Final Merger.doc - BYU Marriott School

advertisement

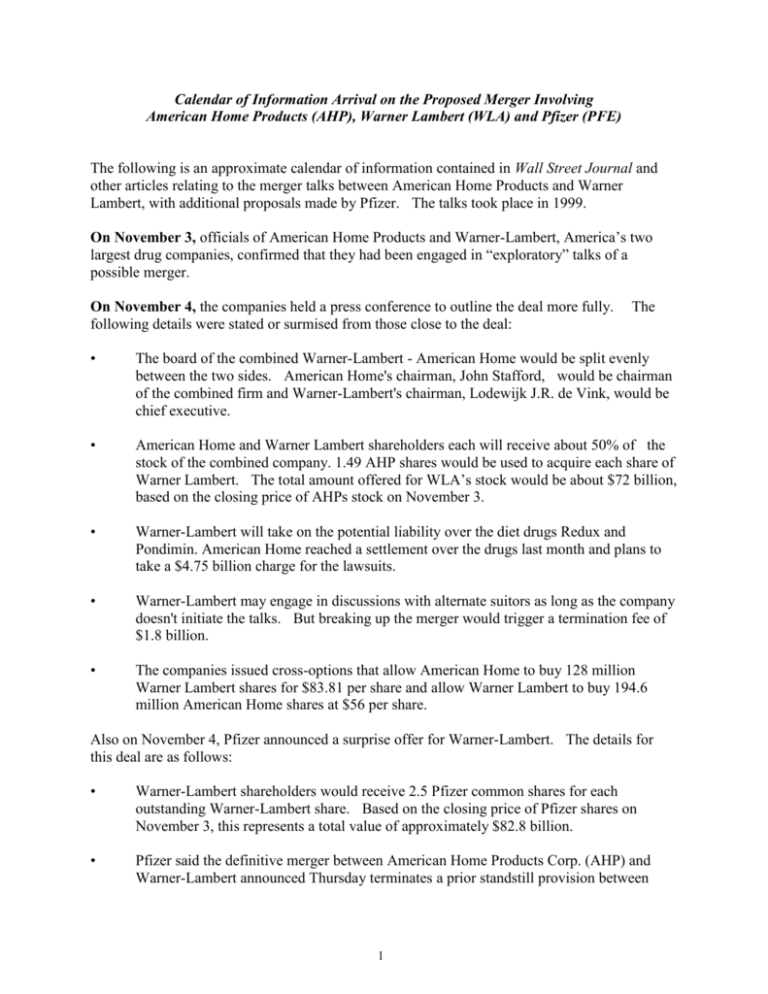

Calendar of Information Arrival on the Proposed Merger Involving American Home Products (AHP), Warner Lambert (WLA) and Pfizer (PFE) The following is an approximate calendar of information contained in Wall Street Journal and other articles relating to the merger talks between American Home Products and Warner Lambert, with additional proposals made by Pfizer. The talks took place in 1999. On November 3, officials of American Home Products and Warner-Lambert, America’s two largest drug companies, confirmed that they had been engaged in “exploratory” talks of a possible merger. On November 4, the companies held a press conference to outline the deal more fully. following details were stated or surmised from those close to the deal: The • The board of the combined Warner-Lambert - American Home would be split evenly between the two sides. American Home's chairman, John Stafford, would be chairman of the combined firm and Warner-Lambert's chairman, Lodewijk J.R. de Vink, would be chief executive. • American Home and Warner Lambert shareholders each will receive about 50% of the stock of the combined company. 1.49 AHP shares would be used to acquire each share of Warner Lambert. The total amount offered for WLA’s stock would be about $72 billion, based on the closing price of AHPs stock on November 3. • Warner-Lambert will take on the potential liability over the diet drugs Redux and Pondimin. American Home reached a settlement over the drugs last month and plans to take a $4.75 billion charge for the lawsuits. • Warner-Lambert may engage in discussions with alternate suitors as long as the company doesn't initiate the talks. But breaking up the merger would trigger a termination fee of $1.8 billion. • The companies issued cross-options that allow American Home to buy 128 million Warner Lambert shares for $83.81 per share and allow Warner Lambert to buy 194.6 million American Home shares at $56 per share. Also on November 4, Pfizer announced a surprise offer for Warner-Lambert. The details for this deal are as follows: • Warner-Lambert shareholders would receive 2.5 Pfizer common shares for each outstanding Warner-Lambert share. Based on the closing price of Pfizer shares on November 3, this represents a total value of approximately $82.8 billion. • Pfizer said the definitive merger between American Home Products Corp. (AHP) and Warner-Lambert announced Thursday terminates a prior standstill provision between 1 Pfizer and Warner-Lambert that it claims Warner-Lambert had used to prevent Pfizer from making an offer to acquire the company. The standstill agreement prohibited Pfizer from trying to acquire Warner-Lambert while the two firms’ agreement to co-market the drug, Lipitor, is in effect. • Pfizer’s offer is conditioned upon elimination of the $1.8 billion break-up fee and stock options which are part of the Warner-Lamber and American Home Products agreement. 2 • The combination would create a company with revenue of $28 billion, and a market capitalization of over $200 billion. The combined company would have research and development expenditures of about $4 billion, and "little significant overlap or redundancy." • Pfizer expects cost savings and efficiencies of more than $1.2 billion from the merger, which would add immediately to earnings, before one-time restructuring charges. • Pfizer said its offer includes combining both companies' boards. Pfizer also filed a lawsuit on November 4 in a Delaware court to enjoin the break-up fee and lock-up option granted by Warner-Lambert Co. (WLA) to American Home Products Corp. (AHP) on their pending merger. A major reason for the concern over the fee and the option is that these provisions make it difficult for Pfizer to use “pooling of interest” accounting in the merger. Using purchase accounting would create a goodwill account of approximately $80 billion. Amortizing that account over 40 years and taking into account the exercise of American Home’s options on Warner-Lambert’s shares could cause earnings dilution of 30% in 2000. On November 5, Pfizer hired a proxy solicitation firm to ready itself for a proxy fight, and Warner and AHP also signed