Estimating Cost of Capital in Firm Valuations with Arithmetic or

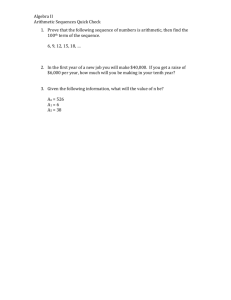

advertisement