Vested Termination Lump

Sum Window – Right for your

company?

September 25, 2014

Agenda

Background

Considerations

Administration

Communications

Wrap Up

Q&A

2

Speakers

Dean Aloise, ASA, FCA, EA, MAAA

Managing Director

Wealth Practice

Peter J. Borgman

Senior Vice President

Retirement Products and Services

Thomas Mosher, FSA, EA, MAAA

Principal and Consulting Actuary

Wealth Practice

Phil Parker, FCA, EA, MAAA

Principal

Global Technology Delivery and Solutions Practice

3

Purpose of Today’s Webinar

Balanced View

• There are pros and cons

• One size does not fit all

Make Clear the

Financial Benefits

• Can be significant savings

• Example shown later: Spend

$250,000 to save $3.3 million

Highlight the

Potential Risks and

Participant Impact

• May be financial “gotchas” up front

• Participants focus is critical to ensure

this program is a win win for all

4

Administration

Terminated Vested Lump Sum

Window Administration

Capabilities:

Xerox has handled over 40 client

programs in the past 3 years

• Deep experience in administering client

programs

Xerox is currently handling 14

client programs

• Standard processes and tools for

handling target populations ranging

from 150 – 60,000 participants

• Flexible solutions to cover end-to-end

program requirements

• Cross-functional teams configured to

cover design, development, operations,

fulfillment, and call center support

5

Background

Background

Defined benefit plan sponsors have been considering and implementing

de-risking investment strategies in the wake of interest rate and market

turbulence over the last 20 years.

• As plans begin to return to being fully funded again, sponsors may want to consider

permanent risk transfer options, including administrative and design alternatives.

• Very recently, interest in one such option has escalated — offering terminated vested

participants a payout through lump sum windows.

• Terminated vested lump sum (TVLS) windows are very prevalent in 2014 and activity is

expected to remain high into 2015.

• Factors influencing decisions about executing a TVLS window vary by plan and by

company

– Plan structure – open, closed and frozen pension plans

– Cost/benefit to execute window

– Investment management considerations

– Perspectives on paying lump sums

7

Pension Plan De-Risking Approaches

Offer Participants

Lump Sums

• Participants must elect to receive a lump sum

• Settle liability directly with participants for an amount close to

accounting liabilities

Purchase Group

Annuities

• Plan sponsors can elect to transfer pension liability to high

quality insurance carrier

• Premiums can exceed accounting liabilities by 10 - 30%

• U.S. insurers’ capacity raises some concern

Retain Liabilities and

Manage Risk More

Closely

• Plan payments typically expected to continue for 80+ years

• Sponsors have structured long term LDI strategies to

mitigate pension cost and funded level volatility

• Certain demographic risk transfer products may proliferate

8

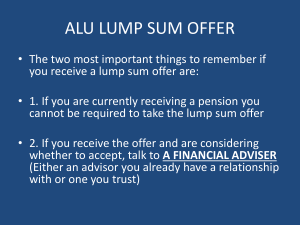

Alternative Lump Sum Tactics

Limited one-time option or “window”:

• Plan is amended to provide lump sum elections to all or a portion of terminated vesteds:

− Separate from mandatory small cashout “sweeps” or other existing plan provisions for

lump sums

• Lump sum paid only if valid elections made during temporary window period

• Qualified Joint and Survivor Annuity and Qualified Optional Survivor Annuity must also be

offered (with spouse as beneficiary) – if participant is retirement eligible, all optional forms

otherwise available to participant must also be offered

• Providing lump sum election to retirees in pay status requires private letter ruling

Permanent optional form of payment:

• Offer option to all terminating employees or only those who are eligible for retirement

• Restrict eligibility to lump sums below a threshold (e.g. $10,000) to eliminate deemed

smaller annuity benefits

• Permanent feature can add significant cost to annuity contract upon plan termination

9

Considerations

TV Lump Sums Considerations: Summary

Key Advantages

• Permanent liability reduction

• Reduced future administrative costs - most notably plan administration and PBGC premiums that

are scheduled to increase considerably

• Pending change in mortality tables effective in the near future will increase both liabilities and

lump sum costs

• Lump sums are less expensive than purchasing annuities

• Accelerates participant access to retirement assets

Disadvantages

• Potential settlement accounting charges

• In some cases, additional contributions to maintain funding status

• Loss of investable assets (perceived value of asset arbitrage)

• Potentially significant short term administration costs

• Anti-selection among lump sum eligibles

• Participants left to managing their retirement savings on their own

11

Detail on PBGC Premiums

Year

Flat Rate

(previous

law)

New Law

Flat Rate

Variable rate per

$1000 of

underfunding

(previous law)

New Law

Variable Rate

Variable

rate cap

(previous

law)

New Law

Variable

Rate Cap

2013 $42

Same

$9 indexed ($9)

