Simultaneous First-Price Auctions with Preferences over Combinations

advertisement

Simultaneous First-Price Auctions with Preferences

over Combinations: Identification, Estimation and

Application∗

Matthew Gentry†

Tatiana Komarova‡

Pasquale Schiraldi§

October 2014

(Preliminary and incomplete)

Abstract

Motivated by the empirical prevalence of simultaneous bidding across a

wide range of auction markets, we develop and estimate a structural model

of strategic interaction in simultaneous first-price auctions when objects are

heterogeneous and bidders have preferences over combinations. We begin by

proposing a general theoretical model of bidding in simultaneous first price

auctions, exploring properties of best responses and existence of equilibrium

within this environment. We then specialize this model to an empirical framework in which bidders have stochastic private valuations for each object and

stable incremental preferences over combinations; this immediately reduces to

the standard separable model when incremental preferences over combinations

are zero. We establish non-parametric identification of the resulting model

under standard exclusion restrictions, thereby providing a basis for both testing on and estimation of preferences over combinations. We then apply our

model to data on Michigan Department of Transportation highway procurement auctions, we quantify the magnitude of cost synergies and assess possible

efficiency losses arising from simultaneous bidding in this market.

∗

We are grateful to Philip Haile, Ken Hendricks, Paul Klemperer, and Balazs Szentes for their

comments and insight. We also thank seminar participants at the University of Wisconsin (Madison), the University of Zurich, University of Leuven, Cardiff University, Oxford University, Cornell

University, the University of East Anglia, and Universitie Paris 1 for helpful discussion.

†

London School of Economics, m.l.gentry@lse.ac.uk

‡

London School of Economics, t.komarova@lse.ac.uk

§

London School of Economics and CEPR, p.schiraldi@lse.ac.uk

1

1

Introduction

Simultaneous bidding in multiple first-price auctions is a commonly occurring but

rarely discussed design of many real-world auction markets. In environments where

values over combinations are non-additive in the set of objects won, bidders must

account for possible combination wins at the time of bidding. This in turn substantially alters the strategic bidding problem compared to the standard first price

auction with ambiguous welfare implications depending on the importance of synergies (either positive1 or negative2 ) among objects. As a first step toward exploring

this issue, we develop a structural model of bidding in simultaneous first-price auctions and study identification and estimation in this framework. We then apply our

results to estimate cost synergies arising in Michigan Department of Transportation

(MDOT) highway procurement auctions, using the resulting estimates to quantify

efficiency losses arising from simultaneous bidding in this application.

To underscore the prevalence of simultaneous bidding in applications, note that

most widely studied first-price marketplaces in fact exhibit simultaneous bids. Concrete examples include markets for highway procurement in most US states (JofretBonet and Pesendorfer 2003, Krasnokutskaya 2009, Krasnokutskaya and Seim 2004,

Somaini 2013, Li and Zheng 2009, Groeger 2014, many others), snow-clearing in

Montreal (Flambard and Perrigne 2006), recycling services in Japan (Kawai 2010),

cleaning services in Sweden (Lunander and Lundberg 2012), oil and drilling rights

in the US Outer Continental Shelf (Hendricks and Porter 1984, Hendricks, Pinkse

and Porter 2003), and to a lesser extent US Forest Service timber harvesting (Lu

and Perrigne 2008, Li and Zheng 2012, Li and Zhang 2010, Athey, Levin and Siera

2011, many others). Furthermore, in many of these applications we expect bidders

to have non-additive preferences over combinations; due, for instance, to capacity effects in highway procurement (Jofret-Bonet and Pesendorfer 2003), distance between

contracts in snow clearing and waste collection, or information spillovers in Outer

Continental Shelf drilling (Hendricks and Porter 1984). In such cases strategic simul1

These commonly arise from cost savings in procurement auctions.

These may arise when bidders have resource and capacity constraints or when winning alternative items offered can meet the same need.

2

2

taneity may substantially influence both bidder behavior and market performance.

To illustrate the policy questions arising in simultaneous multi-object auctions,

note that given a set of L heterogeneous objects for sale, bidders could in general assign either positive or negative synergies to winning multiple objects. Consequently,

bidder i’s preference structure could in principle be as complex as a complete 2L dimensional set of signals describing the valuations i assigns to each of the 2L possible

subsets of objects. Meanwhile, the simultaneous first-price mechanism allows bidders

to submit (at most) L individual bids on the L objects being sold. Consequently, the

simultaneous first-price auction format is necessarily inefficient – the “message space”

(standalone bids) permitted is insufficiently rich to allow bidders to express their true

preferences (over combinations). On the other hand, while allowing combinatoric bids

would alleviate the “message space” problem, due to strategic considerations even

this is not guaranteed to produce an efficient allocation (see for example the discussions in Cantillon and Pesendorfer 2006, Crampton at al. 2006). Meanwhile, the

combinatorial first-price mechanism may impose substantial practical costs on both

bidders (the combinatoric bidding problem) and the seller (in allocating objects; the

combinatorial “winner determination problem”). A simultaneous first-price auction

sidesteps both concerns at the cost of potential losses in efficiency or revenue resulting from inability to express combinatoric preferences. Hence in evaluating the

relative merit of the simultaneous first-price format it is first necessary to assess the

magnitude of losses to to simultaneous bidding, a question about which very little is

presently known.3

Despite the prevalence of simultaneous bidding across a variety of first-price markets, there presently exists very little work assessing the revenue and efficiency implications of such simulteneity in practice. This dearth of research is not surprising

given that there presently exists no known method for estimating preferences over

combinations in simultaneous first-price auctions. In turn, without any means to

assess the magnitude of such preferences in practice, meaningful statements on the

3

In environments with substitutes it is known that any Bayes-Nash equilibrium of the simultaneous first-price auction achieves at least half of optimal social welfare – see Feldman et al. (2012)

discussed in more detail below. Apart from this, however, very little is known about efficiency in

practice, and even this (wide) bound becomes meaningless when objects are complements.

3

economic consequences of simultaneous bidding become virtually impossible.

Motivated by this gap in the literature, we develop an empirical model of bidding

in simultaneous first-price auctions when objects are heterogeneous and bidders have

non-additive preferences over combinations, to our knowledge the first such in the

literature. This model turns on a novel decomposition of bidder preferences, which

we outline briefly here. We represent the total value i assigns to a given combination as the sum of two components: the sum of the standalone valuations i assigns

to winning each object in the combination individually, plus a combination-specific

complementarity (either positive or negative) capturing the change in value i assigns to winning objects in combination.4 We interpret standalone valuations as

private information drawn independently across bidders conditional on observables,

but require incremental preferences over combinations to be stable in the sense that

complementarities are unknown functions of observables.5 We find this framework

natural in a variety of procurement contexts – when, for instance, non-additivity in

preferences can be represented as realizations of a “combination shock” realized after

a multiple win. Furthermore – and crucially – our framework collapses immediately

to the standard separable model when complementarities are zero, supporting formal

testing of this hypothesis. We apply this model to data on Michigan Department of

Transportation (MDOT) highway procurement auctions and evaluate the efficiency

losses due to simultaneous bidding in this market. In so doing, we make three main

contributions to the literature on structural analysis of auction markets.

First, we propose a structural model of simultaneous first-price auctions permitting identification of non-additive preferences over combinations. Identification in

this framework rests on two key assumptions. First, as noted above, we assume that

bidders’ incremental preferences over combinations are stable functions of observables. Second, we assume that the marginal distributions of i’s standalone valuations are invariant either to the characteristics of i’s rivals or to the characteristics

4

Note that this decomposition is without loss of generality; the key identifying restriction is the

structure we impose on complementarities.

5

Note that this structure does not restrict dependence between i’s standalone valuations for

different objects in the market. We view this flexibility as critical, as in practice we expect i’s

standalone valuations to be positively correlated.

4

of other objects on which i is bidding.6 We show that optimal behavior in this environment yields an inverse bidding system non-parametrically identified up to the

function describing incremental preferences over combinations, with the resulting

system collapsing to the standard inverse bidding function of Guerre, Perrigne and

Vuong (2000) auction by auction when incremental preferences over combinations are

zero. Building on this inverse bidding system, we translate the exclusion restrictions

outlined above into a system of identifying restrictions on model primitives, with

excludable variation in the characteristics of i’s rivals yielding non-parametric identification and excludable variation in characteristics yielding semiparametric identification of i’s primitives.7 Taken together, these results provide a formal basis for

structural analysis of simultaneous first-price auctions with non-additive preferences

over combinations, to our knowledge the first such in the literature.

