Dim Sum Bond Primer - InvescoPowerShares.com

advertisement

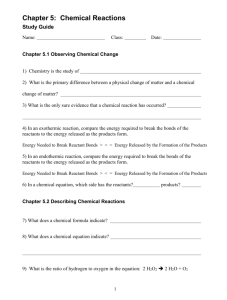

White Paper Dim Sum Bond Primer The Economic/Political Backdrop In order to understand the significance of the dim sum bond market, investors must first have a basic understanding of the currency regime in China. The Chinese government has maintained tight controls on the value of its currency for decades, keeping its value artificially low and thereby supporting economic growth through exports. Only recently has China begun to show signs of interest in letting the market play more of a role in determining the currency’s value. This change has been part of China’s broader efforts to internationalize its currency and establish it as a global reserve. Renminbi (RMB) is the official currency of China; its primary unit is the yuan (CNY). For most of its recent history, RMB has only been allowed to circulate within mainland China. This meant all trade with China was settled in non-RMB currencies (mostly US dollars), with the People’s Bank of China (PBoC) keeping tight controls on the pegged rate at which it exchanged RMB for US dollars. Liberalization1 This all began to change in 2003, when Hong Kong banks were permitted to begin conducting retail RMB business; in 2004 Hong Kong became the first jurisdiction to be allowed limited accumulation of RMB outside mainland China. The following year, China began to allow the RMB to float within a managed range against a basket of currencies and the RMB began to rise against the USD: $/ ¥ The removal of the yuan’s peg to the US dollar in 2005 marked the beginning of a steady 3.5% annualized increase in value relative to the US dollar.2 0.17 0.16 0.15 0.14 0.13 0.12 0.11 0.10 ‘95 ‘97 ‘99 ‘01 ‘03 ‘05 ‘07 ‘09 ‘11 ‘13 Source: Bloomberg L.P., as of Dec. 31, 2013. Past performance is not a guarantee of future results. With a very small portion of China’s cross-border trade being settled in RMB, there was very little of it circulating outside of China, particularly relative to China’s significant proportion of global trade. 1 Source: HSBC Global Research, as of September 2011 2 Source: Bloomberg L.P., as of Dec. 31, 2013 Not FDIC Insured | May Lose Value | No Bank Guarantee For US Use Only 1 White Paper Dim Sum Primer This changed in July 2009 when China began to permit a limited number of foreign trade partners to be paid in RMB and then expanded that list in 2010. When this happened, RMB deposits began to rapidly accumulate in Hong Kong: RMB Deposits with Hong Kong Licensed Banks (¥ billion) RMB deposits with Hong Kong licensed banks have increased by more than 40% since the end of 2011.2 900 800 700 600 500 400 300 200 100 0 ‘95 ‘97 ‘99 ‘01 ‘03 ‘05 ‘07 ‘09 ‘11 ‘13 Source: Bloomberg L.P., as of Dec. 31,2013. Past performance is not a guarantee of future results. Offshore vs. Onshore Outside of mainland China, the RMB is not managed, but rather is allowed to float freely. Not surprisingly, it exhibits characteristics of being its own separate currency. As such, RMB outside mainland China (offshore) is labeled CNH while the onshore version maintains its designation of CNY. China allows some mainland entities to simultaneously access both the CNH and CNY markets, but maintains controls on the extent to which they may do so. So while there is some market pressure to keep CNH and CNY in parity, there is not unlimited ability to arbitrage them, which means at times there can be some divergence: • $/ ¥ As the offshore yuan has matured, its tracking of the onshore yuan has become increasingly tighter.2 CNH • CNY 0.170 0.165 0.160 0.155 0.150 0.145 2010 2011 2012 2013 Source: Bloomberg L.P., as of Dec. 31, 2013. Past performance is not a guarantee of future results. Offshore Bonds As CNH deposits grow, depositors are increasingly looking for ways to earn returns on those deposits. The offshore bond market has developed in response to this demand. Dim sum bonds are yuan denominated and generally issued in Hong Kong by a variety of issuers ranging from governments to corporations. These bonds get their name from the Chinese cuisine that is especially popular in Hong Kong. The dim sum bond market was introduced in 2007 when People’s Republic of ChinaIncorporated-Financial-Institutions were first allowed to issue RMB-denominated bonds offshore. In 2010, the regulatory environment for offshore RMB bonds was eased and additional entities became eligible to both issue and invest in dim sum bonds. Since 2007, total issuance is over ¥500 billion, with ¥92 billion issued in 2011, ¥128 billion in 2012 and ¥328 billion in 2013.2 2 Source: Bloomberg L.P., as of Dec. 31, 2013 Not FDIC Insured | May Lose Value | No Bank Guarantee For US Use Only 2 White Paper Dim Sum Primer Investing in Dim Sum Bonds Correlation of Weekly Returns to Dim Sum Bonds Dim sum bonds have provided a diversification benefit through the low correlation they exhibited to other asset classes: Asset Class* Correlation US Aggregate Bonds 0.14 Investment Grade Corporate Bonds 0.18 Municipal Bonds 0.10 5-Yr Treasury 0.12 Emerging Market Sovereign Debt 0.18 Dim Sum Bonds 1.00 US Equity -0.01 Emerging Market Equity 0.05 Dim sum bonds may offer investors a new means of accomplishing a variety of portfolio objectives, including currency exposure, alternative investment exposure, and diversifying a fixed-income portfolio. In September 2011, Chinese officials stated their intention to gradually move away from their managed-range CNY policy and toward allowing the yuan to float freely, letting it achieve full convertibility by 2015.1 In early 2014, the People’s Bank of China issued public comments confirming their ongoing intention to expand the yuan’s trading band and increase its flexibility.3 In a globalized economy, foreign currency exposure can be an important piece of a portfolio’s construction, offering the potential to protect against a weakening US dollar. Dim sum bonds are