Same

$400

Same

2014 $49

Same

2013 rate indexed +

$4 ($14)

Same

$400

indexed

($412)

Same

2015 $49 indexed

$57

2014 rate indexed +

$5 (at least $19)

2014 rate

indexed + $10

(at least $24)

$400

indexed (at

least $412)

Same

2016 $49 indexed

$64

2015 rate indexed (at

least $19)

2015 rate

indexed + $5

(at least $29)

$400

indexed (at

least $412)

$500

2017 $49 indexed

$64 indexed

2015 rate indexed (at

least $19)

2015 rate

indexed (at

least $29)

$400

indexed (at

least $412)

$500

indexed

12

Status of Mortality Table Changes

The Society of Actuaries (SOA) announced on July 28 that updated mortality

tables will likely be released by October 31, 2014. For accounting purposes,

auditors may recognize mortality studies published by actuarial organizations:

• The new mortality tables released in October will be a factor for consideration for 2014 year end

disclosure (affecting next year’s expense)

• Major accounting firms have issued guidance indicating that they will expect sponsors to:

− Consider the effects of the SOA’s updated mortality tables, and

− Document rationale for best estimate for mortality rates

For funding purposes, benefit restrictions, PBGC premiums, and minimum

lump sums, actuarial organizations’ studies on assumptions have traditionally

been taken into account by the IRS and other government agencies:

• Timing for the adoption of new mortality tables has not been announced

• Given that IRS has promulgated mortality assumptions to use through 2015, updates might not

take place until at least 2016

13

Financial Cost – Alternate Measurements

The value of an individual’s pension liability varies depending on the

purpose of the calculation, primarily due to the interest rate used.

Annuity purchase

Determined by the annuity provider, generally conservative

fixed income rates with margins and expense loads

2.75%

Accounting

Spot fixed income rates as of measurement date

5.00%

PBGC variable

premium

Same basis as for lump sums (e.g., 0-4: 1.25%, 5-19:

4.57%, 20+: 5.60%), no lag period

5.15%

Lump sum

1 month average of fixed income rates, with a lag period

that may be more than a year (e.g., 0-4: 1.40%, 5-19:

4.66%, 20+: 5.62%); basis close to accounting

5.21%

Funding (MAP-21)

25-year average of fixed income rates, subject to “collar”

(0-4: 4.43%, 5-19: 5.62%, 20+: 6.22%)

5.92%

Funding (HATFA)

25-year average of fixed income rates, subject to revised

“collar” (0-4: 4.99%, 5-19: 6.32%, 20+: 6.99%)

6.63%

Risk adjusted

Long term expected return on assets

8.25%

14

Financial Cost – Variance Between Accounting

Methods

ASC (FAS)

IAS

Mark to Market

ASC (FAS)

Expected Return on

Assets

Long term

expectation

Equal to discount

rate

Long term

expectation

Gain/Loss Upon

Remeasurement

P&L amortization Immediate

if outside corridor recognition in

P&L

Immediate

recognition in

P&L

Settlement - One

Time Charge/Credit

If amount settled

is greater than

Service Cost +

Interest Cost

None

15

None

ASC (FAS) Accounting Impact: Settlement

Charge - Example

(in $millions)

Before TVLS

Window

PBO @ 1/1/15

$ (97.0)

Impact of

Window

$

After

Window

13.9

$ (83.1)

(13.2)

89.4

MV @ 1/1/15

102.6

Funded Status @ 1/1/15

$ 5.6

$

0.7

$

6.3

2.6

$

0.0

$

2.6

FY 2015 Expense

Service cost

$

Interest cost

Expected return

Amortization

Total

$

Settlement Charge

4.9

(0.7)

4.2

(8.0)

1.1

(6.9)

2.3

(0.4)

1.9

1.8

--

Assumes unamortized loss position is $36.5 million

16

$

0.0

5.0

$

1.8

5.0

Possible Tactic to Avoid Settlement Charge

Sequential Targeted Lump Sum Windows

No. of

1/1/2015

Participants Lump Sum

Value (in

$millions)

Lump Sum Amount

Cumulative

No. of

Participants

Cumulative

1/1/2015 Lump

Sum Value

< $10,000

407

$0.7

407

$0.7

$10,000 – $24,999

944

$4.5

1,351

$5.2

$25,000 - $49,999

517

$5.1

1,868

$10.3

$50,000 - $74,999

155

$2.7

2,023

$13.0

$75,000 - $99,999

58

$1.5

2,081

$14.5

$100,000 - $249,999

73

$3.1

2,154

$17.6

$250,000+

19

$2.4

2,173

$20.0

2,173

$20.0

Total

17

Cost/Benefit Analysis - Example

Take Rate

Source

One-time Cost

Administration/Actuarial

Administration of Window Participants

Data Maintenance - sponsor

Valuation Processing - actuary

$

250,000

50%

Savings

Recurring (Year 1) Present Value

$

$

$

(6,250) $

(1,250) $

(500) $

(175,000)