Second, building on our identification argument, we develop a three-step procedure yielding empirical estimates of primitives in our structural model. First, in Step

1, we estimate the multi-variate joint distribution of bids as a function of bidderand auction-level characteristics. Due to the high-dimensional nature of this estimation problem, we follow several prior studies (e.g. Cantillon and Pesendorfer 2006

and Athey, Levin and Siera 2011) by employing a parametric approximation to the

observed bid density in implementation of this step. Next, in Step 2, we parametrize

preferences over combinations as a function of bidder- and combination-specific covariates8 and estimate parameters in this function by minimization of a simulated

analog to our semiparametric identification criterion. As in practice we parametrize

6

The first of these exclusion restrictions is widely invoked in the literature; see, e.g. Guerre, Perrigne and Vuong (2009) or Somaini (2012). The second is specific to the combinatoric environment

we consider, although we believe it is natural in a variety of applications.

7

As it is difficult to rule out ties a priori in the fully general simultaneous model, we also

extend our partial identification results (see Appendix C) to accommodate potential mass points

in equilibrium bids. We show that in this case primitives are partially identified, with Monte

Carlo analysis suggesting that identified sets are tight in practice. While we do not believe ties are

important in the application —they are never observed in the data — we consider, this analysis

helps to underscore robustness of our results.

8

In our application, combination-specific covariates might include the sum of engineer’s estimates

across projects in a combination, distance between projects in a combination, and indicators for

whether projects in a combination are of the same type, among others.

5

preferences over combinations as a linear function of observables, this reduces to a

quadratic minimization problem solvable by OLS. Finally, in the third step, we map

estimates derived in Step 2 through the inverse bidding system derived in Step 1

to obtain estimates of the distribution of private costs rationalizing observed bidding behavior. We conclude this part by showing the performance of our estimation

procedure in a Monte Carlo study.

Finally, we apply the framework developed above to analyze simultaneous bidding

in Michigan Department of Transportation (MDOT) highway procurement markets.

We view this market as prototypical of our target application: large numbers of

projects are auctioned simultaneously (an average of 33 per letting round in our

2002-2009 sample period), more than half of bidders bid on at least two projects

simultaneously (with an average of 2.65 bids per round across all bidders in the

sample), and combination and contingent bidding are explicitly forbidden. Within

this marketplace, we show that factors such as size of other projects, number of bidders in other auctions, and the relative distance between projects have substantial

reduced-form impacts on i’s bid in auction l. This finding is expected when bidders

have non-trivial preferences over combinations, but difficult to rationalize within

either the standard separable Independent Private Values model or typical extensions of it (e.g. affiliated values, unobserved heterogeneity, and endogenous entry

among others). We then apply the three-step estimation algorithm described above

to recover structural estimates of primitives for bidders competing for two-auction

combinations, with results suggesting that winning two auctions together leads to

cost savings for moderately sized projects but cost increases for large projects: 4.5

percent savings for a two-auction combination of median size, transitioning to 2.3

percent increase for one at the 90th percentile. Finally, we use our estimation results

to analyze the implications of the auction design chosen by the MDOT. Specifically,

we use our costs estimates to assess the degree of inefficiency in MDOT highway procurement auctions, to estimate the extent of the exposure problem,9 and to determine

what share of the expected total surplus is collected by the auctioneer.

9

The exposure problem in auctions of multiple items involves the risk of bidders winning unwanted items, i.e. winning items at prices above bidders’ values for them.

6

Related literature While we are not aware of a detailed structural exploration

of bidding in simultaneous first-price auctions, there is a small but growing empirical literature on combinatorial first-price auctions: i.e. first-price auctions in which

participants are allowed to submit package bids. The seminal paper in this literature

is Cantillon and Pesendorfer (2006), who analyze simultaneous first-price sealed-bid

auctions in which bidders can submit bids on combinations. The authors address the

problem of non-parametric identification of distributions of bidders valuations when

all the bids and all the identities of the bidders are observed. They also suggest an

estimation procedure which they apply to data from the London bus routes market,

but find little evidence of cost synergies. Allowing bidders to submit combinatorial

bids, substantially alters analysis of the bidding problem; in the language of mechanism design, the “message space” (standalone bids) is now sparse relative to the

type space (preferences over combinations), and therefore it leads to a fundamentally

different identification problem. More recently, Kim, Olivers and Weintraub (2014)

extend the methodology of Cantillon and Pesendorfer (2006) to large-scale combinatoric auctions, using additional structure on combinatoric preferences to circumvent

the substantial curse of dimensionality involved. They then apply methodology to

data on combinatoric auctions used in procurement of Chilean school meals, finding

that the combinatoric first-price auction performs well in terms of both efficiency

and revenue despite the presence of substantial cost synergies in the marketplace.

Paralleling these two structural studies, there is also a small reduced-form literature seeking to quantify the role of preferences over combinations in multi-object

auctions. For instance, Ausubel, Cramton, McAfee and McMillan (1997) and Moreton and Spiller (1998) use regression analysis to measure synergy effects in the recent

experience in FCC spectrum auctions. Lunander and Lundberg (2012) use data from

public procurement auctions of internal regular cleaning services in Sweden to show

that firms inflate their standalone bids in combinatorial first-price auctions relative

to their corresponding bids in simultaneous first-price auctions. Despite this, they

do not find significant differences in the procurer’s cost between these two types of

auctions. Lunander and Nilsson (2004) experimentally compare simultaneous, sequential, and combinatorial first-price sealed-bid auctions and show that, despite

7

potential for synergies, revenue comparison between formats produced statistically

insignificant differences.

From a more theoretical perspective, there exist several studies analyzing strategic interaction in stylized models involving simultaneous first-price auctions. For

instance, Szentes and Rosental (1996) study a first-price sealed-bid acution for identical objects with two identical players and complete information, while Ghosh (2012)

examines a simultaneous sealed-bid first-price auction for two identical objects with

budget-constrained symmetric bidders. While these models confirm that interaction

between auctions can have substantial effects on behavior and welfare, the stylizy focus on stylized models which are not well suited to support empirical analysis. There

is also a substantial literature analyzing properties of various combinatorial auction

mechanisms: Ausbel and Milgrom (2002), Ausbel and Cramton (2004), Cramton

(1998, 2002, 2006), Krishna and Rosenthal (1996), Klemperer (2008, 2010), Milgrom

(2000a, 2000b), and Rosenthal and Wang (1996), to mention just a few. Detailed

surveys of this literature are given in de Vreis and Vorha (2003), and Cramton et al.

(2006). While these studies are similar in that they explicitly consider settings where

bidders have preferences over combinations, the theoretical and empirical problems

encountered in the simultaneous first-price format differ substantially from those

encountered in a combinatorial context.10

Finally, approaching the problem from a substantially different angle, there is a

growing literature on simultaneous first-price auctions within computer science. This

literature is focused almost exclusively on theoretical worst-case efficiency bounds,

termed in computer science the “Bayesian price of anarchy.” For instance, working

within essentially the same model we consider here, Feldman et al. (2012) show that

when preferences are subadditive expected social welfare of any BNE is at least 12

of optimal social welfare. Meanwhile, Syrgkanis (2012) considers a more restrictive

class of “fractionally subadditive” valuations, showing that in this case there exists a

10

Though only tangentially related to our problem, there is also a growing literature on multi-unit

discriminatory auctions of homogeneous objects. Reny (1999, 2011), Athey (2001), and McAdams

(2006) address issues of existence of equilibria and equilibrium properties in such auctions. Meanwhile, Hortacsu and Puller (2008), Hortacsu and McAdams (2010), and Hortacsu (2011) provide

more empirical perspectives on multi-unit auctions.

8

tighter worst-case efficiency bound. Note that these studies analyze bidder behavior

only tangentially, with existence of BNE never directly addressed. Furthermore, even

these (wide) bounds no longer convey any restrictions when objects are complements;

in this case, virtually nothing is known about efficiency of the simultaneous first-price

mechanism.

2

A general model of simultaneous first-price auctions

Consider a one-shot game in which N risk-neutral bidders compete for L prizes

allocated via separate simultaneous first-price auctions. Apart from the possibility

of simultaneous bidding, auctions are run according to standard first-price rules: the

high bidder in auction l wins object l and pays the amount bid. Bids are binding,

bidders may not submit combination bids, bids in one auction may not be made

contingent on outcomes in any other, and there is no resale. For the moment, assume

ties are broken randomly and independently across auctions.