on so-called proxy solicitation firms. Such firms would engage in battle should Pfizer choose to pursue a consent solicitation to replace Warner's board of directors, which is not subject to staggered elections. Warner Lambert and American Home Products are planned to raise the stakes in this battle to include Warner's key drug Lipitor. Warner began actively reviewing the confidentiality agreement that Warner and Pfizer signed on March 4, 1996, with respect to their joint development of Lipitor. Warner is examining whether it can terminate Pfizer's right to distribute the drug given that the standstill provision between the two companies also contained in that agreement is no longer in force. Lipitor is expected to have sales of nearly $4 billion this year. On November 19, American Home Products Corp. (AHP) and Warner-Lambert Co. (WLA) said they expect $1.2 billion in cost savings in 2002 from their prospective merger. The savings would help drive net income growth of 20% annually. By 2002, the combined AmericanWarner's net income would rise to $6.8 billion, or $2.55 a share, from an estimated $3.9 billion, or $1.48 a share, in 1999, the companies said. Revenue would rise to $36.1 billion in 2002 from $26.3 billion in 1999, they said. American Home said it has 50 projects in the development pipeline, compared with 27 for Pfizer. On November 23, Legal experts say Warner-Lambert Co. would be pursuing a risky strategy that could easily backfire should it decide Tuesday to sue Pfizer Inc. to scrap a lucrative joint marketing pact. Warner-Lambert, which has agreed to merge with American Home Products Corp., is trying to defend itself from Pfizer's hostile bid, 3 now valued at $74.6 billion. At stake is control of the cholesterol-lowering drug Lipitor, which will have sales of nearly $4 billion this year and is well on its way to becoming the top-selling drug in the world. While Warner-Lambert's board is scheduled to take up the issue of possible litigation over Lipitor at a regularly scheduled meeting Tuesday, the actual filing of a lawsuit could take another day, people familiar with the situation said. In the meantime, Pfizer filed a new complaint against Warner-Lambert and American Home Products. The action alleges Warner-Lambert breached its contractual obligations to Pfizer in a standstill agreement between the two companies. The complaint also alleges American Home wrongfully interfered with Pfizer's contractual relationship with Warner-Lambert by inducing the breach. A Warner-Lambert lawsuit likely would allege that Pfizer breached the Lipitor marketing agreement by violating so-called standstill agreements in the co-marketing deal, according to people close to the situation. These standstill provisions in general prohibit Pfizer from making a move for Warner-Lambert as long as the deal is in effect. Such a lawsuit would represent a bold attempt to hurt Pfizer -- and its share price -- by trying to take back control of the drug. But some attorneys and analysts said Warner-Lambert could jeopardize Lipitor's future growth prospects by challenging the until-now hugely successful collaboration. "They are playing with fire with the most valuable franchise in the global pharmaceutical industry," said Jeff Chaffkin, a PaineWebber analyst. "If they lose, they look very bad and they risk their key franchise. It's a very high-risk strategy which personally I'd prefer they not take." Warner-Lambert officials argue that Pfizer's overtures to Warner-Lambert -- starting with an Oct. 25 letter from Pfizer Chairman William Steere to Warner-Lambert Chairman Lodewijk J.R. de Vink breached the pact. "Pfizer's first letter violated the standstill agreement," said Anthony Wild, president of Warner-Lambert's pharmaceutical unit, in an interview. While no decision has been made, "you can safely assume a major portion of [Tuesday's] meeting" will be about this issue, Mr. Wild said. Six attorneys who specialize in corporate law, however, said Warner-Lambert doesn't appear to have a particularly strong legal case. Their reading of the Lipitor agreement is that Warner-Lambert would relinquish its rights to enforce the standstill agreement if a third company offered to acquire it, or if Warner-Lambert solicited