Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit

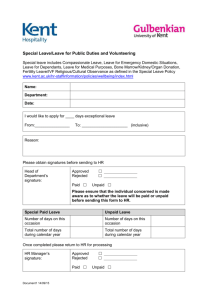

advertisement

INSTRUCTIONS FOR THE UNPAID CLAIMS AND LOSS RATIO ANALYSIS EXHIBIT The Unpaid Claims and Loss Ratio Analysis Exhibits (see Appendix II) are constructed to allow the presentation and collection of industry loss information in a standard format. The compiled information will allow the analysis of the impact of discounting on claims reserves and the analysis of the evolution of loss trends. In order to achieve these objectives, the exhibits are constructed by class of insurance and by accident year and contain information on a current year and on a cumulative year basis. You will find definitions of various terms used in these instructions in Appendix I. The Analysis Exhibits will provide information in detail on an actuary’s category basis. Actuary’s category represents the category used by the actuary for claims reserves analysis purposes. This category has to be uniquely linked to one and only one exhibit category as listed in Appendix III. For reinsurers, proportional and non-proportional business must be reported separately. The way to fill in the exhibits either by “accident year”, “underwriting year” or “report year” must be indicated on each page. Moreover, the PWC software on the unpaid claims and loss ratio analysis exhibit is adjusted to take account of this requirement. If the actuary’s category is a combination of two or more annual return categories, it is up to the actuary to determine in which annual return category to place it to best represent the operations of the company. A “Total” page must also be completed; this exhibit should balance to the Actuary’s Report. An individual page does not have to be completed for a category that is not material but the total Discounted Reserves including PfAD for the category must be included in Line 15 (“Other Provisions”), of the “Total” page. L'Autorité des marchés financiers might require that the Analysis Exhibits be completed for certain categories. The data for the category might not be credible for one company but could be useful to the regulator once aggregated with the rest of the industry. The Analysis Exhibits are expected to be completed on a net basis with net being defined by the Appointed Actuary in the Actuary’s Report. For instance, if the Appointed Actuary has completed his or her net analysis gross of inter-company reinsurance, the Analysis Exhibits should also be completed on this basis. Any adjustments to the net basis as reported in the Actuary’s Report (e.g. industry pools or inter-company reinsurance) should be made in Lines 14 and 15 of the “Total” page. It is the actuary’s responsibility to ensure the accuracy of the unpaid claims and loss ratio analysis exhibit and accompanying electronic filing. The detailed instructions for the completion of the electronic filing can be found on our website: Instructions for electronic filing data from the unpaid claims and loss ratio exhibits. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 1 / 11 Information Contained in the Unpaid Claims and Loss Ratio Analysis Exhibit (by Column) The exhibits contain amounts segregated by accident years (refer to the section “Basis of presentation other than accident year” in the case of other presentation basis. Columns 03 and 13 through 17 must be completed for the past 10 accident years while columns 02 and 04 through 12 must be completed for all accident years. Column 01 – Accident Year Column 01 of the exhibit represents the segregation by accident year. Line 11 represents the most recent accident year, lines 02 to 10 represent the nine prior accident years and line 01 represents all prior years to line 02. Column 02 – Paid Losses: Current Year Column 02 represents the paid claims and paid allocated adjustment expenses for the current calendar year. Column 03 – Paid Losses: Cumulative Column 03 represents the cumulative paid claims and paid allocated adjustment expenses for all calendar years. The column 03 must be completed only for the accident year XXXX-9 and subsequent. Column 04 – Undiscounted Unpaid Claims and Adjustment Expenses: Case Reserves Undiscounted case basis reserves of the unpaid claims and allocated adjustment expenses are presented in column 04. If the claims liabilities are case reserved on a discounted basis (e.g. tabular reserves), the discounted case reserves are to be entered. Column 05 – Undiscounted Unpaid Claims and Adjustment Expenses: IBNR Undiscounted incurred but not reported reserves are shown in column 05. These reserves also include any adjustment for the deficiency or redundancy of the case reserves (also known as the broad definition of IBNR) presented in column 04. The undiscounted IBNR includes all amounts related to the undiscounted unpaid allocated adjustment expenses. If the claims liabilities for a line are not available on an undiscounted basis (e.g. tabular reserves), then the discounted IBNR is to be entered. Column 06 – Undiscounted Unpaid Claims and Adjustment Expenses: Total This is the total of columns 04 and 05. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 2 / 11 Column 07 – Present Value of Unpaid Claims and Adjustment Expenses: Total Present value case basis reserves and IBNR of the unpaid claims and allocated adjustment expenses are presented in column 07. The underlying rule to be respected with the completion of the Analysis Exhibits is that the amounts shown should correspond to those calculated by the Appointed Actuary in the Actuary’s Report. Do not add any PfAD to this column. Column 08 – Provision for Adverse Deviation (PfAD): Claims The provision for adverse deviation on claims is presented in column 08. Column 09 –MfAD: Claims (%) This column is the margin for adverse deviation and is equal to the ratio of column 08 to column 07. Column 10 – PfAD: Reinsurance The provision for reinsurance adverse deviation is presented in column 10. Column 11 – PfAD: Interest Rate A provision for interest rate adverse deviation is presented in column 11. Column 12 – Discounted reserves including PfAD Column 12 is the result of the following formula: Column (07) + Column (08) + Column (10) + Column (11) Note that for the “Total” exhibit, amounts for column 12 are entered on line 13 (ULAE – Total), line 14 (Facility Association and Plan) and line 15 (Other Provisions) as well as line 16 (Grand Total). Lines 13 through 16 are included only in the “Total” exhibit. Column 13 – Earned Premiums Earned premiums are shown separately by accident year. Net earned premiums are reported and developed at ultimate where development is possible, for example, where experience rating is used. The column 13 must be completed only for the accident year XXXX-9 and subsequent. Column 14 – Investment Income from UPR Investment income from unearned premium for each accident year is presented in this column. The use of the methodology must be consistent with the one used to calculate the discounted reserves presented in the annual statement. The column 14 must be completed only for the accident year XXXX-9 and subsequent. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 3 / 11 Please refer to the Canadian Institute of Actuaries (CIA) Educational Note Evaluation of the Runoff of Claims Liabilities when the Liabilities are Discounted in Accordance with Accepted Actuarial Practice for guidance on the calculation of these amounts. Column 15 – Cumulative Investment Income from Unpaid Claim Reserves The cumulative investment income from the unpaid claim reserves is presented in column 15. The column 15 must be completed only for the accident year XXXX-9 and subsequent. Please refer to the CIA Educational Note Evaluation of the Runoff of Claims Liabilities when the Liabilities are Discounted in Accordance with Accepted Actuarial Practice for guidance on the calculation of these amounts. Column 16 – Loss Ratio (%): Undiscounted The Undiscounted loss ratio is calculated using the following formula: 100 * [Column (03) + Column (06)] Column (13) The column 16 must be completed only for the accident year XXXX-9 and subsequent. Column 17 – Loss Ratio (%): Discounted The Discounted loss ratio is calculated using the following formula: 100 * [Column (03) - Column (15) + Column (12)] Column (13) + Column (14) The column 17 must be completed only for the accident year XXXX-9 and subsequent. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 4 / 11 Information Contained in the Unpaid Claims and Loss Ratio Analysis Exhibit (by Line) These amounts exclude all paid and unpaid unallocated adjustment expenses (“ULAE”) for lines 1 to 12 Line 13 – ULAE - Total The discounted unpaid ULAE including provisions for adverse deviation (PfAD) are entered in line 13, column 12 in the “Total” exhibit. Line 14 – “Facility Association” and “Plan” The discounted unpaid claims of all automobile pools (e.g. Facility Association, Ontario Risk Sharing Pool and Plan de Répartition des Risques) are entered in line 14, column 12 (Facility Association and Plans) of the “Total” exhibit. Line 15– Other Provisions The discounted unpaid claims for all other provisions (e.g. non-material lines of business, nonautomobile industry pools and inter-company reinsurance) are entered in line 15, column 12 (Other Provisions) of the “Total” exhibit. Line 16– Total This is the total of lines 12 through 15 of column 12 of the “Total” exhibit. Line 17– MfAD: Reinsurance (%) MfAD for reinsurance, expressed in percentage, is entered in line 17 of the “Line of Business” exhibits. If the margins vary by year, a weighted average margin that produces the same total PfAD should be entered. In this case, it is important to note that the calculation of the weighted average margin should not correspond to the ratio of the PfAD - Reinsurance (line 12 column 10) of the present value of unpaid claims and adjustment expenses Total (line 12 column 7). Line 18– MfAD: Interest Rate (%) MfAD for interest rate, expressed in percentage, is entered in line 18 of the “Line of Business” exhibits. If the margins vary by year, a weighted average margin that produces the same total PfAD should be entered. In this case, it is important to note that the calculation of the Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 5 / 11 weighted average margin should not correspond to the ratio of the PfAD – Interest Rate (line 12 column 11) of the present value of unpaid claims and adjustment expenses Total (line 12 column 7). Line 19– Interest Rate to Discount Unpaid Claims & Adjustment Expenses (%) The interest rate used to discount the unpaid claim