issued and settled in offshore Chinese renminbi (CNH) and offer investors exposure to both its appreciation potential against the dollar as well as its reserve-currency trajectory. Additionally, using bonds rather than forward currency contracts to gain this exposure may help to offset some currency-related volatility. As a relatively new investment vehicle, dim sum bonds can also be thought of as an alternative investment, offering previously unobtainable exposure to both the Chinese yuan and to issuers in mainland China. Until recently, investors were limited largely to equity investments for their exposure to China’s rapid economic growth. Dim sum bonds offer an alternative to equity for investors looking for exposure to China’s expanding role in the global economy. In addition to the currency component, the low correlation of dim sum bonds to other asset classes is also attributable to their link to China’s yield curve. Rather than being based off US interest rates, yuan-denominated dim sum bonds respond to changes in China’s interest rates. • Yield Curves • US Treasury Curve 5% 4% Yield (%) Because dim sum bonds are yuan-denominated, they move with changes in China’s interest rates rather than US rates.2 China Sovereign Offshore Curve 3% 2% 1% 0% 1Y 2Y 3Y 5Y 7Y 10Y Source: Bloomberg L.P., as of Dec. 31, 2013. Past performance is not a guarantee of future results. To the extent that China’s path of economic growth diverges from that of the US and as it continues to liberalize its currency regime, its interest rate term structure may be significantly different from that of the US. This may offer investors a vehicle for potentially limiting portfolio risk in a rising US rate environment and a new way to diversify their fixed income portfolios. To learn more about dim sum bonds: call 800 983 0903 or email info@powershares.com 3 Source: Bloomberg L.P., as of Jan. 14, 2014 * Dim Sum Bonds, 5-Year Treasury, U.S. Aggregate Bonds, Municipal Bonds, Investment Grade Corporate Bonds, Emerging market Sovereign Debt are measured by the BofA ML Dim Sum Broad Market, Current 5-Year US Treasury Index, US Corporate and US Dollar Emerging Markets Sovereign Plus Indexes, respectively. US equity is measured by the S&P 500 Index and Emerging Market Equity is measured by the MSCI Emerging Markets Index. Diversification does not guarantee a profit or eliminate the risk of loss Not FDIC Insured | May Lose Value | No Bank Guarantee For US Use Only 3 Index Definitions The S&P 500® Index is an unmanaged index considered representative of the US stock market. The MSCI Emerging Markets Index is an unmanaged index considered representative of stocks of developing countries. The BofA Merrill Lynch US Corporate, Government & Mortgage Index tracks the performance of US dollar denominated investment-grade debt publicly issued in the US domestic market, including US Treasuries, quasi-governments, corporates, covered bonds and residential mortgage pass-throughs. The BofA Merrill Lynch US Corporate Index tracks the performance of US dollar-denominated investmentgradecorporate debt publicly issued in the US domestic market. The BofA Merrill Lynch US Municipal Securities Index tracks the performance of US dollar denominated investment-grade tax-exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. The BofA Merrill Lynch Current 5-Year US Treasury Index is a one-security index comprised of the most recently issued 5-year US Treasury notes. The BofA Merrill Lynch US Dollar Emerging Markets Sovereign Plus Index tracks the performance of US dollar denominated emerging market and cross-over sovereign debt publicly issued in the eurobond or US domestic market. The BofA Merrill Lynch Dim Sum Index tracks the performance of publicly issued CNH denominated government, quasi government, corporate and collateralized debt. Important Risk Information Arbitage is risk-free profit. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. A greater positive correlation (+1.00 maximum) means the two investments have behaved more similarly; a greater negative correlation (-1.00 maximum) means the two have performed less similarly. Fixed-income securities, such as notes and bonds, carry interest rate and credit risk. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. Credit risk is the risk of loss on an investment due to the deterioration of an issuer’s financial health. Adverse economic conditions, such as unfavorable or volatile currency exchange rates and interest rates, political events or other conditions may cause the Chinese government to intervene and impose “capital controls,” including the prohibition of, or restrictions on, the ability to transfer currency, securities or other assets. There are special risks associated with investing in securities designed to provide exposure to Chinese Yuan, such as Yuan-denominated bonds in which the Fund will invest. The Chinese government maintains strict currency controls and regularly intervenes in the currency market. As a result, the value of the Yuan, and the value of Yuan-denominated securities, may change quickly and arbitrarily, potentially impacting the availability, liquidity, and pricing of securities designed to provide offshore investors with exposure to Chinese markets. Invesco Distributors, Inc. is the distributor of the PowerShares Exchange-Traded Fund Trusts. PowerShares® is a registered trademark of Invesco PowerShares Capital Management LLC. Invesco PowerShares Capital Management LLC and Invesco Distributors, Inc. are indirect, wholly owned subsidiaries of Invesco Ltd. An investor should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. For this and more complete information about the Fund call 800 983 0903 or visit invescopowershares.com for a prospectus. Please read the prospectus carefully before investing. © 2014 Invesco PowerShares Capital Management LLC invescopowershares.com 800 983 0903 @PowerShares P-DSUM-WP-1-E 1848 02/14