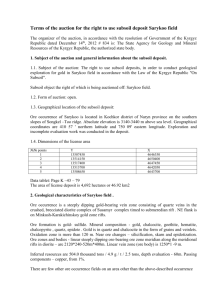

Document

advertisement

COS 444

Internet Auctions:

Theory and Practice

Spring 2009

Ken Steiglitz

ken@cs.princeton.edu

week 8

1

Some other auctions in Ars

All-pay with reserve

Consider simple case with n=2 and

uniform iid values on [0,1]. We also

choose the optimal v* = ½.

b ( v ) E [ pay ] vF ( v )

n 1

v

F ( y)

dy

v*

E [ surplus ] v b ( v )

2

n 1

v

2

2

v

2

2

2

v*

2

,

v v*

2

v*

2

,

v v*

How do we choose b0 to achieve this v* ?

week 8

2

All-pay with reserve

Standard argument: If your value is v* you win

if and only if you have no rival bidder. (This is

the point of indifference between bidding and

not bidding, and your expected surplus is 0.)

Therefore, bid as low as possible! Therefore,

b(v*) = b0 . And so b0 = v*2 = ¼ .

Notice that this is an example where the

reserve is not equal to the entry value v* .

week 8

3

week 8

4

Loser weeps auction, n=2, uniform v

Winner gets item for free, loser pays his bid! Auction

is in Ars . The expected payment is therefore

v

2

v

x dx b ( v )( 1 v ) E [ pay ]

v*

and therefore, choosing v* = ½ as before (optimally),

v 1/ 4

2

b (v )

2 (1 v )

,

v 1/ 2

( goes to ∞ !)

To find b0 , set E[surplus] = 0 at v = v* , and again

argue that b(v*) = b0 . This gives us

2

b0

week 8

v*

1 v*

1/ 2

5

week 8

6

Santa Claus auction, n=2, uniform v

• Winner pays her bid

• Idea: give people their expected surplus and

try to arrange things so bidding truthfully is an

equilibrium.

• Pay bidders

b

F ( y ) dy

v*

• To prove: truthful bidding is a SBNE

week 8

7

Santa Claus auction, con’t

Suppose 2 bids truthfully and 1 has value v

and bids b. Then

E[surplus]

b

F ( y ) dy ( v b ) F ( b )

v*

because F(b) = prob. winning. For equil.:

/ b F (b ) v f (b ) b f (b ) F (b ) 0

bv

week 8

□

(use reserve b0 = v* )

8

Matching auction: not in Ars

• Bidder 1 may tender an offer on a house,

b1 ≥ v*

• Bidder 2 currently leases house and has

the option of matching b1 and buying at

that price. If bidder 1 doesn’t bid, bidder 2

can buy at v* if he wants to

week 8

9

Matching auction: not in Ars

• To compare with optimal auctions, choose

v* = ½; uniform iid IPV’s on [0,1]

• Bidder 2’s best strategy: If 1 bids, match

b1 iff v2 ≥ b1 ; else bid ½ iff v2 ≥ ½

• Bidder 1 should choose b1 ≥ ½ so as to

maximize expected surplus. This turns out

to be b1 = ½ . To see this

week 8

10

Matching auction: not in Ars

Choose v* = ½ for comparison.

Bidder 1 tries to max

(v1 − b1 )·{ prob. 2 chooses not to match }

= (v1 − b1 )·b1

b1 = 0 if v1 < ½

= ½ if v1 ≥ ½ □

week 8

11

Matching auction: not in Ars

Notice:

When ½ < v2 < v1 , bidder 2 gets the item,

but values it less than bidder 1

inefficient!

E[revenue to seller] turns out to be 9/24

(optimal in Ars is 10/24; optimal with no

reserve is 8/24)

BTW, …why is this auction not in Ars ?

week 8

12

Risk aversion

Intuition: Suppose you care more

about losses than gains. How does

that affect your bidding strategy in

SP auctions? First-price auctions?

recall

week 8

13

Utility model

week 8

14

Risk aversion & revenue ranking

Result: Suppose bidders’ utility is

concave. Then with the assumptions

of Ars ,

RFP ≥ RSP

Proof: Let γ be the equilibrium

bidding function in the risk-averse

case, and β in the risk-neutral case.

week 8

15

Revenue ranking

Let the bidder bid as if her value is z,

while her actual value is x. In a first-price

auction, her expected surplus is

W ( z ) u ( x ( z ))

where W(z) = F(z)n-1 is the prob. of

winning. As usual, to find an equilibrium,

differentiate wrt z and set the result to 0

at z = x:

( x )

w ( x ) u ( x ( x ))

W ( x ) u ( x ( x ))

where w(x) = W΄(x).

week 8

16

Revenue ranking

In the risk neutral case this is just:

( x )

w( x)

( x ( x ))

W ( x)

The utility function is concave:

u ( x ) / u ( x ) x

week 8

17

Revenue ranking

Using this,

( x )

w( x)

( x ( x ))

W ( x)

Now we can see that γ΄(0) > β΄(0). If not, then

there would be an interval near 0 where γ ≤ β,

and then

( x )

w( x)

( x ( x )) ( x )

W ( x)

which would be a contradiction.

week 8

18

Revenue ranking

Also, it’s clear that γ(0) = β(0) = 0. So γ starts

out above β at the origin. To show that it stays

above β, consider what would happen should it

cross, say at x = x* :

*

( x )

*

w(x )

*

( x ( x ))

*

*

*

W (x )

*

w( x )

*

( x ( x ))

*

*

*

W (x )

( x )

*

A contradiction. □

week 8

19

Constant relative risk aversion (CRRA)

Defined by utility

u (t ) t ,

1

for concave

In this case we can solve [MRS 03]

( x )

for

w ( x ) u ( x ( x ))

W ( x ) u ( x ( x ))

(v ) v

v

F ( y)

( n 1 ) /

dy

0

F (v )

( n 1 ) /

Very similar to risk-neutral form, but bid as if

there were (n−1)/ρ instead of (n−1) rivals!

week 8

20