Weighted Average Lending & Deposit Rates

advertisement

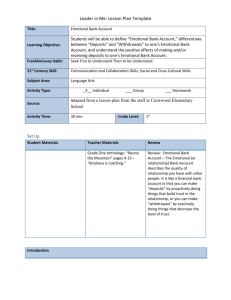

Weighted Average Lending & Deposit Rates (Percent per annum) Gross Disbursements Items Including Zero Markup Including Excluding Interbank Interbank Outstanding Loans Excluding Zero Markup Including Excluding Interbank Interbank Including Zero Markup Including Excluding Interbank Interbank Fresh Deposits Excluding Zero Markup Including Excluding Interbank Interbank Including Zero Markup Including Excluding Interbank Interbank Outstanding Deposits Excluding Zero Markup Including Excluding Interbank Interbank Including Zero Markup Including Excluding Interbank Interbank Excluding Zero Markup Including Excluding Interbank Interbank Jan-16 Public 8.48 9.35 8.59 9.51 10.25 10.32 10.51 10.53 4.77 4.71 5.62 5.58 3.93 4.04 5.75 5.74 Private 7.16 7.72 7.77 7.98 7.98 8.00 8.43 8.45 4.20 3.77 5.45 5.25 3.38 3.33 4.99 4.96 4.52 Foreign 4.83 7.07 5.14 7.07 6.93 6.94 7.57 7.59 2.30 2.44 4.20 4.75 2.98 3.17 4.15 Specialised 14.56 14.56 14.58 14.58 12.71 12.71 13.74 13.74 3.35 3.35 4.47 4.47 3.63 3.61 5.32 5.31 All Banks 7.15 7.79 7.74 8.05 8.59 8.62 9.03 9.05 4.10 3.72 5.40 5.24 3.47 3.46 5.12 5.10 Dec - 2015 Public Private Foreign 8.48 9.00 8.68 9.25 10.39 10.48 10.69 10.71 4.93 6.14 6.94 6.95 3.98 4.21 5.78 5.78 7.42 7.64 7.64 7.92 8.07 8.09 8.50 8.52 4.64 3.92 5.83 5.62 3.38 3.32 5.06 5.02 4.57 3.88 7.16 3.94 7.16 6.89 7.00 7.45 7.58 2.54 2.35 4.86 4.72 3.36 3.22 4.68 Specialised 14.80 14.80 14.82 14.82 12.65 12.65 13.68 13.68 2.20 1.94 5.43 5.17 3.38 3.37 5.12 5.11 All Banks 7.28 7.73 7.49 8.00 8.67 8.70 9.10 9.12 4.58 4.04 5.88 5.75 3.48 3.47 5.19 5.16 7.34 Jan - 2015 Public 10.80 11.76 10.81 11.77 12.03 12.06 12.50 12.51 6.15 6.76 8.08 8.02 5.56 5.68 7.35 Private 10.45 10.64 10.77 11.02 10.32 10.35 10.96 11.01 6.00 5.28 7.74 7.26 4.80 4.79 7.04 7.03 Foreign 7.45 10.38 7.49 10.38 9.03 9.49 9.73 10.27 3.87 3.86 6.81 7.21 4.69 4.83 6.63 7.03 Specialized 13.59 13.59 13.59 13.59 12.31 12.31 13.32 13.32 2.73 2.73 8.36 8.36 4.73 4.69 7.42 7.39 All Banks 10.35 10.69 10.65 11.05 10.73 10.77 11.35 11.40 5.78 5.22 7.70 7.32 4.94 4.95 7.10 7.09 EXPLANATORY NOTES A 1. Gross disbursements mean the amounts disbursed by banks either in pak rupees or in foreign currency against loans during the month. It also includes loans repriced, renewed or rolled over during the month. In case of running finance, the disbursed amount means total amount availed by the borrower during the month(effective from July 2007) while previously (upto June 2007) it was maximum amount availed by the borrower at any time during the month 2. Foreign currency loans are converted into pak rupees at the prevalent inter bank rates of the last day of the reporting month. 3. Loans (Disbursed & Outstanding) mean all types of bank’s domestic advances including working capital finance and disbursements against payments of documents i.e. Letters of credit, Export bills etc. Advances cover all types of advances including interbank placements. Interest accrued is not a disbursement and therefore it is not considered as loan. Staff loans whether interest free or not, are included. 4. All disbursements made to private sector, public sector and government are included. personal loans etc. and credit schemes such as LMM, export p finance scheme and commodity y operations p are included. 5. All credit facilities such as credit cards, p 6. Outstanding loans mean the loans recoverable at the end of the month. Weighted Average rates of advances and deposits have been compiled by; a. Including advances and deposits at zero markup of return, i.e. non-remunerative advances and deposits b. Excluding advances and deposits at zero markup of return, i.e. non-remunerative advances and deposits B 1. Deposits include all types of deposits including interbank deposits and placements. Margin deposits (deposits held by banks as collateral against letters of credits, letters of guarantees etc.) are however, not included. 2. Foreign currency deposits are converted into Pak Rupees at the prevalent interbank rates as of the last day of the reporting month. 3. Fresh deposits mobilized during the month include outstanding balance of: a Fresh deposits (new accounts) mobilized during the month b Re-priced and /or rolled-over deposits during the month 4. Outstanding deposits show position of deposits held by banks at the end of the month. C 1. “Public” stands for Public Sector Banks - the banks incorporated in Pakistan or the shares/capital controlled by the federal and /or provincial governments. 2. “Private” stands for Private Sector Banks incorporated in Pakistan, owned and controlled by private sector. 3. “Foreign” stands for the branches of banks working in Pakistan but incorporated abroad 4. “Specialized” stands for Specialized Banks established to provide credit facilities, assistance and advice to clients in a designated sector or in a designated line of credit; for example, agriculture sector, industrial sector, etc. 5. Weighted Averages have been worked out by weighting interest rates by the corresponding amounts of loans/deposits. The formula used is: Weighted AverageRate = ∑(rate× amount) ÷ ∑(amount) * Compilation of rate of return on deposits and advances excluding interbank has been started from January, 2011. Contact Person: Abdul Rasul Tariq Designation: Sr. Joint Director Phone: 021 -99221471/021-2453629 Fax :021-9212569 Email:Abdul.rasul@sbp.org.pk For Feedback: http://www.sbp.org.pk/stats/survey/index.asp