and adjustment expenses liabilities is entered in line 19 of the “Line of business” exhibits. If interest rates vary by year, a weighted average interest rate that produces the same total present value of unpaid claims and adjustment expenses should be entered. In this case, it is important to note that the calculation of the weighted average interest rate should not correspond to the ratio of the PfAD – Interest Rate (line 12 column 06 – line 12, column 07) of the present value of unpaid claims and adjustment expenses - Total (line 12 column 7). Claims Reported on Other than an Accident Year Basis Normally, the exhibits will be completed on an accident year basis (year in which the claim was incurred). However, some insurers may have used a basis other than accident year when completing the Actuary’s Report. This includes reinsurers which disclose on an underwriting year basis (year when the policy has been written) as well as insurers writing policies on a claims-made basis which disclose on report year basis (year when the claim has been reported). These insurers may encounter difficulties in completing the Analysis Exhibits on an accident year basis. It is recommended that the basis that is most suited to the company’s operation be used. Completing the exhibit on other than an accident year basis is subject to the condition that the regulators are advised of the basis used. The Exhibits must be completed so that the total of the amounts entered equals that calculated by the Appointed Actuary in the Actuary’s Report. Rounding of Data All amounts entered on the Analysis Exhibits are to be expressed in Canadian dollars and rounded to the nearest thousand dollars. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 6 / 11 APPENDIX I Definitions The following definitions apply to the terms used in the Unpaid Claims and Loss Ratio Analysis Exhibits: Actuary's category: This is the category used by the actuary as part of its analysis of the provisions for claims and expenses. This insurance must be unique relationship with a category of analysis. Please note however that this is not an obligation to present all categories of the actuary and the actuary is to determine which should be presented to better reflect the profitability of the company. However, it is an obligation to associate, uniquely, each category of the actuary to one category of analysis. Exhibit’s category has the same meaning as the definitions presently used for annual statement P&C-1 and P&C-2 purposes. They are limited to those presented in appendix II. Case basis: means reported to the insurer and recorded up to the valuation date. IBNR1 (including external adjustment expenses) refers to the total of any additional sums set up to cover claims which have occurred but which have not been reported to the insurer before the date of valuation, plus any additional sum set up to compensate for an anticipated development in case reserves. External adjustment expenses required to settle the not yet reported claims (or any change in amount already reported claims) should also be included in the IBNR amount. Unallocated adjustment expenses should be included only on line 13, column 12 of the “Total” exhibit. Insurer may be an insurance company, a reinsurance company, a (farm) mutual company, society, reciprocal and, in some provinces, the administrators of insurance funds of professional corporations. Paid Claims are the indemnity payments to policyholders or third parties less the sums received as recovery or subrogation. Paid external adjustment expenses include all external expenses of the insurer which are chargeable to the claims settlement function, including charges for independent claims experts and legal expenses less the sums received as recovery or subrogation. 1 Although the definition does not specifically mention the case, it should be understood to include situations where the IBNR amount takes into account a reserve redundancy. In other words, the IBNR amount can be negative in total or for a particular accident year. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 7 / 11 Paid internal adjustment expenses normally include all expenses of the claims department and the share of general administrative expenses chargeable to the claims settlement function less the sums received as recovery or subrogation. The Paid internal adjustment expenses are excluded from the Unpaid Claims and Loss Ratio Analysis Exhibits. Please note that paid external adjustment expenses are to be reported by the method normally used by the insurer to differentiate between the paid external adjustment and paid internal adjustment. While the method may differ from one insurer to another, it is more important that an individual insurer use the same method each year than it is that all insurers use the same method. For a given class of insurance, if the external and internal adjustment expenses are being reported under a statistical plan, then the rules of this plan are to be followed for the purpose of the Unpaid Claims and Loss Ratio Analysis Exhibits. Net basis has the same definition as that used by the actuary to complete the report. Reinsurer is an insurer, which has not written direct business in the year covered by the annual statement and also had no transactions, related to direct