Taglich Brothers

Research Report – Update

Investors should consider this report as only a single factor in making their investment decision.

LightPath Technologies, Inc.

LPTH $2.17 — (Nasdaq CM)

Speculative Buy

John Nobile

February 24, 2016

2014A

$11.8

($0.02)

2015A

$13.7

($0.05)

2016E

$16.1

$0.07

2017E

$17.9

$0.18

Revenues (millions)

Earnings (loss) per share

52-Week range

Common shares out a s of 2/1/16

Approximate float

Market capitalization

Tangible book value/share

Price/tangible book value

$3.79 – $0.82 Fiscal year ends:

15.5 million Revenue per share (TTM)

9.7 million Price/Sales (TTM)

$34 million Price/Sales (FY2017)E

$0.57 Price/Earnings (TTM)*

3.8X Price/Earnings (FY2017)E

June

$1.03

2.1X

2.0X

19.7X

12.1X

* Excludes change in fair value of warrant liability.

LightPath Technologies, Inc. designs and manufactures optical components and assemblies including precision molded glass aspheric optics, infrared optics, fiber-optic collimators, and GRADIUM glass lenses. The company also offers custom optical assemblies, including full engineering design support. LightPath’s products are incorporated into a variety of applications in many industries, including defense products, medical devices, laser aided industrial tools, and barcode scanners to name a few. ( www.lightpath.com

)

Key investment considerations:

Reiterating Speculative Buy rating and raising twelve-month price target to $2.60 per share from $2.30 based on a multiple of 16X applied to our discounted FY17 EPS projection.

Industry research firms project robust growth for the global optical components markets. A growing market should bode well for sales of LightPath’s products.

LightPath’s technology enables high-performance infrared aspheric lenses to be manufactured at a lower cost than the typical diamond turning method. LightPath’s low cost structure allows it to compete with molded plastic aspheric lenses due to the higher performance and durability of glass lenses for only a small premium in price.

For FY16 we project revenue of $16.1 million and EPS of $0.07, down from our previous projection of $17.4 million revenue and EPS of $0.16 to reflect 2Q16 results and the stabilization of selling prices.

For FY17 we project revenue of $17.9 million and EPS of $0.18. Our revenue projection is down from $18.8 million previously to reflect a full year of selling price stabilization. Our EPS projection is up from $0.17 previously due to a greater percentage of total sales coming from higher margin infrared products.

LightPath reported ( 10Q released 2/4/16 ) a 26% increase in 2Q16 revenue to $4.2 million and a loss of ($0.04) per share. The company earned $0.01 per share on revenue of $3.4 million in the year earlier quarter. Excluding the change in fair value of warrant liability, the company would have reported EPS of $0.03 versus a loss of ($0.03) per share in 2Q15. We projected 2Q16 revenue of $4.3 million and EPS of $0.03.

*Please view our disclosures on pages 13 - 15.

790 New York Avenue, Huntington, N.Y. 11743

(800) 383-8464

Fax (631) 757-1333

LightPath Technologies, Inc.

Recommendation and Valuation

We are maintaining coverage of LightPath Technologies, Inc. (LPTH) with a Speculative Buy rating and raising our twelve-month price target to $2.60 per share from $2.30.

We have reset our valuation model to one based on earnings (previously sales based) as we feel it better represents the change in LPTH’s fundamentals (the 6% increase in our FY17 EPS forecast versus the 5% reduction in our sales forecast).

Shares of LPTH currently trade at a forward earnings multiple of 12X, up from 9X since our last report. With increasing profitability in FY16 and FY17, we applied a P/E multiple of 16X our FY17 EPS of $0.18, discounted to account for execution risk, to obtain a year-ahead value of $2.60 per share.

The downside risk to LPTH’s current valuation should be limited due primarily to sustainable earnings growth stemming from sale gains (of 18% in FY16 and 11% in FY17) and gross margin expansion. We project continued gross margin expansion will come from a tilt in LPTH’s product mix towards infrared optics (from

8.7% of total sales in FY15 to 10.7% in FY17).

Business

LightPath Technologies, Inc., headquartered in

Orlando, Florida, designs and manufactures optical components and assemblies including precision molded glass aspheric optics, infrared optics, fiberoptic collimators, and GRADIUM glass lenses. The company also offers custom optical assemblies, including full engineering design support. LightPath’s products are incorporated into a variety of applications in many industries, including defense products, medical devices, laser aided industrial tools, and barcode scanners to name a few.

