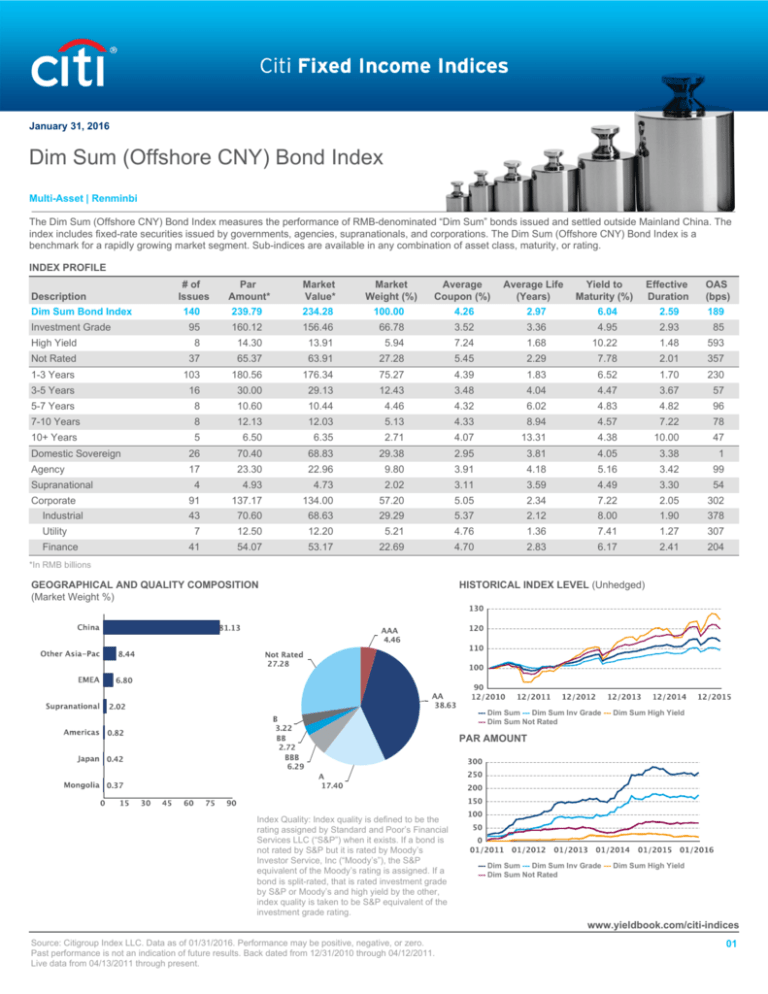

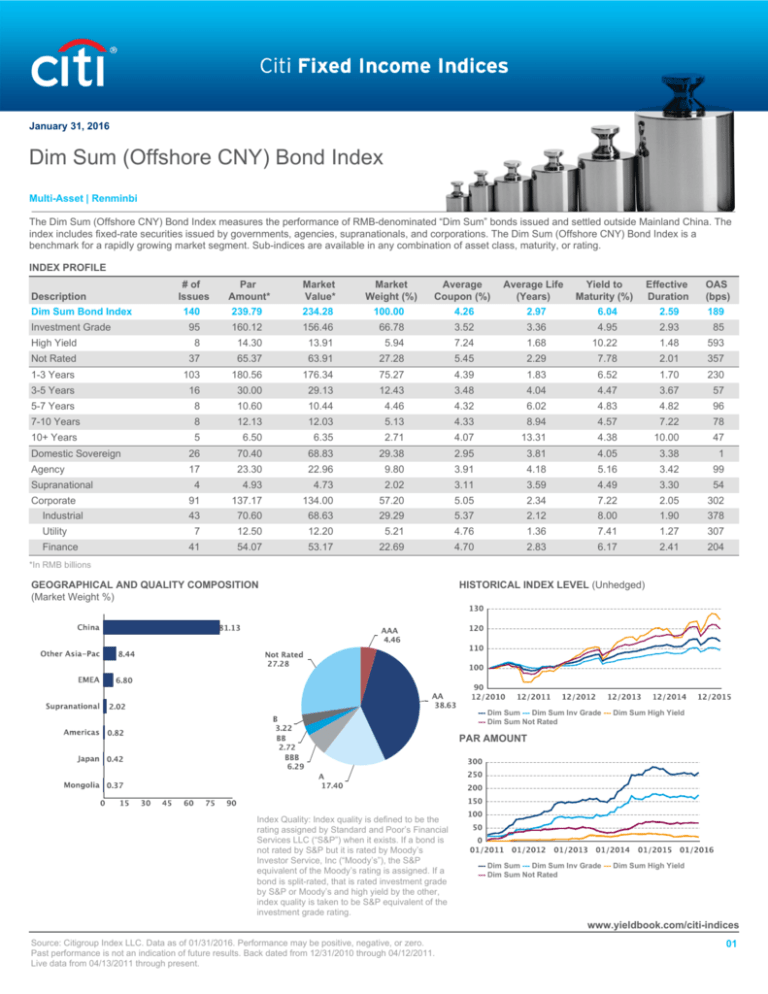

January 31, 2016

Dim Sum (Offshore CNY) Bond Index

Multi-Asset | Renminbi

The Dim Sum (Offshore CNY) Bond Index measures the performance of RMB-denominated “Dim Sum” bonds issued and settled outside Mainland China. The

index includes fixed-rate securities issued by governments, agencies, supranationals, and corporations. The Dim Sum (Offshore CNY) Bond Index is a

benchmark for a rapidly growing market segment. Sub-indices are available in any combination of asset class, maturity, or rating.

INDEX PROFILE

# of

Issues

Par

Amount*

Market

Value*

Market

Weight (%)

Average

Coupon (%)

Effective

Duration

OAS

(bps)

140

239.79

234.28

100.00

4.26

2.97

95

160.12

156.46

66.78

3.52

3.36

6.04

2.59

189

4.95

2.93

85

High Yield

8

14.30

13.91

5.94

7.24

Not Rated

37

65.37

63.91

27.28

5.45

1.68

10.22

1.48

593

2.29

7.78

2.01

1-3 Years

103

180.56

176.34

75.27

357

4.39

1.83

6.52

1.70

3-5 Years

16

30.00

29.13

230

12.43

3.48

4.04

4.47

3.67

5-7 Years

8

10.60

57

10.44

4.46

4.32

6.02

4.83

4.82

7-10 Years

8

96

12.13

12.03

5.13

4.33

8.94

4.57

7.22

10+ Years

78

5

6.50

6.35

2.71

