general environment was composed of six segments, which were: Demographic, Economic, Socio-Cultural, Politico-Legal, Technological, and finally the Global segment. Carefully analyzing the external environment allowed the firm to be aware of the potential threats and opportunities in its environment. Firms could then align their core competencies with the opportunities. 3.1 Demographic Segment Baby boomers were becoming more and more interested in Do It Yourself (DIY) renovations. They were home owners and wished to renovate and redecorate them. Home Improvement was targeting baby boomers; whereas, baby boomers were not proficient with internet usage and let alone make purchases online. They had the income, the drive and the house but they were simply not part of the internet shopper community, those who used the internet used it mainly for pre-shopping information gathering. As it increased the value of their property and add to their real-estate investment. Arrival or departure of kids created a need to renovate and in most of the projects: women were the main decision driver, while men were the executants. Starting a new renovation project was relatively expensive; thus, required moderate disposable income. Geographically speaking, the trend of Do It Yourself renovations was mostly concentrated in the North American suburbs. As pride of owning a pleasant dwelling was deeply rooted in the North American culture. New house construction was on the rise and the growth trend was expected to continue for several years. This presented a strong opportunity in the industry. Group 5 -5- Competition & Strategy John Molson COMM 401 School of Business 3.2 Economic Segment The Do It Yourself renovations industry was a $172 billion market which experienced a significant growth rate in the 90s. This market was dominated by 2 major players: Home Depot and Lowes. The emergence of the internet and the tech boom created a new marketplace and many entrepreneurs tried to make money by selling products on the internet. The dot.com craze created an IPO rush and attracted numerous angel investors and venture capitalists eager to invest, making it easier to raise the required capital to pay for new online businesses. This was a two-sided situation, as the market provided a good opportunity; the dominance of the two major players was a huge threat to smaller players 3.3 Socio-Cultural Segment Do It Yourself renovations were becoming a trend in North America, ranging from gardening to bathroom renovation. According to projections almost all dwellings would have started a renovation product during the course of a year. This trend was partially due to the “snob” effect; if the neighbour had it, I had to have it to. Another cause of this trend was the media influence for home renovation, dedicated television shows and specialty magazines were also promoting renovations. A threat to the online marketplace came in the form that computers were still considered a luxury item and were not yet a commodity. Internet availability was low and only low connection speeds were affordable by home users. Consumers were reluctant to buy products online as security was a major concern. They used the internet primarily for some market research and educated themselves about the various options before make in a purchase in a brick & mortar store. This was a potential opportunity for the industry once the online security issues were to be addressed. 3.4 Technological Segment This segment was the industry foundation. Internet adoption rate was on the rise and recent development in technology created more powerful scripting languages to develop better websites. New technologies were released in the market on a daily basis, rendering old technologies obsolete, by providing even more flexibility and features that created interactive websites. Content was king on the internet as it was the main communication vehicle, but at the same time its size must be kept as small as possible due to poor connection speed. Businesses were also starting to rely on EDI (electronic data Group 5 -6- Competition & Strategy John Molson COMM 401 School of Business interchange) to transact with their suppliers. However, both in the consumer and business sectors, security or lack thereof remained a key reason for not transacting online. This was definitely a major opportunity. 3.5 Global Segment A website was open for business 24 hours a day, 7 days a week; this allowed service to a global market at the time judged most convenient by the consumers. This opened new markets and did not impose any restriction; in essence, creating an opportunity. Based on this analysis, it can be said that the general environment was favourable to the industry, as the threats greatly out balanced by the opportunities. 4.0 Porter’s Five Forces of Competition With the general environment complete the DIY industry is the next focal point. This was done by addressing each of Michael Porter’s five forces of competition. Those five forces had a great impact on every firm in the industry; thus, having an influence over the strategy to choose to earn above-average returns. 