business during the statement year and no outstanding claims related to direct business at either the beginning or end of the statement year. Obviously some references to insurers will not be relevant for reinsurers but the intent will be clear from the context. Unpaid claims (case basis, excluding adjustment expenses): sums estimated by the claims department of the total future payments to be made to policyholders and third parties with respect to claims reported to the insurer and recorded up to the valuation date less the sums to be received as recovery or subrogation. Unpaid external adjustment expenses (case basis): sums estimated by the claims department to be chargeable to the claims settlement function for future external expenses to investigate and settle incurred claims reported to the insurer and recorded up to the valuation date less the sums to be received as recovery or subrogation. The sum includes charges to be paid for independent claims experts and legal expenses. Unpaid internal adjustment expenses2 (total): all sums estimated for future direct expenses of the claims department to investigate and settle incurred claims reported or not to insurer at the valuation date plus the share of general administrative expenses which will be chargeable to the claims settlement function less the sums to be received as recovery or subrogation. These expenses should be included only on line 13, column 12 of the “Total” exhibit. 2 Insurers are not required to alter their normal basis of setting up reserves in order to take into account recovery or subrogation. If an insurer does not normally adjust reserves for these purposes, it does not have to make a special adjustment for the purpose of the claims exhibits. Instructions for the Unpaid Claims and Loss Ratio Analysis Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 8 / 11 Unpaid Claims and Loss Ratio Analysis Exhibit APPENDIX II (All amounts are on a Net basis and in $'000) Actuary's Category : Exhibit for all categories Exhibit Category : Total Paid Lossesa Year Line Current Year (XXXX) Cumulative (XXXX and Prior) (02) (03) (01) Unpaid Claim Analysisa Undiscounted Unpaid Claims and Adjustment Expenses Present Value of Unpaid Claims and Adjustment Case IBNR Total Expenses - Total Reserves (04) (05) (06) (07) Loss Ratio Analysisa Provision and Margin for Adverse Deviation (PfAD and MfAD) PfAD: Claims ($'000) MfAD: Claims (%) PfAD: Reinsurance ($'000) PfAD: Interest Rate ($'000) (08) (09) (10) (11) Income Discounted Reserves Including PfAD (12) 1 XXXX-10 & Prior - - - 2 XXXX-9 - - - 3 XXXX-8 - - - 4 XXXX-7 - - - 5 XXXX-6 - - - 6 XXXX-5 - - - 7 XXXX-4 - - - 8 XXXX-3 - - - 9 XXXX-2 - - - 10 XXXX-1 - - - 11 XXXX - - - 12 Total - - 13 ULAE - Total 14 "Facility Association" and "Plan" 15 Other Provisions 16 Grand Total - - - - - - a) Including Allocated loss adjustment expenses (ALAE), but excluding Unallocated loss adjustment expenses (ULAE), except for lines 13 to 15. Instructions for the Unpaid Claims and Loss Ratio Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 - - - - Earned Premiums Cumulative Loss Ratio (%) Investment Income from Invest. Income Unpaid Claim Undiscounted Discounted from UPR Reserves (13) (14) (15) - - - (16) (17) Unpaid Claims and Loss Ratio Analysis Exhibit APPENDIX II (All amounts are on a Net basis and in $'000) Actuary's Category : Exhibit per category Exhibit Category : Data Aggregation Basis Paid Losses a Year Line (01) Current Year (XXXX) Cumulative (XXXX and Prior) (02) (03) Unpaid Claim Analysis a Undiscounted Unpaid Claims and Adjustment Expenses Case Reserves IBNR Total Present Value of Unpaid Claims and Adjustment Expenses - Total (04) (05) (06) (07) Loss Ratio Analysis a Provision and Margin for Adverse Deviation (PfAD and MfAD) Income PfAD: Claims ($'000) MfAD: Claims (%) PfAD: Reinsurance ($'000) PfAD: Interest Rate ($'000) (08) (09) (10) (11) Discounted Reserves Including PfAD (12) 1 XXXX-10 & Prior - - - 2 XXXX-9 - - - 3 XXXX-8 - - - 4 XXXX-7 - - - 5 XXXX-6 - - - 6 XXXX-5 - - - 7 XXXX-4 - - - 8 XXXX-3 - - - 9 XXXX-2 - - - 10 XXXX-1 - - - 11 XXXX 12 Total - - - - - 17 MfAD: Reinsurance (%) 18 MfAD: Interest Rate (%) 19 Interest Rate to Discount Unpaid Claims and Adjustment Expenses (%) - a) Including Allocated loss adjustment expenses (ALAE), but excluding Unallocated loss adjustment expenses (ULAE) Instructions for the Unpaid Claims and Loss Ratio Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 - - Earned Premiums Cumulative Investment Income from Invest. Income Unpaid Claim from UPR Reserves (13) (14) (15) - - - - - - Loss Ratio (%) Undiscounted Discounted (16) (17) Appendix III Exhibit Categories Property-Personal Property-Commercial Aircraft Automobile-Liability – Private Passenger Automobile-Personal Accident – Private Passenger Automobile- Other – Private Passenger Automobile-Liability – Other than Private Passenger Automobile-Personal accident – Other than Private Passenger Automobile-Other – Other than Private Passenger Boiler and Machinery Credit Credit Protection Fidelity Hail Legal Expense Liability Mortgage Other Approved Products Surety Title Marine Accident and Sickness Instructions for the Unpaid Claims and Loss Ratio Exhibit Senior Direction, Supervision of Insurers and Control of Right to Practice September 2015 11 / 11