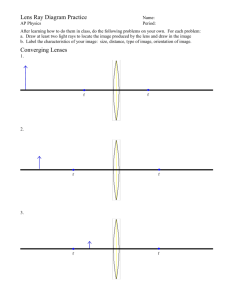

Precision Molded Aspheric Lenses - Aspheric (nonspherical) lenses are the most powerful lenses for managing laser light. This is because aspheric lenses can dramatically reduce or even eliminate optical aberrations (the inability to focus on one point). In a laser system, optical aberrations arise from the use of spherical surfaces. The drawing at right illustrates the difference between refractive light with one focal point

(top) and many focal points (bottom).

A single aspheric lens can often replace a much more complex multi-lens system. The resulting device is smaller and lighter, and sometimes less expensive than multi-lens systems. Because molding is a consistent and economical way to produce aspheres in large volumes, LightPath is able to produce aspheric optics in large volumes at affordable prices (see competitive advantage section).

Infrared Optics – LightPath manufactures aspheric lenses for use in many applications requiring infrared optics.

The company’s precision molded aspheric optics enables system designers to reduce the number of lenses in a typical thermal imaging system allowing for similar performance at a lower cost.

Taglich Brothers, Inc.

2

LightPath Technologies, Inc.

Infrared optics enable the detection of infrared radiation (popularly known as heat radiation). Infrared radiation can be seen on the electromagnetic spectrum as having longer wavelengths than that of visible light. Infrared optics are used extensively by the military for night vision, navigation, surveillance, and targeting. Infrared optics also have industrial, scientific and medical applications. Night vision devices allow people or animals to be observed without the observer being detected. Astronomers use sensor equipped telescopes to penetrate dusty regions of space and detect objects such as planets. Infrared thermal-imaging cameras are used to detect heat loss in insulated systems, changing blood flow in the skin, and overheating of electrical apparatus.

Collimators – LightPath’s collimators (a device that narrows a beam of particles or waves) are designed to collect light from a fiber optic cable and produce a collimated beam. The company’s “connectorized” collimators provide a simple low cost assembly for the collimation of light from a fiber patch cord (a fiber optic cable capped at either end with connectors that allow it to be rapidly and conveniently connected to CATV, an optical switch or other telecommunication equipment). Small beam collimators are designed to collimate light using a fused micro lens on the end of a fiber to produce a small beam (between 0.7mm and 1.2mm). Large beam collimators are ideal for high power laser delivery systems and utilize GRADIUM lenses (discussed below) or aspheric lenses.

GRADIUM Lenses

– LightPath’s

GRADIUM lenses are made from the company’s proprietary glass. Its unique qualities reduce optical aberrations inherent in conventional lenses and allow a single lens to perform tasks traditionally performed by multi-element, conventional lens systems. Typical applications include surgical lasers and high power lasers for welding and cutting.

Applications - Within the large optical components market (discussed in next section), LightPath’s market is estimated at approximately $350 million. The company’s products have many applications over a diverse array of industries within the global optical components market. The company has targeted specific applications for its precision molded optics and infrared products. Some of these applications can be seen in the chart at right.

Source: LightPath Technologies, Inc.

Market Outlook

LightPath markets its products across a wide variety of customer groups including laser systems manufacturers, infrared-imaging systems vendors, industrial laser tool manufacturers, telecommunications equipment manufacturers, medical and industrial measurement equipment manufacturers, and government defense agencies.

Industrial markets comprise 29% of sales, instrumentation 16%, laser 13%, defense 10%, telecommunications

5%, and sales through distributors/catalogs make up the remaining 27%.

Taglich Brothers, Inc.

3

LightPath Technologies, Inc.

Optical communications market research firm LightCounting 1 projects the global optical component market to grow at a compound annual growth rate (CAGR) of 10% from 2015 to 2020. Growth will be driven by increased sales of optical transceivers and related components (a market of which LPTH sells to).

One area that LPTH sees as having the potential for robust growth is in the infrared camera market.

According to a report by Yole

D é veloppement 2 , global unit shipments of uncooled infrared cameras are projected to grow at a

CAGR of 22% from 2015 – 2020 (see chart at right). This growth will be fueled by three commercial markets: automotive, surveillance, and thermography.

Changes in construction spending in

China have a direct effect on demand for laser assisted construction equipment such as laser levels, guides, and surveying equipment.

Source: Yole Developpement

Growth may be tempered by recent developments in that region. In the first few weeks of 2016, stock markets around the world plummeted primarily from fears about a weakening economy in China. Construction spending in China is nearing recession levels and China’s GDP growth in 4Q15

(adjusted in US dollars) fell to 2% from a peak of 25% in mid-2011. While China is still reporting economic growth, the reliability of its economic statistics is in doubt. In January 2016, the New York Times 3 reported that many economists, bankers and analysts who study China’s economic numbers believe that China’s statistics agency smooths data, underestimating growth during economic booms and over estimating it during downturns.