4.1 Threat of New Entrants This was a strong force in the industry, anyone could spin off a new e-commerce website, and knowledgeable developers were easily available. The required capital to start-up was low since little or no inventory was needed because the distributors shipped the products directly to the consumer. Moreover, the needed capital could be secured easily as venture capitalists or angel financers were eager to make their share in the rapid growth of the ecommerce industry. Access to distribution network was a key issue in this industry, since the products were shipped directly to the consumer from the distributor’s warehouse. This also removed the need to achieve economies of scale and reduced the advantage established players had in the industry. Therefore, failure to secure an efficient network could reduce one’s drive to launch a selling website. Customer service and shipping were the main point of product differentiation, copyright of website content was hard to enforce and could easily be copied; product differentiation was therefore extremely hard to establish. Group 5 Moreover, firms already established within the industry were not quick to -7- Competition & Strategy John Molson COMM 401 School of Business retaliate against new entrants; as can be seen by Lowe’s “wait and see” strategy. Hence, the threat of new entrants was a major force in the industry. 4.2 Bargaining Power of Suppliers Not much was said in the case concerning the number or size of suppliers; however, it was doubtful that suppliers would integrate forward. As a result, the only thing that could be inferred was that suppliers would have had power depending on the size of the player they were dealing with. For example, a supplier would have no power when dealing with Home Depot, while the same supplier might have great power when dealing with smaller retailer, such as Home Improvement. To further confirm this point that suppliers had little power in regard to major players, Home Depot threatened to drop those suppliers if they did not lower their prices. However, that the mere fact of asking was not a guarantee that the suppliers would concede to lower prices. Verdict, this threat was a weak force in the industry. 4.3 Bargaining Power of Buyers In the case, the buyers were the end-users and they had no power, as they bought an insignificant part of the industry’s total output, and the total purchase of the best consumer would have been a minute percentage of the seller’s annual revenue. Given the nature of the buyers, there was no chance of backward integration. However, the switching costs were nonexistent. As consumers could switch seller based on price and product availability. Another aspect of the buyer power was that the buyers could quickly compare prices amongst the different player. Verdict, this threat was a weak force in the industry. 4.4 Threats of Substitute Products The only substitute of the DIY market was the contractors, as they carried out the renovation instead of the end-user. Contractor already had their tools and had access to all the appropriate material needed to complete a project. Verdict, this threat was a weak force in the industry. Group 5 -8- Competition & Strategy John Molson COMM 401 School of Business 4.5 Intensity of Rivalry Among Competitors The online home improvement industry was still in its early days, the competition was not yet fully established and the market was still experiencing significant growth. As a result, it could be affirmed that the rivalry was low. The biggest threat came from the brick and mortar stores, whether they were mom and pop shops or the big players (Home Depot & Lowe’s) both of which offered complete solutions, i.e. they sold lumber and cement. These were two products that could not be sold online due to shipping costs. As previously mentioned, selling online required little to no inventory, meaning that funds were not tied up and the firms were not pressed to enter in a price war to free those funds. By providing interesting and valuable content on their website, offer proper customer services and shipping products in a timely manner, firms could retain customer, created customer loyalty, increased their conversion rate and avoided the most dangerous aspect of the internet; that the competition is one click away. Verdict, this threat was moderate to possibly strong force in the industry. It was established that the industry had low entry barriers, low threats of substitute, low suppliers’ and buyers’ power and that rivalry was moderate. According to the I/O model the industry was attractive to a certain extent. There was potential, but it required a significant amount of time and effort to come up with a differentiation strategy, in order to achieve above-average returns. 4.6 Strategic Implications The industry’s strongest forces were the threat of new entrants and the possible intense rivalry. To minimize those forces, a company could have either reduced its costs while providing value to its customers or it could have differentiated its offering from the competition. Any of the 5 business level strategies would have been efficient to expect above-average returns; however, the chosen strategy must fit with the company’s core competencies. 5.0 Competitor Analysis Competitor analysis was based on two major aspects, Market commonality and Resource Similarity. In the case of Home Improvement and its competitors, the only aspect that could be considered was the market commonality. The companies that Home Group 5 -9- Competition & Strategy John Molson COMM 401 School of Business Improvement needed to worry about were Home Depot, Lowe’s, Amazon, Ourhouse.com, Cornerhardware.com and Hardware.com. The DIY market was divided into two segments, the online segment and the brick and mortar segment. This presented a couple of issues, such as some customers were less inclined to purchase products online for security reasons and also because they would rather touch, feel an item and test it out before purchasing it. On the other hand, there are people who are familiar with surfing the internet for products and making purchases. These consumers felt comfortable with this medium and did not leave the comfort of their homes to go shopping. 