such an offer. And the legal experts argued that this is most likely the case. Several months before Pfizer expressed interest in Warner-Lambert, Mr. de Vink initiated talks with American Home. By Oct. 25, when Mr. Steere sent his first letter, negotiations between Warner-Lambert and American Home were "in their final stages," Mr. de Vink said in an interview last week. John Coffee, a professor at Columbia University Law School, said he isn't familiar with the details of the American Home/Warner-Lambert negotiations but added that "in the normal course, after months of negotiations that are about to culminate, either there's an offer from one side or a solicitation from the other." 4 Some people close to Pfizer argue that a Warner-Lambert suit would amount to a scorched-earth tactic designed to drive down Pfizer's stock price. "We did nothing to violate the agreement," said one of these people. "There would not be merit legally or factually to the claim on the face of it." On November 24, In a surprise move, Pfizer Inc. sued Warner-Lambert Co. a second time, claiming that Warner-Lambert violated a major provision of their pact to jointly market the blockbuster cholesterol-lowering drug Lipitor and asking a Delaware state court to stop the merger of Warner-Lambert and American Home Products Corp. Pfizer's lawsuit, which also names American Home as a defendant, came as Warner-Lambert's board itself was considering legal action against Pfizer for allegedly violating the Lipitor pact. Warner-Lambert's board held off, for now, on a decision about whether to sue Pfizer to scuttle the Lipitor agreement. People familiar with Warner-Lambert's thinking said the company is still seriously considering such a lawsuit but wants to make sure it would be in shareholders' interests. Pfizer's lawsuit contends that it was Warner-Lambert that actually breached the standstill agreement. Pfizer argues that the standstill provision ended when Warner-Lambert solicited a merger proposal from American Home. The Pfizer suit may be aimed at both moving to protect its rights over the standstill as well as keep the venue in Delaware, where Pfizer's original suit against Warner-Lambert was filed. Warner-Lambert said, Pfizer's claims that the standstill agreement came to an end because Warner-Lambert solicited an offer from American Home are incorrect. The standstill comes to an end, according to Warner-Lambert, only if Warner-Lambert is acquired by a third company. Warner-Lambert argued that because its deal with American Home is a merger of equals, it isn't being acquired and therefore the standstill agreement was never breached. Several independent corporate lawyers pointed out that Pfizer's claim of a contract breach is an aggressive move, to say the least, and that Pfizer may find winning difficult. Indeed, Pfizer is alleging that Warner-Lambert should have told Pfizer about the merger talks out of "good faith and fair dealing." It is clear there is nothing to that effect in the standstill, these attorneys said. These lawyers speculated that Pfizer's real motive was to make sure that any argument over the Lipitor contract be part of a broader, existing suit in Delaware examining the propriety of Warner-Lambert's merger agreement with American Home. Warner-Lambert "doesn't have a basic duty to disclose to Pfizer," said John Coffee, a professor at Columbia University Law School. "This is to pre-empt Warner's suit and put it on your playing field" in Delaware. Harvey Pitt, a lawyer with Fried Frank in New York, said that Pfizer's reasoning was "difficult and novel." But winning this argument isn't Pfizer's first priority, Mr. Pitt said. "There are always reasons why one wants to be the plaintiff as opposed to waiting to get sued and being stuck with a forum you didn't choose," Mr. Pitt said. On November 29, Salomon Smith Barney raised its rating on Pfizer Inc. (PFE) and downgraded American Home Products Corp. 5 (AHP), saying Pfizer should prevail over American Home in its bid to acquire Warner-Lambert Co. (WLA). Salomon analyst Christina Heuer upped Pfizer to buy from neutral and cut American Home to outperform from buy. The Salomon analyst said conversations with Warner-Lambert institutional investors have indicated