here - WordPress.com

advertisement

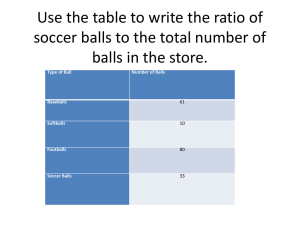

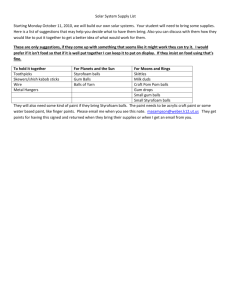

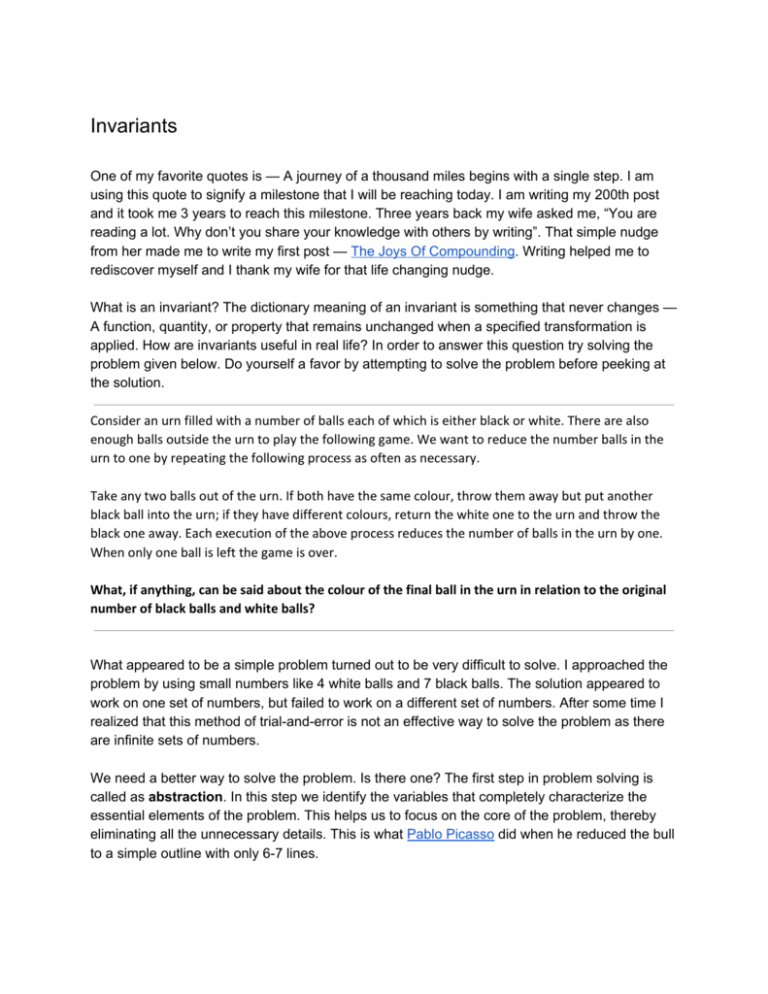

Invariants One of my favorite quotes is — A journey of a thousand miles begins with a single step. I am using this quote to signify a milestone that I will be reaching today. I am writing my 200th post and it took me 3 years to reach this milestone. Three years back my wife asked me, “You are reading a lot. Why don’t you share your knowledge with others by writing”. That simple nudge from her made me to write my first post — The Joys Of Compounding . Writing helped me to rediscover myself and I thank my wife for that life changing nudge. What is an invariant? The dictionary meaning of an invariant is something that never changes — A function, quantity, or property that remains unchanged when a specified transformation is applied. How are invariants useful in real life? In order to answer this question try solving the problem given below. Do yourself a favor by attempting to solve the problem before peeking at the solution. Consider an urn filled with a number of balls each of which is either black or white. There are also enough balls outside the urn to play the following game. We want to reduce the number balls in the urn to one by repeating the following process as often as necessary. Take any two balls out of the urn. If both have the same colour, throw them away but put another black ball into the urn; if they have different colours, return the white one to the urn and throw the black one away. Each execution of the above process reduces the number of balls in the urn by one. When only one ball is left the game is over. What, if anything, can be said about the colour of the final ball in the urn in relation to the original number of black balls and white balls? What appeared to be a simple problem turned out to be very difficult to solve. I approached the problem by using small numbers like 4 white balls and 7 black balls. The solution appeared to work on one set of numbers, but failed to work on a different set of numbers. After some time I realized that this method of trial­and­error is not an effective way to solve the problem as there are infinite sets of numbers. We need a better way to solve the problem. Is there one? The first step in problem solving is called as abstraction . In this step we identify the variables that completely characterize the essential elements of the problem. This helps us to focus on the core of the problem, thereby eliminating all the unnecessary details. This is what Pablo Picasso did when he reduced the bull to a simple outline with only 6­7 lines. Let “w” be the total number of white balls and “b” be the total number of black balls. After each round the total number of white and black balls in the urn changes depending on the color of the balls drawn in the previous round. In the table given below I have summarized all possible cases. By breaking down the problem into three simple cases we have made the problem manageable to be handled by our limited working memory . Both Black Both White Both Different b = (b ­ 2) + 1 w = w b = b + 1 w = w ­ 2 b = b ­ 1 w = w Spend some time to make sure that you really understand what is inside the table. Try to identify the invariant, that which doesn’t change, in all three cases. The recognition of invariants is the most important problem solving skill. Once the skill of identifying invariants has been mastered you will become a problem solving expert. In the above table what does not change? A naive observer will conclude that the total number of white or black balls changes in each round in all three cases. That conclusion is indeed true. But upon deeper inspection one can see that the parity (even or odd) of the white balls don’t change in all three cases. From this simple fact we can conclude that the color of the last ball in the urn is white if we start the game with odd number of white balls. Otherwise the color of the last ball in the urn will be black. Invariance is a concept that lies at the core of physics. Albert Einstein spent well over a decade to come up with general relativity . One of the key ingredient of general relativity is an invariant called as space­time. Einstein came up with the idea of space­time invariant as both space and time is malleable. It’s not hard to see that space is relative and not absolute. But it took a lot of time for me to understand that time is also relative. It took Einstein a simple thought experiment with a moving light clock to prove that time is not absolute but relative. Watch the fascinating video in which Brian Cox explains why time slows down in a moving clock. It is difficult to overstate the importance of the idea