(35,000)

(14,000)

PBGC Premium

Flat rate reduction

Variable premium reduction

$

$

(39,900) $ (1,161,000)

(55,100) $

(336,568)

Mortality Improvement

Minimum funding requirement

PBGC variable premium

$

$

(218,057) $ (1,292,000)

(48,140) $

(294,054)

$

(369,197) $ (3,307,623)

Total - Ongoing Basis

$

250,000

Versus Annuitization (Insurance Contract)

Settlement Accounting

One-time charge

Change in expense

(8,482,500)

$

4,171,028

$

18

4,244

(8,482,500)

Investment Strategy Considerations

Asset Investment Arbitrage:

• Perception of investment advantage of return on assets out-earning future increases in

liabilities

• Immediate impact is difference between assumed rate of return on assets and expected

interest cost on liabilities released

• Arbitrage is “two-sided”

– In the short term, asset returns can be positive or negative, and are variable

– Value of arbitrage depends on asset investments, interest rate volatility assumptions, and

time horizon

Timing:

• Modeling higher future interest rates will determine a break even point:

– Reduction (savings) in lump sum payout “pays for” carrying costs and potential liability

increase events

• Liquidation of potentially large amount of assets to pay lumps

– Lead time to transition smoothly re-allocation of assets

19

Administration

Workflow

21

Best Practice Considerations

Call center:

• Establish specialty call center with separate

toll-free number

Avoids calls to HR:

• Elections on the web

Data remediation:

• Planning will need to reflect extra time to make data

complete, including determining if participants are

alive and updating address information

Spouse DOB:

• If marital status is known but spouse’s DOB is not,

use assumed Spouse DOB = Participant DOB to

prepare benefit statements. If spouse’s DOB is later

provided, DOB and benefit calculations need to be

updated

22

Best Practice Considerations (cont.)

Rollovers:

• Does the DC plan accept rollovers from the DB plan? If not,

consider amending the DC plan to allow this choice. If rollovers are

permitted, make sure the DC plan is ready to handle

QDRO:

• Are QDRO liabilities clearly defined on the administrative system? If

the administrator is not able to provide details in time for the offering,

these participants are generally excluded (as well as participants

with QDROs under determination)

Response time:

• Optimal window period is 45 days. Reminder postcard if no

response one month into response period

Backend/Processing:

• Do you have a clearly defined procedure for processing

distributions? Expect a high volume in a short time period.

Packages are processed as received, but last-minute returns and

follow-up will extend 2 - 3 weeks following the election period and

we need to build your current process into this accelerated schedule

23

Communications

Communication Goals

Awareness:

• Opportunity is coming

Understanding:

• How the opportunity works

Analysis:

• Decision support

Action:

• How to elect

Follow-up:

• What to do with payment

25

Communication Considerations

Anticipate questions and noise from current employees; prepare

managers, HR and employee relations

Make it easy for participants to share offer details with family and

financial advisors by providing personalized information

Post all written communications on the website

Keep the opportunity top-of-mind by staggering release of

announcement postcards or sending supplemental announcements

Additional options to consider: Webinars, Q&As, outbound calls,

modeling tools, investment education

26

Wrap Up

Lump Sum Window – Path to Risk Transfer

Data Issues

Logistics/

Rationale

Communication

Strategy

Compliance

Asset

Management

Risk

Transfer

Incomplete

data

Timing/

Delivery

Announcement

Procedure

review and

oversight

Fund to

appropriate

level

Lump sum

offering

Outdated

information

Resources

Decision guide

Amendments,

SPD updates

Liquidity

requirements

Elections

Estimated

accrued

benefits

Project

management

Election

packages

Package

content

Locating

deferred

vested

participants

Cost/benefit

Reminder

Maintenance

of Records

Investment

strategy

28

Directive for

payment

Next Steps

Contact Us

• We have a cross-practice team that brings together the expertise in each service area.

Today’s speakers are both on the cross-practice team. Contact either:

– Tom Mosher – 203.352.1609

– Phil Parker – 415.306.2243

• Our clients should reach out to:

– Your client manager

– Your lead Retirement consultant

– Your current administration team lead

Set up a complimentary, in-person meeting or a private webinar for your

management team/colleagues

• We can present the contents of today’s webinar to a broader internal audience.

Read more about current topics, and join in the on-line discussions related

to lump sum windows on our blog at: http://bit.ly/lumpsumwindows

29

Q&A

30

30

©2014 Xerox Corporation and Buck Consultants, LLC. All rights reserved. Xerox® and Xerox and Design® are registered trademarks of Xerox Corporation in the United States and/or other countries.

Buck Consultants® is a registered trademark of Buck Consultants, LLC in the United States and/or other countries. BR11782