that the majority favor the combination with Pfizer. Warner-Lambert Co. (WLA) also filed a counterclaim against Pfizer Inc. (PFE), stating it is entitled to terminate the companies' Lipitor agreements. Warner-Lambert is alleging that Pfizer intentionally disregarded its contractual agreements and misstated terms of the standstill restrictions to which it had agreed in the Lipitor agreements. Warner-Lambert alleged that Pfizer breeched its agreement when it made its Nov. 4 proposal to acquire Warner-Lambert. Warner-Lambert said Pfizer, in its claim, asserted that the standstill provisions terminated when Warner-Lambert entered into its merger agreement with American Home Products Corp. (AHP). Warner-Lambert said the standstill agreements end only if it is being acquired. Warner-Lambert's counterclaim also asserts that Pfizer breached the Lipitor agreements by using confidential information when it made and priced its bid to acquire Warner-Lambert. The restriction on the use of confidential information would not end with a termination of a standstill, Warner-Lambert added. The company said sales of Lipitor are expected to surpass $3.6 billion in 1999. Warner-Lambert had $10.21 billion in total sales in 1998. Company Profiles Stock price data and the most recent financial statements for American Home Products, Warner-Lambert, and Pfizer are provided below. Additionally, the following excerpts from articles in the Wall Street Journal provide subjective assessments of the status of each firm. American Home is about to launch some promising new drugs, including a vaccine for pneumococcal disease in children, but some of its strongest existing sellers, like Premarin, are aging. A deal with Warner-Lambert would greatly expand its portfolio of medicines. American Home attempted last year to complete mergers with SmithKline Beecham and Monsanto Co. but because management issues could not be worked out, those deals failed. Of all the major U.S. drug makers, American Home is widely viewed as the one company needing to complete a major merger to compete in the fast-moving sector. While its share price has perked up a bit in recent weeks, American Home has been concerned about the possibility of a hostile overture by a rival drug company. Consequently, it recently adopted a "poison pill" shareholder-rights plan. Pfizer is revered for its golden touch in the research laboratories, but it has suffered a number of setbacks lately and some people are concerned about its short-term outlook. Its antibiotic Trovan, which was expected to be a blockbuster, has been restricted because of safety problems. Pfizer's decreasing share of Lipitor sales (the blockbuster cholesterol-lowering drug it co-markets with Warner-Lambert) could depress Pfizer's earnings per share growth to high-single digits in 2004. Also, Pfizer has what Salomon called 6 an "average" pipeline and major U.S. patent expirations in 2005-07 on three drugs, including Zoloft, Zithromax and Norvasc. A Pfizer/Warner-Lambert combination could benefit from major events in 2000 that should boost sales of the drugs Lipitor, Celebrex and Zithromax, according to the Salomon analyst. As for Warner-Lambert, Wall Street analysts have expressed concerns about whether it has enough potentially profitable new drugs in its pipeline, though profit growth has been robust because of Lipitor's success. Incentives to Merge in the Pharmaceutical Industry Drug companies have been merging for about a decade, and some highly touted deals have collapsed following initial hoopla. But what makes things different right now is that the world-wide pharmaceutical industry is facing a set of unprecedented challenges. Despite an explosion of biological discoveries that are expected to unleash a flood of innovative new medicines in the next five to 10 years, pharmaceutical firms are entering an era when patents that protect hot-selling products are expiring; the pickings are slim inside their research pipelines; and the corporate chiefs atop the largest firms are aging and eager to make one last splash before they retire. To weather the bumpy road ahead and keep investors happy with consistently high profit growth, drug makers must produce a steady flow of truly innovative