The growth of property investment in

China, a main driver of the economy,

Source: National Bureau of Statistics of China has been slowing. In January 2016, the National Bureau of Statistics of

China reported that growth of total investment in real estate development in 2015 slowed to 1%, down from

10.5% growth in 2014 and 19.8% growth in 2013 (see chart at right).

The cooling real estate market helped hold annual economic growth to its lowest level in 25 years.

1.

“Growing Investments of Web 2.0 Companies into Networking Infrastructure Adds Excitement to the Market” (Press

Release). LightCounting Market Research. February 2015. Retrieved May 2015.

2.

“Uncooled Infrared Imaging Technology & Market Trends” (Press Release). Yole D

é veloppement. July 2015.

Retrieved September 2015.

3.

Bradsher, Keith (January 26, 2016). “Inquiry in China Adds to Doubt Over Reliability of Its Economic Data”. The New

York Times.

Taglich Brothers, Inc.

4

LightPath Technologies, Inc.

While the company does not break out its sales to the industrial tool market in China, it said that sales to this market were showing signs of improvement in 1H16. However, we believe the diminishing outlook for China’s economy should constrain LPTH’s sales to this market. We are not expecting any significant growth for LPTH’s industrial tool sales. Current forecasts for China’s construction sector are for annual growth of about 3.9% into

2020, less than one third of the average rate hit in the ten years leading up to 2014, according to a November 2015 report by Global Construction Perspectives and Oxford Economics.

Competition / Competitive Advantage

The market for optical components is highly competitive and highly fragmented. LightPath competes with manufacturers of conventional spherical lenses and optical components, providers of aspheric lenses and optical components and producers of optical quality glass. Many of the company’s competitors have greater financial, manufacturing, marketing and other resources than LightPath does.

Some of LightPath’s competitors of conventional lenses and optical components include companies such as

Nikon and Olympus Corporation. Aspheric lens competitors include Panasonic and Alps Electric. Infrared molded aspheric optic competitors include products from Umicore and traditional infrared lenses manufactured from germanium such as those from Janos Technologies.

The company’s key competitive advantage lies in its optical design expertise

(LPTH invented GRADIUM glass and certain processes for fabricating GRADIUM glass lenses of which it is the proprietary manufacturer) and being a low cost

Source: LightPath T echnologies W hite Paper producer of aspheric lenses.

As shown at right, the cost per lens using LightPath’s precision molded optics

(PMO) method versus competitors’ single point diamond turning (SPDT) method is less with quantities over 70 lenses (typical orders are for well over 100 lenses). As production increases, the cost per lens significantly decreases (approximately ½ the cost versus SPDT @ 700 lenses) and ultimately becomes constant at cost levels much lower than those using the SPDT method. Because molding is a consistent and economical way to produce aspheres in large volumes, LightPath has focused its engineering efforts on perfecting this method.

Molded plastic aspheres are often used in products that stress cost or weight over performance and durability.

LightPath’s low cost structure allows it to compete with molded plastic aspheres due to the higher performance and durability of glass lenses for only a small premium in price. A single molded aspheric lens can replace two or three spherical lenses based on the higher performance of an aspheric lens.

The company’s GRADIUM lenses have successfully competed in the market for high power laser optics.

GRADIUM lenses are derived from the company’s proprietary glass to produce lenses for the high power laser optics market.

2Q and 1H2016 Financial Results

2Q16 - Revenue increased 26% to $4.2 million. LightPath lost $535,000 or ($0.04) per share versus net income of $141,000 or $0.01 per share in 2Q15. Excluding the change in fair value of warrant liability, the company would have reported net income of $520,000 or $0.03 per share versus a net loss of $394,000 or ($0.03) per share in 2Q15. We projected 2Q16 revenue of $4.3 million and net income of $550,000 or $0.03 per share.

Taglich Brothers, Inc.

5

LightPath Technologies, Inc.

The increase in revenue was primarily due to an increase in sales of specialty products and non-recurring engineering (product development) revenue. Revenue excluding the non-recurring engineering product group increased 23% to approximately $4 million. Gross margins increased to 55.7% from 37.9% due primarily to a favorable product mix (higher margin specialty products made up approximately 29% of total sales in 2Q16 versus 16% in 2Q15). SG&A expenses increased to $1.6 million from $1.3 million primarily due to management bonuses. R&D costs decreased to $168,000 from $350,000 due to a decrease in wages. The company pays no taxes due to its net operating loss carryforwards.

1H16 - Revenue increased 41% to $8.4 million.

LightPath earned $307,000 or $0.02 per share versus a net loss of $438,000 or ($0.03) per share in 1H15. Excluding the change in fair value of warrant liability, the company would have reported net income of $994,000 or $0.06 per

Product sales

Cost of sales

Gross profit

Six Months Ended

(in thousands $)

12/15A

8,426

3,815

4,611

12/14A

5,956

3,708

2,248 share versus a net loss of $919,000 or ($0.06) per share in 1H15.