Allocations and outcomes In analyzing this environment, we adopt the following

notation and definitions. An allocation a is an L × 1 vector whose lth element gives

the identity of the bidder winning object l. An outcome from the perspective of

bidder i is an L × 1 indicator vector ω with a 1 in the lth place if object l is allocated

to bidder i (al = i) and a 0 in the lth place otherwise. An outcome matrix Ω is a

2L × 1 matrix whose rows contain (transposes of) each possible outcome ω: e.g. if

L = 2,

"

#

0

0

1

1

ΩT =

0 1 0 1

Since in practice we will normalize preferences over the “win nothing” outcome to

zero, we could equivalently omit the row corresponding to ω = 0 from Ω.

9

Bidder preferences Bidders have preferences over outcomes but are indifferent to

allocations conditional on outcome: i.e. given any set of objects won, i is indifferent

to how remaining objects are distributed among rivals. Let Yiω be the combinatoric

valuation bidder i assigns to outcome ω, and Yi be the 2L × 1 vector describing

the combinatoric valuations i assigns to all possible outcomes (with elements of Yi

corresponding to rows in Ω). Yi is known to bidder i at the time of bidding but

unknown to rivals or the auctioneer; Yi thus represents bidder i’s private type in the

bidding game. We maintain the following two assumptions on private types:

Assumption 1 (Independent Private Values). Each bidder i draws private type Yi

from an absolutely continuous c.d.f. FY,i with support on a compact, convex set

L

Yi ⊂ R2 , with Yi private information, FY,i common knowledge, and types drawn

independent across bidders: Yi ⊥ Yj for all i, j.

Assumption 2 (Values Normalized and Non-decreasing). Yi0 = 0 and Yiω is non0

decreasing in the vector of objects won: ω 0 ≥ ω implies Yiω ≥ Yiω .

Actions and strategies Formally, i’s action space is the set of non-negative L × 1

vectors of the form bi ≡ (bi1 , ..., biL ), with bil denoting i’s bid in auction l. Let Bi

be the set of feasible (non-negative) bids for bidder i; note that under Assumption

1 we may take Bi to be compact without loss of generality, and under Assumption

2 Bi need not include a null bid (since i always prefers to win any additional object

at bid 0). As usual, a pure strategy for bidder i is a function si : Yi → Bi . Following

Milgrom and Weber (1985), we define a distributional strategy for bidder i as a

probability measure σi on Yi × Bi whose marginal on Yi is Fi . Let s = (s1 , ..., sN )

and σ = (σ1 , ..., σN ) denote pure and distributional strategies respectively.

Standalone valuations and complementarities Let Vil denote the valuation i

assigns to the outcome “i wins object l alone”: Vil ≡ Yiel , where el (the lth unit

vector) is a vector of zeros with a one in the lth place. We call Vil bidder i’s standalone valuation for object l, and let the L × 1 vector Vi ≡ (Vi1 , ..., ViL ) describe

i’s standalone valuations over all L objects in the marketplace. We then define the

10

complementarity bidder i associates with outcome ω as the difference between i’s

combinatorial valuation for ω and the sum of i’s standalone valuations for objects

won in ω:

Kiω ≡ Yiω − ω T Vi .

Let Ki be the 2L ×1 vector describing i’s complementarities over all possible outcomes

ω:

Ki ≡ Yi − ΩVi .

Note that Ki = 0 if and only if i’s preferences over outcomes are additively separable

in the set of objects won.

Marginal and combination probabilities Given our distinction between standalone valuations and complementarities, we will frequently wish to distinguish between the marginal and combination win probabilities generated by bid vector b.

Toward this end, let P (b; σ−i ) be the 2L × 1 vector describing the probability distribution over outcomes arising when i submits bid b facing rival strategies σ−i , with

P ω (b; σ−i ) the element of P (b; σ−i ) describing the probability of outcome ω. Similarly, let Γ(b; σ−i ) be the L × 1 vector describing marginal win probabilities arising

when i submits bid vector b facing rival strategies σ−i , with Γl (b; σ−i ) the marginal

probability i wins auction l. Note that Γ(b; σ−i ) is related to P (b; σ−i ) by

Γ(b; σ−i ) = ΩT P (b; σ−i ).

Furthermore, if ties are broken randomly across auctions then Γl (b; σ−i ) depends only

on bid bl , and if ties occur with probability zero then Γl (b; σ−i ) is the c.d.f. of the

maximum rival bid in auction l.

2.1

Best-response bidding

As Milgrom (1999) and others have noted in the context of simultaneous ascending

auctions, strategic analysis of bidder behavior in environments with complementarities is complicated enormously by the so-called “exposure problem” – when bids

11

are submitted auction by auction but preferences are defined over combinations, a

rational bidder may ultimately regret winning the set of objects allocated to him at

the prices he must pay. Put another way, the “message space” (Bi ⊂ RL ) permitted

by the simultaneous first-price auction game is insufficient to allow bidders to fully

L

communicate their preferences (Yi ⊂ R2 ) over outcomes. This turns out to invalidate much classical intuition regarding bidding behavior; for instance, as we show

below, a strict increase in type (y 0 > y in all elements) can yield a strict decrease in

best-response bid (b0 < b in all elements). In this subsection, we explore what can

(and cannot) be said about behavior in the simultaneous first-price auction model.

Toward this end, consider the problem of bidder i with type realization yi competing against rivals who bid according to strategy profile σ−i . Conditional on winning

outcome ω at bid vector b, i receives net payoff Yiω − ω T b, with the 2L × 1 vector

yi − Ωb describing i’s net payoffs over all possible outcomes. Bidder i then chooses

b ∈ Bi to maximize

πi (b; σ−i ) ≡ (yi − Ωb)T P (b; σ−i ).

Let vi be the standalone valuation vector corresponding to i’s type realization yi ,

and ki ≡ yi − Ωvi be i’s corresponding complementarities. Applying the identity

Γ(b; σ−i ) = ΩT P (b; σ−i ), we can then rewrite πi (b; σ−i ) as follows:

πi (b; σ−i ) = (yi − Ωb)T P (b; σ−i )

= (Ωvi − Ωb)T P (b; σ−i ) + kiT P (b; σ−i )

= (vi − b)T Γ(b; σ−i ) + kiT P (b; σ−i ).

(1)

Note that if i’s preferences over combinations are additive, then ki = 0 and (1)

reduces to the standard separable form

πi (b; σ−i ) =

L

X

(vil − bl )Γl (bl ; σ−i ).

l=1

So long as ties are broken independently across auctions, bids in one auction will

then have no effect on payoffs in any other, and applying standard auction theory

12

auction-by-auction will characterize equilibrium in the overall bidding game.

Robust predictions of best-response bidding As noted above, the “exposure

problem” arising when preferences over combinations are not additively separable

substantially complicates strategic analysis of the simultaneous first-price auction

game. This problem is, if anything, more acute in simultaneous first price auctions

than in simultaneous ascending auctions, since in the first-price case bidders cannot

update bids as the auction proceeds. This in turn invalidates key predictions of the

classical auction model such as monotonicity of best responses in types. Rather,

applied to our setting, standard best-response arguments yield only the following

(weak) “monotone probability” property:

Lemma 1. Consider bidder i competing against rival strategy profile σ−i . Let y 0 and

y 00 be any elements of Yi , and let b0 and b00 be any corresponding best responses by i

to σ−i . Then

(y 00 − y 0 ) · [P (b00 ; σ−i ) − P (b0 ; σ−i )] ≥ 0.

In other words, under best-response bidding, P (·; σ−i ) must move in the same dotproduct direction as y.

Proof. By definition of best responses,

(y 0 − Ωb0 )T · P (b0 ; σ−i ) ≥ (y 0 − Ωb00 )T · P (b00 ; σ−i )

⇔ y 0 · [P (b0 ; σ−i ) − P (b00 ; σ−i )] ≥ b0 · ΩT P (b0 ; σ−i ) − b00 · ΩT P (b00 ; σ−i ),

and analogously

y 00 · [P (b00 ; σ−i ) − P (b0 ; σ−i )] ≥ b00 · ΩT P (b00 ; σ−i ) − b0 · ΩT P (b0 ; σ−i ).

Combining these last two inequalities yields the desired result.

Observe that in contrast to the standard single-auction model, increases in a given

element of P (b; σ−i ) could correspond to either increases or decreases in the elements

of b. In other words, “monotonicity” of P (b; σ−i ) with respect to y (in the sense

13

defined above) says little about monotonicity of b with respect to y. For instance,

suppose that bidder i’s type changes from y 0 to y 00 such that y 00 corresponds to a

larger standalone valuation for object l. All else equal, bidder i would then wish to

increase probability weight on the outcome “i wins object l alone.” But (in principle)

bidder i could increase probability weight on this outcome either by increasing bid

in auction l or by reducing bids in other auctions. In extreme cases, this in turn

raises the possibility that best responses could be strictly decreasing in type:

Example 1: Best responses can be strictly decreasing in type Consider the

case of two bidders and two auctions. For bidder 1,

15

5

1

K (1,1) = − v1 − v2 + ,

8

16

4

and (v1 , v2 )T ∈ {(0, 0)T , (0, 2)T , (2, 2)T }. That is, bidder 1 has types y 0 = (0, 0, 0, 54 )T ,

y 00 = (0, 0, 2, 11

)T , and y 000 = (0, 2, 2, 25

)T .