5.1 Home Depot At that moment Home Depot was not a threat for Home Improvement in the online retail of Do It Yourself segment As a matter of fact there were only few rivalries as the online DIY market was a fairly new concept. However, Home Depot intended to launch an online extension to reach out to new customers within six month of the tech boom. This meant that Home Depot would sweep away a significant amount of clientele. Home Depot had the infrastructure to capitalize on e-purchases as compared to Home Improvement, who did not have brick and mortar store fronts to provide customers with services like store pick-ups after purchasing online; delivery was far more expensive fo Home Improvement. On another note, some essential products were required to finish a renovation product such as lumber and concrete. These products were not carried by Home Improvement as the cost of shipping these items was extravagant. This gave Home Depot an added advantage over Home Improvement since they provided the needed products to finish renovation projects. Home Depot on another front had greater buying power as company revenues exceeded $38 billion at the end of January 2000. Together with brand recognition and their distribution network and Home Depot had an edge over Home Improvement. Group 5 - 10 - Competition & Strategy John Molson COMM 401 School of Business 5.2 Lowe’s Lowe’s was considering a wait and see strategy as to whether the online DIY market would be something worth joining. So at the moment point in time there was no rivalry between Lowe’s and Home Improvement because Lowe’s had not yet launched a website. Lowe’s, just like Home Depot had the infrastructure needed to provide a better online service compared to Home Improvement. This included the ability to provide service like pick-up, delivery and the most popular products that weren’t carried by Home Improvement, lumber and concrete/cement. 5.3 Amazon Amazon as an e-commerce based company had the reputation of being number one at providing products online. At that time Amazon was one of the biggest threats to Home Improvement because they possessed the infrastructure and network, together with logistics to outperform and provide better and cheaper service to the home improvement market. Further still, Amazon had the “First-mover” advantage which combined with its high buying power would have been in position to outperform Home Improvement. In 1999 Amazon purchased the catalogue retailer “Tool Crib of the North” and gained momentum in sales of home improvement products. Amazon had an existing customer base and relished in introducing new categories to its website to leverage the market share in the online sale of home improvement products. 5.4 Other The competitors in the other section include smaller online stores like Ourhouse.com, Hardware.com and CornerHardware.com who aggressively came up with their own tailored content-rich websites with product information and how-to projects as valued to their customers. They were considered to be a moderate threat because of their visibility. Group 5 - 11 - Competition & Strategy John Molson COMM 401 School of Business These competitors further had significant marketing budgets, for example Ourhouse.com had a $100 million budget to launch its marketing strategy and CornerHardware.com was able to raise $50 million for their marketing efforts. 6.0 Internal Analysis When looking at the internal analysis we were gauging at the organizations collection of resources and capabilities that brought above-average returns. Each firm used different skills to develop their core competencies; therefore, it gave them the edge over their competition. The aforementioned referred to the Resource Based Model of Superior Returns and was composed of; Resources, Capabilities, Competitive Advantage, Industry Attractiveness, Strategy Formulation and Superior Returns. 6.1 Resources Venture capitalists (VC) backing – Richard Share was good at securing VC funding in the way that he presented his ideas and the relentless persistence. This was a strength relative to rivals because at the current time, there were hundreds of companies looking to the next ‘dot.com’ and financing was hard to get. Web developers – Era of talented web who were able to design advanced, interactive websites, also had the ability to incorporate new ideas. This was a strength relative to rivals because internet websites were still simple with basic user interfaces for customers. This gave customers a new type of web page to explore. DIY expert – they had retired professionals working for them and gave advice customers in the DIY segment. This was essential for Home Improvement because competitors such as Lowe’s and Home Depot had people in their stores to interact with clients. This would have helped give a more caring impression. Knowledge & Experience (Customer Service) – they had a dedicated after sales support staff who went an extra mile to help clients Content of the website – they were able to promote thousands of products to the consumer as if they were actually shopping. This was a strength relative to rivals because the web developers created them in days rather than in weeks or months. Group 5 - 12 - Competition & Strategy John Molson COMM 401 School of Business Advertising agreements with other websites – good advertising objectives and initiatives enabled a variety of web based marketing and promotions. Employees – all types of employees from higher management to the support staff were dedicated and fully supportive of the company’s missions and objectives. Dedicated and helpful distributor. 