Consumer Behavior and Travel Mode Choices

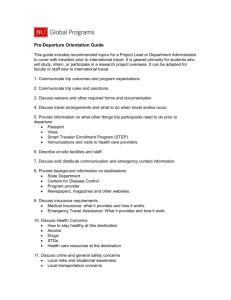

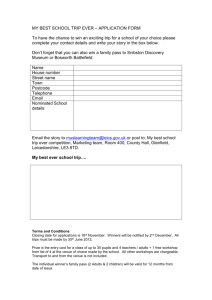

advertisement