Estimating the sacrifice ratio for the euro area

advertisement

ARTICLES

Estimating the sacrifice ratio

for the euro area

Jérôme Coffinet

Julien Matheron

Céline Poilly

Research Directorate

Monetary Policy Analysis

and Research Division

Research Directorate

Economic and Financial

Research Division

Research Directorate

Economic and Financial

Research Division

and University of

Cergy-Pontoise – THEMA

In this article, we use three methods to estimate the sacrifice ratio, which corresponds

to the short-term cost of disinflation in terms of output loss: an ad hoc method,

a structural VAR approach and a general equilibrium model.

Estimates are based on euro area data from the first quarter of 1985 to the

fourth quarter of 2004. According to these three methods, the sacrifice ratio is estimated

at between 1.2 and 1.4%. In other words, the short-term cost of a 1 percentage point

permanent decline in inflation would be over 1 GDP point. Given the long-term cost

of inflation, this result highlights the importance of price stability.

A series of counterfactual exercises is carried out to measure the sensitivity of the result

to different degrees of labour market rigidity. In the neighbourhood of the estimated

values, two important results are brought to light:

• a decline in wage indexation to past inflation and wage stickiness results in a

proportionate fall in the sacrifice ratio;

• however, the impact of a decline in nominal wage stickiness is limited; conversely,

greater wage stickiness leads to a rise in the sacrifice ratio. In addition, the impact of a

change in wage stickiness is asymmetrical, as an increase in stickiness has a particularly

negative effect on the sacrifice ratio.

Key words: sacrifice ratio, labour market flexibility, disinflation

JEL codes: E502, E58

NB:This study is part of a project “Labour market flexibility and monetary policy effectiveness”.This article presents the main results of a previous

study carried out by Coffinet, Matheron and Poilly (2007).The authors would like to thank Thomas Heckel for his remarks on a previous version

of this article.

Banque de France Bulletin Digest • No. 160 • April 2007

1

ARTICLES

Estimating the sacrifice ratio for the euro area

1| The sacrifice ratio, a tool for analysing

monetary policy

1|1 Definition and relevance of the sacrifice ratio

for monetary policy

In the 1980s, developed countries set price stability as the primary objective

of their monetary policy. Indeed, price stability contributes to raising

the growth potential of an economy, by making relative prices more

transparent, lowering the risk premium on inflation and preventing the

arbitrary redistribution of wealth and income (ECB, 2004). Numerous

studies confirm the positive effect on long-term growth of containing

inflation (Barro, 1996; Feldstein, 1999). However, in the short run, the

recessionary effects brought about by a disinflationary policy are likely

to constrain growth.

This is why the sacrifice ratio, defined as the cumulative output loss

resulting from a permanent 1 percentage point decrease in inflation,1 has

attracted so much attention from central bankers. Indeed, the objective,

i.e. price stability, having been established, it is important to understand

its mechanisms, advantages and possible costs.

1|2 The sacrifice ratio and the labour market

In the literature, the sacrifice ratio is often linked to price and wage

stickiness.

From a theoretical point of view, two types of arguments are usually

brought forward. On the one hand, wage stickiness resulting from the

wage setting mechanisms (frequency of changes, degree of indexation),

which reflects a lesser degree of labour market flexibility, is likely to weigh

on the adjustment of the economy in a disinflationary period and thus

increase the sacrifice ratio. Gordon (1982) uses this argument to explain

the fact that the sacrifice ratios are higher in the United States than in

Japan over the 1960-1980 period. On the other hand, according to the

New Keynesian view, the non-neutrality of money in the short term is

attributable to producer prices rather than wages (Mankiw, 1990). Wage

setting institutions could thus only play a secondary role as regards the

level of the sacrifice ratio.

1 For a detailed presentation of the concept of the sacrifice ratio, see Coffinet (2006).

2

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

From an empirical point of view, labour market rigidities are generally

control variables of the estimates and not a subject of research as such.

