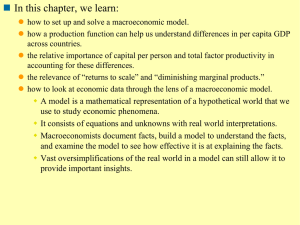

How Important Are Capital and Total Factor Productivity for

advertisement