6.3 Capabilities Creating an efficient web presence – they had the in-house capability of producing their own web content to attract customers to their website. Give advice on DIY – the experts they hired were retired or injured tradesmen with decade of professional home improvement experience. They gave tips and advice to customers Ability to make dynamic, sticky websites, which grabbed the customer’s attention for longer and increased the possibility of more sales (conversion rate). Capability to raise funds Capability to satisfy customers (shipping/ order satisfaction) they had an excellent customer service group who quickly answered e-mails and calls, as well as a high order fulfilment rate. 6.4 Core Competency 1. Their first core competency was their ability to create dynamic web pages that encompassed flexibility as well as product definition. They were able to do it at a faster rate and at a cheaper rate than if it were outsourced. 2. Delivering quality customer service that went beyond expectations. After sales representatives were prompt and answered calls and sent emails. 6.5 Attractive industry As mentioned earlier, based on Porter’s 5 forces this would be an attractive market. The barriers to entry were low, there was no buyer power, supplier power varied according to the size and the only available substitutes were considerably more expensive (contractors). However, based on the facts presented in the case, it can be said that Home Group 5 - 13 - Competition & Strategy John Molson COMM 401 School of Business Improvement was not quite suited to be part of the industry. At this point in time they were still in the start-up phase and had not yet established any solid reputation in the industry. The biggest players in the market, Home Depot & Lowe’s, had the reputation and size to bully around smaller companies. There were also problems with the way that Home Improvement was setup. In the early 2000’s internet purchases were still a new concept and there was reluctance from customers based on two main reasons. The first reason revolved around security issues, and giving ones credit card over the internet was not safe. There were numerous cases of fraud. The second issue was that by interacting only through a web page, a customer lost the touchabiblity (people prefer to see, touch and feel the product before making a purchase), associated with purchasing the best tool or merchandise. Even at that point the major players were only starting to explore internet capabilities and seemed to have little or no concern that Home Improvement had launched a wonderful web site. Finally distribution networks were essential to succeed in this industry. This was an area that must be studied and exploited because it was still new to the home improvement market. The business model that Home Improvement began was flawed to begin with. No doubt, there was significant potential in the DIY market but the target market was primarily baby boomers. Baby boomers at that time had little or no knowledge of the internet. They were the ones who owned houses, had the disposable income and the drive to carry out DIY projects. However, they were definitely not the ones to go online and make purchases. In essence, their model to begin was extremely defective. 6.6 Value Chain Analysis Firm Infrastructure Human Resource Management MA Support Activities R G IN Technological Development Service Marketing & Sales Outbound Logistics Operations Inbound Logistics Procurement IN G M AR Primary Activities The value chain is based on the valued activities that consumers are ready to pay for, and deals with the customer’s perception of value versus cost. At the same time, the value Group 5 - 14 - Competition & Strategy John Molson COMM 401 School of Business chain will help an organization better understand the areas in their organization that have added value and which areas need improvement. The value also analyses the procedure by which an organization procures raw materials, moves them through their manufacturing processes and delivers them to the final customer.Infrastructure: N/A Human Resource Management: System developers (e-commerce platform), DIY experts, after sales customer service. Pay good salaries to keep these employees at Home_Improvement. A negative observation is that the organization chart is too complex for size of the company. Tech: Heavy investment developing an efficient e-commerce platform (This resulted in a product differentiation). It is an unsustainable competitive advantage for the time being. –Procurement: N / A –Inbound: N / A –Operations: N / A –Outbound: Good order fulfilment process and smooth transitions. The coordination and information exchange between the distributor and Home_Improvement is good. –Mark & Sales: Good e-commerce platform, strongest in the industry to date, as well after sales support is strong. 