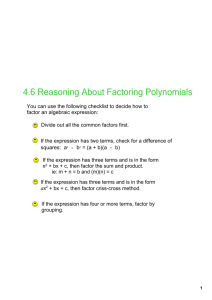

The Role of “Reverse Factoring”

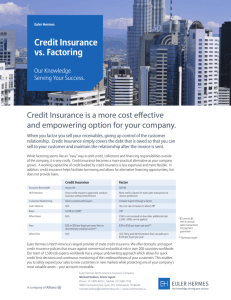

advertisement