4.07

13.31

4.38

10.00

47

Domestic Sovereign

26

70.40

68.83

29.38

2.95

3.81

4.05

3.38

1

Agency

17

23.30

22.96

9.80

3.91

4.18

5.16

3.42

99

Description

Dim Sum Bond Index

Investment Grade

Supranational

Corporate

Industrial

Utility

Finance

Average Life

(Years)

Yield to

Maturity (%)

4

4.93

4.73

2.02

3.11

3.59

4.49

3.30

54

91

137.17

134.00

57.20

5.05

2.34

7.22

2.05

302

43

70.60

68.63

29.29

5.37

2.12

8.00

1.90

378

7

12.50

12.20

5.21

4.76

1.36

7.41

1.27

307

41

54.07

53.17

22.69

4.70

2.83

6.17

2.41

204

*In RMB billions

GEOGRAPHICAL AND QUALITY COMPOSITION

(Market Weight %)

HISTORICAL INDEX LEVEL (Unhedged)

--- Dim Sum --- Dim Sum Inv Grade --- Dim Sum High Yield

--- Dim Sum Not Rated

PAR AMOUNT

Index Quality: Index quality is defined to be the

rating assigned by Standard and Poor’s Financial

Services LLC (“S&P”) when it exists. If a bond is

not rated by S&P but it is rated by Moody’s

Investor Service, Inc (“Moody’s”), the S&P

equivalent of the Moody’s rating is assigned. If a

bond is split-rated, that is rated investment grade

by S&P or Moody’s and high yield by the other,

index quality is taken to be S&P equivalent of the

investment grade rating.