of invariance in modern science. At the heart of physics is the desire to produce an intellectual framework that is universal and in which the laws are never a matter of opinion. As physicists, we aim to uncover the invariant properties of the universe because, as Noether well knew, these lead us to real and tangible insights. Identifying the invariant properties is far from easy, however, because nature’s underlying simplicity and beauty are often hidden. Nowhere in science is this truer than in modern particle physics. Particle physics is the study of the subatomic world; the quest for the fundamental building blocks of the universe and the forces of nature that stick them together. We have already met one of the fundamental forces, electromagnetism. Understanding it led us to an explanation for the nature of light that has launched us on the road to relativity. In the subatomic world there are two other forces of nature that hold sway. The strong nuclear force sticks the atomic nucleus together at the heart of the atom, and the weak nuclear force allows stars to shine and is responsible for certain types of radioactive decay; the use of radiocarbon dating to measure the age of things, for example, relies on the weak nuclear force. The fourth force is gravity, the most familiar perhaps, but by far the weakest. Our best theory of gravity today is still Einstein’s general theory of relativity and, as we shall see in the final chapter, it is a theory of space and time. These four forces act between just twelve fundamental particles to build everything in the world we can see, including the sun, moon, and stars, all the planets in our solar system, and indeed our own bodies. This all constitutes an astonishing simplification of what at first glance appears to be an almost infinitely complicated universe. ‐ Why does E=mc2 ? In 2015, the world emitted 36 billion tons of carbon dioxide to produce energy. This is a mind blowing number and we need to bring down the carbon dioxide emission to zero before the end of this century. If someone asked me to quantify this problem, then I wouldn’t even know where to start. But for Bill Gates this problem is a piece of cake to quantify. How did he do that? First, he abstracted out the problem by identifying four key variables. The key variables that Bill Gates identified are — population, services, energy, and carbon dioxide. Second, he identified the invariants [population, services, energy] that can’t be fixed. This led him to narrow down on one key variable which is carbon dioxide. Finally, he quantified the problem by using elementary school mathematics. The goal is to bring down the right hand side of the equation to zero. This means that carbon emission should go down to zero. In order to achieve that we need to produce energy that is clean and also cheap. Cheap because everyone must be able to afford it. Clean because it must not emit any carbon dioxide, which is driving climate change. Having looked at the power of invariants from the vantage points of high school mathematics, particle physics, and energy let’s look at the power of invariants in the field of investing in common stocks. The world of investing is very different from the world of physics as things change all the time in business. Hence, searching for a perfect invariant in a business is an illusion. But that doesn’t preclude us from searching for businesses that change very slowly. Let’s start with Benjamin Graham, who is the father of value investing. Why did he always start his analysis with the balance sheet and not the income statement? This is because the value of assets changes very slowly (read it as invariant) compared to earnings which fluctuates a lot. By anchoring on assets, which is in the balance sheet, Benjamin Graham had a solid foundation for valuing a business. During his early days Warren Buffett emulated his master, Benjamin Graham, by buying assets for cheap if it sold way below book value. But over the years his friend Charlie Munger convinced him on the power of quality businesses. This made Buffett to buy into wonderful businesses at a fair price than a fair business at a wonderful price. Buffett not only gave importance to the balance sheet, but also to the income statement, quality of management, and other intangibles like brands, etc. Does this mean that Buffett gave up on the idea of invariants? Of course not. Buffett embraced invariants which were present in businesses with durable competitive advantages that are operating in stable industries. Take a look at what he wrote in his 2007 letter to shareholders. A truly great business must have an enduring “moat” that protects excellent returns on invested capital. The dynamics of capitalism guarantee that competitors will