Indeed, analysing the link between labour market rigidities and sacrifice

ratios comes up against some difficulties. First, the studies on the subject

are all conducted under partial equilibrium, which limits the understanding

of the mechanisms at the root of the sacrifice ratio. Second, estimating

the sacrifice ratio itself is based on two different methodologies, which

have sometimes yielded divergent results: an approach based on an

ad hoc identification of disinflationary periods (Ball, 1994; Zhang, 2005)

on the one hand, and a structural VAR methodology (Cecchetti and Rich,

2001) on the other.

1|3 Objectives of the study

This study aims to estimate the sacrifice ratio for the euro area since the

1980s using an ad hoc method, a structural VAR representation and a general

equilibrium model, then on the basis of the latter to analyse the interactions

with the labour market. In Part 2, we estimate the sacrifice ratio for the euro

area using two traditional methods (ad hoc and structural VAR). In Part 3,

it is estimated using a general equilibrium model. Counterfactual exercises

and sensitivity analyses are then carried out to clarify the mechanisms

whereby disinflation is likely to lead to a loss of output in the short term.

For the sake of consistency, all of the data used directly2 in this study

are taken from the Area-Wide Model (AWM) database (Fagan, Henry and

Mestre, 2005) for the period from Q1 1985 to Q4 2004.

2| Traditional estimates of the sacrifice ratio

for the euro area

2|1 Ad hoc method

The approach developed by Ball (1994) consists in identifying the disinflation

episodes ex ante, then calculating the sacrifice ratio for each episode. The

loss in terms of output is equal to the cumulative sum over the entire

disinflationary period of the difference between output and potential

output. The sacrifice ratio is then defined as the ratio of output loss to the

change in trend inflation over the period under review.3

2 This is not the case for the structural VAR.

3 For an explanation of this method see Coffinet (2006).

Banque de France Bulletin Digest • No. 160 • April 2007

3

ARTICLES

Estimating the sacrifice ratio for the euro area

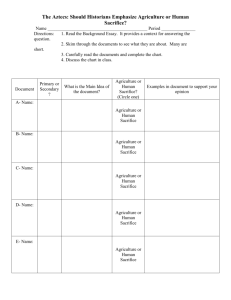

Table 1 Sacrifice ratios for the euro area according to the Ball method

Variable

Initial level of inflation

Final level of inflation

Start of the disinflation episode

End of the disinflation episode

Sacrifice ratio

Value

5.10%

1.38%

Q2 1991

Q4 1998

1.37%

The period 1985-2004 shows only one episode of disinflation (see Table 1).

It starts in the second quarter of 1991 and ends in the fourth quarter

of 1998. The decline in underlying inflation amounts to 3.72% and the

sacrifice ratio 1.37%.

These results seem to be consistent with those of Coffinet (2006), according

to which the sacrifice ratio for Germany and France during the same period

stands at roughly 2% compared with 0.7% in Italy.

2|2 Structural VAR representation4

The use of a structural VAR representation to estimate sacrifice ratios was

first introduced by Cecchetti (1994) then taken up by Cecchetti and Rich

(2001). This approach first consists in estimating a two-variable structural VAR

model (including output and inflation) or three-variable model (including

output, inflation and real interest rates), taking account of possible identifying

restrictions.5 The impulse response functions of the variables are then

written as a weighted sum of the different shocks. Lastly, the sacrifice ratio is

calculated as the ratio of cumulative output loss due to a monetary shock over

the cumulative effect of this same monetary shock on the inflation rate.

According to Durand, Huchet-Boudon and Licheron (2005), the average

sacrifice ratio for the euro area is around 1.19% for the period from

Q1 1994 to Q4 2003.

2|3 Limitations of these approaches

Although the ad hoc method provides a precise analysis of the link between

the estimated sacrifice ratios and indicators of labour market rigidity, it

4 In the VAR representation, all of the selected variables from the theoretical model have the same status.The relations are thus purely statistical.

5 The structural VAR models incorporate some information from the economic literature to identify the structural VAR shocks (for example, the

fact that aggregate demand shocks do not have a permanent effect on the level of real GDP).