medicines to command premium prices and quickly generate mammoth sales results. But because the process of discovering and marketing breakthrough medicines is so expensive and serendipitous, product-hungry drug makers feel pressured to solve their short-term revenue needs by joining forces. The result is that the prevailing mantra among the biggest, strongest players is that drug development and world-wide marketing has become so expensive that only the Goliaths can succeed. The future may well bring a global drug industry with, say, a half dozen giants. "In this industry, bigger is better - especially when you look at the price of bringing new drugs to the market," says Bob Kirby, an analyst for Edward Jones in St. Louis. "Plus, the cost of marketing a drug in the U.S. and abroad is fairly daunting." In recent years, mergers occurred among the industry's weaker players that were being crippled by plummeting revenues as big-selling drugs lost their patent protection, or as small R&D programs failed to produce enough new drugs to sustain growth. By merging, these companies including Burroughs Wellcome, Marion Merrell Dow, and Sandoz - often generated strong short-term profit gains for their newly-combined companies through a BandAid financial strategy of jettisoning employees and shutting down redundant administrative, sales and manufacturing operations. Many companies are now seeking a revenue-producing bridge to get them through the next few years when they expect that new 7 genetic science will yield a trove of important medicines against heart disease, cancer, diabetes, and infectious diseases. Merck, for one, is in a particularly difficult place right now, with four major medicines due to lose patent protection in the next two years, including its heart drug Vasotec and Pepcid for ulcers. Raymond Gilmartin, Merck's chairman, says he's confident the company will come through those patent expirations just fine. But other industry officials, including other CEOs, express doubt. "We're entering a new era after a very benign five-year run," said analyst Steven Gerber of CIBC World Markets. "We're seeing moderating growth rates, diminished new-product prospects and a big surge in drug patent expirations along with a challenging political environment. So, these companies will be looking at economic efficiencies and will be less reliant on price increases and new-product launches to drive earnings. The easiest way to do that is in deals like this." Despite compelling forces driving such deals, several highly visible mergers fell apart in the past two years. American Home twice failed to consummate deals, one with SmithKline and another with Monsanto Co., largely because of clashes between top management. Indeed, the drug industry is run by men with strong egos and their own distinctive visions of how best to exploit the scientific potential being produced by their research labs. But several longtime drug-company leaders - including American Home's 62-year-old John Stafford - are approaching retirement, and mergers now appear to be driven in part by a search for an acceptable successor. Still, some of the mergers expected in the near future may simply result from drug companies trying to keep pace with their growing competitors or as a defense against some unwanted takeover overture. Even the biggest drug makers control only 4% to 6% of the world's pharmaceutical business. That fragmentation, and all of its inefficiencies, suggests to some industry leaders that more consolidation is simply inevitable. "If you believe that the industry will consolidate further, and I believe there's a lot of consolidation to come, then American Home was a takeover candidate," said Barbara Ryan, an analyst for Deutsche Banc Alex. Brown. "So they are taking control of their own destiny rather than having someone else do it for you. Nobody does these kind of deals offensively. They're all defensive." 8 Company (Exchange:Symbol) As of: Close 52 Week Range 5 Year Range Shares Outst Market Value 11/26/99 AMERICAN HOME PRODUCTS 53 38.50 - 70.25 13.84 - 70.25 1305.721 M (NYSE:AHP) Engaged in the discovery, development, manufacture, distribution and sales of a diversified line of pharmaceuticals, consumer health care and agicultural products. 