repeatedly assault any business “castle” that is earning high returns. Therefore a formidable barrier such as a company’s being the low cost producer (GEICO, Costco) or possessing a powerful world‐wide brand (Coca‐Cola, Gillette, American Express) is essential for sustained success. Business history is filled with “Roman Candles,” companies whose moats proved illusory and were soon crossed. Our criterion of “enduring” causes us to rule out companies in industries prone to rapid and continuous change. Though capitalism’s “creative destruction” is highly beneficial for society, it precludes investment certainty. A moat that must be continuously rebuilt will eventually be no moat at all. Additionally, this criterion eliminates the business whose success depends on having a great manager. Of course, a terrific CEO is a huge asset for any enterprise, and at Berkshire we have an abundance of these managers. Their abilities have created billions of dollars of value that would never have materialized if typical CEOs had been running their businesses. But if a business requires a superstar to produce great results, the business itself cannot be deemed great. A medical partnership led by your area’s premier brain surgeon may enjoy outsized and growing earnings, but that tells little about its future. The partnership’s moat will go when the surgeon goes. You can count, though, on the moat of the Mayo Clinic to endure, even though you can’t name its CEO. Long‐term competitive advantage in a stable industry is what we seek in a business. If that comes with rapid organic growth, great. But even without organic growth, such a business is rewarding. We will simply take the lush earnings of the business and use them to buy similar businesses elsewhere. There’s no rule that you have to invest money where you’ve earned it. Indeed, it’s often a mistake to do so: Truly great businesses, earning huge returns on tangible assets, can’t for any extended period reinvest a large portion of their earnings internally at high rates of return. In 1988 more than twenty Wall Street analysts were following the Coca Cola stock. Most of them were bearish on the future prospects of Coca Cola. At that time Buffett and Munger were heavily buying the stock and ended up investing around $1.2 billion. Around 25 percent of Berkshire Hathaway’s book value was invested in Coca Cola stock. What did Buffett and Munger see which the Wall Street analysts failed to see? The typical Wall Street analyst looked at how Coke will look like in the next few quarters. But Buffett and Munger tried to figure out how Coke will look like 50 years from now. This helped them to receive quality signal without any noise. But how can someone figure out how the business will look 50 years from now? They focused on variables that don’t change that much. In other words they were using invariants to solve the unsolvable problem. This was beautifully explained by legendary investor Mohnish Pabrai in his excellent book Mosaic: Perspectives on Investing . 1. Buffett is a huge sugar‐addict and had been a lifelong passionate consumer of Pepsi Cola – until 1987. He used to add cherry syrup to his Pepsi before Cherry Coke was concocted. When he was 7 years, he used to count the discarded bottle caps around vending machines and carefully tabulate which drink people were having the most. He remembers being astounded with the overwhelming numbers of Coke caps (over 80%) relative to the numbers for all other drinks. 2. Buffett is rumored to have a subscription to Advertising Age magazine. He asked himself what it would cost to replicate the Coca Cola brand in a few years. The conclusion Charlie and he reached was that it probably could not be done – even with $100 Billion given to the best marketing team on Earth. At the time, one could have bought the entire Coca Cola company for under $20 Billion. So, here was a company whose brand alone was worth well over $100 Billion and the entire company could be bought for under $20 Billion. 3. Buffett poured over the last 80 years of Coca Cola annual reports. He found that, like a software company, their gross margin on their syrup sold to bottlers is well over 80%. Coke’s future success was a function of the number of servings of coke sold worldwide. The more the servings, the more the cash flow. He found that over the last 80 years, their syrup volumes sold has risen every single year. The last 80 years included many ugly world events – World War I, the great depression, World War II, The Korean War, The Vietnam War, The Cold War, numerous recessions, being kicked out of India in the 1970s et cetera. Through all of that Coke has grown every single year. The question Munger and Buffett posed to each other was simple – What volume of syrup