8

8

Suppose that bidder 2’s fixed strategy is to bid either in auction 1 (with probability 12 ) or in auction 2 (with probability 21 ), drawing bids from the uniform U [0; 1]

distribution in either case.

Bidder 1’s types correspond to the following profit functions:

1 1

1 1

π = −b1 ·

− · max{min{1, b2 }, 0} − b2 ·

− · max{min{1, b1 }, 0}

2 2

2 2

max{min{1, b1 }, 0} + max{min{1, b2 }, 0}

5

+ ( − b1 − b2 ) ·

,

4 2

1 1

1 1

00

π = −b1 ·

− · max{min{1, b2 }, 0} + (2 − b2 ) ·

− · max{min{1, b1 }, 0}

2 2

2 2

11

max{min{1, b1 }, 0} + max{min{1, b2 }, 0}

+ ( − b1 − b 2 ) ·

8

2 1

1

1 1

000

π = (2 − b1 ) ·

− · max{min{1, b2 }, 0} + (2 − b2 ) ·

− · max{min{1, b1 }, 0}

2 2

2 2

25

max{min{1, b1 }, 0} + max{min{1, b2 }, 0}

+ ( − b1 − b 2 ) ·

8

2

0

14

T

3 T

1 1 T

, and b000 = 16

, 16 , respecyielding best response bids b0 = 18 , 18 , b00 = 0, 16

tively. Ignoring the first component, which corresponds to the case of winning no

auctions, we see that y 000 is strictly greater than y 0 . Thus a strict increase in type

(from y 0 to y 000 ) can generate a strict decrease in i’s best response bid (from b0 to b000 ).

This is what was to be shown. Monotonicity of bl in vl Obviously, a key feature driving the example above

is that while moving from y 0 to y 000 increases the absolute utility i assigns to all

outcomes, it also decreases the marginal change in payoff (i.e. complementarity) i

assigns to the combination outcome “win 1 and 2 together.” This raises a natural

followup question: holding ki and other elements of vi fixed, must an increase in vil

(weakly) increase i’s best-response bid for object l? Applying Lemma 1, the answer

turns out to be yes:

Lemma 2. Let y 0 and y 00 be any elements of Yi such that vl00 > vl0 , vk00 = vk0 for k 6= l,

and k 00 = k 0 . For any rival strategy profile σ−i , if b0 is a best response to σ−i at y 0

and b00 is a best response to σ−i at y 00 , then b00l ≥ b0l .

Proof. Setting k = k 0 = k 00 , we have y 0 = Ωv 0 + k and y 00 = Ωv 00 + k. Hence applying

Lemma 1,

(y 00 − y 0 ) · [P (b00 ; σ−i ) − P (b0 ; σ−i ] = (Ωv 00 − Ωv 0 )T [P (b00 ; σ−i ) − P (b0 ; σ−i )]

= (vl00 − vl0 ) [Γl (b00l ; σ−i ) − Γl (b0l ; σ−i )] ≥ 0.

Thus vl00 > vl0 implies Γl (b00l ; σ−i ) ≥ Γl (b0l ; σ−i ). If Γl (b00l ; σ−i ) > Γl (b0l ; σ−i ), then

we must have b00l > b0l since Γl (·; σ−i ) is weakly increasing in bl . Alternatively, if

Γl (b00l ; σ−i ) = Γl (b0l ; σ−i ), then either b00l = b0l or b00l < b0l and Γl (·; σ−i ) is flat on

an open interval below b0l . But in the latter case bidder i could slightly reduce b0l

without changing the probability distribution over objects won, which contradicts

the definition of best response. Hence we must have b00l ≥ b0l .

Monotone cross-auction effects When does an increase in vl increase bestresponse bids in other auctions? The answer turns out to depend on a strong condi15

tion which we call supermodular complementarities:

Definition 1 (Supermodular complementarities). For any Yi ∈ Yi and any outcomes

ω1 , ω2 , Yiω1 ∧ω2 + Yiω1 ∨ω2 ≥ Yiω1 + Yiω2 , where ω1 ∧ ω2 denotes the meet of ω1 , ω2 and

ω1 ∧ ω2 denotes the join of ω1 , ω2 .

Note that this condition is substantially stronger than either of the following

plausible but insufficient alternatives:

• Positive complementarities: For all Yi ∈ Yi , Yi ≥ ΩVi , where Vi is the standalone valuation vector corresponding to Yi .

• Superadditive complementarities: For all Yi ∈ Yi and any outcomes ω1 , ω2 , ω3

such that ω1 = ω2 + ω3 , Yiω1 ≥ Yiω2 + Yiω3 .

While these conditions both reflect cases where bidder i wants to win objects “together”, they turn out to be insufficient for cross-auction monotonicity because they

fail to provide enough structure on higher-order combinations. Hence it is not hard

to construct examples satisfying both positive and superadditive complementarities

in which an increase in vl decreases some bk .11 Supermodular complementarities

turns out to be exactly the condition required to rule out such problematic cases,

leading to the following result:

Lemma 3. Suppose that Yi satisfies supermodular complementarities, and let y 0 and

y 00 be any elements of Yi such that vl00 > vl0 , vk00 = vk0 for k 6= l, and k 00 = k 0 . For any

rival strategy profile σ−i , if b0 is a best response to σ−i at y 0 and b00 is a best response

to σ−i at y 00 , then b00 ≥ b0 .

Proof. See Appendix.

Two further comments are worth noting here. First, we have also explored conditions under which an increase in vl would necessarily lead to a decrease in bk for

11

For instance, a bidder could derive a positive complementarity from winning two objects together but no additional complementarity from winning three. This structure would be consistent

with superadditive complementarities, but an increase in (say) v3 could lead bidder i to shift from

bidding aggressively in auctions 1 and 2 to bidding aggressively in auctions 2 and 3.

16

some k 6= l. Not surprisingly, a sufficient condition for this turns out to be submodular complementarities, defined as above but with Yiω1 ∧ω2 + Yiω1 ∨ω2 ≤ Yiω1 + Yiω2 .

Second, when L = 2, complementarities are supermodular or submodular as ki R 0.

Hence if L = 2 then cross-auction effects have the same sign as ki : best-response b1

is increasing in v2 if ki > 0 and decreasing in v2 if ki < 0.

2.2

Existence of equilibrium

One key message of Lemma 3 is that monotonicity of best responses in the simultaneous first-price auction game depends on strong (and in our view typically implausible)

assumptions on the underlying preference space. Insofar as possible, therefore, we

seek to analyze equilibrium existence without invoking monotonicity. Toward this

end, we here consider two alternative approaches to establishing existence. First,

following Milgrom and Weber (1985), we show that an equilibrium in pure strategies exists if the bid space Bi is discrete. Since in practice bids are virtually always

specified up to some minimum currency unit, this in turn is sufficient to guarantee

existence in virtually all applications. Second, building on Jackson, Simon, Swinkels

and Zame (2002), we show that there exists an equilibrium in the “communication

extension” of the simultaneous first-price auction game in which bidders send “cheap

talk” signals which the auctioneer uses to break ties. If ties occur with probability

zero, this in turn corresponds to a full equilibrium in distributional strategies.

Existence with discrete bid space First suppose the bid space is discrete; e.g.

bids can be specified up to a minimum increment of one cent. Then applying the

arguments of Milgrom and Weber (1985) under Assumptions 1 and 2, we establish:

Proposition 1 (Equilibrium with discrete bid space). If the bid space B = ×i Bi is

discrete, then there exists a pure strategy Bayesian Nash Equilibrium of the simultaneous first-price auction game. If in addition complementarities are stable and

supermodular, then there exists a pure strategy Bayesian Nash Equilibrium for any

compact convex B.