5 Giralda Farms Valuation Volatility Madison, NJ 07940 Trailing P/E NE Liquidity 63.707 M PH: (973) 660-5000 Forward P/E 30.1 FX: Price/Sales 5.2 CEO: John R. Stafford Price/Book 12.3 Group: Sponsorship Dividend Yield(%) 1.7 510 Drug Manufacturers/Major Forward PEG 36 month Beta 0.73 Number of Institutions 2193 Percent Held by 68.10% Institutions NC Balance Sheet Items as of: September 30, 1999 ASSETS($Mill) LIABILITIES & OWNER'S EQUITY($Mil) Current Assets 9596.7 Current Liabilities 7549.2 Cash & Equivalents 2146.3 Short Term Debt 1951.2 Property,Plant and Equipment 4373.6 Long Term Debt 3621.7 Intangibles 7805.8 Other Liabilities 6947.4 Other Assets 1967.4 StockHolder's Equity 5625.3 Total Assets 23743.5 Total Liabilities and Equities 23743.6 Five Year Selected Financials History: Fiscal Year Ends on December (in millions) 12mos (3) 1998 1997 1996 1995 1994 1993 13313.2 13462.7 14196 14088.3 13376.1 8966.2 8304.9 Revenue Pct Chg(vs. Year Before) NA -5 1 5 49 8 NA Depreciation 664 664.7 702 658.1 679.2 306.2 241.1 Revenues Earns Bef. Inc. Tax 3063.1 3266.3 3244.1 2976.6 2512.5 2177.8 1995.7 -1470.7 2474.3 2043.1 1883.4 1680.4 1528.3 1469.3 -1.15 1.85 1.56 1.46 1.35 1.24 1.18 NA 19 7 8 9 5 NA 0.92 0.66 1.08 0.79 0.76 0.74 0.72 Current Assets 9596.7 7955.6 7361.3 7470.4 7986.1 7821.2 4807.7 Current Liabilities 7549.2 4210.7 4327 4337.6 4556.2 4618.1 1584.4 Long-Term Debt 3621.7 3859.2 5031.9 6020.6 7808.8 9973.2 859.3 1305.721 1312.399 1300.754 1279.966 Net Income E.P.S. E.P.S. Pct Chg(vs. Year Before) Dividends/Shr Shares Outstanding(millions) 9 1254.8 1223.924 1241.304 Common Equity 5625.2 9614.7 8175.3 6962 5543 4254 3876.4 Profit Margin -11 18.4 14.4 13.4 Return on Equity NE 25.7 25 27.1 12.6 17 17.7 30.3 35.9 37.9 Return on Assets -6.2 11.7 9.8 9.1 7.9 7.1 19.1 P/E Ratio NE 30.5 24.5 20.1 18 12.7 13.7 Price-Sales Ratio 5.2 5.5 3.51 2.66 2.27 2.14 2.42 Price-Book Ratio Debt/Equity Ratio 12.3 7.69 6.08 5.39 5.49 4.51 5.19 0.64 0.4 0.62 0.86 1.41 2.34 0.22 Book Value/Shr 4.31 7.33 6.29 5.44 4.42 3.48 3.12 Div Payout Ratio NE 35.68 69.23 54.11 56.3 59.68 61.02 -9.8 18.3 8.6 7.4 5.7 18.6 43.2 Interest Coverage Ratio Data provided by : Media General Financial Services NOTICE: Information presented is gathered from sources deemed reliable. Media General Financial Services (MGFS) does not represent, warrant or guarantee this data or any calculations or analyses thereof as to completeness, accuracy, timeliness or fitness for a particular purpose or use. MGFS shall not have any liability of any kind for any damages even if notified of the possibility of such damages. 10 Company (Exchange:Symbol) As of: 11/26/99 PFIZER INC (NYSE:PFE) Close 52 Week Range 5 Year Range Shares Outst 36.25 31.51 - 49.99 4.42 - 49.99 3871.259 M Market Value Research-based health care company which discovers, develops, manufactures and sells technology-intensive products in the following business segments: health care, consumer health care and animal health. 235 E 42nd Street Valuation Volatility New York, NY 10017 Trailing P/E 49 PH: (212) 573-2323 Forward P/E 43.2 FX: (212) 573-7851 Price/Sales 9.02 CEO: William C. Steere, Jr. Price/Book 15.97 Group: Liquidity 148.179 M Dividend Yield(%) 0.9 510 Drug Manufacturers/Major Forward PEG 36 month Beta 0.99 Sponsorship Number of Institutions 2357 Percent Held by 55.00% Institutions NC Balance Sheet Items as of: September 30, 1999 ASSETS($Mill) Current Assets LIABILITIES & OWNER'S EQUITY($Mil) 11484 Current Liabilities 9092 942 Short Term Debt 5486 5059 Long Term Debt 525 776 Other Liabilities 1836 Other Assets 2920 StockHolder's Equity 8786 Total Assets 20239 Cash & Equivalents Property,Plant and Equipment Intangibles Total Liabilities and Equities 20239 Five Year Selected Financials History: Fiscal Year Ends on December (in millions) Revenues 12mos(3) 1998 1997 1996 1995 1994 1993 15564 13544 12504 11306 10021.4 8281.3 7477.7 Revenue Pct Chg(vs. Year Before) NA 8 11 13 21 11 NA Depreciation 426 489 502 430 374 292 258.2 Earns Bef. Inc. Tax 4040 3603 3346 3080 2560.2 1972.5 913.3 Net Income 2859 3351 2213 1929 1572.9 1298.4 657.5 E.P.S. 0.74 0.85 0.57 0.5 0.42 0.34 0.17 NA 49 14 19 24 100 NA 0.28 0.25 0.23 0.2 0.17 0.16 0.14 E.P.S. Pct Chg(vs. Year