6.7 VRIO Analysis VRIO was the criteria used to identify whether or not an organization possesses the capability to sustain a competitive advantage. This is measured against the value, rarity, cost of imitation and the ability to exploit the capability. Based on the industry, section 2.0, it could be said that Home Improvement was at a competitive disadvantage. The product that they offer was neither valuable, rare, costly to reproduce or hard to exploit. This places Home Improvement in a difficult position against already existing threats and new threats. Customers will not value this service as valuable because of the fact that someone Group 5 - 15 - Competition & Strategy John Molson COMM 401 School of Business else will come along and do it better. At the current time, since they more-less a first mover in this domain, they do have an sustainable competitive advantage. However it is so small that it is considered nonexistent, which leads to characterize Home Improvement as having below average returns. Valuable Valuable Rare Costly to Org. to be Competitive Performance Imitate Exploited Consequences Implications NO NO NO NO Competitive Disadvantage Below Average Returns YES NO NO YES Competitive Parity Average Returns YES YES NO YES Temporary Competitive Advantage Avg./Above Average Returns YES YES YES YES Sustainable Competitive Advantage Above Average Returns 6.8 Strategic Implic ations In order for Home Improvement to earn above average returns, they had to develop or purchase a distribution channel. At that time their costs were way too high which caused a significant problem with their ability to stay profitable. They could have corrected this problem by either shipping items using a different method or by getting rid of the distributor and venturing out on their own. Although this would help produce superior returns, Home Improvement has no expertise on how to setup such a system. 7.0 Business Level Strategy Based on the core of business level strategies, “value is delivered to customers when the firm is able to use competitive advantages resulting from superior fit among primary and support activities.” In a broad target market like that of the DIY, Home Improvement had a unique source of competitive advantage based on “Differentiation”. Home Improvement had: - 98.7 percent order fulfilment rate in the holiday season - short phone wait times of at least 8 seconds - a call to the customer service centre was answered by a customer service representative in 22 seconds Group 5 - 16 - Competition & Strategy John Molson COMM 401 School of Business - website up time was at 99.91 percent - resolved all email queries within 9 hours - provided free shipping (promotion) - provided gift wrapping services Home Improvement was able to get a differentiation advantage by providing equal buyer’s costs and created sustainability through customer perceptions of uniqueness in services provided. However the company’s ability to provide unique customer service did not offset the high costs incurred by the company in its ability to attract new customers and deliver products in a timely fashion. The company’s current had a customer acquisition cost of $800 per customer and soaring shipping charges from its distributors. 8.0 Performance Measures As we saw with the ratios, the company is not doing very well, it is selling under cost and is on the verge of bankruptcy, while this may please the customers (low prices, great shipping options and good customer support, it does not appeal to the shareholders and other stakeholders, which in this case are more important to the firm than the customers and this would indicate poor performances using the multiple stakeholders approach. Using survival as an indicator of performance might not be appropriate; as this would indicate that the company is doing well. Based on the accounting measures, which paint a more accurate portrait, the company is performing poorly, investor might want to try to recoup what they’ve already invested in order to minimize their loss. 9.0 Strategic Implications Home Improvement was faced with ever increasing operation costs and they did not have the ideal distribution channel necessary to provide cheaper service. So what it came to was that they strategically needed to; - find a better distributor - consider an agreement with one of the major brick and motor companies like Lowe’s Group 5 - 17 - Competition & Strategy John Molson COMM 401 School of Business - or finally capitalize on their client/customer service abilities and concentrating on the service sector The implication of finding a better distributor would have helped the company get a better deal for its distribution network and thus not having to pass on the extra cost of shipping to the customer. The implication of considering an agreement with Lowe’s as opposed to Home Depot would have provided an online presence for Lowe’s since they did not have a website dealing with online purchases. That would have complemented and reduced setup costs for Lowe’s. Lastly, the implications of Home Improvement going into the e-service business would have been to focus the company’s energy on what they were good at, and that was their provision of superior customer service. 