17

Existence with endogenous tiebreaking Alternatively, consider any bid space

L

B, and let the outcome correspondence P : B → ∆2 describe the set of allocation

rules permissible at bid profile b ∈ B. Following Jackson, Simon, Swinkels and Zame

(2002), we define the communication extension of the simultaneous first-price auction

game as the game that results when the auctioneer allows each bidder i to submit

both a bid b ∈ Bi and a signal s ∈ Si ≡ Yi indicating his private type, where signals

s1 , ..., sN may be used to break ties but are otherwise “cheap talk” in that conditional

on allocation they have no effect on payoffs. Then applying Theorem 1 in Jackson,

Simon, Swinkels and Zame (2002), we obtain the following result:

Proposition 2 (Equilibrium with endogenous tiebreaking). There exists an equilibrium with endogenous tiebreaking in the communication extension of the simultaneous

∗

)

first-price auction game: that is, a profile of distributional strategies σ ∗ = (σ1∗ , ..., σN

∗

2L

and a tiebreaking rule p : S × B → ∆ selected from P such that bidders truthfully

communicate types and σ ∗ represents an equilibrium given tiebreaking rule p∗ . If in

at least one such equilibrium ties occur with probability zero, then there exists an

equilibrium in distributional strategies in the original auction game.

3

An empirical framework for simultaneous firstprice auctions

Having outlined the key building blocks of our structural model, we turn to the

main objective of this paper – development of an empirical framework supporting

structural analysis of simultaneous first-price auction markets. Toward this end, we

assume the econometrician has access to a “typical” simultaneous first-price auction

sample, interpreted as a sample of T auction rounds drawn from some stable underlying data generating process. In each round, the auctioneer offers Lt objects for

auction to Nt bidders active in the marketplace (though in general not all bidders

need be active in all auctions). Bidders then simultaneously submit sealed bids on

the set of auctions in which they are active, with the set of bidders active in each

18

auction common knowledge to all participants.12 For each round t, we assume the

econometrician observes data on all bidders i and auctions l present in the market.

Asymptotic statements should be interpreted as applying when T → ∞.

For each bidder i present at time t, let Sit be the set of auctions in which i

bids at time t, with bit the corresponding vector of i’s bids. For each round t, the

econometrician observes Sit , bit , and a vector of bidder-specific characteristics Zit for

all bidders i active in the round; to simplify notation, we will adopt the convention

that Zit includes Sit . For future reference, let Lit denote the cardinality of Sit ,

and define Zt ≡ (Z1t , ..., ZNt ,t ). Extending our theoretical model, we assume bidders’

private information is drawn independently conditional on Zt and the auction-related

observables described below.

Meanwhile, on the auction side, we partition the econometrician’s information

into two sets of covariates. First, for each object l auctioned at time t, the econometrician observes a vector of covariates Xlt ; for future reference, we define Xt ≡

(X1t , ..., XLt ,t ). The econometrician may also observe a vector of market-level characteristics Wt taken to affect combinatoric valuations but not standalone valuations;

we formalize this restriction in Assumption 4 below. In a highway procurement context, Xt would include factors like project size, project location, and type of work

in each project, whereas Wt could include distance between projects, interaction between project sizes, and other factors assumed irrelevant for Vil after conditioning

on Zit and Xlt . Note that our identification analysis permits Wt to be null.

3.1

Identifying assumptions

Even cursory analysis of the simultaneous first-price problem suggests a major empirical obstacle: whereas in general the model could involve up to 2Lit − 1 unknown

combinatoric valuations for a given bidder, the data generating process yields only

Lit observed bids corresponding to these unobservables. To obtain a viable empirical

model for simultaneous first-price auctions, it is therefore imperative to specialize

12

While we do not model entry formally here, our analysis can be readily extended to incorporate

endogenous participation along the lines of Levin and Smith (1994) and Athey, Levin and Siera

(2011)). We outline this extension in more detail below.

19

the model before taking it to data. Obviously, whether a given specialization is

plausible will depend crucially on the problem at hand, and no one assumption is

likely to be suitable for all applications. Since our main interest here is procurement,

however, we here propose two restrictions on primitives which we find natural in

many procurement contexts. As we go on to show, these turn out to be sufficient for

non-parametric identification of primitives given data of the form above. We thereby

provide a formal basis for empirical analysis of simultaneous bidding in a wide range

of applications of practical and policy interest. To our knowledge this is the first

such framework proposed in the literature, opening the door for empirical analysis

of factors never previously explored.

Assumption 3 (Stochastic Vi , stable Ki ). For all i and t, Kit = κi (Zt , Wt , Xt ), with

Vit is distributed according to joint c.d.f. Fi (·|Zt , Wt , Xt ).

Assumption 4 (Exclusion). Fi (·|Zt , Wt , Xt ) = Fi (·|Zit , Xt ) and κi (Zt , Wt , Xt ) =

κi (Zit , Wt , Xt ).

Assumption 3 says that complementarities are a stable function of bidder-, auction, and combination-specific observables. This assumption is motivated by our interpretation of Ki as a pure combination effect; i.e. an incremental cost or benefit

derived from winning two objects together. We find this structure reasonable for applications such as procurement contracting, where bidders are obligated to perform

all projects won. It would be less plausible in a setting like unit demand with resale,

where the object ultimately resold would depend on i’s idiosyncratic preferences.

Note that κi (·) can also be interpreted as an expectation over a combination-specific

utility shock realized after a multiple win. Also, and importantly, Assumption 3

formally nests the hypothesis of additively separable preferences: κi (Zt , Wt , Xt ) = 0.

Assumption 4 imposes two exclusion restrictions: own primitives Fi , κi are invariant to rival characteristics Z−it , and standalone valuations Vi are invariant to

combination characteristics Wt given Zi , Xt . The former is widely invoked in the

non-parametric auction literature (e.g. Haile, Hong and Shum (2003), Guerre, Perrigne and Vuong (2009), Somaini (2014)), while the latter formalizes the exclusion

restriction underlying the definition of Wt . Note that the first part of Assumption

20

4 can be justified within a market-wide entry and bidding model along the lines

Levin and Smith (1994); where, for instance, auction-level entry decisions depend on

auction-specific entry cost draws, with realizations of Vi discovered after entry.13

In addition to the fundamental restrictions on primitives captured in Assumptions

3 and 4, we maintain two regularlity conditions on the underlying auction process:

Assumption 5. In each letting t, observed bids are generated by play of an equilibrium with endogenous tiebreaking in the JSSZ communication extension to the simultaneous first-price auction game. Furthermore, for any t, t0 such that (Zt , Wt , Xt ) =

(Zt0 , Wt0 , Xt0 ), the equilibrium played at t is the same as the equilibrium played at t0 .

Assumption 6. For each (Zt , Wt , Xt ) ∈ Z × W × X and each bidder i active in

letting t, the joint distribution of bids submitted by i is absolutely continuous.

The assumption that a single equilibrium is played is widely invoked in the literature; see, e.g., Somaini (2014) and references therein. In light of our existence results,

Assumption 5 formally interprets this equilibrium to be of the JSSZ type. Assumption 6 is a weak regularity condition on the observed distribution of bids which we

expect to hold in any equilibrium such that bidders do not bid atoms. Note that

when Ki = 0 any combination of strategies which would represent an equilibrium

auction-by-auction will also be an equilibrium in the bidding game, and under standard regularity conditions (e.g. Assumption 1) strategies in any such equilibrium

will satisfy the smoothness requirements in Assumption 1. Hence Assumption 6 is

without loss of generality when Ki = 0, implying that all results below formally nest

this hypothesis as a special case.

3.2

Non-parametric Identification

Under Assumptions 3 and 4, model primitives are the distribution of standalone valuations Fi (·|Zit , Xt ) and the complementarity function κi (Zit , Wt , Xt ) for each bidder

13

In practice, we expect more flexible models of auction entry (e.g. Roberts and Sweeting (2013),

Gentry and Li (2014)) to better reflect true participation decisions. Under the null hypothesis

of zero complementarities, however, these will not help to rationalize the cross-auction bidding

patterns noted below. We therefore focus on exogenous participation as a baseline, leaving detailed

analysis of cross-auction entry for future research.

21

i. Taking i as given, the identification problem is thus to recover Fi (·|Zit , Xt ) and

κi (Zit , Xt ) from observed bidding behavior. Let Gi (·|Zt , Wt , Xt ) be the c.d.f. of the

joint distribution of the Lit × 1 bid vector bi submitted by bidder i at observables

(Zt , Wt , Xt ); note that under Assumption 5 Gi (·|Zt , Wt , Xt ) is identified directly from

observables for all i and t. Consistent with Assumption 1, we permit arbitrary correlation between elements of Vi , but assume vectors Vi , Vj are drawn independently

across bidders; we relax this structure to accommodate auction-level unobserved heterogeneity below. Independence of Vi , Vj implies independence of bi , bj , so knowledge

of G1 , ..., GNt is sufficient to characterize the joint distribution of all bids submitted

by all bidders at time t.