Before) Dividends/Shr Current Assets 11484 9931 6820 6468 6152.4 5788.4 4733.2 Current Liabilities 9092 7192 5305 5640 5187.2 4825.9 3443.6 Long-Term Debt 525 527 1123 687 833 604.2 570.5 Shares Outstanding(millions) 3871.259 3885.892 3885.892 3873.88 Common Equity 8786 8810 7933 6954 5506.6 4323.9 3865.5 Profit Margin 18.4 24.7 17.7 17.1 15.7 15.7 8.8 11 3827.429 3774.492 3854.925 Return on Equity 32.5 38 27.9 27.7 28.6 30 17 Return on Assets 14.1 18.3 14.4 13.2 12.4 11.7 7 P/E Ratio 49 85 43.6 27.6 25.6 18.9 33.8 Price-Sales Ratio 9.02 11.93 7.71 4.73 4 2.94 2.96 Price-Book Ratio 15.97 18.34 12.17 7.68 7.28 5.59 5.74 Debt/Equity Ratio 0.06 0.06 0.14 0.1 0.15 0.14 0.15 Book Value/Shr 2.27 2.27 2.04 1.8 1.44 1.15 1 Div Payout Ratio 37.84 29.41 40.35 40 40.48 47.06 82.35 NC NC NC NC NC NC 9 Interest Coverage Ratio Data provided by : Media General Financial Services 12 Company (Exchange:Symbol) As Close 52 Week Range 5 Year Range Shares Outst Market Value of: 11/26/99 WARNER LAMBERT CO 89 60.81 - 93.94 9.99 - 93.94 855.804 M (NYSE:WLA) Develops, markets and manufactures health care and consumer products. Products include ethical pharmaceuticals and hard-gelatin capsules; over-the-counter health care products, shaving products and pet care products; and chewing gums and cough tablets. 201 Tabor Road Valuation Volatility Morris Plains, NJ 07950 Trailing P/E 48.6 PH: (973) 540-2000 Forward P/E 46.1 FX: (973) 540-3761 Price/Sales 6.3 CEO: Melvin R. Goodes Price/Book 16.68 Group: Dividend Yield(%) 0.9 510 Drug Manufacturers/Major Forward PEG Liquidity 119.425 M 36 month Beta 0.93 Sponsorship Number of Institutions 1909 Percent Held by Institutions 70.00% 1.5 Balance Sheet Items as of: September 30, 1999 ASSETS($Mill) LIABILITIES & OWNER'S EQUITY($Mil) Current Assets 5049.4 Current Liabilities 3377.9 Cash & Equivalents 1012.9 Short Term Debt 233.1 Property,Plant and Equipment 3149.5 Long Term Debt 1280.8 Intangibles 1627.6 Other Liabilities 1297.2 Other Assets 711.1 StockHolder's Equity 4581.7 Total Assets 10537.6 Total Liabilities and Equities 10537.6 Five Year Selected Financials History: Fiscal Year Ends on December (in millions) Revenues Revenue Pct Before) Depreciation Chg(vs. Year 12mos(3) 1998 1997 1996 1995 1994 1993 12126.2 10213.7 8179.8 7231.4 7039.8 6416.8 5793.7 NA 25 13 3 10 11 NA 339 296.3 275.5 230.8 201.9 181.4 170.4 Earns Bef. Inc. Tax 2337.3 1919.1 1423.7 1213.9 1067.2 1011.1 814.6 Net Income 1586.1 1254 869.5 786.5 739.5 694 285 1.83 1.48 1.04 0.95 0.9 0.86 0.35 NA 42 9 6 5 146 NA E.P.S. E.P.S. Pct Chg(vs. Year Before) Dividends/Shr 0.76 0.64 0.51 0.46 0.43 0.41 0.38 Current Assets 5049.4 4102.3 3297 2784.8 2778 2515.3 2218.7 Current Liabilities 3377.9 3230 2588.9 2136.9 2425.2 2353.4 2015.9 634.5 535.2 546.2 Long-Term Debt Shares Outstanding(millions) Common Equity Profit Margin 1280.8 1260.3 1831.2 1720.5 858.661 821.552 817.489 814.426 4581.7 3612.1 2835.5 2581 2246.1 1816.4 1389.6 13.1 12.3 10.6 10.9 10.5 10.8 4.9 13 814.408 808.384 805.646 Return on Equity 34.6 34.7 30.7 30.5 32.9 38.2 20.5 Return on Assets 15.1 13.6 10.8 10.9 12.1 12.5 5.9 P/E Ratio 48.6 50.8 39.8 26.3 18 14.9 32.1 Price-Sales Ratio 6.3 6.05 4.13 2.81 1.87 1.61 1.56 Price-Book Ratio 16.68 17.09 11.92 7.88 5.86 5.7 6.53 Debt/Equity Ratio 0.28 0.35 0.65 0.67 0.28 0.29 0.39 Book Value/Shr 5.34 4.4 3.47 3.17 2.76 2.25 1.72 Div Payout Ratio 41.53 43.24 49.04 48.42 47.78 47.67 108.57 NC NC NC NC NC NC NC Interest Coverage Ratio Data provided by : Media General Financial Services 14 Simplified Statement of Compensation and Holdings of Stocks and Options of CEOs for Potential Merger Partners Company Chairman 1998 Salary & Bonus Stocks Held Options Held Exercise Price Expiration Date American Home Products John R. Stafford $ 620,784 1,812,132 $ 12/31/05 2,774,000 25.93 789,028 $ 12/31/05 47.06 Pfizer Mr. Steere $ 1,795,776 2,132,400 $ 12/31/05 1,379,700 8.96 2,700,000 $ 12/31/05 20.58 Warner-Lambert Lodewijk J.R. de Vink $ 1,934,654 1,564,062 $ 12/31/05 1,879,333 14.48 932,955 $ 12/31/05 26.77 15 Cumulative Abnormal Returns for American Home Products, Pfizer, and Warner-Lambert 30.00% Warner Lambert 25.00% November 3, 1999 Cumulative Abnormal Returns (%) 20.00% 15.00% 10.00% 5.00% 0.00% 9/27/99 American Home