10.0 Alternatives There were various courses of actions that Home Improvement could have taken. They are as follows: 10.1 Alternative I – Sell and Exit the Industry Home Improvement could sell the business and exit the market. According to the projected financial statements Home Improvement was losing money well into their fourth year. Their projected income statement suggested that they were not profitable and it was a significantly long time for a company in their industry to be losing money. They had already invested a considerable amount of money in the business and there were no signs of profit. The competition was increasing by the day and it was not easy to differentiate. Obviously building a reputation was a time consuming process. Consumers were not yet comfortable with making purchases online. Online security was also an issue and getting consumers to buy products which were easily available in stores like Home Depot and Lowe’s at approximately the same price was quite a challenge. There were established ecommerce players in the industry which accounted for 75% of the sales volume such as Amazon.com, Egghead.com, ValueAmerica.com, and eBay. At that rate it would have Group 5 - 18 - Competition & Strategy John Molson COMM 401 School of Business taken a long time for Home Improvement to establish itself in the market and become profitable. Hence, Home Improvement could opt to exit the market. Some factors to be considered here were that Home Improvement did have high debt. Their resale value was low and they would have had to layoff their employees. Hence, it may not have been the best move. 10.2 Alternative II – Purchase or develop a Distribution Channel The biggest challenge that Home Improvement faced was with the distribution of its products. Home Improvement shipped its products by air and it proved to be extremely costly. Home Improvement launched a promotion in which purchases over $50 were shipped for free and reached the consumer the next day. The freight charges amounted to 32% of the revenue. According to the Vice President of Operations if a distribution centre was setup it would generate $12, $42 and $78 million in the upcoming years respectively. A distribution channel would give more control to Home Improvement in order to advance its processes. By achieving economies of scale Home Improvement could reduce the costs and either passed the savings to the consumers or increased their margins. However, doing so would have increased the amount of money tied up in inventory, raised fixed costs and would have created a high exit barrier. With all said and done, the underlying assumption here was that the projections of the VP Operations would be correct. There are other factors to be considered such as; Home Improvement did not have the know-how of managing a distribution channel. More importantly, they did not have to the money to purchase one either. Hence, it may not have been a feasible option. 10.3 Alternative III- Move into the E-Business service industry Home Improvement could diversify itself by using its web savvy and computer skills to help organizations develop their e-businesses. They could provide e-solutions for companies to achieve above-average returns. While they may not be suited for the DIY renovations Group 5 - 19 - Competition & Strategy John Molson COMM 401 School of Business industry, their e-commerce platform was extremely powerful. Selling this platform as a stand alone product would have proved to be a viable solution. Given that there was an increased trend towards a new e-commerce store every second. They could tap that huge market by reusing the investments already made; doing so would have been in line with their core competencies. As a result, the chances of earning above-average returns would have increased. Some aspects to be considered with this option would have been the restructuring of the company. They might have had to layoff some employees. They would still have had to serve existing customers who purchased items on their website or had warranties. Or they would have alienated part of their clientele. 10.4 Alternative IV – Approach Lowe’s Home Improvement could have also approached Lowe’s and made an agreement in which Home Improvement could provide the e-business service, advice from “home pros” and use Lowe’s distribution network to sell products online. Home Improvement had excellent statistics for answering customer calls, resolving email queries and order fulfillment rate. It would be beneficial for both Lowe’s and Home Improvement to work together and increase their market share. They could form an alliance to provide superior customer service to their clients. Home Improvement had been successful in increasing the traffic to their websites. By forming an alliance with Lowe’s they would be able to give the customers an option to make purchase online and have it delivered to their homes or pick it up at their nearest Lowe’s outlet. This would have increased the capacity of the distribution network. It would provide Home Improvement could have then used the Lowe’s brand to market the products to consumers. This would have given consumers more security and they would have been more inclined towards online shopping. There were some aspects to be considered when approaching Lowe’s and they were that Home Improvement was not established in the market. They did not have a name. Lowe’s might not have been comfortable with such an alliance. As they did not know about the credibility of Home Improvement and they did not know if they could handle the large volume of sales. Hence, it is an option but primarily depends on the reaction of Lowe’s and their comfort level to form an alliance. Group 5 - 20 - Competition & Strategy John Molson COMM 401 School of Business 11.0 Recommendations After a thorough analysis, there were a couple of options that Home Improvement could have opted for. They could have approached Lowe’s and formed an alliance with them to achieve above-average returns. This would have been a win-win situation for both parties, provided that there was a mutual agreement. They could have also provided e-business solutions. They had the expertise in-house and it would have given them a wide array of products. They would have been able to achieve above-average returns. 