Factoring Mechanism: Receivables Financing Explained

advertisement

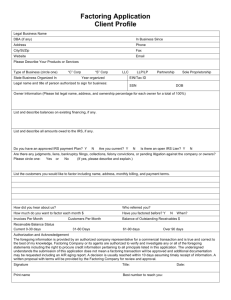

Factoring Mechanism Factoring is a receivables management and financing mechanism which is designed to improve cash flows and cover the credit risk of the seller. Unlike other forms of receivables financing, like bills discounting and forfaiting; factoring involves a continuous relationship between a factor and a seller, to finance and administer the receivables of the latter. Factors are financial companies which pay cash against the credit sales of the client, and obtain the right to receive the future payments on those invoices from the debtors of the client. Functions of a factor Factoring constitutes a suite of financial services offered under a factoring agreement, which includes receivables financing, credit protection, accounts receivables collection and management, sales ledger administration and advisory services. I. Receivables financing: The factoring institution advances a proportion of the value of the book debts immediately to the client and the balance is paid on maturity of the book debts. This improves the cash flow position of the client, by replacing the credit sales for cash. II. Credit protection: The factoring institution takes over the credit risk of the client, and agrees to bear the loss in case of default by the debtor. Credit protection is provided by the factor only in case of non-recourse factoring. III. Accounts receivables collection and management: The factoring company collects the receivables of the client and also manages the credit collection schedule. By reducing the time invested by the client in such activities, it allows the client to focus on business development. IV. Sales Ledger management: The factor undertakes sales ledger management, including maintenance of credit records, collection schedules, discounts allowed and ascertainment of balance due from all debtors. V. Advisory Services: A factoring company advises the client on its export and import potential, and also helps the client in identification and selection of potential trade debtors, based on the credit information available with it. The factor also advises on the prevailing business trends, policies, impending developments in the commercial and industrial sector etc. Factoring mechanism The parties involved in a factoring arrangement are: 1. The Client, or the seller 2. The Debtor, or the buyer 3. The Factor (International factoring may have a correspondent factor in addition to the domestic factor) Exhibit I: Factoring mechanism Detailed Steps: 1. Client approaches Factor Company and requests for factoring facility. 2. Factor asks for Client’s financial statements (last three years’ balance sheet). 3. Client fills the application form and submits his last three years’ financial statements. 4. Factor company conducts Client appraisal by conducting his credit assessment on the quantitative (this includes analysis of current ratios, gearing ratios, profitability ratios, etc.) and qualitative parameters such as integrity, management etc and approves/ disapproves client request. 5. Once approved, the Factor Company assigns overall factoring limit to the client. The client is required to submit sales ledger of his customers to the factor, who assesses the customers to determine limit of sanction according to the quality of customers. 6. Bank NOC / Letter of Disclaimer (LOD) are called for after sanction of limit but before operationalisation of the account. 7. In case of approval of client request, client is asked to submit following documents: a. documents for collateral, if any b. Personal guarantee of directors, etc 8. Factor Company examines the sales ledgers of client’s customers and conducts Buyers’ due diligence. For this, it seeks bank reports, credit reports from credit bureaus, D&B report, etc. 9. Based on the credit assessment of each customer of the client, Factor company sets credit limits for each customer. 10. Factor Company grants in-house approval. 11. Factoring Company is required to send letter of notification to the client’s buyers and the buyers are required to accept the same and send it to the factor company. 12. A factoring agreement is signed between the client and the factoring company. 13. Client is required to submit original invoices with assignment clause written on these and proof of delivery of these invoices. 14. Factor Company makes advance prepayment (Up to 80% of invoice value). 15. Factoring company manages client’s ledger, sends due date reminders to client’s customers and collects payments as and when due. 16. Factoring company uses appropriate software to manage the above processes. 17. Factoring company pays balance due to the client upon receipt of full payment. Detailed Steps in International Factoring (Two Factor Model) 1. The importer places the order for purchase of goods with the exporter 2. The exporter approaches the export factor (in the exporter’s country) for limit approval on the importer. Export Factor in turn requests the import factor in the Importer's country for the arrangement 3. The import factor assesses the importer and approves/rejects the arrangement and accordingly conveys to the export factor 4. Exporter is informed of the commencement or otherwise, of the factoring arrangement 5. The exporter delivers the goods to the importer 6. Exporter produces the documents to the export factor 7. The export factor disburses funds to the exporter upto the prepayment amount and forwards the documents to the Import factor as well as the Importer 8. On the due date of the invoice, the Importer pays the Import Factor, who in turn remits the payment to the export factor. 9. The exporter receives the balance payment from the export factor. Charges applicable Usually, a one time setup fee, a service fee and an interest charge is levied for a factoring transaction. The service fee is levied for the additional services of the factor, besides financing. It is calculated as a percentage of the gross value of the invoices factored, and is based on: I. The gross sales volume II. The number of customers/debtors of the client III. The number of invoices and credit notes IV. The credit risk involved