4

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

is nevertheless open to criticism. First, the calculation of the sacrifice

ratios is highly sensitive to the identification of the start and end of the

disinflation episodes. Second, the numerous methodologies put forward

to estimate the potential output specific to each episode have yielded

mixed results. Finally, these methods are not able to isolate the monetary

shocks. In other words, the disinflation episode is entirely and arbitrarily

attributed to a monetary shock, without taking account of other possible

supply and demand shocks.

Under the structural VAR approach, it is easier to distinguish structural

supply and demand shocks and monetary policy may be broken down

between systematic components (reaction function of the monetary

authorities) and stochastic components (monetary policy shocks).

However, two criticisms may be made. First, the results are sensitive to the

specification of the model. This is partly due to the difficulty of identifying

the shocks. Second, VAR models are not associated with enough theoretical

constraints to be really structural. They are therefore open to the Lucas

criticism and cannot be used to analyse the economic mechanisms that

underpin the sacrifice ratio.

3| Estimating the sacrifice ratio

in the framework of a general equilibrium model

3|1 Presentation of the model

This third part features a small microfounded dynamic stochastic general

equilibrium model likely to explain the dynamic behaviour of the variables

following a shock. According to this methodology, it is not only possible

to calculate the sacrifice ratio and test its significance, but also to study

the mechanisms at work during a disinflation episode. In addition, this

approach enables us to assess the sensitivity of the sacrifice ratio to the

various labour market rigidities. The model used, where prices and wages

are sticky and indexed to past inflation, fits into the New Keynesian school

of thought.

The model in equilibrium can be synthesized by 6 behavioural equations

(Box 1).6

6 More precisely, we derived the optimisation programme for each agent (household, firm) and imposed an ad hoc monetary policy rule.We then

represented each solution in loglinear form. Each variable is therefore expressed as the deviation of its logarithmic value from its stationary

value. See Coffinet, Matheron et Poilly (2007) for a more detailed presentation of the model and the underlying assumptions.

Banque de France Bulletin Digest • No. 160 • April 2007

5

ARTICLES

Estimating the sacrifice ratio for the euro area

BOX 1

Equations of the theoretical model

(1)

Euler equation: yt = βηEt {yt + 1} + yt - 1 – (1 – (η(1 + β))) λt + gt – ηζt

(2)

Risk-free bonds equation: λt = it + Et {λt + 1 – πt + 1}

(3)

Price-setting equation: πt – γp πt - 1 = κp (wt + ϖp yt) + βEt {πt + 1 – γp πt},

where κp = ƒ(αp) with ƒ(.) decreasing function

(4)

Wage-setting equation: πwt – γw πt - 1 = κw (ϖw ϕyt – λt – wt) + βEt {πwt + 1 – γw πt} + χt

where κw = g(αw) with g(.) decreasing function

(5)

Accounting equality: πwt = πt + wt – wt - 1 + ζt

(6)

Monetary policy rule: it = ρti it-1 + (1 – ρi)[ap πt - 1 + ay yt - 1] + εt

yt is output, λt is the Lagrange multiplier, interpreted as a cumulative long-term real

interest rate, πt is the inflation rate, πwt is the wage inflation rate, wt is the real wage

and it is the nominal interest rate. As this model does not include capital, consumption

is equal to output. All of the non-stationary variables are expressed as a deviation

from their stochastic trend.

In addition, ζt, gt, χt and εt are random (productivity, preference, labour supply and

monetary) shocks. Except for ζ, which is iid, all of these shocks are supposed to follow

an autoregressive process of order 1.

The parameters are 0 < β < 1, η > 0, 0 < γp ≤1, κp > 0, ωp > 0, 0 < γw ≤1, κw > 0,

ϖw > 0, ϕ > 0, ρi > 0, ay > 0, 1 < ap .

The Euler equation (1) reflects the consumption behaviour of the

representative household, which depends on past consumption, expectations

of future consumption and λt, the marginal utility of wealth. This variable

may be interpreted as the cumulative long-term real interest rate.

Equation (2) is the risk-free bonds pricing equation. It links the return on

these assets to the expected growth rate of the marginal utility of wealth.