Products 10/7/99 10/17/99 10/27/99 11/6/99 11/16/99 11/26/99 -5.00% -10.00% -15.00% -20.00% Pfizer -25.00% Date 16 12/6/99 Closing Stock Prices Date 10/1/99 10/4/99 10/5/99 10/6/99 10/7/99 10/8/99 10/11/99 10/12/99 10/13/99 10/14/99 10/15/99 10/18/99 10/19/99 10/20/99 10/21/99 10/22/99 10/25/99 10/26/99 10/27/99 10/28/99 10/29/99 11/1/99 11/2/99 11/3/99 11/4/99 11/5/99 11/8/99 11/9/99 11/10/99 11/11/99 11/12/99 11/15/99 11/16/99 11/17/99 11/18/99 11/19/99 11/22/99 11/23/99 11/24/99 11/26/99 11/29/99 AHP Pfizer WLA 44.0000 37.3125 68.5000 43.2500 43.2500 45.1250 48.6875 50.5000 49.6250 48.3750 48.0000 46.5625 44.9375 46.1875 48.5000 49.3750 49.9375 50.0000 49.2500 48.8750 50.7500 51.8750 52.2500 50.8125 50.3750 56.0000 55.0000 55.0000 54.2500 52.8750 54.8750 55.5000 55.9375 55.8750 55.0000 52.4375 52.5000 54.0000 53.7500 52.3750 54.2500 53.0000 52.5000 37.6250 37.5000 39.0000 38.6250 39.5000 39.8125 39.3750 38.0000 37.6875 36.8750 37.0000 39.9375 41.5000 41.7500 41.6250 40.0000 37.0000 38.5000 39.7500 39.6875 38.5000 38.1250 38.5625 37.2500 34.7500 35.3750 35.0000 35.0000 35.3750 35.1250 35.0000 33.8750 33.8125 33.8125 33.7500 35.1250 35.6875 36.3750 36.0000 37.4375 69.0000 69.0000 69.8125 69.9375 73.5000 72.8125 73.5000 73.0625 69.5625 67.8750 70.5625 74.4375 76.1875 76.5000 77.1875 77.0000 75.7500 75.8125 77.0000 79.8125 80.0000 78.4375 83.8125 90.5000 89.9375 87.8750 90.0625 92.0625 93.2500 93.6250 92.7500 90.8750 88.6875 88.4375 87.6250 89.3125 88.3750 88.6250 89.0000 91.3750 Volume Returns S&P 500 AHP Pfizer WLA AHP 1282.8100 4,361,100 8,817,400 3,516,800 1304.6000 1301.3500 1325.4000 1317.6400 1336.0200 1335.2100 1313.0400 1285.5500 1283.4200 1247.4100 1254.1300 1261.3200 1289.4300 1283.6100 1301.6500 1293.6300 1281.9100 1296.7100 1342.4400 1362.9300 1354.1200 1347.7400 1354.9300 1362.6400 1370.2300 1377.0100 1365.2800 1373.4600 1381.4600 1396.0600 1394.3900 1420.0300 1410.7100 1424.9400 1422.0000 1420.9400 1404.6400 1417.0800 1416.6200 1407.8300 17 2,492,800 2,973,100 2,586,200 8,173,600 6,787,400 2,688,600 2,140,000 1,964,900 2,994,600 4,015,700 3,313,500 5,364,900 5,362,100 4,747,800 2,627,400 1,677,300 2,335,200 1,778,000 2,530,000 2,056,900 2,489,600 2,634,200 10,790,700 13,426,500 7,432,400 2,794,300 3,278,700 4,869,100 2,506,700 2,948,500 2,807,900 2,968,000 2,709,100 1,906,200 2,641,500 1,959,800 1,796,100 2,701,000 574,900 4,209,100 7,062,500 7,933,000 8,986,200 5,804,300 12,724,400 7,100,300 7,132,000 6,642,800 4,791,300 5,843,200 6,566,600 14,703,900 17,309,200 15,670,300 8,761,900 14,945,500 9,618,200 7,795,300 10,385,600 9,989,300 7,052,700 6,623,800 7,114,400 14,064,500 44,375,100 21,419,400 21,135,700 15,382,800 9,028,900 10,357,400 12,646,700 18,769,000 18,863,000 17,206,700 14,101,800 14,198,100 14,980,300 12,508,800 5,049,200 14,355,200 3,236,900 2,061,500 2,522,200 1,908,000 5,492,800 2,056,200 2,072,200 3,055,200 3,335,100 2,306,500 2,926,100 5,309,200 4,115,100 3,959,400 2,358,600 3,162,200 2,887,800 2,430,900 3,242,900 3,619,600 3,764,900 3,230,100 8,267,200 16,059,000 16,373,600 5,533,300 6,360,900 6,353,600 3,559,100 3,220,700 3,341,200 5,291,700 3,665,200 3,254,600 2,564,500 2,953,100 1,921,900 1,744,700 780,500 2,141,400 Pfizer -1.70% 0.00% 4.34% 7.89% 3.72% -1.73% -2.52% -0.78% -2.99% -3.49% 2.78% 5.01% 1.80% 1.14% 0.13% -1.50% -0.76% 3.84% 2.22% 0.72% -2.75% -0.86% 11.17% -1.79% 0.00% -1.36% -2.53% 3.78% 1.14% 0.79% -0.11% -1.57% -4.66% 0.12% 2.86% -0.46% -2.56% 3.58% -2.30% -0.94% WLA 0.84% -0.33% 4.00% -0.96% 2.27% 0.79% -1.10% -3.49% -0.82% -2.16% 0.34% 7.94% 3.91% 0.60% -0.30% -3.90% -7.50% 4.05% 3.25% -0.16% -2.99% -0.97% 1.15% -3.40% -6.71% 1.80% -1.06% 0.00% 1.07% -0.71% -0.36% -3.21% -0.18% 0.00% -0.18% 4.07% 1.60% 1.93% -1.03% 3.99% S&P 500 0.73% 0.00% 1.18% 0.18% 5.09% -0.94% 0.94% -0.60% -4.79% -2.43% 3.96% 5.49% 2.35% 0.41% 0.90% -0.24% -1.62% 0.08% 1.57% 3.65% 0.23% -1.95% 6.85% 7.98% -0.62% -2.29% 2.49% 2.22% 1.29% 0.40% -0.93% -2.02% -2.41% -0.28% -0.92% 1.93% -1.05% 0.28% 0.42% 2.67% 1.70% -0.25% 1.85% -0.59% 1.39% -0.06% -1.66% -2.09% -0.17% -2.81% 0.54% 0.57% 2.23% -0.45% 1.41% -0.62% -0.91% 1.15% 3.53% 1.53% -0.65% -0.47% 0.53% 0.57% 0.56% 0.49% -0.85% 0.60% 0.58% 1.06% -0.12% 1.84% -0.66% 1.01% -0.21% -0.07% -1.15% 0.89% -0.03% -0.62%