L

Inverse Bid Function Let P−i (·|Zt , Wt , Xt ) : Bi → ∆2it be the probability distribution over outcomes facing bidder i at observables (Zt , Wt , Xt ) taking rival strategies as given, and Γ−i (·|Zt , Wt , Xt ) ≡ ΩT P−i (·|Zt , Wt , Xt ) be the Lit × 1 vector of

marginal win probabilities corresponding to P−i (·|Zt , Wt , Xt ). Note that identification of G1 , ..., GNt implies identification of P−i , Γ−i for all i and (Zt , Wt , Xt ). Given

any realization vi of Vi and any vector of complementarities Ki , we can therefore

write the problem facing bidder i at observables (Zt , Wt , Xt ) in terms of directly

identified objects as follows:

max{(vi − b) · Γ−i (b|Zt , Wt , Xt ) + P−i (b|Wt , Zt , Xt )T Ki }.

b∈Bi

Temporarily suppose that i’s objective is differentiable at b∗ ∈ int(Bi ); we show below

that under Assumption 6 this holds almost surely with respect to the measure on

Bi induced by Gi . Then by hypothesis of equilibrium play, b∗ must satisfy necessary

first-order conditions for an interior optimum:

∇b Γ−i (b∗ |Zt , Wt , Xt )(vi − b∗ ) = Γ−i (b∗ |Zt , Wt , Xt ) − ∇b P−i (b∗ |Wt , Zt , Xt )T Ki . (2)

Note that these first order conditions do not require an equilibrium in pure strategies;

they depend only on continuity of G1 , ..., GNt . Assumption 6 formally guarantees this

22

condition holds, but recall this is without loss of generality when Ki = 0.

L

Let Kit denote the following (2Lit − Lit − 1)-dimensional subspace of R2 it :

Lit

Kit = {k ∈ R2

: k1 = k2 = . . . = kLit +1 = 0}.

That is, Kit contains 2Lit -dimensional vectors whose first Lit + 1 components are

equal to zero. These zero components correspond to the cases of bidder i winning at

most one object (ω = (0, . . . , 0) or ω 0 ω = 1).

Taking Ki ∈ Kit as given, the first order conditions (2) generate for each b∗ ∈

int(Bi ) an Lit × 1 system of equations in the Lit × 1 vector of unknown standalone

valuations vi . We now establish that this system may be inverted for vi at almost

every bi submitted by i. Recall that Γ−i (b|Zt , Wt , Xt ) is an Lit × 1 vector whose

lth element describes the probability that bid vector b wins auction l, and under

Assumption 6 this is simply the probability that the maximum rival bid in auction l

is below bl . Hence ∇b Γ−i (b|Zt , Wt , Xt ) will be a diagonal matrix with (l, l)th element

given by the p.d.f. of the maximum rival bid in auction l. In equilibrium this p.d.f.

must be positive at (almost) every b∗ ∈ int(Bi ), and again invoking Assumption 6

this will be (almost) every bid submitted. We therefore conclude:

Proposition 3 (Inverse Bidding Function). Let K be any vector in Kit , (Z, W, X)

be any realization in Z × W × X , and maintain Assumptions 1-6. Then for almost

every bi drawn from Gi (·|Z, W, X), there exists a unique vector ṽ ∈ RLit satisfying

the first-order system (2) at bi given (K; Z, W, X). This ṽ can be expressed in terms

of bi via the inverse bidding function

ṽ = ξi (bi |K; Z, W, X),

where ξi (·|·; Z, W, X) : Bit × Kit → RLit is defined by

ξi (b|K; Z, W, X) ≡ b + [∇b Γ−i (b|Z, W, X)]−1

× Γ−i (b|Z, W, X) − ∇b P−i (b|Z, W, X)T K ,

23

(3)

and the right-hand expression is identified up to K.

Interpreted as a function of bi , ξi (bi |K; Z, W, B) describes the unique vector of

candidate standalone valuations at which bi could be a best response under the

hypothesis K = κi (Z, W, X). If in fact K = κi (Z, W, X), then under Assumptions 5

and 6 the first-order system (2) describes the true equilibrium bidding relationship

and hence we must have vi = ξi (bi |K; Z, W, B) almost surely. Otherwise, there may or

may not exist v rationalizing bi at K, but regardless ξi (bi |K; Zt , Wt , Bt ) will represent

the unique candidate for vi at which bi satisfies first order necessary conditions for a

best response.14 Note that at K = 0 the lth element of ξi (·) reduces to

ξil (b|0; Zt , Wt , Xt ) = bil +

Γ−i,l (bil |Zt , Wt , Xt )

;

dΓ−i,l (bil |Zt , Wt , Xt )/dbl

i.e. the standard inverse bidding function of Guerre, Perrigne and Vuong (2000)

defined auction by auction.

Identifying restrictions We next apply Assumptions 3 and 4 to translate the

inverse bidding relationship (3) into a system of identifying restrictions on model

primitives κ and F . For ease of exposition, we suppress the subscript t in notation.

First enforce Assumption 3: Ki = κi (Z, W, X) for all i. By Proposition 3, we

then must have for almost every bi drawn from Gi (·|Z, W, X),

vi = ξi (bi |κi (Z, W, X); Z, W, X).

In practice, of course, κi (Z, W, X) is unknown. But for any vector K ∈ Kit , ξi (·|K; Z, W, X)

becomes an identified map from bi to the unique vi consistent with bi under the hypothesis κi (Z, W, X) = K:

vi = ξi (bi |K; Z, W, X) if κi (Z, W, X) = K.

14

(4)

Obviously, imposing sufficient conditions for bi to be a best response – by, for instance, requiring

second-order conditions to hold at ξ(bi |K; Zt , Wt , Bt ) – can only improve identification.

24

But recall that this relationship must hold for almost every bi in the support of

Gi (·|Z, W, X). Under the hypothesis κi (Z, W, X) = K, Equation 4 thus implies a

unique identified candidate F̃i (·|K; Z, W, X) for the unknown c.d.f. Fi (·|Z, W, X):

Z

1[ξi (Bi |K; Z, W, X) ≤ v] Gi (dBi |Z, W, X).

F̃i (v|K; Z, W, X) =

(5)

Bi

Now enforce Assumption 4: κi (Z, W, X) = κi (Zi , W, X), Fi (·|Z, W, X) = Fi (·|Zi , X).

Letting κ0 ≡ κi (Zi , W, X), we then must have for any (Z−i , W ):

F̃i (·|κ0 ; Zi , Z−i , W, X) = Fi (·|Z, W, X) = Fi (·|Zi , X).

(6)

The right-hand side of this final expression is invariant to (Z−i , W ), with κ0 also

invariant to Z−i . Holding (Zi , X) fixed, we thereby obtain two classes of identifying

restrictions on the unknown function κi (·): the first induced by variation in Z−i and

leading to the possibility of non-parametric identification, the second induced by W

and leading to the possibility of semiparametric identification. We develop each of

these in turn.

Non-parametric identification of κi based on variation in Z−i To understand

how variation in Z−i identifies κi (·), consider a simple two-auction example. Holding

(Zi , W, X) fixed, define κ0 ≡ κi (Zi , W, X) as above. Starting from some initial

0

competition structure Z−i , let Z−i

be the competition structure derived from Zi

by adding one additional bidder to Auction 2. Then the marginal probability that i

0

wins Auction 1 will be similar at Z−i and Z−i

, but the probability of the combination

outcome “i wins both 1 and 2” will differ. Furthermore, under Assumption 4, this

change in combination win probabilities is the only way changing Z−i matters for

i’s strategy in Auction 1. Therefore to the extent that moving from competition

0

structure Z−i to competition structure Z−i

matters for i’s behavior in Auction 1,

0

it can be only through κ0 ; if moving from Z−i to Z−i

has no effect, then we must

have κ0 = 0. The number of feasible “experiments” is limited only by the support

of Z−i , with each experiment inducing a continuum of non-linear equations in the

25

finite vector κ0 . Under weak regularity conditions this system will have the unique

(overdetermined) solution κ0 = κi (Zi , W, X). Noting that (Zi , W, X) is arbitrary,

iteration of the argument then yields identification of κi (·) for any (Zi , W, X).

We now formalize this intuition. By linearity of ξi (Bi |K; Z, W, X) in K, note

that for any K ∈ Kit and any (Z, W, X) we can write

EBi [ξi (Bi |K; Z, W, X)|Z, W, X] = Υi (Z, W, X) − Ψi (Z, W, X) · K,

(7)

where Υi (Z, W, X) is an identified Lit × 1 vector defined by

Z

Bi + ∇b Γ−i (Bi |Z, W, X)−1 Γ−i (Bi |Z, W, X) Gi (dBi |Z, W, X)

Υi (Z, W, X) =

Bi

and Ψi (Z, W, X) is an identified Lit × 2Lit matrix defined by

Z

Ψi (Z, W, X) =

∇b Γ−i (Bi |Z, W, X)−1 ∇b P−i (Bi |Z, W, X)T Gi (dBi |Z, W, X).