The price-setting equation (3) is the new Phillips curve. It links the rate

of inflation to the real marginal cost and expectations of future inflation.

Parameters αp and γp measure the degree of product market rigidity: the

higher the values of the parameters, the stickier the prices. αp is the

probability of a firm not being able to reoptimise its price at a given date

(Calvo, 1983). γp is the degree of price indexation to past inflation.7

7 Symmetrically, 1 – γp measures the degree of price indexation to the inflation target.

6

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

The wage-setting equation (4) is the wage Phillips curve. It stems from

the assumption of labour market rigidities via the wage setting process.

Thus, wage inflation is linked to expectations of future wage inflation. The

parameters αw and γw are respectively the probability of a household not

being able to reoptimise its wage at a given date and the degree of wage

indexation to past inflation.8

In addition, wage inflation and inflation are linked through equation (5).

Lastly, according to the monetary policy rule (6), the central bank sets

nominal interest rates on the basis of past inflation and output (Taylor,

1993). Coefficients ap and ay measure respectively the degrees of reaction

to past inflation and past consumption. In addition, in the tradition of

Clarida, Gali and Gertler (2001), nominal interest rates show inertia,

measured by ρi.

3|2 Estimation of the model and the sacrifice ratio

BOX 2

Method for estimating the parameters of the model

We first define θT as the vector stacking the autocovariances of order 0 to 6 of the

variables of interest (output, inflation, wage inflation and nominal interest rate). This

vector is estimated using a VAR model of order 2.

We then calculate h(ψ), the vector of the theoretical counterparts of θT . More precisely,

for a given value of the parameters ψ, the resolved theoretical model is written in the

form of a VAR model, for which we deduce the value of the moments of these same

variables. Thus, the vector of theoretical moments h(ψ) is a function of the value of

the parameters of the model, contained in the vector ψ.

Lastly, we estimate the value of the parameters which minimise the quadratic

distance between the vector of empirical moments θT., and its theoretical counterpart.

Formally, the vector of the estimated parameters ψT , is chosen such that:

ψT = Argmin (h(ψ) – θT)’WT (h(ψ) – θT), where WT is a weighting matrix.

The standard deviations of the estimated parameters are obtained by direct numerical

integration.

8 Like in the case of the product market, 1 – γw measures the degree of wage indexation to the inflation target.

Banque de France Bulletin Digest • No. 160 • April 2007

7

ARTICLES

Estimating the sacrifice ratio for the euro area

Table 2 Results of the estimation of the model

Parameter

αp

αw

γp

γw

b

ay

ap

ρi

Interpretation

Degree of nominal price stickiness

Degree of nominal wage stickiness

Price indexation

Wage indexation

Habit persistence

Elasticity of i relative to y

Elasticity of i relative to p

Degree of smoothing of i

Value

0.84***

0.67***

0.47***

1.00

0.86***

0.10***

1.44***

0.07

In this Table, the symbol *** denotes a significiance threshold of 1%

The parameters of the model are obtained by matching the autocovariances

of the series under consideration (Box 2).9 For the sake of clarity, only the

estimated values of the parameters essential for the study of the sacrifice

ratio and its sensitivity to labour and product market rigidities are presented

(Table 2).10 For the set of estimated parameters, the model is capable of

correctly replicating the empirical moments.11

As regards the nominal rigidities, it appears that on average

households’ wages do not change for roughly three quarters (which

corresponds to a value of αw equal to 0.67). In addition, wages are entirely

indexed to past inflation (γw = 1), which is characteristic of the euro area

(Avouyi-Dovi and Matheron, 2005).12 Furthermore, the degree of price

stickiness is relatively higher than that of wages (αp = 0.84), which means

that on average firms do not alter their prices during one year and three

quarters. Finally, the degree of indexation of prices to past inflation is 0.47,

in accordance with Smets and Wouters (2003).

As regards the monetary policy rule, it appears that the degree of smoothing

of the interest rate is very low and non significant, while the weights of

inflation and output in the rule (1.44 and 0.10 respectively) correspond

on the whole to the standard values.