The increase in revenue was primarily due to an increase in sales across all product lines. High and low volume precision molded optics increased

18% to $5.2 million, infrared product sales increased 53% to $726,000, specialty product

SG&A

R&D

(Gain) loss on disposal of equipment

Operating income (loss)

Interest expense

Interest expense - debt costs

Change in fair value of warrant liability

Other income (expense)

3,014

316

12

1,269

(22)

-

(687)

(253)

2,470

694

-

(916)

(10)

(13)

481

20 sales increased 119% to $2.2 million, and nonrecurring engineering sales increased 241% to

$335,000.

Gross margins increased to 54.7% from 37.7% due primarily to a favorable product mix (higher margin infrared products were 8.6% of total sales versus 7.9%, while specialty products sales were

26.3% versus 17%). SG&A expenses increased to

$3 million from $2.5 million primarily due to management bonuses. R&D costs decreased to

$316,000 from $694,000 due to a decrease in wages. The company pays no taxes due to its net operating loss carryforwards.

Liquidity

Net Income / (loss)

EPS

Shares Outstanding

Margin Analysis

Gross margin

SG&A

R&D

Operating margin

Year / Year Growth

Total Revenues

Net Income

EPS

Source: Company filings

307

0.02

16,595

54.7%

35.8%

3.8%

41.5%

(170.1)%

(160.4)%

(438)

(0.03)

14,298

37.7%

41.5%

11.7%

15.1% (15.4)%

As of December 31, 2015, the company had $2.5 million cash, a current ratio of 4.1X versus 2.9X for the electronic components industry, no debt, and approximately 64% of assets are covered by equity. By our forecasts, the company should have sufficient capital to meets its operational needs for the next twelve months.

Cash provided by operations in the first six months of FY2016 was approximately $1 million consisting primarily of cash earnings of $1.5 million and a $597,000 increase in working capital. The change in working capital was primarily due to increased inventories and decreased accounts payable. Cash used in investing consisted primarily of $596,000 of capital expenditures. Cash used in financing of $56,000 consisted primarily of payments on debt and capital leases. Cash increased by $859,000 to $2.5 million at December 30, 2015.

Economic Outlook

In January 2016, the International Monetary Fund (IMF) lowered its global economic growth forecast to 3.4% in

2016 and 3.6% in 2017, down from an earlier (October 2015) growth forecast of 3.6% in 2016 and 3.8% in 2016.

The lowered growth estimate primarily reflects weaker prospects for emerging market economies.

Taglich Brothers, Inc.

6

LightPath Technologies, Inc.

The IMF lowered its economic growth estimate for the US to 2.6% in both 2016 and 2017, down from an earlier

(October 2015) growth forecast of 2.8% in both 2016 and 2017. The IMF said that the strengthening US dollar was weighing on manufacturing activity and lower oil prices were curtailing investment in mining structures and equipment. However, overall activity in the US remained resilient and was supported by still-easy financial conditions and strengthening housing and labor markets.

The advance estimate of US GDP growth (released on January 29, 2016) showed the US economy grew at an annual rate of 0.7% in 4Q15, down from 2% growth in 2Q15. The 4Q15 US GDP growth estimate primarily reflects a rise in consumer spending. Spending on services, durable and nondurable goods also rose. Partly offsetting these contributions to GDP growth was a decline in inventory investment, exports, and business investment.

Both Europe and China currently buy LPTH’S products. Growth estimates for Europe increased to 1.7% in 2016, up from an earlier (October 2015) growth forecast of 1.6%. Europe’s 2017 growth estimated remained unchanged at 1.7%. The IMF said that stronger private consumption in Europe was supported by lower oil prices and easy financial conditions which was outweighing a weakening in net exports.

The IMF kept its economic growth projections for China at 6.3% in 2016 and 6% in 2017. However, the IMF’s latest projections for China are down from 6.9% growth in 2015 and 7.3% in 2014 which primarily reflect

China’s rebalancing of economic activity away from investment and manufacturing toward consumption and services.

With approximately ½ of LightPath’s sales to customers in Europe and China, and approximately ½ of sales to the

US, the low and/or slowing economic growth projections for these areas could constrain product growth for the company.

Projections

For FY16 we project revenue of $16.1 million and net income of $1.1 million or $0.07 per share, down from our previous projection of $17.4 million revenue and net income of $2.6 million or $0.16 per share to reflect 2Q16 results and a stabilization of selling prices (we do not believe the approximate 30% year-to-date increase in average selling prices sustainable). We project flat pricing in 2H16 and FY17 with revenue growth coming solely from unit growth.