--- Dim Sum --- Dim Sum Inv Grade --- Dim Sum High Yield

--- Dim Sum Not Rated

www.yieldbook.com/citi-indices

Source: Citigroup Index LLC. Data as of 01/31/2016. Performance may be positive, negative, or zero.

Past performance is not an indication of future results. Back dated from 12/31/2010 through 04/12/2011.

Live data from 04/13/2011 through present.

01

Dim Sum (Offshore CNY) Bond Index | January 31, 2016

TOP 10 ISSUERS (By Market Weight)

Description

CHINA PEOPLES REPUBLIC OF

# of

Issues

Par

Amount*

Market

Value*

Market

Weight (%)

Average

Coupon (%)

Average Life

(Years)

Yield to

Maturity (%)

Effective

Duration

OAS

(bps)

26

70.40

68.83

29.38

2.95

3.81

4.05

3.38

1

BANK OF CHINA LTD

6

9.00

8.73

3.73

3.94

2.53

5.74

2.32

161

CHINA DEVELOPMENT BANK CORP

5

7.50

7.32

3.13

4.19

7.03

5.30

5.51

126

CHINA CONSTRUCTION BANK CORP

6

6.55

6.40

2.73

3.86

2.60

5.38

2.35

127

BEIJING CAPITAL LAND LTD

2

4.30

4.23

1.81

5.60

1.48

8.12

1.34

371

INDUSTRIAL AND COMMERCIAL BANK O

3

4.30

4.20

1.79

4.65

4.55

5.69

3.09

171

CHINA UNICOM (HONG KONG) LTD

1

4.00

3.93

1.68

4.00

1.21

6.55

1.14

213

LENOVO GROUP LTD

1

4.00

3.92

1.67

4.95

4.36

5.63

3.82

178

SINOCHEM GROUP

2

3.50

3.44

1.47

4.18

1.40

6.38

1.32

207

KOREA DEVELOPMENT BANK

3

3.50

3.43

1.47

3.98

2.63

5.11

2.45

104

*In RMB billions

DESIGN CRITERIA AND CALCULATION METHODOLOGY

Coupon:

Fixed-rate (excludes zero-coupon)

Currency:

Denominated and settled in RMB

Minimum Maturity:

At least one year

Minimum Size Outstanding:

RMB 1 billion

Minimum Quality:

No minimum S&P or Moody’s rating requirement, defaulted bonds excluded; if an individual issue is not rated by S&P

or Moody’s but its issuer has an S&P or Moody’s rating, we assign the issuer rating to the issue as its implied rating

Composition:

RMB-denominated governments, agencies, supernationals, and credit securities excluding synthetics, convertible

bonds, retail bonds, and certificates of deposits.

Weighting:

Market capitalization

Rebalancing:

Once a month at month end

Cash Reinvestment Rate:

At daily average of the one-month Euro Deposit rate, calculated from actual scheduled payment date of cash flow

through end of period

Pricing:

Primary: Citi trader pricing.

Supplementary: third-party sources, transaction-related information, proprietary pricing models.

Calculation Frequency:

Daily

Settlement Date:

Monthly – Settlement is on the last calendar day of the month.

Daily – Same day settlement except if the last business day of the month is not the last calender day of the month;

then, settlement is on the last calendar day of the month.