9 All of the parameters of the model have not been estimated; some are calibrated either because their value may be deduced from the large

ratios or because they are not identifiable.

10 All of the results of the estimation are available in the working paper. All of the estimated values of the parameters are consistent with the

existing literature.

11 This result is described in the working paper. In addition, we are able to carry out a more in depth assessment of the quality of the estimated

model through a series of exercises on the theoretical impulse response functions and the forecast error variance decomposition.

12 The estimated value of this parameter, for euro area data, tended to be very high. In order to remain within a reasonable framework, we decided

to limit it to its upper bound.

8

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

Chart 1 Cumulative output loss following a 1 percentage point disinflation

(relative deviation in %, quarterly data)

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

-1.2

-1.4

-1.6

0

10

20

30

40

50

60

70

Source: AWM database – Estimates by authors.

Chart 1 shows the cumulative output loss over a horizon of 70 quarters

following a 1 percentage point permanent decline in inflation (the estimation

method is explained in Box 3). The shaded area corresponds to the 95%

confidence interval. By construction, once the disinflationary shock has been

absorbed, the cumulative output loss stabilises at the level of the sacrifice

ratio, i.e. 1.28% (this value is significantly different from zero). This result

is close to that obtained using the ad hoc method and consistent with the

existing literature (Durand, Huchet-Bourdon and Licheron, 2005).

BOX 3

Estimating the sacrifice ratio

The sacrifice ratio is usually defined as the cumulative output loss arising from a

1 percentage point permanent decrease in inflation. In the framework of the estimated

model, the sacrifice ratio is calculated as follows. At t = 0, the inflation target

(i.e. long-term inflation) goes from π1 to π2 < π1 . Consequently, at t = 0, the relative

deviation of inflation compared to the new steady-state is π-1 ≈ π1 – π2 > 0. In addition,

wage inflation and the nominal interest rate, in a steady state, are linked to inflation.

Consequently, the initial values of the variables are all set at 0, except those for inflation,

wage inflation and the nominal interest rate, which are set at π-1.The sacrifice ratio Rt

is thus defined as Rt = (∑t=0…T yt) / |π1 – π2|.

Subsequently, the disinflation episode corresponds to a 1 percentage point decrease in

inflation, such that |π2 – π1| = 1. A negative value for Rt denotes an output loss.

Contrary to the ad hoc approach, the value of the sacrifice ratio depends on the

estimated parameters of the model. It is then possible to calculate the confidence

interval according to the estimated parameters.

Banque de France Bulletin Digest • No. 160 • April 2007

9

ARTICLES

Estimating the sacrifice ratio for the euro area

3|3 Wage stickiness and the sacrifice ratio

Unlike the ad hoc method, the structural model enables us to interpret with

precision the economic mechanisms that occur following a disinflationary

period. In particular, Chart 2 shows the pattern of output (yt), real wages

(wt), wage inflation (πwt), inflation (πt), the nominal interest rate (it) and the

cumulative long-term real interest rate (λt) following a permanent decline

in inflation in the framework of this model.

On this chart, the episode under consideration corresponds to a 1 percentage

point disinflation, so the relative deviations of inflation, wage inflation and

the nominal interest rate are equal to 1% before the start of the disinflation

episode.

The value of the sacrifice ratio is measured as the area between the x-axis

and the output curve. The size of this area depends on the amplitude and

the persistence of the change in output. The latter, in turn, depend on the

dynamics of the cumulative real interest rate, as shown by equation (1).

In the case studied here, the disinflation mechanism may be described as

follows: given the central bank’s reaction function, expressed by equation (6),

relatively aggressive in response to inflation (ap = 1.44), nominal interest

rates rise by a greater amount than inflation. Furthermore, monetary policy

is hardly sensitive to output changes (ay = 0.10). This results, at least in

the short run, in a rise in real interest rates. Provided that this is a lasting

rise, economic agents will also expect an increase in cumulative long-term

interest rates. Via the behavioural equations (1) and (2), this leads to a drop

Chart 2 Transitional dynamics following a 1 percentage point disinflation

(relative deviation in %, quarterly data)

2.5

2.0

1.5

1.0

0.5

0.0

-0.5

0

2

y

w

4

6

8

πw

π

10

12

14

16

18

20

i

λ

Source: AWM database – Estimates by authors.