Excluding non-recurring engineering revenue, year-to-date average selling prices increased 28%. Contributing to the boost in average selling prices was a favorable product mix with higher price point products used in medical instruments (such as endoscopes) replacing lower price point products used in China (for industrial tools).

Expectations in the coming quarters are for selling prices to stabilize with the current product mix.

We project gross margins of 54.4%, in line with year-to-date margins. The company expects SG&A and R&D expenses to remain near current levels of approximately $6 million (SG&A) and $600,000 (R&D) annually. The company should pay no taxes due its net operating loss carryforwards.

We project the company will generate $2.1 million cash from operations from cash earnings of $2.8 million and a

$687,000 increase in working capital. The increase in working capital will come primarily from an increase in accounts receivables. Cash from operations and the positive effect from exchange rates, should be partially offset by $800,000 of capital expenditures and 126,000 of capital lease payments, increasing cash by $1.6 million to

$3.3 million by June 30, 2016.

For FY17 we project revenue of $17.9 million and net income of $3 million $0.18 per share. Our revenue projection is down from $18.8 million previously to reflect a full year of selling price stabilization. Our net income projection is up from $2.8 million or $0.17 per share previously due to a greater percentage of total sales coming from higher margin infrared products (10.7% in FY17 versus 9.8% in FY16). The greater percentage of sales coming from higher margin infrared products should increase gross margins to 54.8%.

Taglich Brothers, Inc.

7

LightPath Technologies, Inc.

SG&A expenses are projected to increase to $6.2 million due primarily to increased commissions and bonus payments. R&D expenses are projected to increase to $640,000 as the company continues to invest in new product development for infrared optics. The company should pay no taxes due its net operating loss carryforwards.

We project the company will generate $3.5 million cash from operations from cash earnings of $3.9 million and a

$431,000 increase in working capital. The increase in working capital will come primarily from an increase in accounts receivables. Cash from operations should be partially offset by $800,000 of capital expenditures and

$126,000 of capital lease payments, increasing cash by $2.5 million to $5.9 million by June 30, 2017.

Risks

In our view, these are the principal risks underlying the stock.

Competition - The market for optical components is highly competitive and highly fragmented. LightPath competes with manufacturers of conventional spherical lenses and optical components, and providers of aspheric lenses and optical components. Many of the company’s competitors have greater financial, manufacturing, marketing and other resources than LightPath does.

Technological changes – LightPath may not be able to keep pace with technological changes and develop new products in a timely manner to remain competitive.

Concentration of customer risk - In FY15, three customers accounted for approximately 28% of LightPath’s annual revenue. The loss of any of these customers, or a significant reduction in sales to any such customer, would adversely affect LightPath’s revenue.

Reliance on suppliers – The company utilizes a number of glass compositions in manufacturing its molded glass aspheres and lens array products and currently purchases a few key materials from single or limited sources.

There can be no assurance that a satisfactory supply of such production materials will continue to be available or at reasonable prices.

Economic risk - Demand for LightPath’s products may be affected by the economic trends in the countries or regions in which they are sold. In FY15, 54% of LPTH’s revenue was derived from sales outside of the US, with the majority of foreign sales (90%) occurring to customers in Europe and Asia. Economic downturns and resulting declines in demand in LightPath’s markets may adversely affect the company’s operating results and financial condition.

Liquidity risk - Shares of LightPath Technologies have risks common to those of the microcap segment of the market. Often these risks cause microcap stocks to trade at discounts to their peers. The most common of these risks is liquidity risk, which is typically caused by small trading floats and very low trading volume and can lead to large spreads and high volatility in stock price. There are 9.7 million shares in the float and the average daily volume is approximately 577,000 shares.

Miscellaneous risk - The company's financial results and equity values are subject to other risks and uncertainties including competition, operations, financial markets, regulatory risk, and/or other events. These risks may cause actual results to differ from expected results.

Taglich Brothers, Inc.

8

Cash and cash equivalents

Accounts receivable

Inventories

Other receivables

Prepaid interest expense

Prepaid expenses and other

Total current assets

Net property and equipment

Intangible assets

Debt costs

Other assets

Total assets

Accounts payable

Accrued liabilities

Accrued payroll and benefits

Deferred revenue

Loan payable

Capital lease obligation, current

Total current liabilities

Capital lease obligation

Deferred rent

Warrant liability

Loan payable

Convertible debentures

Total liabilities

Total stockholders' equity*

Total liabilities & stockholders' equity

LightPath Technologies, Inc.