Base Date:

December 31, 2010

ACCESS TO CITI FIXED INCOME INDICES

•

•

•

•

•

•

www.yieldbook.com/citi-indices

The Yield Book

Citi VelocitySM

Bloomberg SBI <GO>; SBBI <GO>

- Dim Sum – RMB:SBDSBIL <INDEX>;USD:SBDSBIU <INDEX>;HKD:SBDSBIH <INDEX>

- Dim Sum IG – RMB:SBDSIGL <INDEX>;USD:SBDSIGU <INDEX>;HKD:SBDSIGH

<INDEX>

- Dim Sum HY – RMB:SBDSHYL <INDEX>;USD:SBDSHYU <INDEX>;HKD: SBDSHYH

<INDEX>

Reuters

- Dim Sum - RMB:.SBDSBIL; USD:.SBDSBIU; HKD:.SBDSBIH

- Dim Sum IG - RMB:.SBDSIGL; USD:.SBDSIGU; HKD:.SBDSIGH

- Dim Sum HY - RMB:.SBDSHYL; USD:.SBDSHYU; HKD:.SBDSHYH

Other data and analytic vendors and financial news organizations.

A full list of those is available in Citi's Index Guide

CUSTOMIZATION

•

•

Citi offers flexibility in customizing its family of fixed income indices to meet

the most specific investment goals

Customization options include sector, industry, geography, currency,

maturity, rating, issue size, weighting methodology, and more

LICENSING

Citi's fixed income indices are designed, calculated and published by Citigroup

Index LLC and may be licensed for use as underlying indices for OTC or

exchange-traded structured products, including ETFs, swaps, warrants, and

certificates.

The information and data (collectively, "Index Data") contained herein is provided by Citigroup Index LLC ("CitiIndex") solely for information purposes with respect to the index discussed herein

(the "Index") and nothing herein constitutes (a) a recommendation or an offer to sell or a solicitation to deal in any financial product, enter into any transaction, or adopt any investment strategy, or

(b) legal, tax, regulatory, financial, or accounting advice. None of CitiIndex, its directors, officers, employees, representatives, delegates, contractors, or agents (each, a "CitiIndex Person") makes

any express or implied representations or warranties as to (i) the accuracy, adequacy, or completeness of the Index Data, (ii) the advisability of purchasing or entering into any financial product

the performance of which is linked, in whole or in part, to the Index, (iii) the results to be obtained by the issuer of any product linked to the Index or by any other person or entity, from the use of

the Index or any data included therein for any purpose, (iv) the merchantability or fitness for a particular purpose of the Index, or (v) any other matter. Each CitiIndex Person hereby expressly

disclaims, to the fullest extent permitted by applicable law, all warranties of accuracy, completeness, merchantability, or fitness for a particular purpose with respect to the Index and any Index

Data. To the fullest extent permitted by applicable law, no CitiIndex Person shall have any liability (direct or indirect, special, punitive, consequential, or otherwise) to any person even if notified of

the possibility of damages. CitiIndex is not under any obligation to continue the calculation, publication, and dissemination of the Index, nor shall any CitiIndex Person have any liability for any

errors, omissions, interruptions, or delays relating to the Index. CitiIndex acts as principal and not as agent or fiduciary of any other person.

The Index reflects the performance of notional investment positions in its constituents. There is no actual portfolio of assets to which any person is entitled or in which any person has any

ownership interest. The Index merely identifies certain hypothetical investment positions, the performance of which are used as a reference point for the purpose of calculating the level of the

Index. The Index and the information contained herein are CitiIndex's proprietary material. No person may reproduce or disseminate the information contained herein without the prior written

consent of CitiIndex.

© 2016 Citigroup Index LLC. All rights reserved. Citi, Citi and Arc Design, and Citi Velocity are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered

throughout the world. The Yield Book is a registered service mark of The Yield Book Inc. and is registered in the U.S. and other countries.

Americas +1 212 816 0700 | Europe +44 20 7986 3200 | Asia Pacific +852 2501 2358 | Japan +81 3 6270 7225 | Email fi.index@citi.com

02