10

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

in output on impact, which is itself linked to the scope and persistence of

the rise in cumulative long-term real interest rates.

The scope and persistence of this rise depend on the degrees of nominal

wage stickiness and indexation. Indeed, Chart 2 shows that wage inflation

is initially higher than inflation. This results from the strong indexation of

nominal wages to past inflation (γw = 1 in equation (4)). Consequently, real

wages rise and prevent inflation from adjusting to its new long-term target.

The stronger the inflationary pressures, the firmer the response required

by the central bank, resulting in a further rise in real interest rates.

In addition, inflation dynamics in the model are more inertial when the

elasticity of inflation relative to the real marginal cost is low (αp large).

This specificity contributes to increasing the real interest rate.

The structural model gives us a more detailed picture of the effect on the

sacrifice ratio of the different degrees of nominal wage stickiness and

indexation. We re-estimate the sacrifice ratio by varying the parameters αw

and γw in the neighbourhood of their estimated value, the other coefficients

remaining unchanged. It should be stressed that the monetary policy

remained unchanged throughout the exercise. Table 3 shows the results,

with for each pair (αw, γw) the corresponding sacrifice ratio.

Relative to its estimated value (αw = 0.67), setting αw at 0.72 means

that wages cannot be reoptimised during approximately one additional

half-quarter,13 which reflects a small increase in the degree of nominal

wage stickiness.

It appears that a decline in wage indexation to past inflation results in

a fall in the sacrifice ratio. Indeed, when γw decreases, wage inflation

adjusts more rapidly to its long-term target, which contributes to easing

the inflationary pressures generated by wage stickiness.

Table 3 The sacrifice ratio and degrees of nominal wage stickiness (αw)

and indexation to past inflation (γw)

αw

γw

0.90

0.95

1.00

0.62

0.67

0.72

-0.89%

-0.98%

-1.07%

-1.01%

-1.14%

-1.28%

-1.18%

-1.37%

-1.57%

13 The average length of time during which wages are unchanged in quarters, denoted D, is defined using the following equation: D = 1/(1– αw).

Banque de France Bulletin Digest • No. 160 • April 2007

11

ARTICLES

Estimating the sacrifice ratio for the euro area

In addition, a fall in labour market rigidity results in a decline in the

sacrifice ratio, all the more so as wages are indexed. Indeed, all other

things being equal, a 5% increase in γw brings about a 0.14 point rise in the

sacrifice ratio with αw set at its estimated value. In the neighbourhood of

the estimated values, a decline in wage stickiness αw, leads to a relatively

small drop in the sacrifice ratio. Conversely, an increase in αw has more

negative consequences for the sacrifice ratio (a 5% rise in αw leads to 0.29

percentage point fall in the sacrifice ratio, all other things being equal).

This result reflects the non-linear effect of nominal wage stickiness (αw)

and the average length of time during which wages remain unchanged on

the economy’s dynamics generated by a disinflationary shock. In particular,

the higher the parameter αw , the more inertial the economy.

This structural approach corroborates the assumption that labour market

rigidities have a clear impact on the output loss arising from a disinflationary

shock. However, it moderates this impact insofar as the size of the variations

in the sacrifice ratio according to the degree of wage stickiness seems

relatively small.

This article presents a structural estimation of the sacrifice ratio for the euro area

that is consistent with the other estimation methods available (ad hoc method and

structural VAR representation). The value of the sacrifice ratio for the euro area over

the period under review is estimated at between 1.2% and 1.4%.