Consolidated Balance Sheets

(in thousands $)

FY13A FY14A FY15A 12/16A FY16E FY17E

1,565

2,127

1,771

353

-

262

6,078

2,236

35

-

28

8,377

1,197

2,473

3,323

200

-

298

7,491

3,174

-

-

28

10,693

1,644

3,049

3,181

254

-

244

8,372

4,276

-

-

67

12,715

2,503

2,855

3,356

167

-

376

9,257

4,341

-

-

67

13,665

3,326

3,588

3,037

167

-

376

10,493

4,513

-

-

67

15,073

5,870

3,995

3,353

167

-

376

13,761

4,724

-

-

67

18,552

1,066

111

440

2

-

3

1,622

4

220

1,102

-

-

2,948

5,429

8,377

1,809

125

478

-

55

6

2,473

6

77

731

110

-

3,397

7,296

10,693

1,552

84

843

-

52

166

2,697

310

513

1,195

-

-

4,715

8,000

12,715

1,080

79

940

-

.

167

2,266

247

585

1,883

-

-

4,981

8,684

13,665

1,482

99

940

-

-

167

2,687

247

585

1,883

-

-

5,402

9,671

15,073

1,636

110

940

-

-

167

2,853

247

585

1,883

-

-

5,568

12,984

18,552

* FY16 includes $143 additional paid-in capital from stock-based compensation

Source: Company filings and Taglich Brothers' estimates

Taglich Brothers, Inc.

9

Product sales

Cost of sales

Gross profit

SG&A

R&D

Amortization of intangibles

(Gain) loss on disposal of equipment

Operating income (loss)

LightPath Technologies, Inc.

Income Statements for the Fiscal Years Ended

(in thousands $)

FY13A FY14A FY15A FY16E FY17E

11,783

6,608

5,175

11,834

6,445

5,389

13,662

7,683

5,979

16,076

7,334

8,742

17,900

8,097

9,803

3,991

939

33

2

210

4,514

1,215

36

-

(376)

5,133

1,108

-

(1)

6,013

616

-

12

(261) 2,101

6,200

640

-

-

2,963

Interest expense

Interest expense - debt costs

Change in fair value of warrant liability

Loss on extinguishment of debt

Other income (expense)

Net Income / (loss)

EPS

Shares Outstanding

(96)

(4)

(15)

-

120

215

0.02

12,959

(1)

(35)

93

-

6

(313)

(0.02)

14,002

(18)

(14)

(463)

-

41

(22)

-

(687)

-

(253)

(715)

(0.05)

14,712

1,139

0.07

16,248

-

-

-

-

-

2,963

0.18

16,600

Margin Analysis

Gross margin

SG&A

R&D

Operating margin

Year / Year Growth

Total Revenues

Net Income

EPS

43.9% 45.5%

33.9% 38.1%

8.0% 10.3%

43.8%

37.6%

8.1%

54.4%

37.4%

3.8%

54.8%

34.6%

3.6%

1.8% (3.2)% (1.9)% 13.1% 16.6%

4.4%

124.9%

118.9%

Source: Company filings and Taglich Brothers' estimates

0.4% 15.4%

NMF

NMF

NMF

NMF

17.7%

259.3%

244.2%

11.3%

160.1%

154.6%

Taglich Brothers, Inc.

10

Product sales

Cost of sales

Gross profit

SG&A

R&D

Amortization of intangibles

(Gain) loss on disposal of equipment

Operating income (loss)

Interest expense

Interest expense - debt costs

Change in fair value of warrant liability

Loss on extinguishment of debt

Other income (expense)

Net Income / (loss)

EPS

Shares Outstanding

Margin Analysis

Gross margin

SG&A

R&D

Operating margin

LightPath Technologies, Inc.

Quarterly Income Statements 2015A - 2017E

(in thousands $)

9/14A 12/14A 3/15A 6/15A FY15A 9/15A 12/15A

2,603

1,626

977

3,353

2,083

1,270

3,199

1,598

1,601

4,507

2,376

2,131

13,662

7,683

5,979

4,190

1,939

2,251

4,236

1,876

2,360

3/16E 6/16E FY16E 9/16E 12/16E

3,800

1,748

2,052

3,850

1,771

2,079

16,076

7,334

8,742

4,100

1,866

2,235

4,350

1,979

2,371

3/17E

4,600

2,070

2,530

6/17E FY17E

4,850

2,183

2,668

17,900

8,097

9,803

1,144

343

-

-

(510)

1,325

350

-

-

(405)

1,146

249

-

-

206

1,518

166

-

(1)

448

5,133

1,108

-

(1)

(261)

1,440

148

-

-

663

1,573

168

-

12

607

1,500

150

-

-

402

1,500

150

-

-

429

6,013

616

-

12

2,101

1,550

160

-

-

525

1,550

160

-

-

661

1,550

160

-

-

820

1,550

160

-

-

958

6,200

640

-

-

2,963

(3)