12.0 Conclusion In conclusion, Home Improvement does have certain abilities they exploit; however, they should revisit their core competencies. They should redefine their target market. They should study the demographics of their market extremely carefully. They should look into other options to make profits such as providing e-business solutions or forming an alliance with Lowe’s adding value to their services and using their distribution channel to sell products. Group 5 - 21 - Competition & Strategy John Molson COMM 401 School of Business 13.0 Epilogue The actual name of Home Improvement was HomWarehouse.com. They did stay in business for too long. In July of 2000 there was a message posted on the website that they would be “unavailable for the foreseeable future”3. They were bought by WalMart.com. “Wal-Mart was impressed with the commerce platform developed by the Homewarhouse.com team,” as stated by Jeanne Jackson the CEO Wal-Mart.com. The terms of purchase were not disclosed. Some of the employees continued to work under Wal-Mart whereas others were laid off. The reaction was ambivalent as some people felt that “it was sold for convenience”4. The queries of customers with outstanding orders were left unanswered. The founder Richard Shane and CEO Hal Smith were not involved with Wal-Mart.com. 3 4 http://www.findarticles.com/p/articles/mi_m0VCW/is_15_26/ai_65075563 http://sfgate.com/cgi-bin/article.cgi?file=/examiner/archive/2000/07/11/BUSINESS10184.dtl Group 5 - 22 - Competition & Strategy John Molson COMM 401 School of Business 14.0 Appendix Articles Group 5 - 23 - Competition & Strategy John Molson COMM 401 School of Business HomeWarehouse.com goes offline Home Channel News, August 7, 2000 E-tailer only in operation since last October, will be folded into Wal-Mart.com SAN MATEO, CALIF. -- Hardlines e-tailer HomeWarehouse.com is history. Last month, the short-lived venture was folded into Wal-Mart.com, the stand-alone online counterpart of retail giant Wal-Mart. Neither party disclosed the terms of the agreement. "We are very impressed with the commerce platform developed by the Homewarehouse.com team," said Wal-Mart.com CEO Jeanne Jackson in a prepared statement. More than half of HomeWarehouse's 120-person staff has been retained and now works out of Wal-Mart.com's temporary headquarters in Menlo Park, Calif., according to a Wal-Mart spokesperson. HomeWarehouse opened for business last October. Its site offered a core hard-lines assortment, plus animated how-tos and project advice from home improvement experts called HomePros. Investors in the company included venture capital firm Accel Partners, which also backs Wal-Mart.com. Bruce Golden, a partner with Silicon Valley-based Accel, told NHCN that the decision to integrate HomeWarehouse into Wal-Mart.com was "the prudent path" for the long-term health of the company. He said HomeWarehouse had a competent management team and a sound business plan, but simply could not raise any The entire business-to-consumer sector has recently been devastated from the standpoint of financing;" said Golden. "There are public companies whose stock prices are at a fraction of their IPOs. There's no forgiveness at all in the B-to-C market right now, and over the next couple of years pure-play e-tailers will face the challenge of raising new capital." HomeWarehouse has been unable to raise any more money since December, when it received $9 million from Comdisco Ventures. Golden said it became clear to HomeWarehouse's management that the time was right to align with a bigger and bettercapitalized company. Group 5 - 24 - Competition & Strategy John Molson COMM 401 School of Business HomeWarehouse founder Richard Shane and CEO Hal Smith will not be involved with WalMart.com. Golden said both men are taking some time off to review their options, but have expressed interest in becoming involved with other Internet start-ups. Smith, who in January left his post as president and CEO of outdoor equipment company Bass Pro to join HomeWarehouse, said in a press release that the deal "is a positive outcome for both [Wal-Mart and HomeWarehouse]." Less than three months ago, HomeWarehouse launched a $1 million-plus multimedia advertising campaign in the western United States. It sent out 54-page circulars to residents from California to Washington, offering free T-shins with every order, prepaid UPS return mailing labels and free shipping for purchases over $100. But by the first week of July, the company's Web site was out of commission. A brief note on the home page told visitors that the site would be "unavailable for the foreseeable future." While HomeWarehouse's fate raises questions about the outlook for the industry e-tailers, some similar companies say they are managing just fine. Corner Hardware.com.'s cofounder Peter Hunt told NHCN that his company is well-funded and won't need to raise money any time in the near future. "We're seeing positive gross margins even after shipping subsidies, and right now CornerHardware is living up to all our expectations," said Hunt. "Our average purchase size is 25 percent higher than the average in brick-and-mortar stores. If all goes well, we could launch an IPO by the beginning of next year." Group 5 - 25 -