Bi

Furthermore, by Equation (6) and invariance of Fi (·|Zi , X) in Z−i we must have for

0

:

any Z−i , Z−i

0

EBi [ξ(Bi |κ0 ; Zi , Z−i , W, X)|Z, W, X] = EBi [ξ(Bi |κ0 ; Zi , Z−i

, W, X)|Z 0 , W, X].

(8)

Substituting (7) into (8), we thereby obtain an Li × 1 system of linear restrictions

in the 2Li × 1 vector κ0 = κ(Zi , W, X):

(Υi (Z, W, X) − Υi (Z 0 , W, X)) − (Ψi (Z, W, X) − Ψi (Z 0 , W, X)) · κ0 = 0.

(9)

0

For a single Z−i , Z−i

pair, this system will typically be rank-deficient and thus will

not uniquely determine κ0 . But the underlying equality restriction must hold for

0

every Z−i , Z−i

∈ Z−i . Pooling these restrictions, we therefore conclude:

Proposition 4. For any (Zi , W, X) ∈ Zi × W × X , suppose there exist vectors

26

Z−i,0 , Z−i,1 , ..., Z−i,J in the support of Z−i |Zi , W, X such that the JLi × 2Li matrix

Ψi (Zi , Z−i,1 , W, X) − Ψi (Zi , Z−i,0 , W, X)

..

MΨ ≡

.

Ψi (Zi , Z−i,J , W, X) − Ψi (Zi , Z−i,0 , W, X)

has full column rank when projected onto Kit . Then κi (Zi , W, X) is identified.

Recall that the expectations criterion (8) exploits only equality of first moments

of Fi (·|Zi , X) across Z−i , whereas the underlying invariance restriction (6) requires

equality (and, under Assumption 1, finiteness) of all moments. The system of equations in Proposition 4 merely provides a simple and directly verifiable sufficient condition guaranteeing that the underlying system of functional identities has a unique

solution. Note further that variation in, e.g., number of rivals in other auctions will

produce exactly the kind of variation in Ψi needed for full column rank of MΨ : intuitively, changes in combination win probabilities relevant for cross-auction bidding

only through κ0 . We thus view full column rank of MΨ as a weak regularity condition

guaranteeing identification of model primitives.

Parametric identification of κi based on variation in (Z−i , W ) While nonparametric identification is useful as an ideal, in applications we will typically wish

to impose some parametric structure on κi (·). Toward this end, suppose that to the

assumptions maintained above we add the hypothesis that κi (·) is of the form

κi (Zi , W, X) = C̃i (Zi , W, X, θ0i ),

(10)

where C̃i (Zi , W, X, θ0i ) is a known transformation of (Zi , W, X, θ0i ), and θ0i ∈ Θi ⊂

Rpi . For simplicity, we consider the case when κi (Zi , W, X) is linear in parameters

– that is, κi (Zi , W, X) = Ci (Zi , W, X)θ0i . Then Assumption 4 gives us that for any

(Z, W, X), (Z 0 , W 0 , X) with Zi = Zi0 , Equation (8) reduces to the linear-in-parameters

form

(Υi − Υ0i ) − (Ψi Ci − Ψ0i C0i ) · θ0i = 0,

27

where Υi , Ψi , Ci are identified functions of (Z, W, X) and Υ0i , Ψ0i , C0i are identified

functions of (Z 0 , W 0 , X). Given an appropriate collection of

0

, Wj0 , Xj )}Jj=1 ,

{(Zi,j , Z−i,j , Wj , Xj ), (Zi,j , Z−i,j

we can then express θ0i as the solution to the following L2 -minimization problem

min

θ∈Θi

J

X

Υij − Υ0ij − (Ψij Cij − Ψ0ij C0ij ) · θ

T

Υij − Υ0ij − (Ψij Cij − Ψ0ij C0ij ) · θ ,

j=1

(11)

with identification of θ0i implied by a standard rank condition on the difference

(Ψij Cij − Ψ0ij C0ij ) across j. Note that given {Υij , Υ0ij , Ψij , Ψ0ij }Jj=1 , the problem of

finding θ0i reduces to intercept-free least squares of differences (Υij − Υ0ij ) on differences (Ψij Cij − Ψ0ij C0ij ) across j.

The L2 -minimization problem described above can be written in an analogous

0

integral form if we consider all possible (Zi,j , Z−i,j , Wj , Xj ), (Zi,j , Z−i,j

, Wj0 , Xj ) .

Namely, the L2 criterion would have the form

Z

Z

Z

T

(Υi − Υ0i − (Ψi Ci − Ψ0i C0i ) · θ) (Υi − Υ0i − (Ψi Ci − Ψ0i C0i ) · θ)

0 ,W 0 )

(Zi ,X) (Z−i ,W ) (Z−i

0

dFZ−i W (Z−i

, W 0 |Zi , X) dFZ−i W (Z−i , W |Zi , X)dFZi X (Zi , X)

This latter criterion will typically induce a richer set of restrictions on θ0i than will

the discrete version above.

Identification of Fi To complete the argument, it only remains to note that under Assumptions 3-6, identification of κi (Zi , W, X) for any (Zi , W, X) implies nonparametric identification of Fi (·|Zi , X) at (Zi , X):

Fi (v|Zi , X) ≡ F̃i (v|κi (Zi , W, X); Z, W, X) for all (Zi , W, X),

with F̃i (·|·; Z, W, X) a directly identified function of observables. The conditions

above yield identification of κi (Zi , W, X) for arbitrary (Zi , W, X), from which we

28

conclude that Fi (·|Zi , X) is identified.

4

Application: Simultaneous Bidding in Michigan

Highway Procurement

As noted in the Introduction, simultaneous bidding arises in a wide variety of frequently studied procurement markets: for highway construction, snow clearing, recycling, cleaning, and offshore drilling among others. Our goal in the last section was

to develop an empirical framework suitable for structural analysis across many such

markets. As one illustration of the novel empirical insights made possible by this

framework, we now turn to consider a particular application: the marketplace for

Michigan Department of Transportation (MDOT) highway construction and maintenance contracts. As common in similar procurement contexts, MDOT allocates

contracts for a wide range of highway construction and maintenance services via lowprice sealed-bid auctions. Contracts are auctioned across 15 to 20 “letting dates”

per year, with multiple contracts auctioned on each letting date: an average of 33

per letting date across our sample period (2002-2009), with a maximum of 83 on a

single date. More than half (56 percent) of bidders submit bids on multiple contracts

within any given letting date, with a median of 3 and a mean of 3.96 contracts bid

among bidders in this subset. Bids are submitted to MDOT auction by auction,

with combination and contingent bidding explicitly forbidden by MDOT auction

rules. Bidders may amend bids up to the letting date, but once announced letting

results are legally binding, with winning bidders held liable for failure to complete

contracts won (though they may subcontract up to 60 percent of contract work).

The instutional framework of the MDOT auction marketplace thus closely parallels

our simultaneous first-price structure, with factors like capacity constraints, subcontracting costs, project location, and project type inducing potential non-additivity

in project payoffs.

29

4.1

Data and descriptive statistics

MDOT provides detailed records on contracts auctioned, bids received, and letting

outcomes on its letting website (http://www.michigan.gov/mdot). Building on these

records, we observe data on (almost) all contracts auctioned by MDOT over the

sample period October 2002 to March 2009.15 Our sample includes a total of 5532

auctions over X letting dates, where for each auction the following information is

observed: project description, project location, prequalification requirements, the

internal MDOT engineer’s estimate of the total cost of the project, and the list of

participating firms and their bids. Based on this information, we classify projects

into several project types, leading to a final distribution of projects across types

summarized in Table 1. As evident from Table 1, roughly 60 percent of contracts

are for road and bridge construction and maintenance broadly defined, with the

remainder mainly for safety and other miscellaneous construction.

The data contains information on a total of 629 unique bidders active in the

MDOT marketplace over our sample period, which we subclassify by size and scope

of activity as follows. We define “regular” bidders to be those who have submitted

more than 100 bids in the sample period. This yields a total of 35 regular bidders

in the sample, with all remaining bidders classified as “fringe”. For the subsample

of regular bidders, we also collect data on number and location of plants by firm.