(13)

(54)

-

1

(7)

(1)

535

-

19

(3)

-

(105)

-

(8)

(5)

-

(839)

-

29

(579)

(0.04)

14,312

141

0.01

15,420

90

0.01

15,714

(367)

(0.02)

15,235

(18)

(14)

(463)

-

41

(13)

-

368

-

(175)

(715) 843

(0.05) 0.06

14,712 16,543

(9)

-

(1,055)

-

(78)

-

-

-

-

-

(535)

(0.04)

15,250

402

0.02

16,600

-

-

-

-

-

429

0.03

16,600

(22)

-

(687)

-

(253)

-

-

-

-

-

1,139

0.07

16,248

525

0.03

16,600

-

-

-

-

-

661

0.04

16,600

-

-

-

-

-

820

0.05

16,600

-

-

-

-

-

958

0.06

16,600

-

-

-

-

-

2,963

0.18

16,600

37.5% 37.9% 50.0% 47.3% 43.8% 53.7% 55.7%

43.9% 39.5% 35.8% 33.7% 37.6% 34.4% 37.1%

13.2% 10.4% 7.8% 3.7% 8.1% 3.5% 4.0%

(19.6)% (12.1)% 6.4% 9.9% (1.9)% 15.8% 14.3%

54.0% 54.0% 54.4% 54.5% 54.5% 55.0% 55.0% 54.8%

39.5% 39.0% 37.4% 37.8% 35.6% 33.7% 32.0% 34.6%

3.9% 3.9% 3.8% 3.9% 3.7% 3.5% 3.3% 3.6%

10.6% 11.1% 13.1% 12.8% 15.2% 17.8% 19.7% 16.6%

Year / Year Growth

Total Revenues

Net Income

EPS

(7.4)% 15.3% 6.5% 44.9% 15.4% 61.0% 26.3%

NMF 169.8% 167.7% NMF NMF 245.6% NMF

18.8% (14.6)%

346.7% 216.9%

17.7% (2.1)%

259.3% (37.8)%

2.7%

223.5%

21.1%

104.0%

26.0%

123.2%

11.3%

160.1%

NMF 162.8% 161.5% NMF NMF 248.3% NMF 322.8% 207.3% 244.2% (47.3)% 213.5% 104.0% 123.2% 154.6%

Source: Company filings and Taglich Brothers' estimates

Taglich Brothers, Inc.

11

LightPath Technologies, Inc.

Statement of Cash Flows for the Periods Ended

(in thousands $)

FY13A FY14A FY15A 6mos16A

Net income (loss)

Depreciation & amortization

Interest from amortization of debt discount and costs

Stock, warrants issued to consultant

Stock issued for legal settlement

(Gain) loss on disposal of property and equipment

Stock based compensation

Change in provision for doubful accounts receivable

Change in fair value of warrant liability

Loss on extinguishment of debt

Deferred rent

Cash earnings (loss)

Changes in assets and liabilities

Accounts receivables

Other receivables

Inventories

Prepaid expenses and other

Accounts payable and accrued liabilities

Deferred revenue

(Increase) decrease in working capital

Net Cash Provided by (Used in) Operations

215

813

4

-

-

3

268

2

15

-

(126)

1,194

(313)

666

35

-

-

1

357

(9)

(94)

-

(144)

499

(715)

537

13

-

-

(1)

285

(16)

464

-

16

583

307

390

-

-

-

12

175

-

687

-

72

1,643

FY16E

1,139

563

-

-

12

350

-

687

-

72

2,823

FY17E

2,963

589

-

-

-

350

-

-

-

-

3,902

4

(313)

(257)

47

(83)

(36)

(337)

154

(1,107)

(91)

795

(2)

(560)

(54)

141

2

67

-

40

64

(331)

(137)

(233)

-

(638) (588)

556 (89)

(404) (597)

179 1,046

(539)

87

144

(132)

(248)

-

(407)

-

(316)

-

292

-

(687) (431)

2,136 3,471

Proceeds from sale of equipment

Purchase of property and equipment

Net Cash Used in Investing

Proceeds from exercise of warrants

Proceeds from exercise of stock options

Proceeds from sale of common stock

Proceeds from loan payable

Costs associated with settlement of debentures

Repayments of debentures

Payments on note payable

Payments on capital lease obligation

Net Cash Provided by (Used in) Financing

Effect of exchange rates

Net Change in Cash

Cash - Beginning of Period

Cash - End of Period

-

(1,097)

-

(1,982)

-

(694)

6

(596)

(1,097) (1,982) (694) (590)

6

(800)

-

(800)

(794) (800)

3

-

9

-

(40)

(180)

-

(4)

1,539

-

7

165

-

-

-

(7)

-

-

1,135

-

-

-

(113)

(59)

28

3

8

-

-

-

(32)

(63)

(212)

(36)

(789)

2,354

1,565

1,704

(1)

(368)

1,565

1,197

963

(1)

447

1,197

1,644

(56)

459

859

1,644

2,503

28

3

8

-

-

-

(32)

(126)

-

-

-

-

-

-

-

(126)

(119)

459

1,682

1,644

3,326

(126)

-

2,545

3,326

5,870

Source: Company filings and Taglich Brothers' estimates

Taglich Brothers, Inc.