might The Coca Cola Company conservatively be expected to ship in the year 2000...2025...2050? They probably came up with some mouth‐watering numbers, then extrapolated free cash flow (about 1 cent per 8 ounce serving) and finally arrived at a present value of all that future cash flow. 4. In 1886, when Coke was first concocted, it sold for 5 cents per 8 ounce serving. Today, one can buy 8 ounces of Coke on sale for under 17 cents. If Coke’s pricing had moved in lockstep with inflation, we’d be paying several dollars for a single can. This is a very unusual product whose unit price has declined dramatically over the years. Very few consumer products have demonstrated the level of decline in prices that Coke has over the last century. 5. Billions of people around the world have yet to have their first Coke. In addition, the daily per capita consumption of bottled beverages around the world is minuscule compared to the United States and Europe. However, it has repeatedly risen dramatically in various countries as per capita incomes have risen. We are likely to see big increases in per capita incomes in the third world over the coming decades. The key variables that Buffett and Munger focused on are — population growth, habit formation, biological need for ingesting water, brand power, and distribution advantages. Most of these variables were invariants and they didn’t change much for a very long time. No wonder Coke produced lollapalooza results for Berkshire Hathaway. What are the key lessons that a retail investor can draw from all this? 1. While studying businesses identify key variables that are responsible for generating the profits. What if you cannot identify the key variables? Move on to the next business. Are there some examples of identifying key variables? Take a look at the annual report of FairHolme Funds , which is run by a super investor named Bruce Berkowitz. Recently he invested in Seritage Growth Properties which is a public REIT. Bruce summarized his investment thesis in a single key variable called as enterprise­value­per­square­foot. The chart given below tells you that story. 2. If you are investing in a company for a couple of years, then it doesn’t matter if the key variable is an invariant or not. But if you are investing in a business for 3+ years, then make sure that the key variables change very slowly (read it as invariant). One of the key variable, which happened to be an invariant, that Buffett and Munger identified in See’s candies is untapped pricing power. The table given proves the pricing power. 3. If your business depends on two key variables and the probability of both the variables going in the right direction is 90 percent. Then the odds of the business being successful is 81 percent. On the other hand, if the business depends on ten key variables, then the odds of business being successful is only 35 percent. The lesser the number of key variables higher the chances of success. This concept is beautifully explained by Warren Buffett in his shareholder letter. Last year MidAmerican wrote off a major investment in a zinc recovery project that was initiated in 1998 and became operational in 2002. Large quantities of zinc are present in the brine produced by our California geothermal operations, and we believed we could profitably extract the metal. For many months, it appeared that commercially‐viable recoveries were imminent. But in mining, just as in oil exploration, prospects have a way of “teasing” their developers, and every time one problem was solved, another popped up. In September, we threw in the towel. Our failure here illustrates the importance of a guideline – stay with simple propositions – that we usually apply in investments as well as operations. If only one variable is key to a decision, and the variable has a 90% chance of going your way, the chance for a successful outcome is obviously 90%. But if ten independent variables need to break favorably for a successful result, and each has a 90% probability of success, the likelihood of having a winner is only 35%. In our zinc venture, we solved most of the problems. But one proved intractable, and that was one too many. Since a chain is no stronger than its weakest link, it makes sense to look for – if you’ll excuse an oxymoron – mono‐linked chains. ‐ Warren Buffett References 1. 2. 3. 4. 5. 6. 7. Algorithmic Problem Solving by Roland Backhouse 2 Why Does E=mc ? by Brian Cox If you could have one superpower, what would it be? by Bill Gates Letters to shareholders by Warren Buffett Mosaic: Perspectives on Investing by Mohnish Pabrai FairHolme Funds annual report Focus on the Key Variables of an Investment by John Huber Author : Jana Vembunarayanan Website : https://janav.wordpress.com Twitter : @jvembuna