This data is derived from a variety of sources: OneSource North America Business

Browser, Dun and Bradstreet, Hoover’s, Yellowpages.com and firms’ websites. Based

on this information, we further subclassify regular bidders as “large” or “small” by

number of plants in Michigan, with “large” regular bidders defined as those with at

least 6 plants. We thus obtain a final classification of 9 large regular bidders, 26

small regular bidders, and 594 fringe bidders in the MDOT marketplace.

4.1.1

Summary statistics

Tables 2 and 3 summarize several key measures of market structure and bidder behavior. Table 2 surveys the auction side of the marketplace. The first key feature

15

For a small number of contracts MDOT records are incomplete.

30

Table 1: Summary of Projects by Type

Contract Type

New Construction

Preventive Maintenance

Resurfacing

Road Reconstruction

Road Rehabilitation

Roadside Facilities

Safety

Traffic Operations

Bridge Construction

Bridge Reconstruction

Bridge Rehabilitation

Miscellaneous

Frequency

0.46

12.00

14.99

9.07

7.70

6.42

11.28

6.12

0.36

11.37

3.58

16.65

emerging from this table is, not surprisingly, the large number of contracts auctioned

simultaneously in the market: a mean of 33 per letting date across the whole letting

date, with a maximum of 83 on a single letting date (note that smaller “supplements” lettings are occasionally held two or three weeks after the main letting in

a given month). The number of bidders submitting bids on any given contract is

small relative to the total number of bidders active in the marketplace, with about

five bids per contract received on average across the sample (approximately 2.5 of

these on average by regular bidders). For each contract, MDOT prepares an internal “Engineer’s Estimate” of expected procurement cost released to bidders before

bidding; the log of this estimate is summarized in Table 2, with the dispersion in

this measure indicating the substantial variation in size and complexity of projects

in the marketplace (from tens of thousands to hundreds of millions of dollars if measured in levels rather than logs). The statistic “Money Left on the Table” measures

the percent difference between lowest and second-lowest bids; on average this is 7.4

percent or roughly $112,000 per contract, suggesting the presence of substantial uncertainty in the marketplace. Finally, to provide a more complete picture of bidder

activity, we also report data on project subcontracting. As evident from the last

two rows of Table 2, this represents an important component of the MDOT auction

31

Table 2: Auction Level Summary Statistics

Auctions per Round

Bidders per Auction

Large Bidders per Auction

Medium Bidders per Auction

Fringe Bidders per Auction

Log Engineer’s Estimate

Money Left on the Table

Project Duration (in days)

Fraction Sub-Contracted

Sub-Contractors per Project

Mean

33.279

4.893

0.900

1.563

2.520

14.296

0.074

119.808

0.153

2.985

St. Dev.

21.776

3.109

0.961

1.709

2.476

1.543

0.084

147.801

0.198

4.079

Min

1.000

1.000

0.000

0.000

0.000

9.482

0.000

6.000

0.000

0.000

Max

83.000

19.000

5.000

8.000

16.000

18.923

0.931

910.000

0.917

49.000

Table 3: Bidder Level Summary Statistics

Bids by Round

Bids by Round if Large

Bids by Round if Small

Participation Rate

Participation Rate if Large

Participation Rate if Small

Mean

2.65

4.873

3.161

0.010

0.060

0.060

St. Dev.

2.45

1.283

0.583

0.023

0.068

0.034

Min

1.000

1.000

1.000

0.000

0.024

0.006

Max

26.000

26.000

17.000

0.242

0.242

0.127

marketplace, with approximately three subcontractors and 15 percent of contract

value subcontracted on average.

Table 3 reframes the auction-level participation variables in Table 2 to provide a

clearer picture of bidder behavior in the MDOT auction marketplace. Again, the key

pattern emerging from Table 3 is the prevalence of simultaneous bidding in MDOT

procurement auctions, with the average bidder competing in roughly 2.5 auctions per

round and regular bidders competing in substantially more (3.16 for small regular

and 4.87 for large regular bidders respectively). Again note that number of bids

submitted in any given auction is small relative to the number of bidders in the

marketplace, with regular bidders competing in about six percent of total auctions

on average.

32

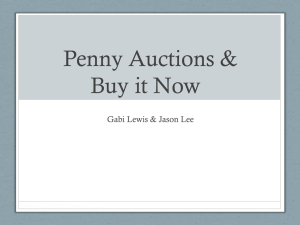

Figure 1: Distribution of Simultaneous Bids Submitted

0.45

0.4

Fraction of Bidders in Sample

0.35

0.3

0.25

0.2

0.15

0.1

0.05

0

0

5

10

15

Number of Simultaneous Bids

20

25

As a graphical perspective on the scope of simultaneous bidding in the MDOT

marketplace, Figure 1 plots the distribution of the number of bids by round submitted

by all bidders in the sample. As evident from Figure 1, more than 55 percent of

bidders in our sample submit multiple bids in the same round, with the median

bidder in this subsample bidding on 3 contracts simultaneously. Despite this, it is

uncommon for a representative bidder to compete in a large number of auctions;

almost 90 percent of bidders in our sample bid in 5 or fewer auctions and only 2

percent bid in more than 10. Not surprisingly, the outliers in this respect are almost

exclusively large regular bidders, although even these bid in fewer than 5 auctions

on average.

4.1.2

Reduced-form regressions

To assess the potential implications of simultaneous bidding on bidder behavior and

auction outcomes, we first explore several simple reduced-form regressions. The

33

unit of analysis in these regressions is a bidder-auction-round combination, with the

dependent variable log of bid submitted by bidder i in auction l in letting t. We

regress log bids on a vector of regressors indended to capture effects of own-auction

and cross-auction characteristics on i’s bid in auction l at time t. We describe

these regressors in detail below. Note that for bidders competing in many auctions

simultaneously there are a very large number of ways to measure potential crossauction effects, with effects potentially non-linear across combinations. To preserve

transparency of the empirical specification, therefore, we focus on bidders competing

in two or three auctions.

Regression specification Based on prior work on highway contracting markets,

we expect three auction-level characteristics to be of primary importance in determining i’s bid in auction l: the size of auction l, as proxied by the MDOT engineer’s

estimate of expected project cost, the level of competition i faces in auction l, and

the distance between project l and i’s base of operations. To control for the first two

effects, we include log of engineer’s estimate and number of rivals in all regression

specifications. Meanwhile, as a proxy for the third, we construct for each bidderproject pair the minimum straight-line distance (in miles) between any of i’s plants

and the centroid of the county in which project l is located. We then control for the

log of this distance in our baseline specifications. As elsewhere in the literature, we

expect project costs to be increasing almost one-to-one in project size, aggressiveness

to be increasing in competition, and project costs (to i) to be increasing in distance.

We therefore expect a positive cost on log of distance to project, a negative coefficient

on number of rivals, and a coefficient on log engineer’s estimate of close to one.

To explore potential cross-auction interaction in the MDOT marketplace, we seek

a set of covariates relevant for bidding in auction l only through κ: i.e. factors shifting

combination payoffs but irrelevant for standalone valuations after conditioning on

characteristics of auction l. We expect (at least) the following factors to be relevant in

this respect: combination size (due to potential capacity effects), number of rivals in

other auctions (shifts combination win probabilities), distance to alternative projects

(as a proxy for substitution between auctions), and whether projects are of the same

34

type. We construct measures of each of these as follows.

As one measure of bid effects due to cross-auction competition, we consider the

average number of rivals across all auctions except l played by bidder i. The effects

of cross-auction competition on strategies in auction l are theoretically ambiguous,

depending both on the sign of κ and on strategic responses by bidders in both

auctions. A priori, however, if κ is negative, we expect greater competition in auction

j to increase marginal returns to winning auction l.

To proxy for effects of combination size, we consider the log of the average engineer’s estimate across all auctions but l in which i is competing. Insofar as marginal

costs to be increasing in capacity utilization (e.g. Jofret-Bonet and Pesendorfer

(2003)), we expect the coefficients on this variable to be positive.

In principle, complementarities arising between similar projects may differ from

those arising between different projects. To allow for this possibility, we also consider log of average engineer’s estimates in other probjects of the same type, defined

similarly to ln aeng other but only averaging across other projects of the same type

as l. In principle, the sign of this effect could be either positive or negative, with a

negative sign interpreted as a relative complementarity between projects of the same

type.

Finally, as an additional proxy for substitutability between projects, we define

log of distance to the neareast other projects, measured as the log of the minimum

distance (in miles) between bidder i and the nearest project other than l. Insofar as

two projects close to i are more substitutable than two projects further away from

i, we expect this variable to have a negative sign.

Regression results Table 4 reports OLS estimates for our baseline regression

specifications: logs bids by bidder, round, and auction on the own- and cross-auction

characteristics defined above. All regression specifications include a full set of bidder