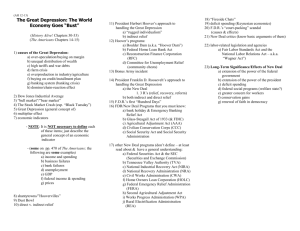

The Impact of New Deal Spending on Local Economic Activity:An

advertisement