12

LightPath Technologies, Inc.

Price Chart

Taglich Brothers’ Current Ratings Distribution

Investment Banking Services for Companies Covered in the Past 12 Months

Rating

Buy

Hold

Sell

Not Rated

#

2

Taglich Brothers, Inc.

13

%

8

LightPath Technologies, Inc.

Important Disclosures

As of the date of this report, we, our affiliates, any officer, director or stockholder, or any member of their families do not have a position in the stock of the company mentioned in this report. Taglich

Brothers, Inc. does not currently have an Investment Banking relationship with the company mentioned in this report and was not a manager or co-manager of any offering for the company within the last three years.

All research issued by Taglich Brothers, Inc. is based on public information. The company paid a monetary fee of $4,500 (USD) in December 2013 for the creation and dissemination of research reports for the first three months. Since June 2014, the company pays a quarterly monetary fee of $4,500

(USD) to Taglich Brothers, Inc., for a minimum of six months for the creation and dissemination of research reports.

General Disclosures

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable but in no way are warranted by us as to accuracy or completeness. We do not undertake to advise you as to changes in figures or our views. This is not a solicitation of any order to buy or sell.

Taglich Brothers, Inc. is fully disclosed with its clearing firm, Pershing, LLC, is not a market maker and does not sell to or buy from customers on a principal basis. The above statement is the opinion of

Taglich Brothers, Inc. and is not a guarantee that the target price for the stock will be met or that predicted business results for the company will occur . There may be instances when fundamental, technical and quantitative opinions contained in this report are not in concert. We, our affiliates, any officer, director or stockholder or any member of their families may from time to time purchase or sell any of the above-mentioned or related securities. Analysts and members of the Research Department are prohibited from buying or selling securities issued by the companies that Taglich Brothers, Inc. has a research relationship with, except if ownership of such securities was prior to the start of such relationship, then an Analyst or member of the Research Department may sell such securities after obtaining expressed written permission from Compliance.

Analyst Certification

I, John Nobile, the research analyst of this report, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities and issuers; and that no part of my compensation was, is, or will be, directly, or indirectly, related to the specific recommendations or views contained in this report.

Public companies mentioned in this report:

Nikon (OTC: NINOF)

Olympus Corporation (OTC: OCPNF)

Panasonic (OTC: PCRFF)

Umicore (OTC: UMICF)

Taglich Brothers, Inc.

14

LightPath Technologies, Inc.

Meaning of Ratings

Buy – The growth prospects, degree of investment risk, and valuation make the stock attractive relative to the general market or comparable stocks.

Speculative Buy – Long term prospects of the company are promising but investment risk is significantly higher than it is in our BUY-rated stocks. Risk-reward considerations justify purchase mainly by high risk-tolerant accounts. In the short run, the stock may be subject to high volatility and could continue to trade at a discount to its market.

Neutral – Based on our outlook the stock is adequately valued. If investment risks are within acceptable parameters, this equity could remain a holding if already owned.

Sell – Based on our outlook the stock is significantly overvalued. A weak company or sector outlook and a high degree of investment risk make it likely that the stock will underperform relative to the general market.

Dropping Coverage – Research coverage discontinued due to the acquisition of the company, termination of research services, non-payment for such services, diminished investor interest, or departure of the analyst.

Some notable Risks within the Microcap Market

Stocks in the Microcap segment of the market have many risks that are not as prevalent in Large-cap, Blue

Chips or even Small-cap stocks. Often it is these risks that cause Microcap stocks to trade at discounts to their peers. The most common of these risks is liquidity risk, which is typically caused by small trading floats and very low trading volume which can lead to large spreads and high volatility in stock price. In addition, Microcaps tend to have significant company specific risks that contribute to lower valuations.

Investors need to be aware of the higher probability of financial default and higher degree of financial distress inherent in the microcap segment of the market.

From time to time our analysts may choose to withhold or suspend a rating on a company. We continue to publish informational reports on such companies; however, they have no ratings or price targets. In general, we will not rate any company that has too much business or financial uncertainty for our analysts to form an investment conclusion, or that is currently in the process of being acquired.

Taglich Brothers, Inc.

15