A series of counterfactual exercices is carried out to gauge the impact of wage stickiness

on the sacrifice ratio. It shows that:

• a decline in nominal wage indexation and stickiness results in a fall in the sacrifice

ratio;

• however, in the neighbourhood of the estimated values, a decline in wage stickiness

has a limited impact on the sacrifice ratio; conversely, greater wage stickiness leads

to a rise in the sacrifice ratio. In addition, the impact of a change in wage stickiness

is asymmetrical, as an increase in stickiness has a particularly negative effect on the

sacrifice ratio. This asymmetry results from the non-linear influence of nominal wage

stickiness on the model’s persistence properties.

12

Banque de France Bulletin Digest • No. 160 • April 2007

ARTICLES

Estimating the sacrifice ratio for the euro area

Bibliography

Avouyi-Dovi (S.) and Matheron (J.) (2005)

“Technology shocks and monetary policy in an estimated sticky price

model of the euro area”, Note d’Études et de Recherche, No. 126, Banque de

France

Ball (L.) (1994)

“What determines the sacrifice ratio?”, published in Mankiw (N. G.)

Monetary Policy, University of Chicago Press, p. 155-182

Barro (R.) (1996)

“Inflation and Growth”, Federal Reserve Bank of St. Louis, Economic Review

(May/June)

BCE (2004)

“The monetary policy of the ECB”. Available on the ECB website

(www.ecb.int)

Calvo (G. A.) (1983)

“Staggered prices in a utility-maximizing framework”, Journal of Monetary

Economics, Vol. 12, p. 383-398

Cecchetti (S. G.) (1994)

“Comment”, published in Mankiw (N. G.), Monetary Policy, University

of Chicago Press, p. 188-193

Cecchetti (S. G.) and Rich (R. W.) (2001)

“Structural estimates of the US sacrifice ratio”, Journal of Business

and Economic Statistics, Vol. 19(4), p. 416-427

Clarida (R.), Galí (J.) and Gertler (M.) (2001)

“Monetary policy rules and macroeconomic stability: Evidence and some

theory », Quarterly Journal of Economics, Vol. 115, p. 147-180

Coffinet (J.) (2006)

“Ratios de sacrifice et rigidités sur le marché du travail”, Bulletin de la

Banque de France, July

Coffinet (J.), Matheron (J.) and Poilly (C.) (2007)

“Une évaluation structurelle du ratio de sacrifice dans la zone euro”,

Note d’Études et de Recherche, forthcoming, Banque de France

Banque de France Bulletin Digest • No. 160 • April 2007

13

ARTICLES

Estimating the sacrifice ratio for the euro area

Durand (J.), Huchet-Bourdon (M.) and Licheron (J.) (2005)

“Sacrifice ratio dispersion in the euro area: what can we learn for the

conduct of a single monetary policy?”, 22e Journées d’Économie monétaire

et bancaire, June

Fagan (G.), Henry (J.) and Mestre (R.) (2005)

“An area-wide model (AWM) for the euro area.”, Economic Modelling, Vol. 22,

p. 39-59

Feldstein (M.) (1999)

The Costs and Benefits of Achieving Price Stability, University of Chicago

Press

Gordon (R.) (1982)

“Why stopping inflation may be costly: Evidence from fourteen historical

periodes”, published in Hall (R.), Inflation: Causes and Effects, University

of Chicago Press

Mankiw (G.) (1990)

“A quick refresher course in macroeconomics”, Journal of Economic Literature,

Vol. 28, p. 1645-1660

Rudebusch (G. D.) (2002)

“Term structure evidence on interest rate smoothing and monetary policy

inertia”, Journal of Monetary Economics, Vol. 49, p. 1161-1187

Smets (F.) and Wouters (R.) (2003)

“An estimated dynamic stochastic general equilibrium model of the euro

area”, Journal of the European Economic Association, MIT Press, Vol. 1,

p. 1123-1175

Taylor (J. B.) (1993)

“Discretion versus policy rules in practice”, Carnegie-Rochester Conference

Series on Public Policy, Vol. 39, p. 195-214

Zhang (L. H.) (2005)

“Sacrifice ratios with long-lived effects”, International Finance, Vol. 8,

p. 231-262.

14

Banque de France Bulletin Digest • No. 160 • April 2007